Leverage AI And Build A Fortress Portfolio With Adobe

Key Points

- Adobe outperforms and guides higher on strength driven by AI interest.

- The analysts are raising their targets and have the stock in reversal.

- Institutions are buying and lending strength to the melt-up.

- 5 stocks we like better than Adobe

Adobe (NASDAQ:ADBE) did not stand out as an AI winner. The company’s creative-centric business model relies heavily on business and consumer spending, which are both questionable now. But then you must also consider that Adobe is a data-centric business model.

All those creative juices flowing through Adobe’s cloud-based platform are creating oodles of data for AI models to suck up during training. In that light, it’s unsurprising that Adobe outperformed in Q2 and is on track to gain momentum as the year progresses.

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

“Adobe achieved record Q2 revenue demonstrating strong demand across Creative Cloud, Document Cloud and Experience Cloud,” said Shantanu Narayen, chair and CEO of Adobe. “Adobe’s ground-breaking innovation positions us to lead the new era of generative AI given our rich datasets, foundation models and ubiquitous product interfaces.”

Adobe Builds A Fortress In The Cloud

Adobe had a solid quarter with growth in both segments. The company reported record Q2 revenue of $4.82 billion, up 9.8% and 100 basis points better than the Marketbeat.com consensus estimate. The gain was driven by a 10% increase in Digital Media Services and a 12% gain in Digital Experience.

Within DMS, Document Cloud grew by 11%, and Digital Experience subscriptions grew by 11%. The bottom line is that the results lend evidence to Oracle (NYSE:ORCL) founder Larry Ellison’s comments that the cloud is more significant than ever and growing faster than before.

The margin news is mixed, but the takeaways are bullish for the market. The gross margin widened but was offset by an increase in operating expenses. The takeaway is that operating earnings, cash flow, free cash flow, GAAP EPS, and adjusted EPA are all up YOY and better than expected. The Q2 adjusted $3.91 is up 44% compared to last year and beat by $0.12, leading to improved guidance.

The guidance is mixed but also bullish for the market. The revenue and earnings targets were raised, but the revenue outlook is only as expected. However, the company is forecasting a better-than-expected margin and adjusted EPS of $15.65 at the low end of the range. That compares well to the $15.49 consensus estimate, and it may be cautious given the ramp in AI interest.

Analysts Drive Adobe Higher: The AI Melt-Up Has Begun

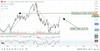

Analysts were meh about Adobe stock going into the report; you can’t blame them. That change following the report with 14 updated price targets. All 14 are increases to the range of $500 to $600. That has the consensus target up but still below the pre-release action. The salient points are that the new range is $500 to $600.

That’s a mid-point of $550; the average is at the high end. The consensus target is still below the price action but up 27% in 1 day. That’s right, 27% in a single day, and will most likely trend higher into the end of the calendar year.

The post-release action has the stock up 5% in premarket trading. The move has the market in reversal and melting up along with other AI stocks. It could continue higher if the market doesn’t top out here and form a consolidation zone. The hurdle is $520; a move above that level could take the stock to the $600 range.

If the AI boom continues to gain momentum as it seems to be doing, company performance and analysts could keep this moving until it reaches new all-time highs. The institutions already own 80% and are buying on balance. That, with an influx of retail interest, is a recipe for higher share prices, and the rally might not end until interest in AI begins to fade.

Should you invest $1,000 in Adobe right now?

Before you consider Adobe, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Adobe wasn’t on the list.

While Adobe currently has a “Hold” rating among analysts, top-rated analysts believe these five stocks are better buys.

The post Leverage AI And Build A Fortress Portfolio With Adobe appeared first on MarketBeat.

Source valuewalk

Adobe Inc. Stock

With 45 Buy predictions and 2 Sell predictions Adobe Inc. is one of the favorites of our community.

As a result the target price of 590 € shows a positive potential of 34.15% compared to the current price of 439.8 € for Adobe Inc..