News

$20 looks like a good fit for The Gap after XL earnings beat

Don't be surprised if you see many shoppers at The Gap Inc. (NYSE: GPS) this holiday season.

Why?

The retailer is crushing it.

Well, sort of.

On Friday, the company behind Old Navy, Banana

Homebuilder stocks soar as sector outpaces the market

Few sectors have impressed as significantly as the homebuilder sector in recent weeks. The SPDR S&P Homebuilders ETF (NYSE: XHB) has risen over 16% over the last month. That performance is enough

Plan to own one retailer? Make it this one

During the holiday season, Wall Street will pay particular attention to retail stocks in what tends to be their make-or-break time of the year.

Some individual names like Ralph Lauren Co. (NYSE:

Jobs Are Going To The Construction Industry, Momentum Play Time

When an industry decides to go on a hiring spree, you better bet on the respective firms' overall management to expect a surge of demand - and, therefore, profits - coming right around the corner

Tip The Risk / Reward Scale In your Favor With These 3 Names

Widely watched inflation indicators have proved to be more persistent than initially thought, making the argument from the FED chairman, Jerome Powell, a shrug from the past year. Inflation has

America's Favorite Dividend Is On Sale, Grab Realty Income Now

The real estate market in the United States is undergoing a tantrum, as neither builders nor would-be buyers are happy with how mortgage rates are behaving today. Shares of Realty Income (NYSE: O)

2 Value Stocks To Claim Your Place In The Appliances Bottom

Today's economic uncertainty, namely wild guesses from economists and talking heads as to where the United States economy will head next, sends aftershocks across different industries and makes

Nordstrom: 3 Reasons the Pre-Earnings Dip Is an Opportunity

Like its summer merchandise, shares of Nordstrom, Inc. (NYSE:JWN) are on sale.

After bouncing nicely off a two-and-a-half-year low, Nordstrom has fallen nearly 20% this month. And with the

Did Tapestry Just Become A Dip Buying Opportunity?

Shares of Tapestry Inc. (NYSE: TPR), owned by high-end luxury brands like Kate Spade and Coach, have declined nearly 20% in the past two weeks. The dire price movement came just after news leaked

G-III, PVH, Ralph Lauren: Promising Charts Even As Revenue Slows

The American consumer is giving mixed signals when it comes to apparel spending, but clothing companies G-III Apparel Group Ltd. (NASDAQ: GIII), PVH Corp. (NYSE: PVH) and Ralph Lauren Corp. (NYSE:

3 High-Yield Values Ready To Rebound

High yields are attractive but can be a red flag for investors. Marketbeat.com’s list of High Yield stocks has many names that cannot sustain their high yields, have already cut their

Nordstrom's Earnings Beat, A Rally In The Making

Shares of Nordstrom (NYSE: JWN) are trading higher by nearly 2% on Thursday's trading session on the back of adjusted earnings per share beat. While

PVH: Is This Value Back In Style?

PVH Corporation (NYSE: PVH) shares pulled back in the wake of the Q1 release and guidance, which begs the question, is the value a buy? The stock is certainly a value compared to peers like Ralph

It’s Time To Try On VF Corporation’s 6% Yield

VF Corporation (NYSE: VFC) has entered a year of change that could lead the stock higher. The company is working to turn around the core brand, Vans, and improve its supply chain and efficiency

Is PulteGroup Overbought After Double-Digit Gains?

Contrary to doom and gloom coming from some market prognosticators, residential home builders have been a highly investable industry in 2023. Recently, PulteGroup Inc. (NYSE: PHM) has been the

Hunting For A Deal? Ross Stores May Just Be It

Despite a choppy United States financial market, where investors are still digesting the aftermath of the FED raising rates in its attempt to control inflation, shares of Ross Stores (NASDAQ:

Can High-Yield Whirlpool Spin Higher In 2023?

Whirlpool Corporation (NYSE: WHR) is not an exciting name, it isn’t a growth stock, and it has headwinds in the form of slowing home sales, but it is also an attractive investment. This blue-chip

Daimler Truck – Nutzfahrzeughersteller behält den Fuß auf dem Gaspedal

Der Nutzfahrzeughersteller Daimler Truck gab im Schlussquartal 2023 kräftig Gas und überraschte mit dem kräftigen Umsatz- und Gewinnplus die Marktteilnehmer. Für 2024 zeigt sich das Management

JOOR bringt 25 Mio. USD zur Beschleunigung von Wachstum und Innovation zusammen; Expansion im Zahlungsverkehr und in neuen Kategorien

Brightwood Capital und Tamarix Capital Partners schließen sich bestehenden Investoren bei neuer Kapitalerhöhung an

NEW YORK, Oct. 17, 2023 (GLOBE NEWSWIRE) -- JOOR, das weltweit führende

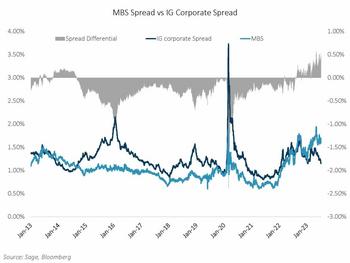

The Fed is Likely Done Hiking – What’s Next?

Economic readings continue to point to a “soft landing” through the next few months, characterized by low and falling inflation and a resilient labor market. Consequently, the Fed raised interest

Mega Tech Names Continue To Lead

In his Daily Market Notes report to investors, Louis Navellier wrote:

Tech Sunshine

Tech names continue to lead despite the very high earnings multiples they’ve already climbed to. With

SunCar Technology Stock Overheats… Will it Rise Again?

Key Points

- SunCar Technology provides auto insurance and aftermarket services in China.

- SDA began trading on the Nasdaq on May 18th and came crashing back down after an initial 7-day win

Nordstrom’s Earnings Beat, A Rally In The Making

Key Points

- Nordstrom shareholders were surprised to see the company report an earnings beat during the first quarter of 2023, especially as the broader industry suffers dire challenges.

It’s Time To Try On VF Corp’s 6% Yield

Key Points

- VF Corp is at an extreme low, and income-investor should pay attention to it.

- The company is on the verge of a turnaround, and growth should come by the end of the year.

- The