Volkswagen AG VZO sell Subdi

Summary

This prediction ended on 29.09.22 with a price of €132.18. The prediction for Volkswagen AG VZO closed with a convincing performance of -13.60%. Subdi has a follow-up prediction for Volkswagen AG VZO where he still thinks Volkswagen AG VZO is a Sell. Dividends of €8.30 are taken into consideration when calculating the performance. Subdi has 100% into this predictionVolkswagen AG (VLKPF) is a German multinational automotive company that designs, manufactures, and sells a wide range of vehicles, including passenger cars, trucks, and buses, under brands such as Volkswagen, Audi, Porsche, and Lamborghini. With headquarters in Wolfsburg, Germany, Volkswagen is one of the largest companies in the automotive industry, with operations in more than 150 countries worldwide. The company is publicly listed in several stock exchanges, with the majority of its shares owned by the Porsche and Piech families. Despite facing several controversies related to environmental regulations and emissions standards, Volkswagen continues to be a major player in the automotive market, with a focus on electric and autonomous vehicles.

Performance without dividends (%)

| Name | 1w | 1m | 1y | 3y |

|---|---|---|---|---|

| Volkswagen AG VZO | 0.518% | 0.518% | 21.364% | -20.830% |

| iShares Core DAX® | 0.795% | 1.458% | 17.980% | 69.888% |

| iShares Nasdaq 100 | -3.088% | -0.762% | 3.169% | 101.814% |

| iShares Nikkei 225® | -0.952% | -2.268% | 12.208% | 45.300% |

| iShares S&P 500 | -1.393% | 0.199% | 1.698% | 63.763% |

According to Subdi what are the pros and cons of Volkswagen AG VZO for the foreseeable future?

Pros

Cons

Comments by Subdi for this prediction

In the thread Volkswagen AG VZO diskutieren

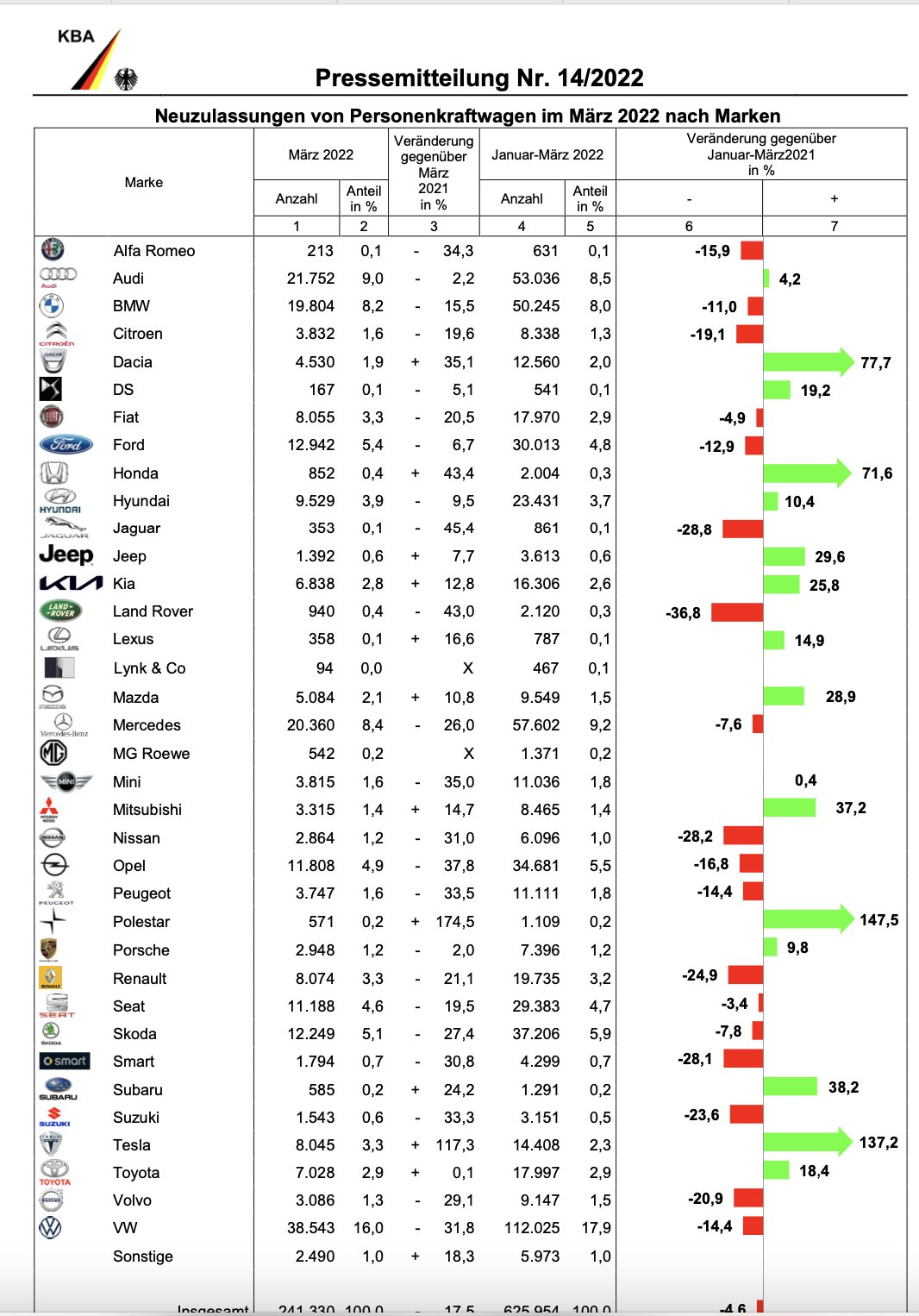

Weltweit sind sie im 1. Quartal von Platz 2 auf Platz 3 zurückgefallen. (der Konzern)

Vor einem Jahr wurde noch davon geträumt, dass VW Tesla überholen könnte. Doch BYD ist jetzt der einzig glaubwürdige Herausforderer von Tesla.

9 Minuten Video:

EV sales in China in Q1 2022 are crucifying legacy auto

Liebe Volkswagen Bullen, was sagt ihr zum Rücktritt von Diess?

Wird die Aktie ab Montag weiter fallen?

Falls ja, soll man die Aktie dann kaufen, oder besser sofort aussteigen?

Die Porsche AG ist jetzt nach dem Börsengang dermaßen überbewertet, dass ich diese Aktie jetzt lieber shorte als Volkswagen. Diese Einschätzung hier war sowieso eher als Warnung für die VW-Bullen gedacht :-)

Current prediction by Subdi for Volkswagen AG VZO

Volkswagen AG VZO

16.12.24

16.12.25

15.12.25

Stopped prediction by Subdi for Volkswagen AG VZO

Volkswagen AG VZO

07.03.24

07.03.25

01.08.24

Volkswagen AG VZO

14.11.22

14.11.23

15.11.23

Volkswagen AG VZO

03.04.21

03.04.22

03.04.22

Volkswagen AG VZO

04.03.21

22.03.21

Volkswagen AG VZO

03.09.20

21.09.20

21.09.20

Volkswagen AG VZO

10.06.20

03.09.20

03.09.20

Volkswagen AG VZO

09.05.20

27.05.20

27.05.20

Volkswagen AG VZO

20.04.16

02.05.16

02.05.16

Volkswagen AG VZO

12.10.15

12.04.16

12.04.16

Volkswagen AG VZO

22.09.15

05.10.15

05.10.15