BYD Co. Ltd buy Subdi

Summary

This prediction ended on 17.07.23 with a price of €10.17. With a performance of 345.52% the BUY prediction by Subdi was a big success. Subdi has a follow-up prediction for BYD Co. Ltd, but this time predicts that BYD Co. Ltd is a Sell. Dividends of €0.11 are taken into consideration when calculating the performance. Subdi has 100% into this predictionBYD Co., Ltd. is a Chinese listed company (Symbol BYDDF) primarily engaged in the manufacture and sale of automobiles, rechargeable batteries and related products. It also offers transportation and key components for hybrid electric vehicles. BYD has been recognized globally for its electric vehicle technology and has produced over 100,000 electric cars and buses for the Chinese domestic market, making it the world's largest manufacturer of electric vehicles. Additionally, the company has expanded globally with its products sold in over 50 countries and regions.

Performance without dividends (%)

| Name | 1w | 1m | 1y | 3y |

|---|---|---|---|---|

| BYD Co. Ltd | 0.368% | 0.368% | 1.457% | 31.657% |

| iShares Core DAX® | 0.760% | 1.149% | 17.258% | 65.150% |

| iShares Nasdaq 100 | 0.732% | 1.884% | 8.152% | 103.965% |

| iShares Nikkei 225® | 1.025% | -0.865% | 13.066% | 45.628% |

| iShares S&P 500 | -0.036% | 1.480% | 3.393% | 63.267% |

Comments by Subdi for this prediction

In the thread BYD Co. Ltd diskutieren

BYD ist langfristig ein Kauf...

BYD - Ich würde jetzt nicht mehr kaufen!

https://www.godmode-trader.de/analyse/byd-ich-wuerde-jetzt-nicht-mehr-kaufen,9643770

The first Blade Battery-powered vehicle in Europe is the Tang SUV

... viel Info und schöne Marketing-Videos in diesem Thread:

https://twitter.com/bridgemccarthy_/status/1425563647858851841

Watch the video and unveil the production and shipment process that brought the BYD Tang to you.

https://twitter.com/BYD_Europe/status/1427265639224430596

China is Coming: Part 2 | In Depth

Im ersten Teil geht es 33 Minuten um die grundsätzliche Stärke der chinesischen Autoindustrie im Vergleich mit amerikanischen, europäischen und japanischen Herstellern:

China is Coming: Observations from an Expert | In Depth

EXCLUSIVE Toyota turns to Chinese tech to reach its electric holy grail

Visitors check a Toyota C-HR electric vehicle (EV) during a media day for the Auto Shanghai show in Shanghai, China April 19, 2021. REUTERS/Aly Song

- Summary

- Toyota's new China-only EV sedan to hit market late 2022

- New EV set to join Toyota's 'bZ series' electric range

- Car will use BYD's 'breakthrough' LFP Blade battery

- Part of broader effort to learn low-cost know-how from BYD...

https://www.reuters.com/business/autos-transportation/exclusive-toyota-turns-chinese-tech-reach-its-electric-holy-grail-2021-12-02/

BYD has reportedly received 10 GWh of orders from Tesla for LFP batteries

BYD's annual sales surpassed 730,000 new energy vehicles and sold more than 590,000 new energy vehicles

https://inf.news/en/auto/9bcf1fb33af1847d150d2289f3fbf80a.html

Toller thread auf Twitter, das ist der 7. Beitrageiner Serie:

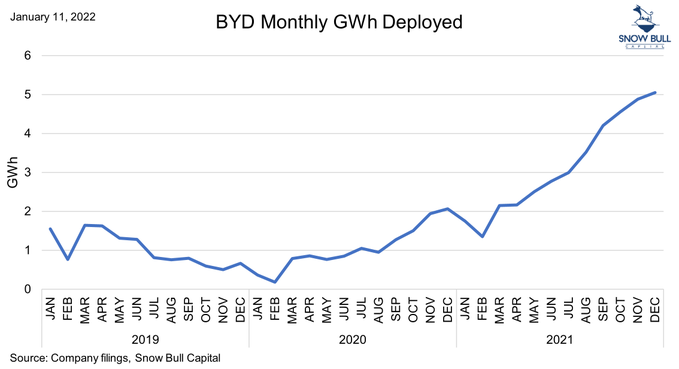

December was the first month BYD deployed more than 5GWh of batteries. In 2021, BYD deployed 37.921GWh, up 201% Y/Y.

MEHR LESEN...

BYD ist schließlich einer der Weltmarktführer, sowohl bei der Energiespeicherung, wie auch bei der Elektromobilität. Ganz anders als Volkswagen ...

https://twitter.com/BYDGlobal/status/1489221317261885442

... weiterlesen: https://www.automotiveworld.com/news-releases/byd-signs-strategic-mou-with-uzauto/

Maruti Suzuki, Toyota India EVs to get latest BYD Blade cell technology

- Blade batteries use Lithium ferrous phosphate (LFP) chemistry

- BYD says Blade cells have proven to be safer than other Li-ion batteries

- Blade battery packs use a ‘cell-to-pack’ architecture, reducing overall cost

So what are Blade batteries, and what is so special about them? Here’s the lowdown.

There are numerous chemistries of Li-ion batteries available, but the most common types are the lithium ‘metal’ oxide (where the metal can be NMC [nickel-manganese-cobalt] or NCA [nickel-cobalt-aluminium], among others) and lithium ferrous phosphate (LFP). While NMC batteries have remained the go-to choice for Western automakers like Mercedes-Benz, BMW, Volkswagen and Ford, the LFP chemistry has found favour with Chinese automakers.

BYD’s Blade batteries are based on the LFP chemistry. They derive their name from the fact that each cell is prismatic (read: cuboidal) and incredibly long, measuring 96cm in length, 9cm in height and just 1.35cm in thickness. However, BYD claims that its Blade batteries are superior to conventional LFP cells.

NMC batteries have been widely criticised for their safety risks and the potential for spontaneous combustion in case of accidents. The cobalt content in the batteries minimises the fire hazard, but with the element being expensive, difficult to ethically source and infamous for being unfriendly to the environment, companies are hard at work to reduce the amount of cobalt in their batteries, and, instead, increase the nickel content. While this does help to substantially increase their energy density, it also makes the batteries more prone to combustion, in case of a mishap.

Enter the LFP batteries. These are generally much safer, but BYD claims to have gone a step further with its version in the Blade cells. It says that during nail penetration tests – considered to be one of the most stringent in assessing battery safety – the surface of the Blade cells only reached a temperature of 30-60deg Celsius, without any signs of smoke or fire. The automaker further states that under similar conditions, conventional LFP batteries had a surface temperature of 200-400deg Celsius, while ternary (NMC) batteries not only exceeded 500deg Celsius, but also “violently burned”.

BYD goes on to state that even in other tests, where their batteries were “crushed, bent, heated in a furnace to 300deg Celsius and overcharged by 260 percent”, there were no incidences of fire or explosion. The company, however, is tight-lipped about how it’s been able to achieve such remarkable results.

NMC cells are said to have an energy density of 200-250Wh/kg, much higher than that of the LFP kind. But the latter have a distinct cost advantage, since they don’t use expensive metals like cobalt and nickel.

BYD has adopted a ‘cell-to-pack’ architecture for its Blade batteries, which is touted to have made them even more economical, in addition to improving their energy density.

For the uninitiated, the battery pack of any electric vehicle is structured in a manner where a cluster of individual cells is put into a frame to protect it from heat and vibration – this unit is called a module. A number of modules grouped together form a battery pack.

Boasting of increased safety, BYD has decided to skip the module phase and directly integrate its cells into a battery pack (hence the name, cell to pack). With lesser packaging involved, the whole pack is cheaper and also slimmer and lighter, resulting in a higher energy content (per unit mass as well as volume) at the pack level. It is, however, important to note that on a cell level, Blade batteries are said to have an energy density of around 160Wh/kg – similar to that of conventional LFP cells.

As we have previously reported, Maruti Suzuki plans to be extremely price competitive with its electric midsize SUV that is expected to be positioned in the Rs 13 lakh–15 lakh range, something that could be made possible due to the lower costs of Blade cells.

In 2019, Toyota entered into an agreement with BYD for the joint development of batteries, as well as electric vehicles that would be launched in China by the mid-2020s. With a partnership already in place, the Japanese automaker is likely to further leverage it to bring BYD’s Blade battery tech to its vehicles in India.

For now, Blade cells are produced at BYD’s production facility in Chongqing, China, which has an annual production capacity of 35GWh. It remains to be seen if Toyota and Maruti Suzuki decide to simply import the cells into India, or if BYD sets up a manufacturing facility here as well. The Chinese company’s name, however, wasn’t listed in the group of companies seeking PLI incentives from the government for setting up Advanced Cell Chemistry (ACC) factories in the country. ...

weiterlesen: https://www.autocarindia.com/car-news/maruti-suzuki-toyota-india-evs-to-get-latest-byd-blade-cell-technology-423553

Eine Bank, ich glaube es war die Citigroup, besaß plötzlich so viele Aktien von BYD zusätzlich wie Warren Buffets Berkshire Hathaway vorher besessen hatte. Daraus wurde geschlossen, dass Warren/Berkshire alle seine Aktien von BYD verkauft hat.

Ich kann mir durchaus vorstellen dass das stimmt, denn Warren ist ganz klar ein amerikanischer Patriot. Kürzlich hat er sich positiv über Jeff Bezos und Elon Musk geäußert, und gesagt dass solche Erfolgsgeschichten nur in Amerika möglich sind, obwohl er nie in deren Unternehmen investiert hatte..

Ich halte es deshalb gut für möglich, dass Warren seine Position in BYD auflöst um in Tesla zu investieren. Die beiden Unternehmen haben vieles gemeinsam, doch es gibt auch Unterschiede:

Tesla macht hohe Gewinne durch die Massenproduktion von nur vier Automodellen, während BYD sein Cash zum größten Teil in den Ausbau der Firma investiert. BYD produziert alles mögliche, unzählige Automodelle, verschiedenste Batterien, Halbleiter, ja sogar Atemschutzmasken.

Die Gemeinsamkeit ist, dass beide Firmen stark vertikal integriert sind, und auch Tesla entwickelt eigene Chips sowie Batterien, jedoch nicht für alle möglichen Anwendungen, sondern nur für die eigenen Produkte. Beide Firmen sind die einzigen Hersteller, die heute nachweislich hochwertige Elektroautos in Massenproduktion mit Gewinnen herstellen können, und beide Firmen sind Technologieführer in bestimmten Bereichen.

Wenn Warren Buffet seine BYD Aktien verkaufen, und auf Tesla umsteigen würde, wäre das für mich kein Problem. Ich bleibe für beide Firmen optimistisch. Ich sehe den Rücksetzer als gute Kaufgelegenheit für BYD, wenn ich bereits bei Tesla long bin ...

Das Wachstum der Absatz-, Umsatz- und Gewinnzahlen war im letzten Quartal so stark, dass selbst die größten Optimisten (wie ich:-) überrascht waren.

Obwohl es sicher ein grundsätzliches Risiko für chinesische Aktien gibt, halte ich Industrieunternehmen für weniger riskant als Unternehmen in den Bereichen Kommunikation und Geldverkehr, denn das sind die Bereiche, die die kommunistische Partei kontrollieren will, um das Machtsystem in China stabil zu halten.

Des weiteren ist BYD nicht mit einer fragwürdigen Konstruktion an US Börsen gelistet, und demnach droht kein Delisting.