"You do things when the opportunities come along. I’ve had periods in my life when I’ve had a bundle of ideas come along, and I’ve had long dry spells. If I get an idea next week, I’ll do something. If not, I won’t do a damn thing." --Warren Buffett

TREASURING TREASURIESE

TREASURING TREASURIES (May 15, 2025): Investors have become disenchanted with investing in U.S. Treasuries, thereby causing their yields to climb in recent years to their highest levels since the beginning of the century. The most informed insiders, known as commercials, have an aggregate net long position which is near the 98th percentile of their historic range. Some of the most-experienced investors today, including Warren Buffett, have been aggressively accumulating U.S. Treasuries since their yields had reached multi-decade highs during the final months of 2022. The media in 2025 have featured far more bearish than bullish articles regarding U.S. Treasuries. In recent weeks there has also been a sharp surge of stories about how the U.S. dollar will lose its role as the world's reserve currency, which is one of the most important reasons especially for non-U.S. investors to own U.S. Treasuries.

The primary reason for investing in U.S. Treasuries is that, relative to U.S. stocks, they have rarely been more undervalued in their entire history going back to when George Washington was the U.S. President.

The U.S. government began to issue U.S. Treasuries in 1789, which was one year prior to the founding of the Philadelphia Stock Exchange and three years before the New York Stock Exchange officially opened for business. As a general principle, investors can either purchase U.S. Treasuries which pay interest or they can buy stocks which pay dividends. The idea is that since U.S. Treasuries are explicitly guaranteed by the U.S. government, whereas stocks can fluctuate unpredictably, the dividend yield on the S 500 Index and for most equity investments will have to be higher than the yield on short-term U.S. Treasuries to induce investors to take the much higher risk of Stock ownership. However, because large-cap U.S. stocks have outperformed nearly all other investments in recent years, most people are willing to accept a lower return from equity dividends and to give up 4.3% guaranteed on U.S. Treasury bills, because they are so confident of making 20% or more per year by investing in the biggest and most popular U.S. stocks. This is obvious by the all-time record inflows into funds of U.S. stocks in retirement accounts and for retail investors in general, even as the fundamental valuations of the most popular U.S. equities are near the 99th percentile of their historic range. The yield on the 10-year U.S. Treasury bond, currently 4.431%, is almost 3.5 times the S 500 yield of 1.27%.

If someone is certain that he will make at least 20% per year in the stock market then he's not interested in getting a guaranteed 4.3%, or even more than 6% as some U.S. Treasury bills had yielded briefly when there was a Congressional standoff in May 2023. (I should probably say he or she, but hardly any woman would be so foolishly overconfident.) This is the real reason that U.S. Treasury yields are far above their long-term historic averages. The only way the U.S. government can induce sufficient investment in U.S. Treasuries is for their yields to be unusually high, because investors are currently interested in taking the greatest risks possible. This is one of the clearest signs that U.S. stocks are in a dangerous and unsustainable bubble which will be followed by a dramatic collapse.

A popular myth is that U.S. Treasury yields will keep rising because the U.S. government is running an especially large budget deficit which could rise even more due to federal tax proposals for 2026 and beyond.

Here is a simple quiz: in which year did the U.S. government experience not only its lowest deficit in many decades, but also an actual budget surplus? The answer is 2000, the final year of Bill Clinton's term in office. This was also the year when U.S. Treasuries sported their highest yields of the past several decades. This doesn't necessarily mean that a smaller U.S. budget deficit will be accompanied by rising Treasury yields, but it is pretty strong proof that there is no positive correlation between the size of the U.S. budget deficit and U.S. Treasury yields. If you study a long-term chart then you will see that the long-term correlation is close to zero.

The huge U.S. budget deficit and the surging total U.S. government debt are real drawbacks with the U.S. economy. The consequences will be numerous and potentially severe, but rising U.S. Treasury yields is not one of them.

A more recent and especially popular myth, especially in the mainstream media, is that the U.S. dollar will no longer serve as the world's reserve currency, a status it has enjoyed since it had supplanted the British pound in that role over a century ago.

The financial media, including many otherwise respectable publications, have observed the recent three-year bottom for the U.S. dollar index and, as they usually do whenever any asset falls to a 3-year low, are considering the possibility that the euro, the Chinese renminbi (yuan), or even a currency which doesn't yet exist will supplant the U.S. dollar as the world's reserve currency. This has raised widespread speculation that U.S. assets and especially U.S. Treasuries are dangerous to own in case the greenback suffers a serious pullback versus other global currencies. Here is a sampling of some recent articles on this topic:

The New York Times featured an article on the first page of their business section on April 28, 2025 about how the euro could become the world's premier currency. OMFIF made a serious case for a currency that doesn't even exist yet, and which will be shared among several countries which have few formal economic or political ties, to potentially take over the global reign from the U.S. dollar. Serious independent analysts including deVere have speculated that the Chinese renminbi could become the king of worldwide currencies.

Meanwhile, the frequency of bearish commentary about the U.S. dollar and U.S. Treasuries rose sharply in recent weeks, including this CNBC forecast of another 15% to 20% pullback for the U.S. dollar broadcast on April 29, 2025.

Magazine covers often highlight trends which are just about to dramatically reverse.

There are several magazines which tend to feature trends on their front covers just before they violently change direction. A classic example is during the exact week of the U.S. dollar index's recent three-year bottom, where The Economist cover story was entitled "How a Dollar Crisis Would Unfold," complete with a caricature of Edvard Munch's painting "The Scream." To give you an idea about how accurate this publication has been, also on the exact week of the recent multi-year bottom in November 2022 for many cryptocurrencies was this Economist cover story entitled "Crypto's Downfall."

Why is there a recent consensus about the U.S. dollar losing its role as the world's reserve currency, combined with a sharp rise in bearish forecasts for the greenback? The primary reason is that, just as with any asset that has recently achieved a three-year extreme in either direction, the vast majority of investors become convinced that such a multi-year trend will continue indefinitely. It doesn't matter whether it is an all-time high for large-cap U.S stocks, a new historic zenith for gold, or a five-year bottom for Brazilian and Chinese stocks. Analysts are most likely to be bullish toward any asset whenever the biggest percentage losses are about to occur for that asset, and to be maximally bearish whenever the strongest rallies are set to occur.

An interesting question is which U.S. government bonds to purchase, given the wide range from 4-week U.S. Treasuries to TIPS and I Bonds. I have been participating in all U.S. Treasury auctions since the summer of 2022 and have been accumulating a wide range of these, especially those which are consistently undervalued like the 6-week, 17-week, and 20-year Treasuries, along with TIPS from 10 through 30 years.

The 6-week and 17-week U.S. Treasury auctions have been around for a much shorter period of time than the better-established 4-, 8-, 13-, 26-, and 52-week Treasury auctions. Therefore, there are fewer participants out of unfamiliarity and a reluctance to change established habits, thus plumping up the 6-week and 17-week yields. The 20-year Treasury has had a longer existence but it is overshadowed by the 10- and 30-year Treasuries, thereby usually resulting in its yield being higher than it should be in relative terms.

TIPS, which pay a combination of a fixed rate determined at auction which is added to the U.S. inflation rate, tend to confuse many investors which stay away from them primarily for that reason. These have been sporting some of their highest real yields in their entire history, and therefore I have been consistently buying them both at auction and in the secondary market. The next 10-year TIPS auction will be held in the morning of Thursday, May 22, 2025.

There are little-appreciated side benefits to having U.S. Treasuries, especially if they are in a brokerage account.

U.S. Treasury interest is exempt from both state and local income taxes by federal law. This means that if you live in a place where these taxes are high, your after-tax return will be greater than with many competing investments. If you own U.S. Treasuries in a brokerage account, then only 1% of their value for short-term Treasuries and 2% for 52-week Treasuries is required to hold them on margin. This means that 100 dollars invested in U.S. Treasuries is as good as 98 or 99 dollars of actual cash for margin collateral purposes, plus it will currently be yielding close to 4.3%.

U.S. Treasuries are fully liquid, so that if you purchase a 3- or 20-year U.S. Treasury and you decide after several months or a year that you would like to sell it, all brokerages have a very active secondary market where you will get close to fair value for these Treasuries. You can also purchase "used" Treasuries in these secondary markets at generally favorable prices to supplement the Treasuries you buy at auction. The ability to sell a Treasury bond prior to maturity, and not to pay state and local income tax, makes these far superior to bank CDs which are almost completely illiquid and are subject to income taxes in all jurisdictions. In addition, U.S. Treasuries purchased at all auctions are free of brokerage fees. You can also purchase U.S. Treasuries at TreasuryDirect.gov which is maintained by the U.S. government and where no fees are charged, plus you get a detailed 1099 form each year for your income taxes.

The following are recent useful charts:

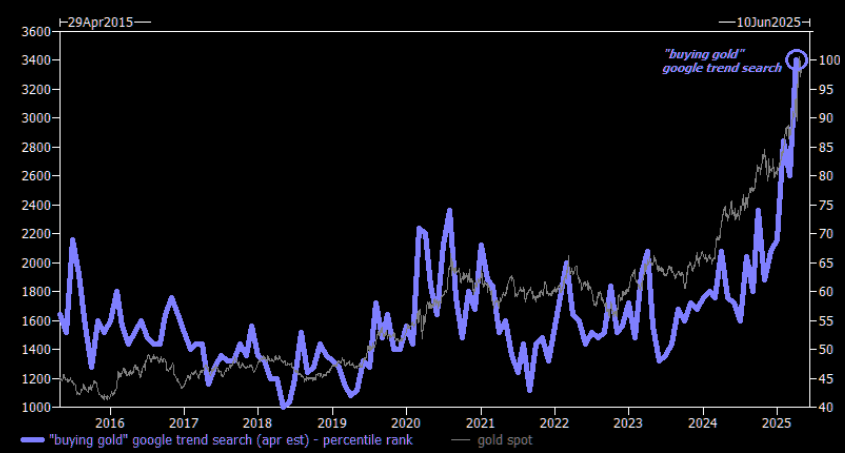

There was a nearly unanimous bullish consensus to buy gold a month ago when it had been the most calmly and positively behaving asset of 2025, as extreme tranquility consistently precedes the most tumultuous storms:

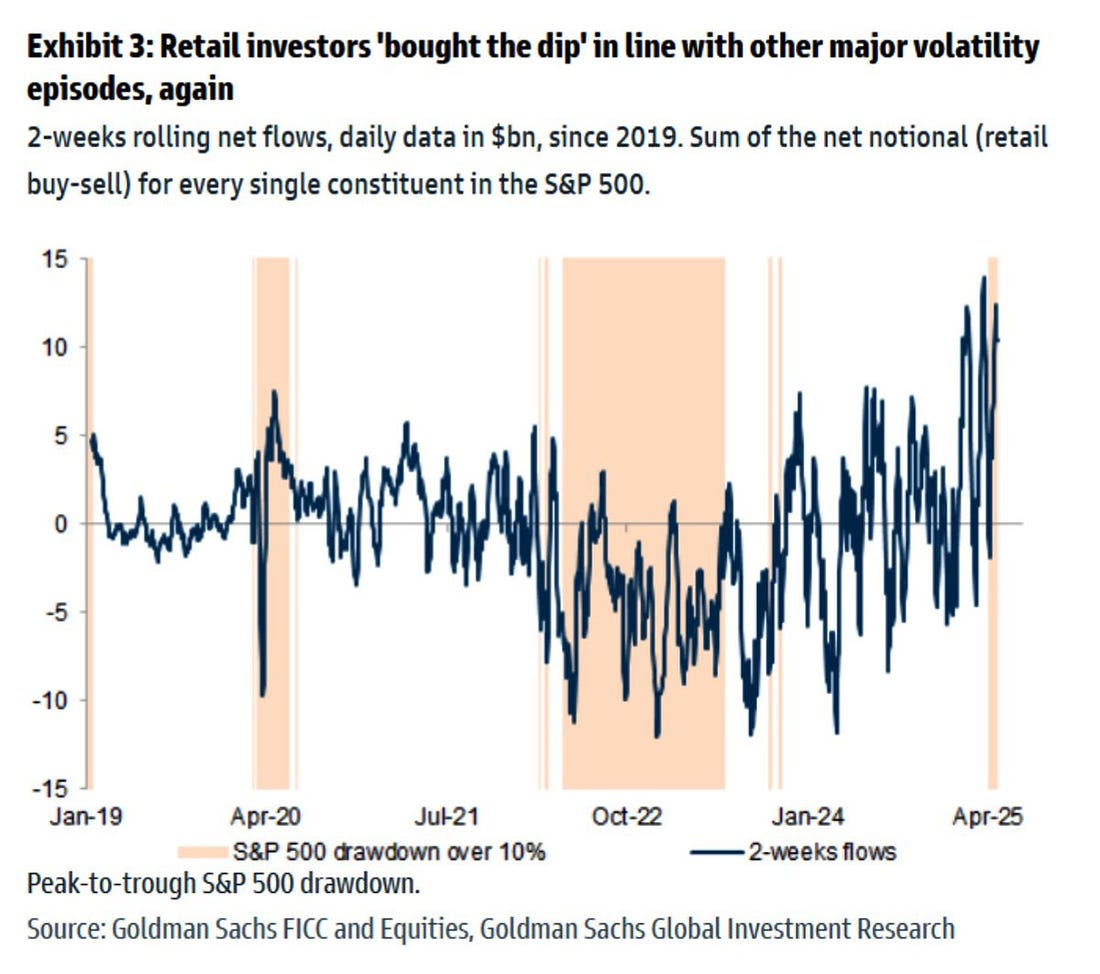

Retail investors have been especially excited about purchasing large-cap U.S. stocks which are modestly below their all-time highs:

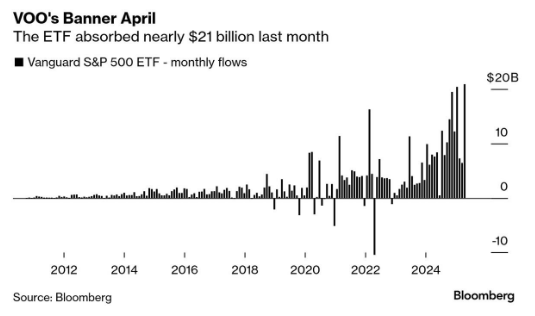

Especially in their retirement accounts, U.S. investors have never been more heavily committed to the largest and most popular U.S. stocks than they are now:

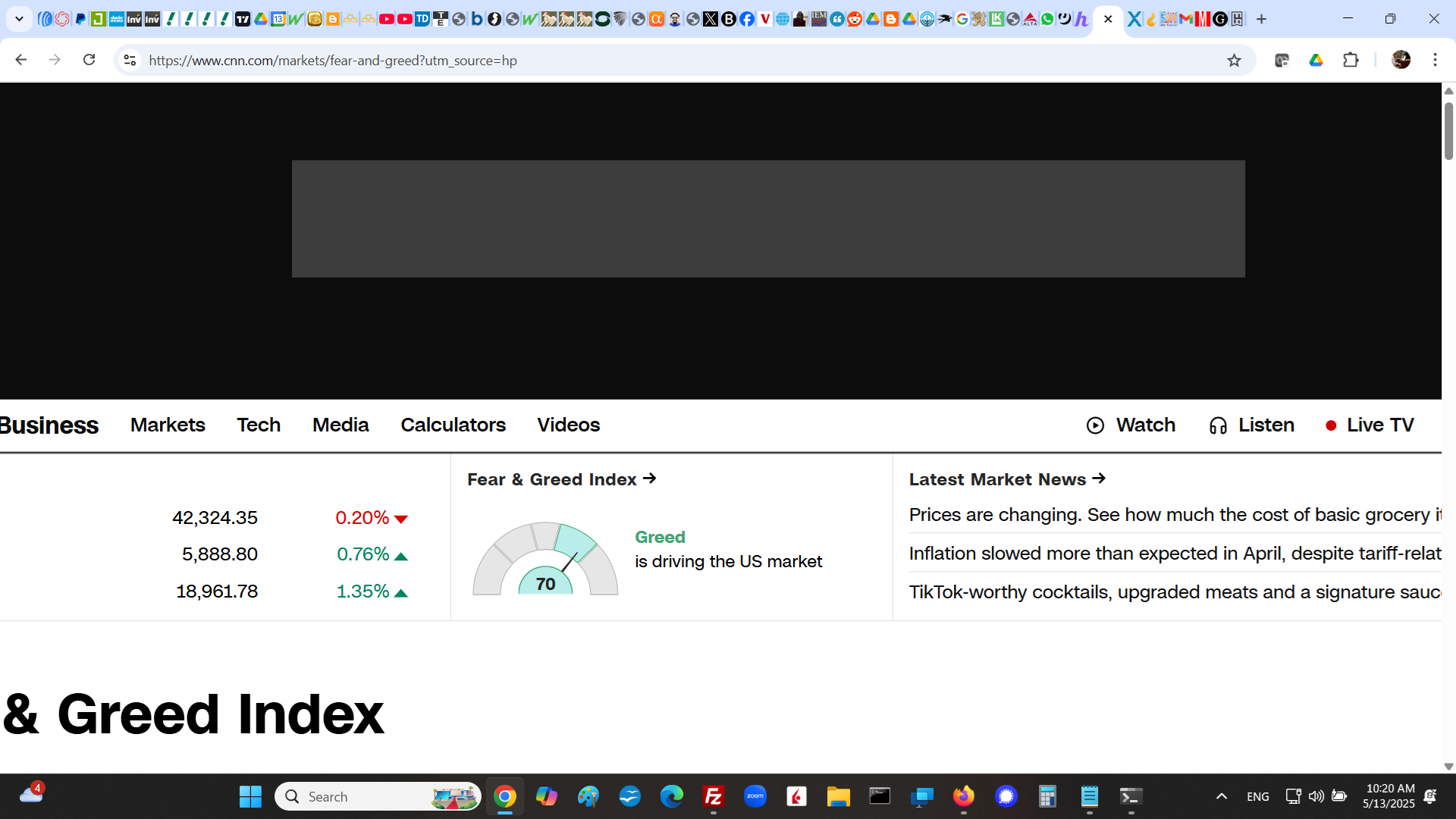

CNN's Fear and Greed Index soared all the way from 3 in early April to 70 during the past week:

The bottom line: with U.S. Treasuries trading near their highest yields and their most depressed valuations since the beginning of the century, investors are shunning them in order to own large-cap U.S. stocks which have only been slightly more overpriced briefly in February 2025. The vast majority of investors have responded to last month's three-year low for the U.S. dollar index by becoming very bearish toward the greenback. Gold mining and silver mining shares have already begun to form lower highs following 12-year peaks on April 21, 2025. Widely popular large-cap U.S. stocks will likely resume and intensify their bear markets which may have begun on February 18-19, 2025 or which will begin in the near future, and which may not touch their ultimate nadirs until they reach their lowest levels since 2013, perhaps during 2028.

Disclosure of current holdings:

Below is my current asset allocation as of 4:00 p.m. on Tuesday, May 15, 2025. Each position is listed as its percentage of my total liquid net worth.

I computed the exact totals for each position and grouped these according to sector.

The order is as follows: 1) U.S. government bonds; 2) shorts; 3) bear funds; 4) precious metals; 5) emerging markets; 6) individual Brazilian ADRs; 7) energy; 8) other individual shares.

VMFXX/TIAA Traditional, TIAA money market/bank CDs/FZDXX/FZFXX/SPRXX/SPAXX/BPRXX/Savings/Checking long: 36.76%;

17-Week/52-Week/26-Week/13-Week/2-Year/8-Week/3-Year/5,10,30-Year TIPS/4-Week/6-Week/20-Year: 24.12%;

TLT long: 10.66%;

I Bonds long: 3.80%;

PMM long: 0.01%;

XLK short: 32.09%;

QQQ short: 23.46%;

SMH short: 1.36%;

GDXJ short: 0.79%;

AAPL short: 0.15%;

GDX short: 0.08%;

SARK long: 0.51%;

PSQ long: 0.26%;

Gold/silver/platinum coins: 9.57%;

PALL long: 2.15%;

EWZ long: 0.33%;

FLBR long: 0.31%;

EWY long: 0.05%;

FLKR long: 0.03%;

TUR long: 0.02%;

UGP long: 0.32%;

VALE long: 0.21%;

BBD long: 0.11%;

GGB long: 0.11%;

EWZS long: 0.01%;

RIG long: 0.28%;

PTEN long: 0.03%;

WTI long: 0.02%;

OGN long: 0.22%;

CLF long: 0.01%.

Steven Jon Kaplan runs True Contrarian where this article appeared first.

Source truecontrarian-sjk