It’s Time! To Bargain Hunt Stocks

The Broad Market Index was down 1.29% last week and 30% of stocks out-performed the index.

Our Otos.io Securities and Exchange Commissions (SEC) financial statement update is now completed for the 2nd quarter and it is time to do our bargain hunt. Otos is indicating a clear buy signal with frequency of rising sales growth up and gross profit margins rising on average, and more frequently across US companies.

What About Rates?

There is still the risk of persistent inflation and higher interest rates associated. However, using healthy cash positions we cannot ignore the growth improvement. Higher risk-oriented strategies should be reducing cash and adding stocks of newly accelerating companies.

Income-oriented strategies have a different task since improvement in that group is less frequent and yields remain very low. It is hard to justify selling a very low risk security (MINT) yielding 5.3% to add a 3% stock yield with an uncertain growth future.

Still, cash is not a good long-term strategy. Buy shares of accelerating companies displaying accelerating top line attributes companies, such as:

Roper Technologies (ROP) $491.510 BUY This Rich Company Getting Better

Roper Technologies (NASDAQ:ROP) has been a profitable company with persistently high cash return on total capital of 8.5% on average over the past 21 years. Over the long term, the shares of Roper Technologies have declined by 17% relative to the broad market index.

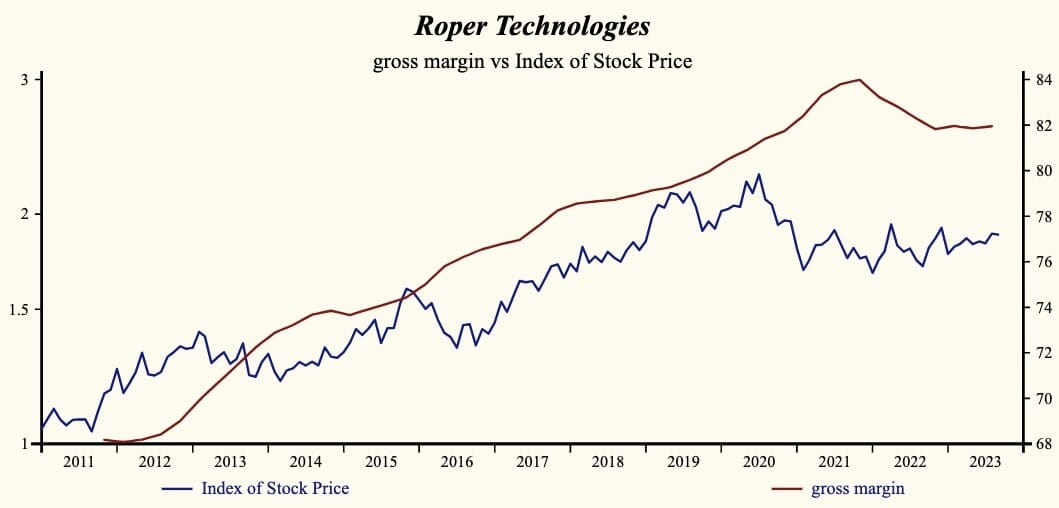

The shares have been very highly correlated with trends in Growth Factors. The dominant factor in the Growth group is the Gross Profit Margin which has been 96% correlated with the share price.

Top Line Growth

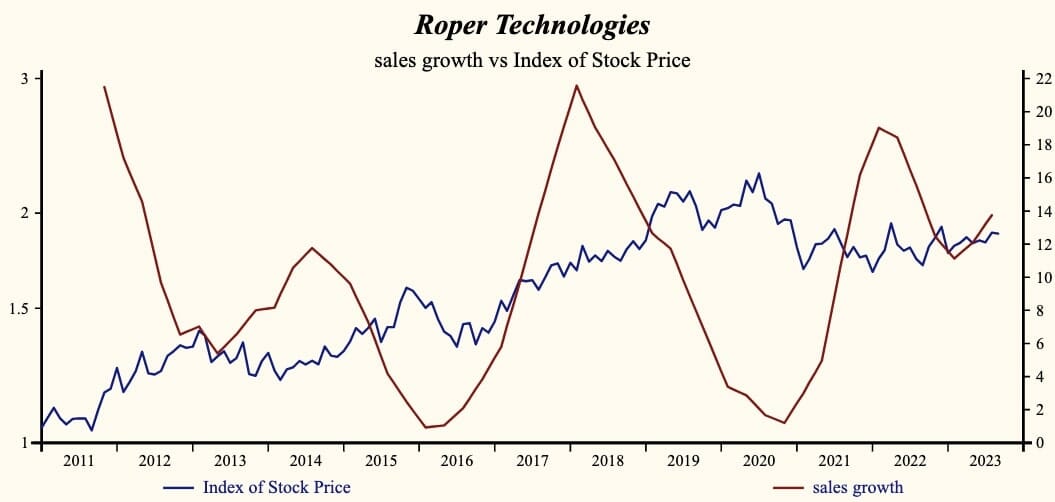

Currently, sales growth is 13.7% which is high in the record of the company but higher than last quarter. The shares have been very highly correlated with the direction of sales growth.

The company is recording a rising Gross Profit Margin. SG expenses are high in the record of the company but falling. That implies that the company has further capability to accelerate EBITD relative to sales with lower costs. Higher gross margins and lower SG expenses are producing a leveraged acceleration in EBITD relative to sales.

Cashflow at New High

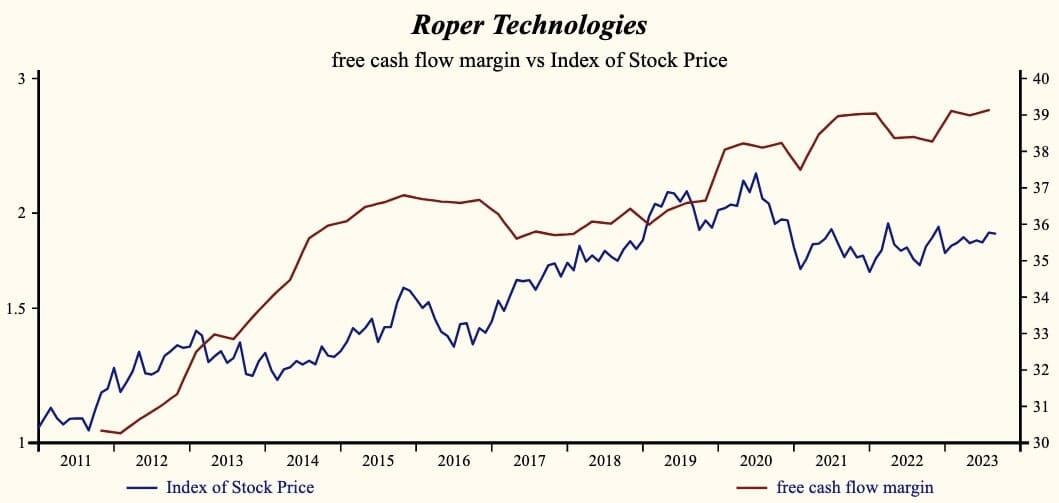

As a percentage of sales, free cash flow measures the relationship between cash flow growth and capital expenditures. The stronger gross margin and lower costs is producing an acceleration in the EBITDA profit margin thereby accelerating free cash flow growth.

The shares of Roper Technologies have declined by 3% since the April, 2022 high.

However, and more recently, the shares have gained interest and are now trading at upper-end of the volatility range in a 17-month falling relative share price trend.

Despite the recent uptick in the share price, the broad improvement in fundamentals provides a good opportunity to buy the shares of this evidently accelerating company.

The more stable the pot appears, the better the attributes. Green and gold are good. Red is bad and the more intense the red the more urgent the call to action.

Learn more and sign up for our Otos NOtos notifications at OTOS.io and experience your financial reality as FREEDOM AND EMPOWERMENT.

Source valuewalk