When Money Runs for Safety

In his Daily Market Notes report to investors, while commenting on the fast changing fund flows, Louis Navellier wrote:

Q2 2021 hedge fund letters, conferences and more

The Fast Changing Fund Flows

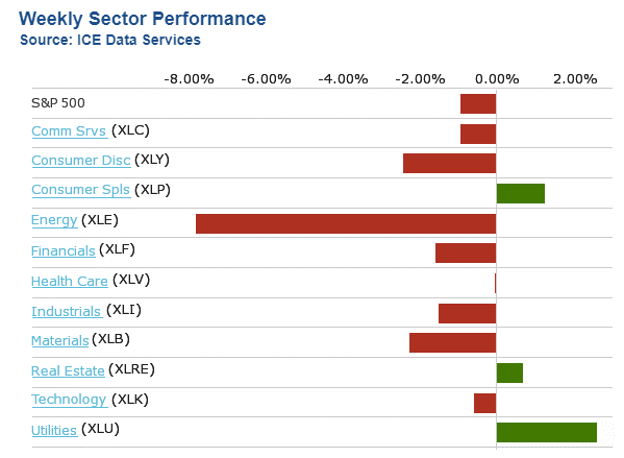

We’re all familiar with the phrase, “Money has to go somewhere.” Well, this past week, safer havens in bonds and defensive equity sectors were on the receiving end of fast-changing fund flows. Treasuries, corporate bonds, preferred stocks, REITs, utilities, and consumer staples shined while the most leveraged sectors of the “reflation” trade were a source of funds.

Heightened uncertainty surrounding the spread of the “Delta variant” of Covid, and a broader acceptance that the economy will cool down more than forecast, has changed the market’s composition of leaders and laggards. Travel, entertainment, and energy stocks are getting sold off aggressively, as well as all things related to “infrastructure.”

Not knowing how the taxes on corporations will play out is being used as a reason to sit tight in non-cyclical assets. Also, the price action of the tape is calling into question the harmony of the Fed’s dovish policy, stimulus spending, falling commodity prices and vibrant economic data surrounding the housing markets, retail sales, and upbeat labor figures for June.

There has been a rolling correction of sorts that has swept through the financials, materials, industrials, transportation, and high-beta growth that is now hitting the prized semiconductor, as of Friday’s close.

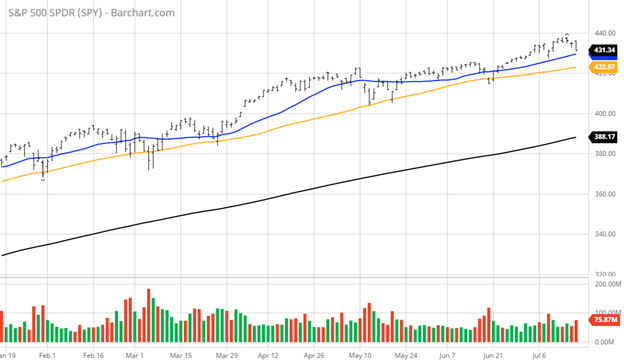

In all actuality – and here is the good news – if the rolling correction runs its course by the end of this week, the market will be well set up to trade higher into what is the heart of earnings season. That’s because the best-of-breed stocks usually run up hard right into the release of their quarterly sales and earnings results. This time around, the current selling pressure could result in buying on the news, depending on the extent of the separate pullbacks in those stocks leading the primary bull trend.

Fear Of The New Delta Variant Threat

All that said, there is a big fly in the market’s ointment that is inflicting newfound fear that can undercut all the economic progress already made. Investors need to get an understanding of this new Delta variant threat – even more so than how any spending or taxation “virus” on Capitol Hill plays out.

A study from the UK (see “Vaccines highly effective against hospitalizations from Delta variant,” June 14, 2021, from Public Health England) found that the Pfizer vaccine is 96% effective against hospitalization from the Delta variant after two doses. So, though it’s still possible to get infected, the vaccines dramatically reduce the risk of serious illness that leads to hospitalization or death.

Getting this message to the public is crucial. Once market participants get a handle on the breadth and scope of this latest viral outbreak, the current phase of consolidation should give way to fresh buying momentum in many of the now beaten down sectors that were so popular heading into July.

We are witnessing fast-changing market conditions, where stock picking is at a major premium and negative headlines that were brushed off recently now trigger widespread selling pressure.

Fear of the unknown usually outweighs other market forces, and right now, investors are dealing with several unknowns. To this end, the Fed has some work to do to convince the market that it is seeing reality, not what they desire to see.

The post When Money Runs for Safety appeared first on ValueWalk.

Source valuewalk