The Fed is Likely Done Hiking – What’s Next?

Economic readings continue to point to a “soft landing” through the next few months, characterized by low and falling inflation and a resilient labor market. Consequently, the Fed raised interest rates for what is probably the last time during the current cycle. The concern for markets this week shifted to the sustainability of continued fiscal spending in a world where the unemployment rate remains below trend and the economy is not clearly in a recession.

Coupled with the policy shift from the Bank of Japan, which raised its upper bound for the 10Y JGB yield to 1.00%, the expectations for higher risk premium in longer maturity bonds could spill over to spread sectors and equities as higher term premium could push credit and equity risk premia higher.

1. Rebalancing of Labor Market.

The Jobs to Workers gap continues to tighten, led by a decline of job openings of 2.5 million jobs since the middle of 2022, signaling the easing of the labor backlog since COVID. The number of unemployed has remained relatively stable and has not risen significantly.

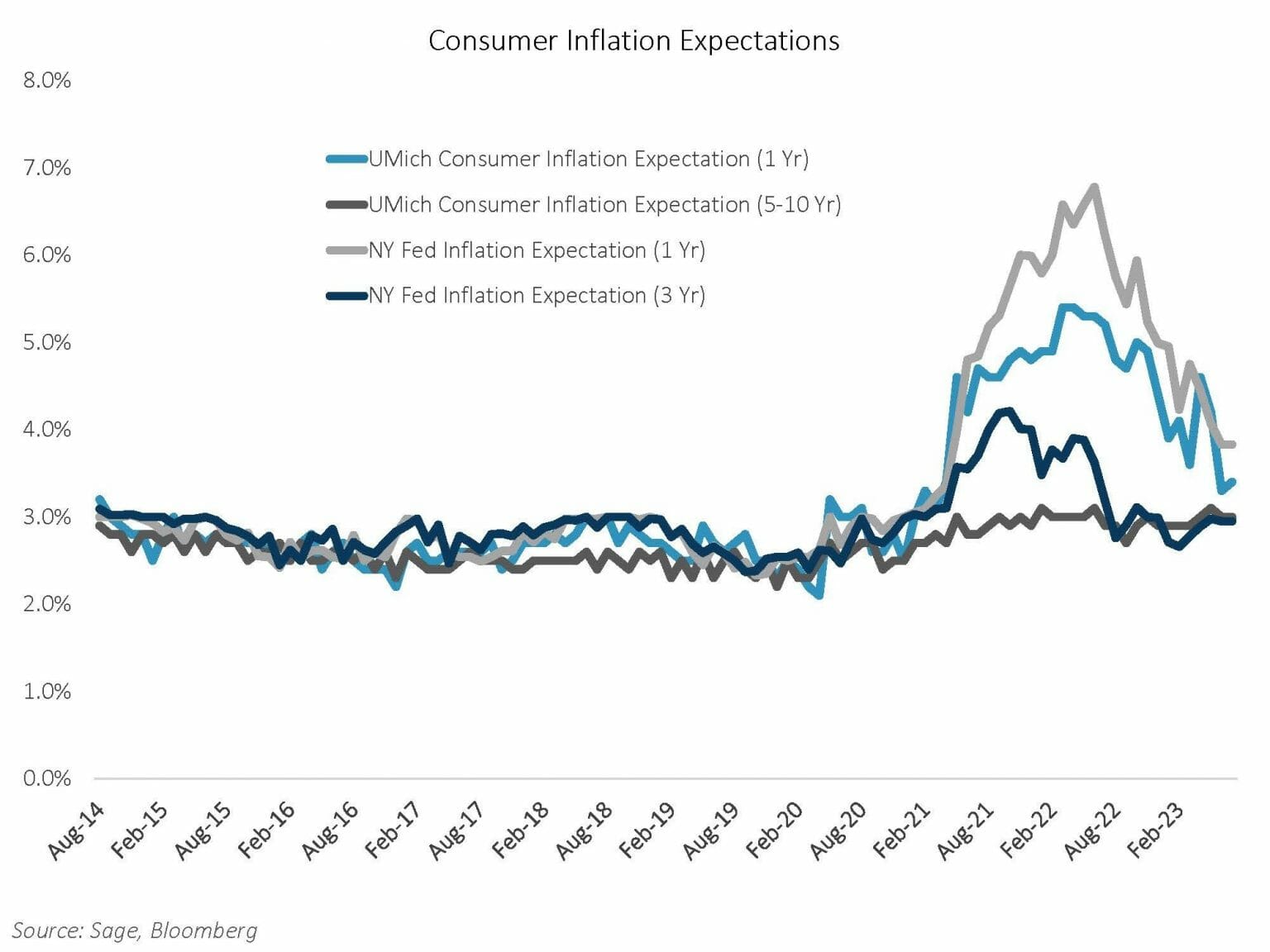

2. Inflation Expectations Normalizing.

Consumer inflation surveys and market-based measures have normalized – the inflation psychology remains anchored to trend inflation. Falling inflation expectations is an additional positive data point that gives the FOMC the ability to stop raising policy rates.

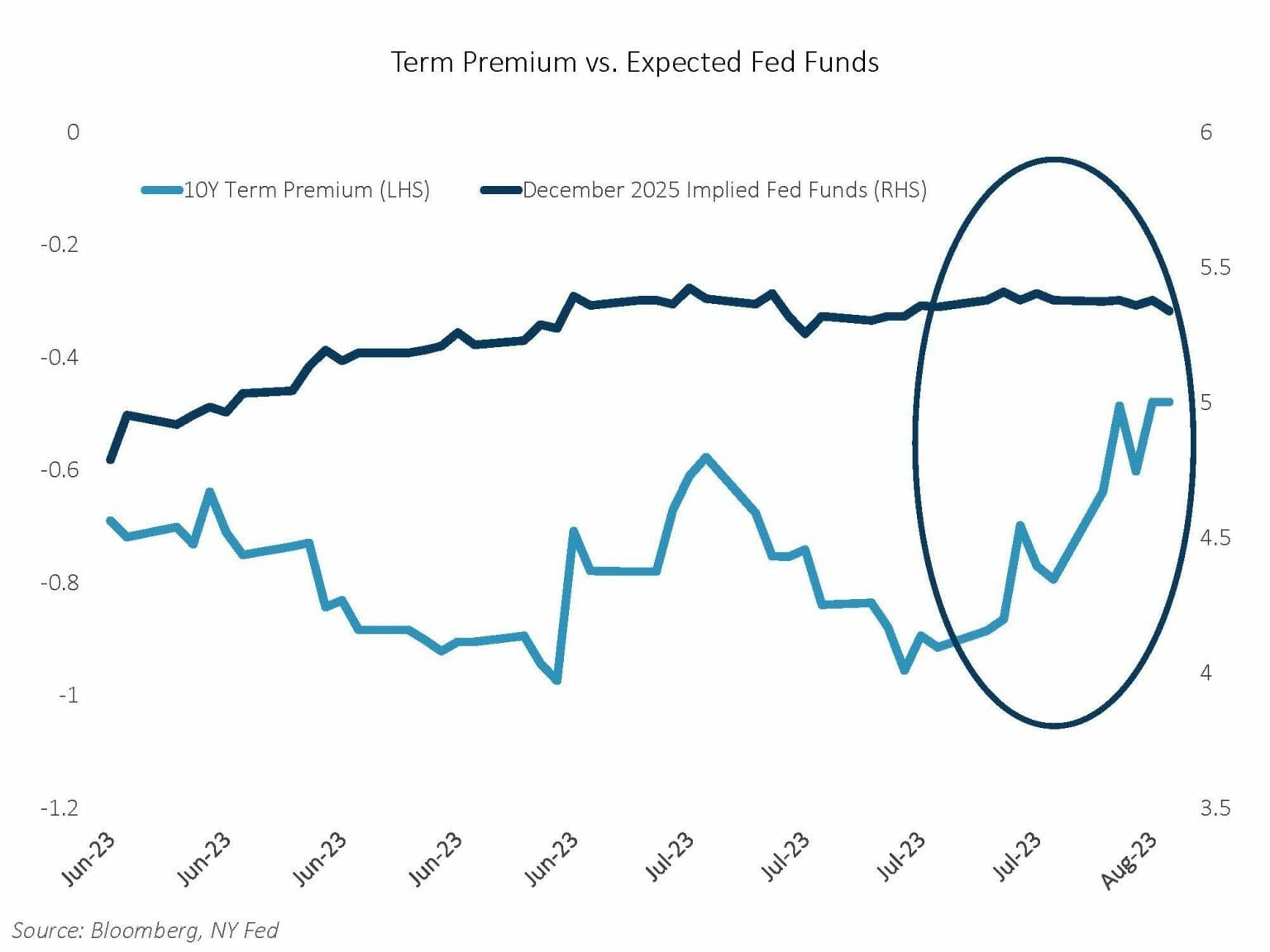

3. Bear Steepening of the Yield Curve.

In early August, market concern shifted to the sustainability of fiscal spending and increased Treasury issuance. The expected path of Fed Funds has remained largely stable since the July FOMC meeting, while term premium popped higher – signaling that investors are demanding more premium for taking on longer maturities. As a result, the long end of the US yield curve moved higher while the short end remained largely the same – a rare “bear steepening” of the yield curve.

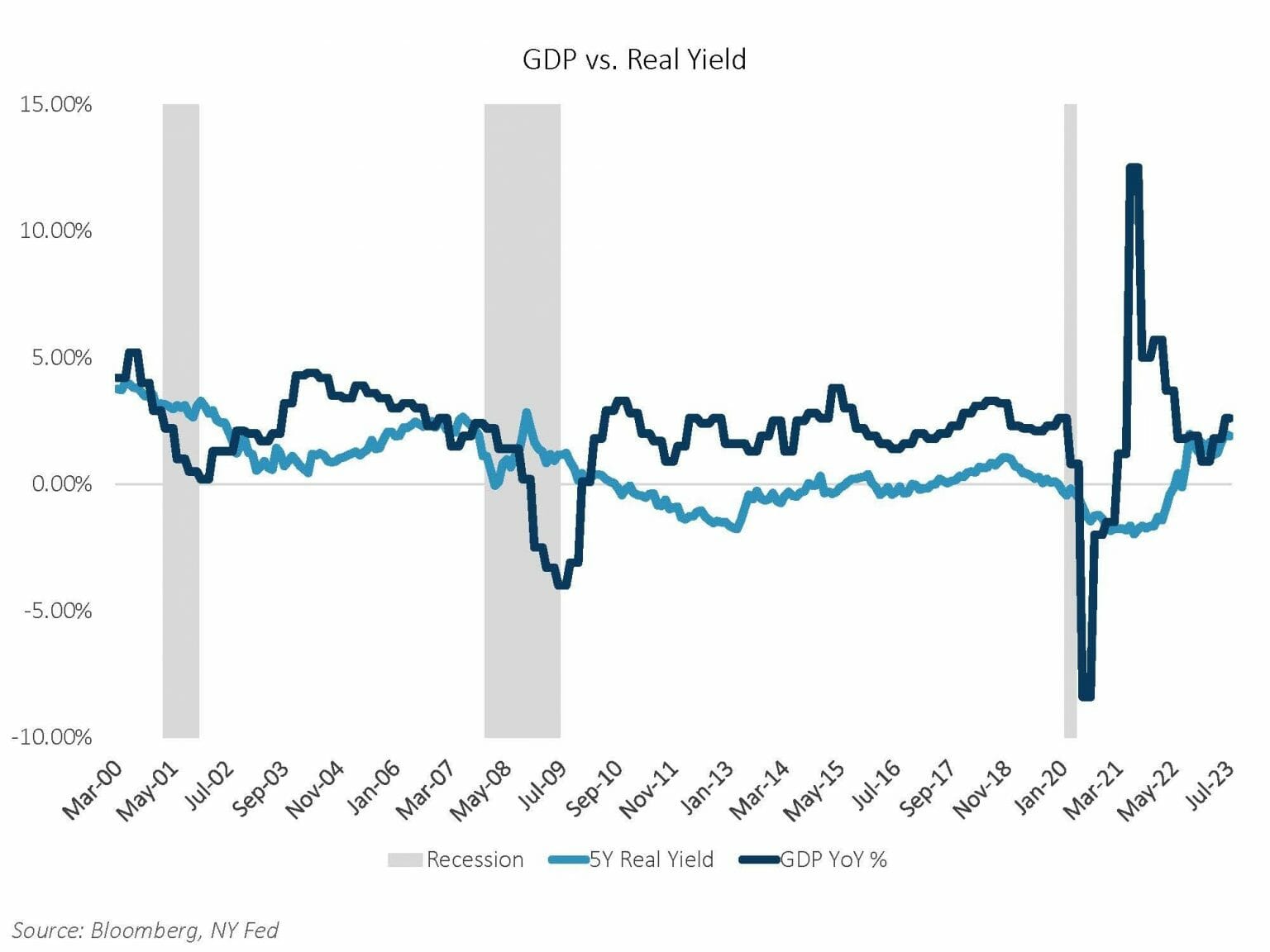

4. Real Interest Rates Could Start to Restrict Economic Growth.

Real interest rates are the cost of capital for the US economy and have now closed the gap with US GDP. A negative GDP/Real Yield Gap has historically resulted in economic slowdowns, will this time be different?

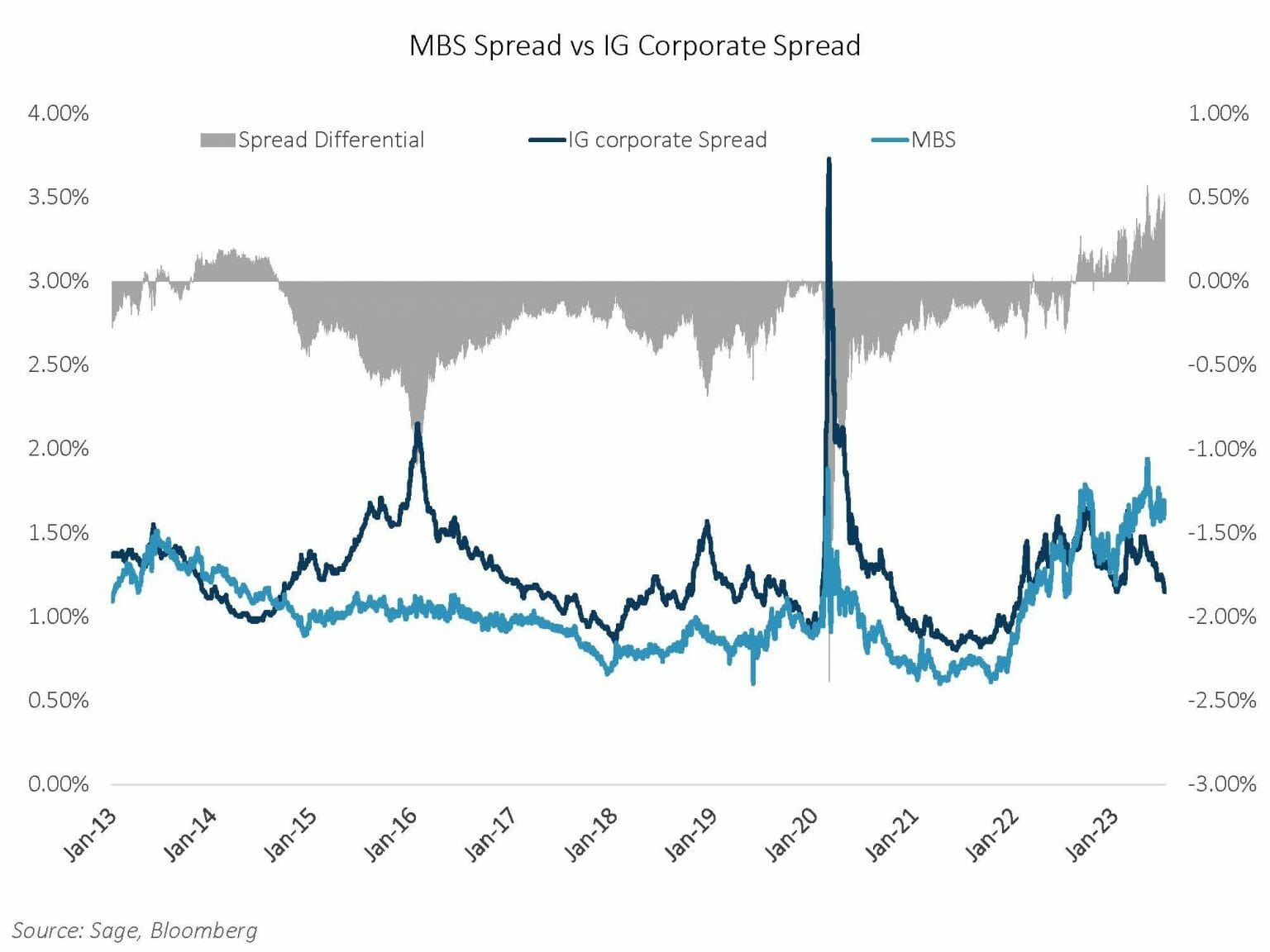

5. Continue to Favor MBS Over Corporates.

We continue to underweight corporate bonds versus MBS. The MBS basis is the most elevated versus corporate bond spreads in over 15 years. For a sector that provides a quality, liquidity, and spread pickup, we believe MBS continues to provide a compelling opportunity.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product.

Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage.

Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions.

Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our website at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

For more news, information, and analysis, visit the ETF Strategist Channel.

Article by Sage Advisory, ETF Trends

Source valuewalk

Gap Inc. Stock

Gap Inc. is currently one of the favorites of our community with 15 Buy predictions and no Sell predictions.

With a target price of 23 € there is a slightly positive potential of 10.31% for Gap Inc. compared to the current price of 20.85 €.