S&P Analysis: Private Equity Investments In Global Asset Management Surge In Q1

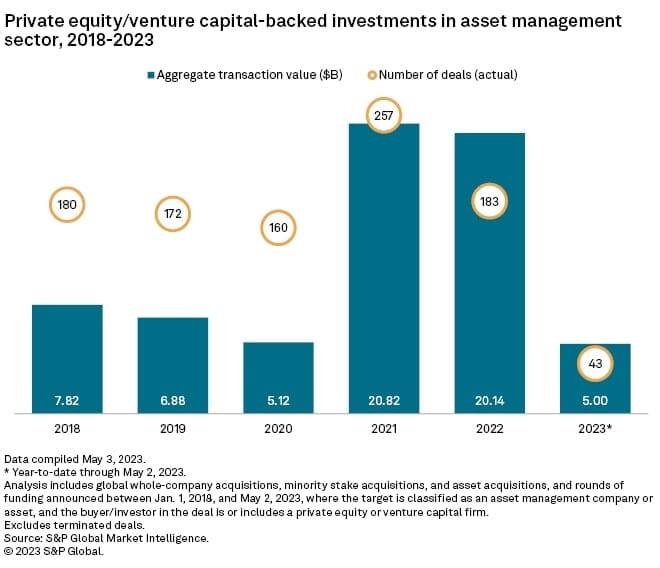

Private equity and venture capital firms announced $5.00 billion of investments across 43 transactions in the asset management sector worldwide this year through May 2, according to new S Global Market Intelligence data and analysis.

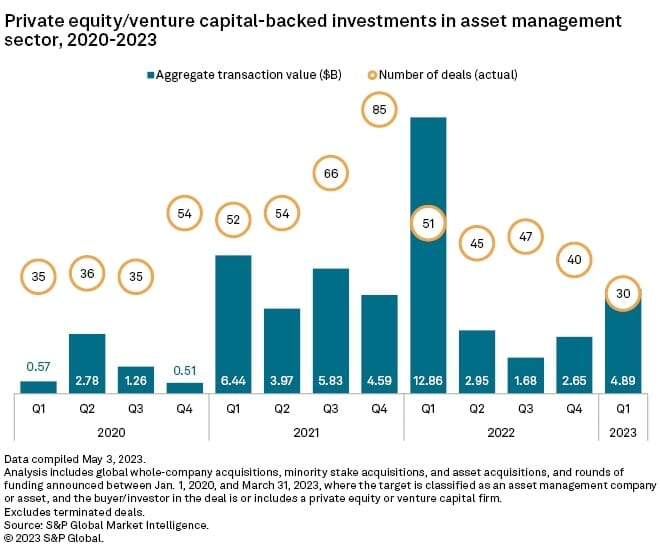

The aggregate transaction value was down 62% from $12.86 billion in the first quarter of 2022, which remains the biggest quarter since the start of 2020.

Key highlights from the analysis include:

- During the first quarter, the asset management companies pulled in $4.89 billion across 30 deals. Clayton Dubilier Rice LLC and Stone Point Capital LLC’s $4.23 billion acquisition of an unknown majority stake in Focus Financial Partners Inc. was mainly responsible for the 84.5% quarter-over-quarter growth.

- Among the largest private equity investments in the asset management sector year to date through May 2 was Tikehau Capital and Arjun Infrastructure Partners Ltd.’s acquisition of an unknown stake in Amarenco Solar Ltd. for $316.1 million.

- Europe had the most number of transactions with 20 deals worth $507.5 million, while the US and Canada had the biggest total investment of $4.45 billion across 17 deals so far in 2023.

Source valuewalk