Published on November 19th, 2020 by Aristofanis Papadatos

PayPal (PYPL) is a high-quality tech stock, with an impressive growth record and exciting growth prospects ahead. The stock has rewarded its shareholders with life-changing returns, as it has more than quintupled in the last five years. Even better, the growth of PayPal has accelerated this year thanks to the coronavirus crisis and thus the stock has nearly doubled in the last 12 months alone.

As a result, PayPal now sports a market capitalization of $220 billion. This makes it a mega-cap stock, defined as those with market caps above $200 billion.

You can download a free spreadsheet of all 20+ mega cap stocks (along with important financial metrics such as price-to-earnings ratios and dividend yields) by clicking on the link below:

Click here to download your Mega Cap Stocks List Excel Spreadsheet now. Keep reading this article to learn more.

Unfortunately, income investors may overlook PayPal, as the company does not pay a dividend. This is fairly common among growth stocks, particularly those in the technology sector, as it is much more profitable to reinvest the earnings in the business than to distribute them to the shareholders. Of the 500 stocks that comprise the S&P 500 Index, nearly 90 do not pay a dividend to their shareholders.

Income-oriented investors who are attracted by the impressive returns of PayPal stock might wonder whether the company will pay a dividend anytime soon. While the initiation of a dividend cannot be excluded, PayPal is not likely to initiate a dividend for many more years.

Business Overview

PayPal operates as a technology platform and digital payments company that enables digital and mobile payments on behalf of consumers and merchants worldwide. The company’s payments platform allows consumers to send and receive payments, withdraw funds to their bank accounts, and hold balances in their PayPal accounts in various currencies.

PayPal benefits from a strong secular trend, namely the shift of consumers from physical payments to digital payments. Thanks to PayPal, consumers and companies can execute payments in a few seconds, much faster than they can pay by following the traditional bank channels, even in electronic banking.

Thanks to this secular trend, PayPal has grown its revenues and its earnings at a breathtaking pace over the last eight years. During this period, the company has grown its revenue at a double-digit rate every single year, from $5.7 billion in 2012 to $20.3 billion in the last 12 months. It has also quadrupled its earnings, from $778 million in 2012 to $3.14 billion in the last 12 months. The consistency in its growth clearly reflects the strong underlying trend that supports the company.

Even better, the growth trajectory of PayPal does not show any signs of fatigue. Instead, growth has accelerated this year amid the coronavirus crisis, which has provided a strong tailwind to the shift of consumers from physical to digital payments.

In the third quarter of 2020, PayPal grew its total payment volume 36% over the prior year’s quarter and its revenue 25%. It was the highest growth rate in both metrics in the history of the company.

Source: Investor Presentation

Notably, PayPal added 15.2 million net new active users in the quarter or 165,000 new users per day. This impressive growth helped the company grow its earnings per share 41%.

It is remarkable that eBay, which used to be the flagship of PayPal, generated just 7% of the payment volume of PayPal in the latest quarter and is expected to generate just 5%-6% of the total payment volume of the company by the end of the year.

Source: Investor Presentation

This is a testament to the exceptionally strong momentum and growth potential of the rest of the business of PayPal.

Growth Prospects

PayPal has an exceptionally strong growth driver, namely the continuous shift of consumers from physical to digital payments. The digitalization of the global economy combined with the increasing popularity of digital wallets is sufficient to keep PayPal in its growth trajectory for more than a decade.

PayPal has grown its revenue and its earnings per share by 18.1% per year and 25.3% per year, respectively, on average over the last eight years. When a company grows at such a fast pace, it usually decelerates over time due to its growing size. However, this is not the case for PayPal, which still has strong business momentum.

As if the growth potential of its digital wallet were not enough, PayPal has begun to enter the physical market as well. It has signed contracts with 10 major retailers, including CVS, Nike and Bed Bath & Beyond, and is in meaningful discussions with more than 100 large retailers. PayPal expects this move into physical retail to be a material growth driver for more than a decade.

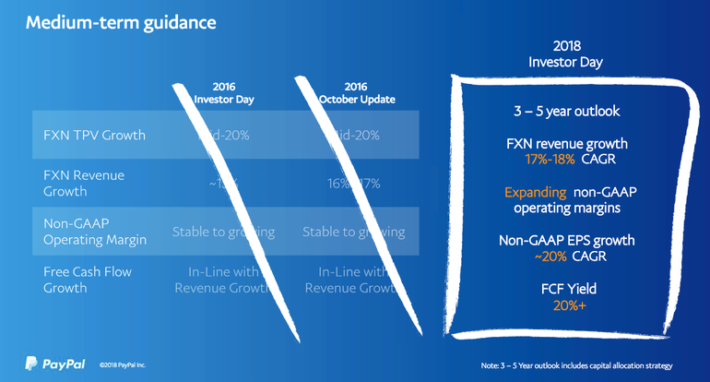

PayPal has offered a bright 3-5 year outlook, expecting 17%-18% annual revenue growth and 20% annual earnings-per-share growth.

Source: Investor Presentation

Management provided the above outlook two years ago and has not provided an update since then. However, the company has accelerated since then and hence investors can still rely on this mid-term outlook. Analysts certainly agree on this view, as they expect PayPal to grow its earnings per share by ~22.4% per year on average over the next three years.

PayPal has been growing its revenue and its earnings at a tremendous pace for several years and is likely to continue growing at an annual rate around 20% for many more years thanks to the secular growth of digital payments and wallets.

Competitive Advantages

PayPal has an unparalleled scale in digital wallets and hence it enjoys a wide business moat. It also enjoys a strong brand name, whose reliability is paramount in the world of digital payments. PayPal also has strong relationships with regulators around the world, while it also enjoys enviable data modeling capabilities.

All these features constitute significant competitive advantages, which are likely to deter potential competitors from gaining market share from PayPal.

Some tech stocks cannot pay dividends to their shareholders due to their lack of earnings. Uber (UBER) and Lyft (LYFT) have not managed to become profitable yet while Netflix (NFLX) has not managed to generate positive free cash flows yet. This is not the case for PayPal, which has posted excessive profits and free cash flows for several years in a row.

Will PayPal Ever Pay A Dividend?

The only reason that PayPal has not initiated a dividend yet is maintaining its high growth rate, which means that it is more profitable to invest cash flow back in the business instead of distributing it to the shareholders. Investors should keep in mind that investing in the business should always be prioritized over paying dividends, as it is the growth of business that produced such strong returns in recent years.

As PayPal still has many years of high earnings growth ahead, it is not likely to initiate a dividend anytime soon. Instead, its management is likely to remain focused on its growth initiatives. In fact, if PayPal initiates a dividend at some point in the future, its stock could plunge on the announcement, as investors might assume that the high-growth era of the company is approaching an end. Therefore, the shareholders of PayPal should be completely satisfied as long as the company keeps growing at a fast pace, without initiating a dividend.

High-growth companies do not offer a dividend for another reason as well. Their stocks usually enjoy such a rich valuation that a dividend is meaningless for the shareholders. To provide a perspective, PayPal is currently trading at a price-to-earnings ratio of 50. Therefore, even if the company distributes 30% of its earnings in the form of dividends, it will offer just a 0.6% dividend yield. Such a yield will be negligible for its shareholders and hence there is little incentive for the company to initiate a dividend at this time.

Final Thoughts

To sum up, PayPal is likely to remain in its high-growth trajectory for several more years thanks to the continuous shift of consumers from physical to digital payments.

As a result, the company will continue investing a significant portion of its earnings in its business and hence it is not likely to initiate a dividend for the next several years. Whenever PayPal initiates a dividend, it might be a negative signal, as it will essentially imply that its growth is about to decelerate.