Compelling Reasons NVIDIA Will Rise Another 50%

NVIDIA Corp (NASDAQ:NVDA) shocked the world with its Q1 results and issued equally shocking Q2 results. The takeaway is that NVIDIA is cemented as the leading player in AI during this early phase of the revolution. The company’s chips are the #1 building block for AI-powered and quick-computing applications, where most of the IT money is flowing this year.

Key Points

- NVIDIA issued another mind-bending report with equally astonishing guidance.

- Shares are moving higher on the news and could gain 35% to 55% in a matter of weeks.

- Investors should not chase the action but wait for price pullbacks to add to positions.

- 5 stocks we like better than NVIDIA

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

The question is, is it too late to get on board with this market? Based on three critical factors, this stock could rise at least another 25% before it peaks out, and it will more likely top 50% before the play is through.

50%? Really? This Is How NVIDIA Gets To $750

The simple fact is that NVIDIA is the hottest stock today. As a wise investor said following the Q2 release, it only takes 1 hot report to erase the impact of 4 bad ones; the meaning is that there are many losing trades in the market right now, and bulls are piling into this 1. That alone can push the stock higher, and there is a significant amount of bullishness in the charts.

The foundation of the move began last year when the stock began to bottom. The bottom formed a Head Shoulders pattern that was confirmed as a reversal this year with the rise of AI. The reversal is now augmented by a solid continuation signal pointing the market higher.

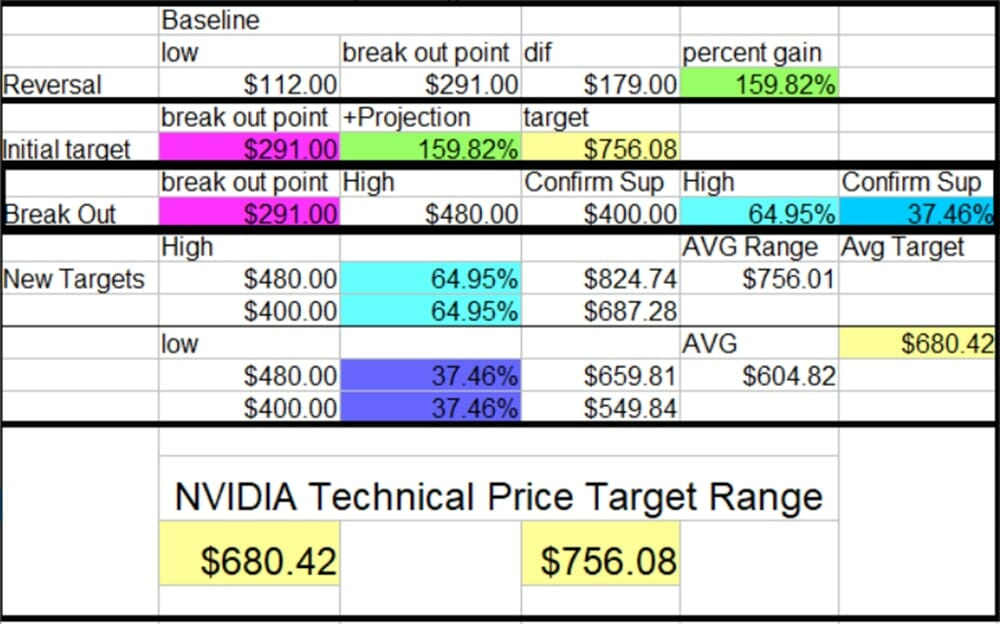

On a technical basis, it is the Head Shoulders pattern that matters now. It is a sign of how large this market is, and it is a big market. The H reversal is worth $179 in magnitude, a gain of 160% from bottom to neckline. Project that gain from the neckline, 160%, and you get $756 or 51.2% from the post-Q2 release price point of $500.

The post-breakout activity backs up that target. The move up from the breakout point topped near $480 and confirmed support at $400, which is good for another 37.5% to 72% advance. When projected from the $400 support level and the $480 high-point, those targets range from $604 to $756, which aligns with the initial target. The average of those targets is good for a gain of 40%.

The Results: They Prove NVIDIA Is Winning AI And Its Accelerating

NVIDIA’s results are jaw-dropping enough on their own, but then you have to consider how mind-bending the guidance was, the margin of outperformance, and how much stronger than the Marketbeat.com consensus the guidance is. The takeaway is that NVIDIA is not only winning in AI, but the shift is accelerating and may not top out for several quarters.

The critical factor for NVIDIA is that it is not just a chip company but a full-service, full-stack AI workshop that facilitates all levels of the industry. Fundamentally, NVIDIA is AI, and AI is NVIDIA.

The Analysts Will Drive NVIDIA Even Higher

The analysts have been a driver of NVIDIA’s stock market all year and will continue to do so in 2023 and 2024. The Q2 release and guidance sparked at least 20 revisions within the 1st 12 hours, and the news is all bullish. The 20 picked up by Marketbeat.com’s tracking tools include 3 upgrades to Buy and 18 increased price targets.

The range of targets is broad, with a low of $550 and a high of $1100, implying the stock will more than double. The consensus of the new targets is $645, about 30% above the pre-market action, leading the broader consensus higher.

This means the market will move higher for investors and traders, but chasing prices may not be a good idea. NVIDIA may make a large surge higher now, but investors with the long game in mind may want to wait for a price pullback before adding to positions because volatility should also be expected. The stock is up more than 400% over the last 12 months and offers a juicy opportunity for current holders to take profits.

Should you invest $1,000 in NVIDIA right now?

Before you consider NVIDIA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NVIDIA wasn't on the list.

While NVIDIA currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

The post Compelling Reasons NVIDIA Will Rise Another 50% appeared first on MarketBeat.

Source valuewalk

NVIDIA Corp. Aktie

Die NVIDIA Corp. Aktie ist etwas beliebter: Mehr Buy- (127) als Sell-Einschätzungen (6).

Für NVIDIA Corp. ergibt sich ein leicht positives Potenzial, angesichts eines Kursziels von 901 € im Vergleich zu 825.0 €.