Why Driftwood Cannot Harvest Financing During The European Gas Crisis?

Driftwood in each aspect of it from the beginning is a grotesque play. Every single corporate action has begged for a management ejection and Souki has anybody willing to do it “a bail me first” policy, something every potential suitor has refrained to DO.

Tellurian LNG has been BY-PASSED Left & Right.. Shockingly 47 MMT of new U.S LNG capacity has been FID & financed).

Q2 2022 hedge fund letters, conferences and more

Tellurian is blend mix distorted cash-flows models, erroneous pricing curves !, wrong project costing wrapped around pipeline/terminal/contracts ! made for the impressionable Joes of seeking alpha of the reddit crowd.

The HOUSTON energy trading community gives no credence to Driftwood. For example Souki has claimed he was not interested in signing a deal with Chevron. So we’ve asked the commercial lead LNG at Chevron. To her knowledge, Tellurian was never shortlisted or under consideration by the company.

Why Anyone But Driftwood?

Other than raising “Gas equities shares” on a stock exchange there is no track record of Souki.

The captain and its promotion are hacks in the domain of managing a trading portfolio and performing the vast & complex integrated project

He or his Lebanese partners have not ever extracted/traded/market/transport one natural gas molecule at a commercial profit $.

Why Driftwood Cannot Harvest Financing During European Crisis Gas?

– Things have gotten worse despite record LNG prices but why exactly. On the record LNG Sp&as have been signed at a deep loss by Tellurian RIGHT after TOTAL got off the boat.

The rest of the cliffhanger is purely invention, Souki is creative (like a chef) Tellurian creates accounting fixes/ presentations, recycle some food leftovers for the next diner, and plant press releases to create motives to justify raising more money and pay unjustifiable bonus and his spending.

All other compensation is comprised of club memberships for Mr. Souki and Mr. Houston.

Mr. Souki, through a company affiliated with him, leased a private airplane in 2019, and we reimbursed him approximately $4.5 million for expenses associated with his use of the plane for Tellurian business in 2019.

(Schedule 14 a, proxy statement) plus another $1,054,000 in personal travel expenses for Tellurian during 2021.

Souki spent the company an estimate of $6,500,000 in private jets travel & hotel expenses since 2019.

Tell loses both on the

- Upstream

- Midstream

- and Marketing & Trading

Tellurian NATURAL GAS PNL is -$22,000,000 per MONTH IN Q2 2022

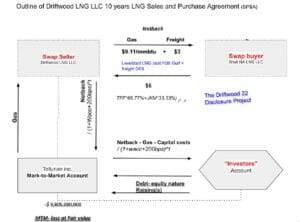

– on the LNG side: the LNG contracts signed by Octavio Simões for Tellurian are netback types and the prospect for Tell to finance a greenfield terminal construction under these terms is practically zero.

- Financing. Netbacks margins would be worth more than $11 per MMbtu negative for Tellurian as “swap seller” (starting 26’…).

- Commercial value.

While others move forward with their commodity financing Driftwood prints a –$9.8B FCFs deficit on its LNG Spa mark-to-market with its counterparties) which explains why nobody can finance the so-called integrated model.

- Tellurian is raising quasi equity bonds to finance its mtm commodity losses Negative Commercial Value with little known non Bulge bracket IB like B. Riley for high fees and at an exorbitant cost of capital.

Periodically (6-12 months) it raises just enough theta to cover (step a) the corporate ATM machine and cover the bonus shares program.

Then (step b) they postpone Driftwood, the project tasks are never completed in time to give a clear final investment decision and (step c): the Lebanese promises that “more financing is on its way” in a video/ sponsored LNG conference/ or the clownesque online zoom events made and paid by Tellurian to inserted itself among real & legit LNG/Energy participants…

- The big picture

The Souki Gang Scheme as of 1/09/22

Tellurian LNG deceives and play the public.

via the Driftwood 22 Disclosure Project

As predicted Optimization Specialist Robert Driftwood has not FID because of fatal flaws but the project drifwood is a Potemkin village by its promoters and they will continue to suck off new investors.

The U.S SEC and DOJ have to stop the music.

The day Tellurian gets delisted it can no longer raise money on the exchange and play the general public. Driftwood is predestined to get aborted.

It’s totally ludicrous that its promotion is without financing but wishes to fake the success a $19B cost project by building small pieces at the slowest pace – raising lumps while waiting for a coming global downturn … to blame for the deal falling through to divert the public rage pointing at Souki and on the company.

- The Driftwood 22 Disclosure Project

Disclaimer

The author may have short position in stock.

Source valuewalk