Updated on May 29th, 2020 by Bob Ciura

To invest in great businesses, you have to find them first. That’s where Warren Buffett comes in…

Berkshire Hathaway’s portfolio is filled with quality high dividend stocks. You can ‘cheat’ off of Warren Buffett’s own picks to find high quality dividend stocks for your portfolio. That’s because Buffett (and other institutional investors) are required to periodically show their holdings in a ’13F Filing’.

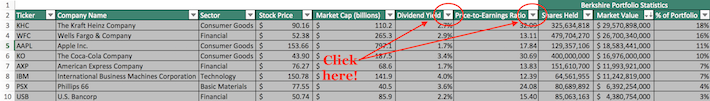

You can see all of Warren Buffett’s stock holdings (along with relevant financial metrics like dividend yields and price-to-earnings ratios) by clicking on the link below:

Free Excel Download: Get a free Excel Spreadsheet of all 47 of Warren Buffett’s stocks, complete with metrics that matter – including P/E ratio and dividend yield. Click here to download Buffett’s holdings now.

This article analyzes Warren Buffett’s top 20 stocks based on information disclosed in his newest 13F filing, as of March 31st 2020.

One of Buffett’s most recent investments is a $10 billion stake in Occidental Petroleum preferred stock. You can watch an analysis on this investment below:

How To Use Warren Buffett’s Portfolio To Find Investment Ideas

Having a database of Warren Buffett’s top stocks is more powerful when you have the ability to filter it based on important investing metrics.

That’s why this article’s Excel download is so useful…

It allows you to search Warren Buffett’s portfolio to find dividend investment ideas that match your specific portfolio.

For those of you unfamiliar with Excel, this section will show you how to filter Warren Buffett’s portfolio for two important investing metrics – price-to-earnings ratio and dividend yield.

Step 1: Click on the filter icon in the column for dividend yield or price-to-earnings ratio.

Step 2: Filter each metric to find high-quality stocks. Two examples are provided below.

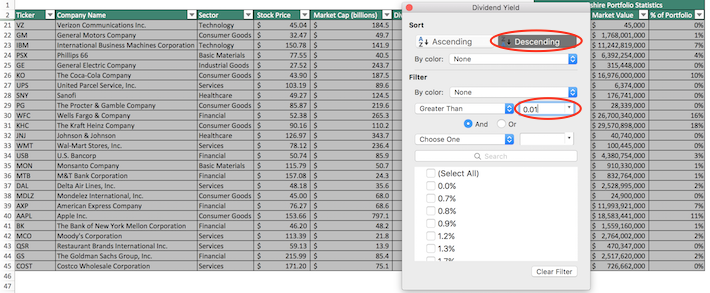

Example 1: To find stocks with dividend yields above 1% and list them in descending order, click the ‘Dividend Yield’ filter and do the following:

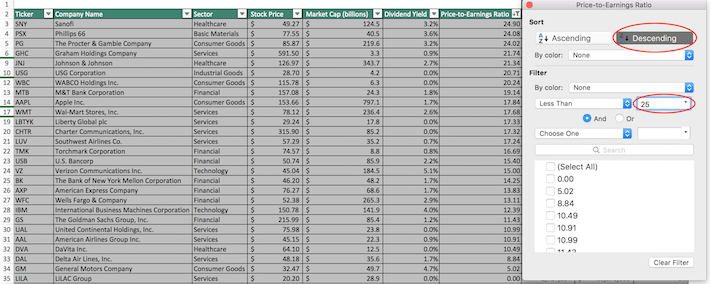

Example 2: To find stocks with price-to-earnings ratios below 25 and list them in descending order, click the ‘Price-to-Earnings Ratio’ filter and do the following:

Table of Contents

You can skip to an analysis of any of Warren Buffett’s top 20 stock holdings with the table of contents below. Stocks are listed by percentage of the total portfolio, from lowest to highest.

- PNC Financial Services Group (PNC)

- The Liberty SiriusXM Group (LSXMK)

- Amazon.com, Inc. (AMZN)

- Mastercard Incorporated (MA)

- Costco Wholesale (COST)

- General Motors (GM)

- Visa Inc. (V)

- VeriSign, Inc. (VRSN)

- Charter Communications, Inc. (CHTR)

- The Bank of New York Mellon (BK)

- DaVita Inc. (DVA)

- U.S. Bancorp (USB)

- JP Morgan Chase (JPM)

- Moody’s Corporation (MCO)

- The Kraft Heinz Company (KHC)

- Wells Fargo & Company (WFC)

- American Express Company (AXP)

- The Coca-Cola Company (KO)

- Bank of America Corporation (BAC)

- Apple Inc. (AAPL)

Warren Buffett & Dividend Stocks

Buffett has grown his wealth by investing in and acquiring businesses with strong competitive advantages trading at fair or better prices.

Free Bonus Section: Benefit from 4 simple (and free) tools to help you invest like Warren Buffett. Click here to download the 4 tools now.

Most investors know Warren Buffett looks for quality, but few know the degree to which he invests in dividend stocks:

- Over 80% of Warren Buffett’s portfolio is invested in dividend stocks

- His top 4 holdings have an average dividend yield of 2.3% (and make up 64% of his portfolio)

- Many of his dividend stocks have paid rising dividends over decades

Warren Buffett prefers to invest in shareholder-friendly businesses with long track records of success.

In Berkshire Hathaway’s most recent 13f filing, there were several notable additions and subtractions. Warren Buffett added to his stakes in U.S. Bancorp (+13%) and The PNC Financial Services Group (+6%). Several positions were reduced by small fractional amounts.

More significantly, Buffett reduced his stakes in Goldman Sachs (GS) by 84%. Buffett also completely divested his investments in the four major airlines–Southwest, American, United, and Delta. The following 20 stocks represent Warren Buffett’s largest 20 stock positions.

#20 – PNC Financial Services Group (PNC)

Dividend Yield: 4.0%

Percent of Warren Buffett’s Portfolio: 0.5%

10 Year Total Return CAGR: 8.7%

Berkshire Hathaway owns approximately 9.2 million shares of PNC Financial, worth approximately $880 million at current share prices. PNC is a diversified national financial services company. It offers retail and business banking services including corporate banking, real estate finance and asset-based lending, wealth management, and asset management. The stock has a market capitalization of approximately $50 billion.

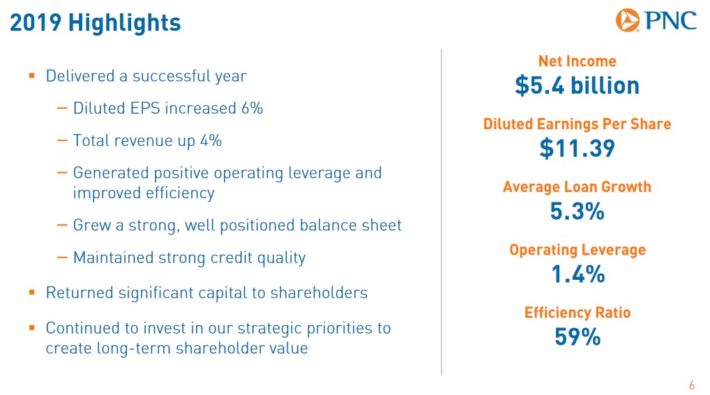

PNC reported strong financial results for 2019. Thanks to steady loan growth of 5.3%, PNC’s total revenue increased 4% and diluted earnings-per-share increased 6% last year.

Source: Investor Presentation

Business conditions have become more challenging to start 2020, due to a number of factors including the coronavirus crisis and falling interest rates. In the 2020 first quarter, diluted earnings-per-share declined 25% from the same quarter last year.

The company ended the 2020 first quarter with loans of $264.6 billion, and total assets of $305.2 billion. PNC also maintained strong credit and liquidity ratios to begin the year. In the first quarter, PNC had a common equity Tier 1 capital ratio of 9.4%, only a slight dip from 9.5% at December 31st, 2019.

PNC has a 4% dividend yield, which makes the stock attractive for dividend investors.

#19 – The Liberty Sirius XM Group (LSXMK)

Dividend Yield: N/A

Percent of Warren Buffett’s Portfolio: 0.6%

10 Year Total Return CAGR: N/A

Berkshire Hathaway owns approximately 30.8 million shares of The Liberty Sirius XM Group, worth just over $975 million. Liberty Sirius is a diversified media and entertainment conglomerate. The stock has a market capitalization above $11 billion. LSXMK is essentially a tracking stock, in that it tracks the economic performance of a collection of underlying investments.

Among its investments include 4% ownership of the Atlanta Braves Major League Baseball club, the Atlanta Braves’ stadium and associated real estate projects, and 2% ownership of the Formula One Group, which consists of Liberty Media’s subsidiary Formula 1 and other minority investments, including Time Warner Inc.

Separately, LSXMK reflects a 5% ownership stake in iHeartMedia, which operates over 850 live broadcast stations and a streaming broadcast radio platform, and a 33% ownership of Live Nation Entertainment, the largest live entertainment company in the world, consisting of concert promotion and venue operations, sponsorship and advertising, ticketing, and artist management.

The largest tracking component is the 71% ownership of satellite ratio operator SiriusXM.

In the 2020 first quarter, LSXMK reported revenue of $1.95 billion, up 12% year-over-year. Total Liberty Sirius XM Group adjusted operating income before depreciation and amortization (OIBDA) increased 7% to $632 million.

#18 – Amazon.com Inc. (AMZN)

Dividend Yield: N/A

Percent of Warren Buffett’s Portfolio: 0.6%

10 Year Total Return CAGR: 34.3%

Warren Buffett owned 533,300 shares of Amazon as of the end of the 2020 first quarter. While Buffett has historically favored value stocks and dividend stocks, in recent years the Oracle of Omaha has become less reluctant to invest in technology companies.

Buffett has traditionally adhered to value investing principles. It is well-known that he seeks to buy companies trading meaningfully below their intrinsic value. Amazon stock certainly does not qualify as a value stock, as the company has barely generated a profit in many years of its existence.

But it is clear to see why Buffett would want to invest in Amazon, as the e-commerce giant has generated massive returns for shareholders in the past 10 years. Amazon’s excellent performance is the result of its dominance of Internet retail.

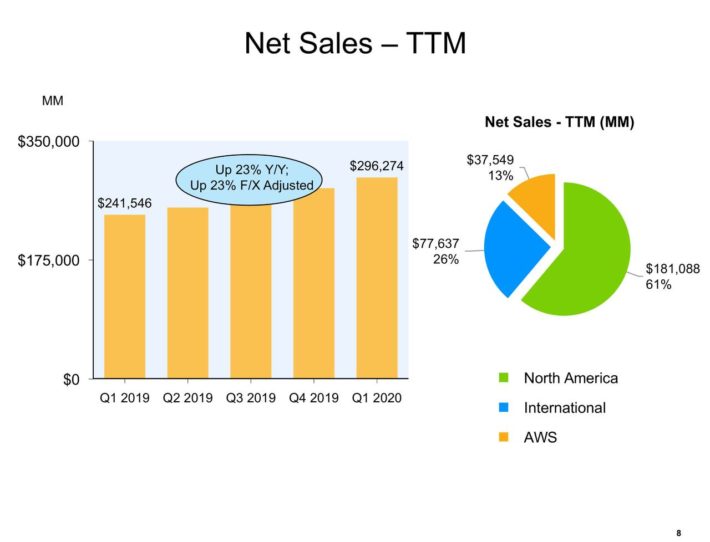

Amazon is an online retailer that operates a massive e-commerce platform where consumers can buy virtually anything with their computers or smartphones. Amazon’s e-commerce operations fueled its massive revenue growth over the past decade. Consider that in 2008, Amazon generated revenue of $14.84 billion. Sales reached $280 billion in 2019, an amazing level of growth over the past decade.

The company has continued to perform well in 2020, as the coronavirus crisis generated even higher demand for Amazon. In the most recent quarter, trailing 12-month sales increased 23% from the same period the previous year.

Source: Earnings Presentation

Amazon is making major investments to continue building its online retail platform. Amazon continues to grow its retail business. It also acquired natural and organic grocer Whole Foods for nearly $14 billion. This gave Amazon the brick-and-mortar footprint it desired to further expand its reach in groceries.

Amazon isn’t stopping there. In addition to the retail industry, it aims to spread its tentacles into other industries as well, including media and healthcare. Amazon has built a sizable media platform in which it distributes content to its Amazon Prime members.

It is also investing for a broader move into the healthcare industry. In 2018, Amazon acquired online pharmacy PillPack for $753 million, likely a precursor to a bigger move into healthcare distribution.

Despite Amazon’s strong revenue growth, the stock does not pay a dividend to shareholders. That said, Amazon has more than made up for its lack of a dividend, with strong share price appreciation.

#17 – Mastercard Inc. (MA)

Dividend Yield: 0.5%

Percent of Warren Buffett’s Portfolio: 0.7%

10 Year Total Return CAGR: 31.3%

Mastercard represents a $1.2 billion investment for Berkshire Hathaway. MasterCard is a world leader in electronic payments.The company partners with 25,000 financial institutions around the world to provide an electronic payment network. MasterCard has more than 2.6billion credit and debit cards in use.

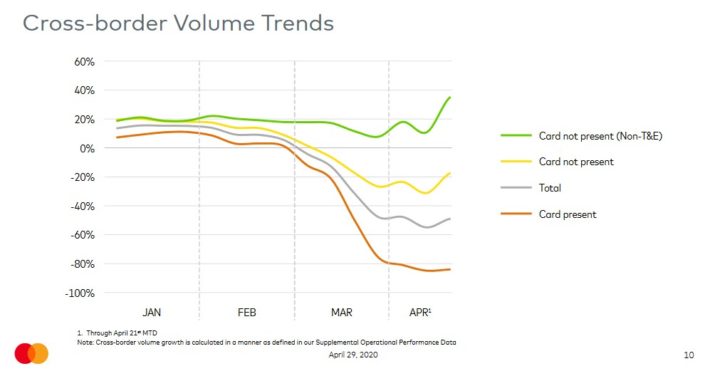

MasterCard reported first-quarter earnings results on 4/29/2020. The company’s adjusted earnings-per-share of $1.83 was $0.10 above estimates and a 2.8% increase from the previous year. Revenue was up 2.8% to $4 billion, which was $20 million higher than expected. MasterCard’s gross dollar volumes were up 8% in constant currency to $1.6 trillion. U.S. growth was 6% with the rest of the world increasing 9%. Switched transactions increased 13% while cross-border volume was down 1%.

Operating margins decreased 160 bps to 55.3%. But the company retired 4.7 million shares which helped offset margin contraction.

Mastercard’s results worsened due to the coronavirus. For the week ending April 21st, cross-border volume declined by 49% with transactions and switched volumes falling 20% each. This was an improvement from the previous three weeks.

Source: Investor Presentation

MasterCard ended the quarter with $10.7 billion in cash and equivalents on its balance sheet and a $6 billion credit facility.

Mastercard has grown earnings-per-share at a rate of almost 18% per year over the last decade, and has a long runway of growth up ahead. It is estimated by some research firms that a little more than 20% of point-of-sale purchase were made with cash in the U.S. This trend is similar to other industrialized countries.

Consumers are also turning towards online shopping to make their purchases, making a credit card essential to them. The conversion from cash to credit and debit cards should allow MasterCard an opportunity for growth for the foreseeable future.

MasterCard has increased its dividends for the last 8years, and has paid an uninterrupted dividend since 2006. While the stock has a low current dividend yield, it has increased its dividend at a high rate for the past several years.

#16 – Costco Wholesale (COST)

Dividend Yield: 0.9%

Percent of Warren Buffett’s Portfolio: 0.7%

10 Year Total Return CAGR: 21.0%

Warren Buffett has a $1.2 billion investment in Costco, and it is not hard to see why. Costco has been an amazing success story. Costco’s humble beginning in a converted airplane hangar has given way to a powerhouse in an industry it helped create.

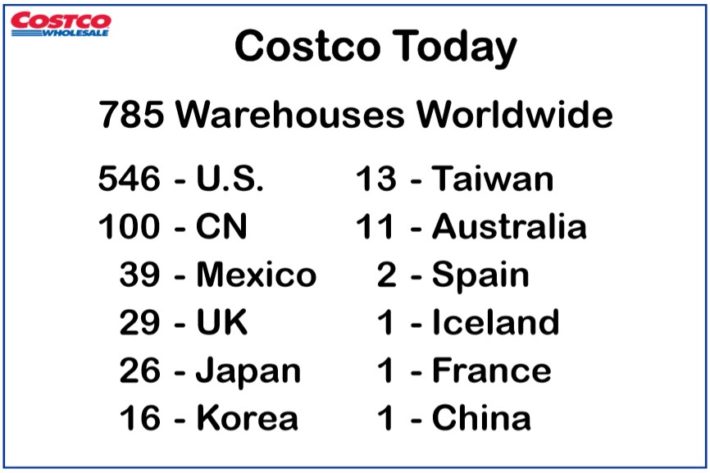

Today, Costco is a diversified warehouse retailer that operates 785 warehouses that collectively generate in excess of $160 billion in annual sales.

Related: The 6 Major Grocery Store Stocks Ranked: Deep Industry Analysis

Costco’s warehouse locations are spread across the world:

Source: Investor Presentation

Costco reported fiscal second-quarter earnings on March 5th and results were better than expected on the top and bottom lines. Total revenue was up 10.5% to $38.3 billion for the quarter and 8.1% to $74.5 billion for the first half of the year. Comparable sales rose 7% in the US in the first half of the year, and 6.6% for the whole company. Excluding gasoline sales and foreign exchange, comparable sales rose 6.6% in the US and 6.5% company-wide.

Digital sales were 28% of revenue in the second quarter and 17.3% in the first half of the year. Net income for the quarter was $931 million, or $2.10 per share, up from $889 million, or $2.01 per share.

Costco has been an obvious winner in the coronavirus crisis as consumers fight to keep their pantries and refrigerators stocked. Sales growth and rising memberships will continue to fuel the company’s long-term growth.

Membership fees are an excellent business for Costco. This is 100% margin revenue and fuels higher comparable sales, as well as more members and more people in the stores buying.

Costco stock has a fairly low dividend yield of 0.9%, due largely to its impressive share price gains over the past several years. However, the company raises its dividend at a high rate each year, such as a 7.7% increase on April 16th.

#15 – General Motors Company (GM)

Dividend Yield: N/A (General Motors has suspended its dividend)

Percent of Warren Buffett’s Portfolio: 0.9%

10 Year Total Return CAGR: N/A

Warren Buffett’s investment portfolio contains 74,681,000 shares of the General Motors Company with an aggregate market value of $1.55 billion.

General Motors produces cars, trucks, and automobile parts, and provides automobile financing solutions to its customers. GM’s brand portfolio includes Chevrolet, Cadillac, Baojun, Buick, GMC, Holden, Jiefang, Wuling,Maven, and OnStar.

Automakers like GM have been among the hardest-hit companies over the past year. Business conditions were already challenged heading into 2020 due to the trade war, and the coronavirus crisus has only added to GM’s struggles. General Motors reported its first-quarter earnings results on May 6, 2020.

For the quarter, total revenue was $32.7 billion, which represents a decrease of 6.2% year-over-year. However, adjusted EPS declined 56% as COVID-19 had a negative impact of $1.4 billion on first-quarter adjusted EBIT.

The company ended the quarter with $33.4 billion in automotive liquidity. This includes approximately $16 billion drawdowns from its revolving credit facilities. Also, the company extended $3.6 billion under its three-year revolving credit agreement.

GM has executed aggressive measures to preserve cash. For example, the company has suspended the quarterly dividend and the company’s share repurchase program. While it is possible the company could resume dividends once the coronavirus crisis ends, there is little visibility as to when that will occur, making the stock relatively unappealing for income investors.

While the near-term outlook is difficult for GM, the stock is attractive on a valuation basis. Buffett has a well-known fondness for value investing, and GM stock fits the bill.

Based on 2019 earnings-per-share, GM trades for a P/E ratio below 6. The company’s profits are very likely to take a hit in 2020 and perhaps 2021, but the long-term earnings power could provide investors with strong returns at the current share price.

#14 – Visa Inc. (V)

Dividend Yield: 0.6%

Percent of Warren Buffett’s Portfolio: 1.0%

10 Year Total Return CAGR: 27.4%

Warren Buffett owns Mastercard, so it makes perfect sense that he would also own Visa. Buffett is a noted fan of companies that have wide economic moats, a term that refers to a company’s durable competitive advantages. The world’s major payments processors have strong moats, as the industry is essentially a duopoly between Mastercard and Visa.

Visa is the world’s leader in digital payments, with activity in more than 200 countries. The stock went public in 2008 and its IPO has proven to be one of the most successful in U.S. history. The company’s global processing network provides secure and reliable payments around the world and is capable of handling more than 65,000 transactions a second. Last year the company generated over $12 billion in profit.

In the most recent quarter, Visa reported revenue of $5.9 billion, adjusted Net Income of $3.10 billion and adjusted earnings-per-share of $1.39, representing increases of 7%, 6%, and 9% respectively compared to the same quarter the previous year. These results were driven by a 5% increase in Payments Volume and a 7% in Processed Transactions, offset by a 2% decline in Cross-Border Volume. During the quarter Visa returned $3.9 billion to shareholders in the form of share repurchases and dividends.

Source: Investor Presentation

The company has withdrawn this guidance amid the ongoing COVID-19 pandemic. On March 31st, Visa announced a $4.0 billion notes offering to improve its financial position. Despite the uncertainty due to coronavirus, Visa has a strong long-term growth outlook.

Visa has delivered very consistent earnings-per-share growth, as profits rose each year from 2009 and 2019 and at a high rate. Earnings-per-share rose by over five fold between 2009 and 2019, for an average annualized growth rate of 22%. Over the long-term we believe Visa has ample room to keep growing thanks to the global transition towards a cashless society.

Last year, global digital payment volume exceeded cash for the first time in history. However, there are still about 2 billion people worldwide who lack access to cashless payments. Notably China and India, which have 1.4 billion people each, are still in the early phases of their transition towards a cashless economy. Therefore, the growth potential for Visa is immense in these two countries.

Through a combination of growing the number of cards, a rising number of transactions per card holder, general economic expansion and share repurchases, Visa should be able to generate attractive earnings-per-share growth over the coming years.

#13 – VeriSign, Inc. (VRSN)

Dividend Yield: N/A (VeriSign does not currently pay a quarterly dividend)

Percent of Warren Buffett’s Portfolio: 1.4%

10 Year Total Return CAGR: 24.4%

Buffett’s Berkshire Hathaway investment portfolio holds 12.8 million shares of VeriSign, In.c with a market value of $2.3 billion.

VeriSign is a globally diversified provider of domain name registry services and Internet security software. The company operates in a single segment, and has a significant international presence. VeriSign was founded in 1995, and trades at a market capitalization of $24 billion.

On the surface, Warren Buffett’s VeriSign investment is highly puzzling. The Oracle of Omaha has been vocally skeptical of technology companies. However, Buffett has become much more willing to invest in the tech sector in recent years. VeriSign’s impressive growth makes it easy to see why Buffett has changed his stance.

In the most recent quarter, VeriSign continued its long track record of growth with 2% revenue growth and strong cash flow.

Source: Investor Presentation

The future looks bright for VeriSign. The business benefits from a number of secular tailwinds, including the ever-increasing use of the Internet. VeriSign’s high renewal rate gives the company a recurring revenue business model, something that would certainly appeal to a conservative investor like Warren Buffett. VeriSign’s business is remarkably stable, particularly given that it is a technology company.

Looking ahead, VeriSign’s growth will be driven by a continued increase in the number of websites, which it already services a large number of. The growing use of the Internet means that VeriSign should continue to realize modest growth even if it can just maintain its current level of market share.

VeriSign does not currently pay a quarterly dividend, which makes it unappealing to income investors in search of dividend stocks. The stock also has a high valuation multiple, making it relatively unappealing for value investors. That said, VeriSign has been a highly rewarding growth stock to own over the past few years, and remains on a firm growth trajectory.

#12 – Charter Communications, Inc. (CHTR)

Dividend Yield: N/A (Charter Communications does not currently pay a dividend)

Percent of Warren Buffett’s Portfolio: 1.4%

10 Year Total Return CAGR: N/A (Charter’s long-term total returns are not meaningful because of a significant merger in 2016)

Warren Buffett’s investment portfolio contains 5.4 million shares of Charter Communications with a market value of $2.4 billion. Charter Communications has an allocation of 1.4% in Buffett’s portfolio, making it his largest telecommunications stake (by far).

Charter Communications was founded in 1993 and executed its initial public offering in 1999 – just three years later. In 2009, the company completed a significant Chapter 11 bankruptcy reorganization and has been turning around its business ever since.

Customer additions have continued to fuel the company’s growth in recent periods:

Source: Investor Presentation

Today, Charter Communications is a leading broadband connectivity company and cable operator, serving more than 29 million customers in 41 states through its Spectrum brand. The company offers a full range of residential and business services including Internet, TV, Mobile and Voice phone services.

Charter Communications has performed well to start 2020, even with the coronavirus crisis. Revenue increased 4.8% from the same quarter the previous year to $11.7 billion, while free cash flow more than doubled to $1.4 billion. Internet revenue growth of 9.5% led the way for Charter Communications last quarter.

The stock does not pay a dividend, but has generated strong returns for shareholders. Future returns will be generated by earnings-per-share growth, the result of revenue growth, margin expansion, and share repurchases.

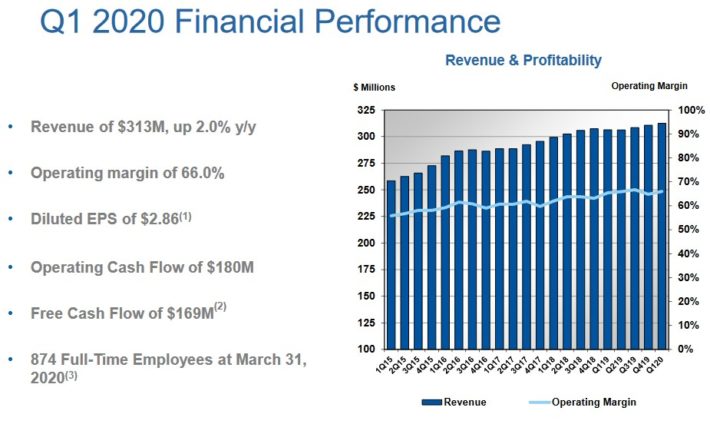

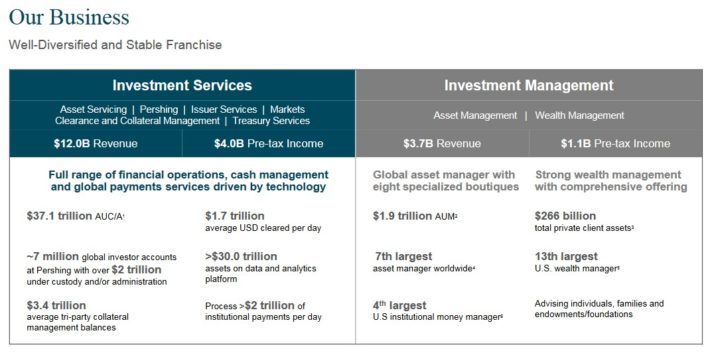

#11 – The Bank of New York Mellon Corporation (BK)

Dividend Yield: 3.2%

Percent of Warren Buffett’s Portfolio: 1.6%

10 Year Total Return CAGR: 5.3%

Berkshire Hathaway’s common stock portfolio contains nearly 80 million shares of the Bank of New York Mellon Corporation with a market value of $2.7 billion. The Bank of New York Mellon Corporation is a global financial services institution that specializes in asset management, custodial services, and wealth management.

Source: Investor Presentation

BNY Mellon’s predecessor, the Bank of New York, was founded in 1784 and today the financial institution trades with a market capitalization of $34 billion. As a result, BNY Mellon is now the 11th largest position in Warren Buffett’s investment portfolio.

The bank is present in 35 countries around the world and acts as more of an investment manager than a traditional bank. Indeed, BNY Mellon’s stated goal is help its customers manage their assets throughout the investment life-cycle. As such, BNY Mellon’s revenue is mostly derived from fees, not traditional interest income.

Bank of New York Mellon posted Q1 earnings on April 16thand results beat expectations handily on both the top and bottom lines. Earnings came to $1.05 per share in Q1, easily besting the consensus for $0.91. This was down from $1.52 in Q4 of 2019, but up from $0.94 in the year-ago quarter. The bank’s model–which doesn’t rely upon borrowing and lending in the way traditional banks do–performs quite well relative to other banks in times of economic stress.

Q1 provisions for credit losses came to $169 million, which was up from just $7 million in the year-ago period. Part of this increase was due to obvious credit-related headwinds from the COVID-19 situation, but part of the increase was also due to new accounting rules surrounding credit loss estimation.

Assets under custody and/or administration, which is Bank of New York Mellon’s headline operating metric given its trust business model, was up 2% to $35.2 trillion, reflecting higher client inflows that were partially offset by lower market values, and a small negative impact from a stronger US dollar. Revenue came to $4.1 billion in Q1, which was up 5% year-over-year. Fee revenue soared 10% year-over-year to $3.2 billion, while net interest revenue was down slightly.

Bank of New York Mellon stock has an attractive dividend yield of 3.2%.

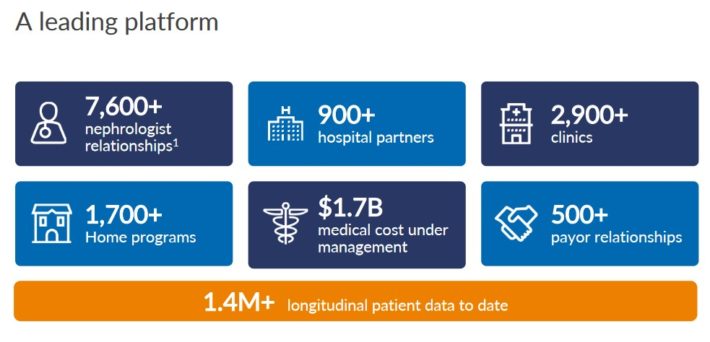

#10 – DaVita Inc. (DVA)

Dividend Yield: N/A (DaVita does not currently pay a quarterly dividend)

Percent of Warren Buffett’s Portfolio: 1.7%

10 Year Total Return CAGR: 9.6%

The Oracle of Omaha’s investment portfolio contains 38.1 million shares of DaVita, Inc., equating to a total investment of $2.9 billion at the time of the last 13F filing. DaVita is about 1.7% of Berkshire’s overall investment portfolio.

DaVita specializes in kidney care, particularly dialysis treatments, for thousands of patients served via kidney care locations across the United States.

While the kidney care industry appears to be very specialized on the surface, this industry is surprisingly large and growing.

Source: Capital Markets Day Presentation

DaVita is not a rapidly-growing business, but it compensates for this by being an industry leading in a slow-changing and recession-resistant business. Patients are unlikely to forego their essential dialysis treatments just because the broader economy is experiencing an isolated economic recession.

Looking ahead, DaVita is expecting to realize operating income growth driven by an increase in the number of treatments, an increase in revenue per treatment, partially offset by a small negative impact from an increase in the expenses incurred per treatment.

DaVita does not currently pay a quarterly dividend, which makes it unappealing for income investors. With that said, the stock may merit further research depending on its current valuation.

DaVita is expected to report adjusted earnings-per-share of $6.13 in fiscal 2020 and the company’s stock is currently trading at ~$80 for a price-to-earnings ratio of 13.0. DaVita’s valuation is reasonable, and likely one of the reasons why Warren Buffett continues to hold this stock.

#9 – U.S. Bancorp (USB)

Dividend Yield: 4.6%

Percent of Warren Buffett’s Portfolio: 3.0%

10 Year Total Return CAGR: 6.9%

Berkshire Hathaway’s investment portfolio contains approximately 151 million shares of U.S. Bancorp with a market value of $5.0 billion, or 3% of the overall investment portfolio. U.S. Bancorp traces its lineage back to 1863 when the First National Bank of Cincinnati opened for business. It has since grown to $22 billion in annual revenue, and is now the 5th-largest bank by assets and deposits.

Source: Investor Presentation

It competes mostly in traditional banking activities, but also offers wealth management, payment and investment services. U.S. Bancorp reported Q1 earnings on April 15th and results were mixed, beating revenue estimates but missing on the bottom line. Earnings-per-share came to 72 cents, widely missing consensus estimates of 81 cents. Like other major banks, U.S. Bancorp boosted its credit loss provisions, with that number nearly tripling year-over-year from $395 million to $993 million.

Net interest income was $3.2 billion in Q1, down -1.1% from the year-ago period. Net interest margins fell meaningfully year-over-year as the yield curve has not only flattened, but been lowered as well across maturity ranges. The damage for U.S. Bancorp was net interest margin falling from 3.16% to 2.91% year-over-year.

Average loans in Q1 were up slightly to $298 billion, while average deposits rose slightly quicker, hitting $363 billion in Q1. That puts the bank’s loan-to-deposit ratio at 82%, which is very high among U.S. Bancorp’s peers, and we think that has the potential to limit loan growth moving forward.

All said, we believe that U.S. Bancorp is well-positioned to continue its streak of impressive profitability for the foreseeable future.

#8 – JP Morgan Chase (JPM)

Dividend Yield: 3.6%

Percent of Warren Buffett’s Portfolio: 3.0%

10 Year Total Return CAGR: 12.5%

Berkshire Hathaway’s investment portfolio owns 57.7 million shares of JP Morgan Chase, for a market value of approximately $5.2 billion.

JPMorgan Chase traces its lineage back to 1799, making it one of the oldest surviving banks in the U.S. The company has a strong global reach in consumer and community banking, commercial and investment banking, as well as asset and wealth management.

It is the product of more than 1,200 different entities that have merged in the 220 years since its creation and is the largest bank in the U.S. by market capitalization, with annual revenue of about $110 billion and a market capitalization of $308 billion.

Source: Investor Presentation

JPMorgan is a mega-cap stock, which are stocks with market capitalizations above $200 billion.

JPMorgan competes in every major segment of financial services, including consumer banking, commercial banking, home lending, credit cards, asset management and investment banking.

The bank reported first-quarter financial results in April. The bank posted earnings-per-share of just $0.78 in Q1, down by about two-thirds from the prior year Q1 value of $2.20. JPMorgan, unsurprisingly, took a huge reserve build against future credit losses, adding $6.8 billion in Q1. That puts its total reserve at $8.3 billion as of the end of Q1, which is more than five times the size it was at the same time last year. Further, JPMorgan said it expects even more reserve builds in Q2.

The bank guided for net interest income to fall ~$3.5 billion this year due to extremely low lending rates, and thus, total revenue should decline year-over-year. Net interest income was $14.5 billion, flat year-over-year, while net interest margin came in at 2.37%. The Consumer and Community Banking segment posted a revenue increase of 2% year-over-year to $13.2 billion.

Corporate & Investment Bank revenue was down fractionally year-over-year to $10 billion. Investment Banking revenue plummeted 49% to $866 million, Fixed Income revenue soared 34% to $5 billion, Equity Markets revenue was up 28% to $2.2 billion, Commercial Banking revenue rose 10% to $2.2 billion, and Wealth Management revenue was up 3%.

JPMorgan is a strong dividend growth stock, and sports an attractive current yield at 3.6%. JP Morgan also appears to be a value stock that falls right in-line with Warren Buffett’s typical investment criteria. JP Morgan is an industry-leader with a dominant position in global banking. The stock trades for a P/E ratio of 11x based on 2021 expected EPS of $8.81, indicating the bank is reasonably valued.

JPMorgan is considered the gold standard in large banking, so its valuation tends to hold up better than its peers, meaning the value proposition tends to be slightly lower but so is the risk when it comes to JPMorgan.

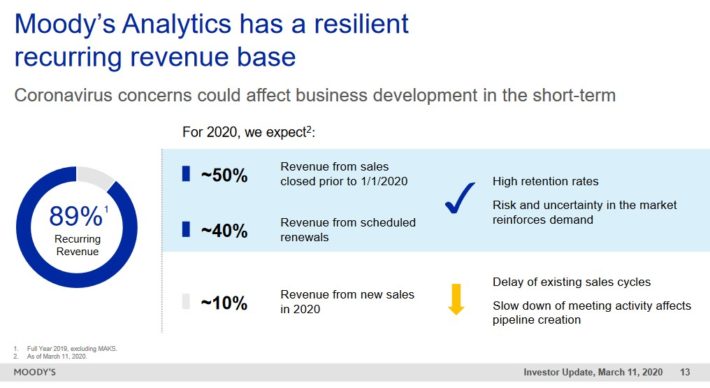

#7 – Moody’s Corporation (MCO)

Dividend Yield: 0.8%

Percent of Warren Buffett’s Portfolio: 3.1%

10 Year Total Return CAGR: 30.4%

Moody’s is a long-time Warren Buffett stock, and today he holds 24,669,778 shares of the Moody’s Corporation with a market value of $5.2 billion. Moody’s Corporation is a risk-focused financial services firm that provides credit ratings, research, and risk analysis on debt and equity securities.

Moody’s was created back in 1909, becoming the first company to analyze securities and rate their investment quality for investors on a large scale. Moody’s began with its Analyses of Railroad Investments in 1909 and has blossomed into the company investors know today, with around $5 billion in annual revenue.

Moody’s is still one of the largest players in the traditional ratings business, but has transformed itself in recent years by investing heavily in data and analytics, which is less cyclical and has very strong margins.

The company benefits from a dominant position in its core industry. It also generates a great deal of recurring revenue, which provides stability for investors.

Source: Investor Presentation

Moody’s reported first quarter earnings on April 30th and results beat expectations on the top and bottom lines. Revenue was up 13% year-over-year to $1.3 billion. Investors Service revenue was up 19% to $794 million, while Analytics revenue rose 5% to $496 million. Organic revenue, which excludes acquisitions and divestitures, rose 9% against the year-ago period.

Earnings-per-share rose 32% year-over-year to $2.73 on an adjusted basis. The company lowered its guidance for this year to $7.80 to $8.40 on an adjusted basis, but 2020 is still expected to be a highly profitable year for the company.

Moody’s earnings-per-share history is quite strong as it has seen just one year in the past decade where its profits have dipped from the prior year. Moody’s earnings growth has averaged 17% per year over the last decade. Moody’s can achieve future growth by continuing its long tradition of acquiring growth, as well as organic revenue growth.

Longer term tailwinds are in place for Moody’s as it continues to feed seemingly insatiable investor demand for real-time analytical data on a wide variety of global securities.

#6 – The Kraft Heinz Company (KHC)

Dividend Yield: 5.2%

Percent of Warren Buffett’s Portfolio: 4.7%

10 Year Total Return CAGR: N/A

Berkshire Hathaway’s investment portfolio owns 325,634,818 shares of The Kraft Heinz Company with a market value of $8.05 billion at the time of the last 13F filing. This investment used to represent Berkshire’s largest single stock position. But a steep decline in Kraft Heinz’s share price over the past few years has significantly reduced the value of Berkshire’s investment.

Kraft Heinz was formed on July 2, 2015 thanks to the merger between Kraft Foods Group and H.J. Heinz Holding Corporation. Today, Kraft Heinz is a processed food and beverages company which owns a product portfolio that includes food products such as condiments, sauces, cheese & dairy, frozen & chilled meals, and infant diet & nutrition. The company was created in 2015 in a merger between Kraft Food Group and H. J. Heinz Company, orchestrated by Warren Buffett’s Berkshire Hathaway and 3G Capital.

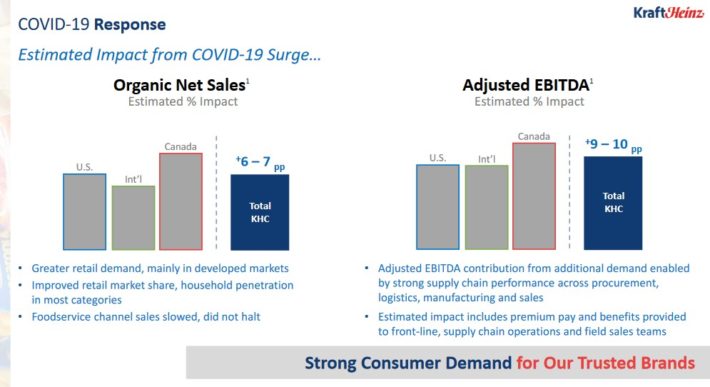

Kraft Heinz reported its first-quarter earnings results on April 30. The company reported that its revenues totaled $6.2 billion during the quarter, which was 3% more than the revenues that Kraft-Heinz generated during the previous year’s period. Organic sales were up by 6%, which was mostly caused by some stockpiling due to the coronavirus crisis.

Source: Investor Presentation

Kraft Heinz generated earnings-per-share of $0.58 during the first quarter, which easily beat the consensus estimate but was down from $0.66 per share in the prior-year period. The company also announced that its deleveraging strategy was on track, as the company plans to reduce its debt further, while maintaining its dividend at the current level.

Kraft Heinz is on its way back as part of a years-long turnaround effort. The company became overly bloated with debt, and cut its dividend by 36% in 2019. But the current dividend, yielding over 5%, appears secure if Kraft Heinz continues to generate steady cash flow to pay down debt.

#5 – Wells Fargo & Company (WFC)

Dividend Yield: 7.4%

Percent of Warren Buffett’s Portfolio: 5.4%

10 Year Total Return CAGR: 2.4%

Warren Buffett’s investment portfolio holds just over 323 million shares of Wells Fargo & Company with a quarter-end market value of $9.3 billion. Wells Fargo is one of the largest financial institutions in the United States with a market capitalization of $115 billion.

Wells Fargo is a long-time Warren Buffett holding and it’s not hard to see why. The company has a number of characteristics that make it a quantitatively more conservative investment than many of the other large U.S. banks.

Wells Fargo was founded in 1852 and provides banking, investments, mortgages, as well as commercial financing products through 7,500 locations in 32 countries. The company’s 260,000 employees help Wells Fargo invest its nearly $2 trillion in assets to produce about $74 billion in annual revenue. The bank has relationships with one-third of US consumers through its vast network of offerings.

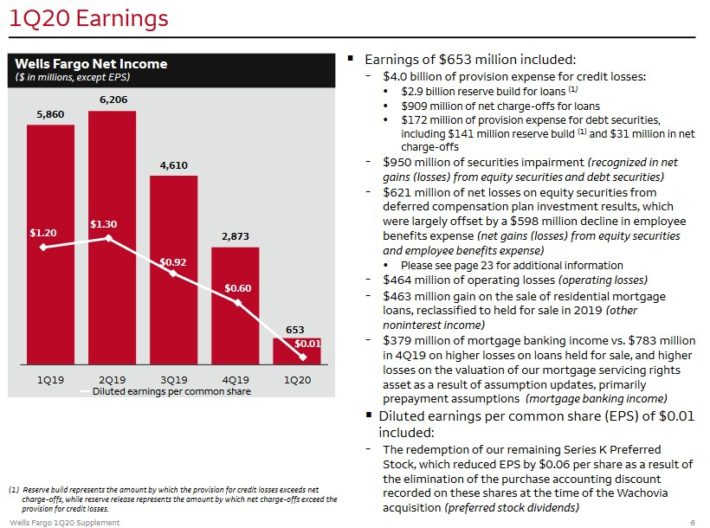

Wells Fargo reported Q1 earnings on April 14th, and results were somewhat mixed, beating expectations for adjusted profit, but missing on revenue. Net income came to $653 million, but just one penny of earnings-per-share.

Source: Investor Presentation

The bank took a reserve build of $3.1 billion and an impairment of securities of $950 million, written down due to market conditions.

Revenue was down markedly, falling from $21.6 billion in the year-ago period to $17.7 billion in this year’s Q1. Net interest income was $11.3 billion, while non-interest income plummeted from $9.3 billion in last year’s Q1 to $6.4 billion this quarter.

Average loans ended the period up 5% from year-end 2019 to $1 trillion. Quarter-end deposits were $1.4 trillion, up 5% from the end of 2019. That puts Wells Fargo’s loan-to-deposit ratio at just over 70%, which is higher than its large banking peers, but still quite low by historical standards.

Wells Fargo is highly leveraged to the mortgage market, meaning it is more sensitive to the slope of the yield curve than the other money center banks, in addition to general housing market weakness. This is a negative if the yield curve remains inverted and/or if housing prices begin to decline.

However, Wells Fargo remains highly profitable and should be able to reduce the share count in the mid-single-digits annually, producing the bulk of its earnings-per-share growth. The stock also has a very high dividend yield above 7%, giving it wide appeal for income investors.

You can read more Sure Dividend analysis on Wells Fargo & Company (as well as JP Morgan Chase) at the following link:

#4 – American Express Company (AXP)

Dividend Yield: 1.7%

Percent of Warren Buffett’s Portfolio: 7.6%

10 Year Total Return CAGR: 11.3%

Berkshire Hathaway’s investment portfolio holds 151,610,700 shares of the American Express Company with a quarter-end market value of $12.9 billion. Buffett’s American Express stake constitutes 7.6% of his overall investment portfolio.

The story behind Warren Buffett’s investment in American Express is a legendary example of opportunistic value investing.

Back in the 1960s, American Express was extending loans to a salad oil company called Allied Crude Vegetable Oil. Allied Crude found that it could obtain loans from American Express based on its inventory of salad oil barrels.

Knowing that water is denser than salad oil and that salad oil would float on water, company workers filled the barrels mostly full of water to fraudulently bolster their inventory and qualify for larger inventory-secured loans.

Eventually, the Allied Crude scandal was uncovered and American Express suffered losses as one of the company’s creditors. American Express’ stock was punished and Warren Buffett was able to accumulate shares on the cheap.

“The best thing that happens to us is when a great company gets into temporary trouble…We want to buy them when they’re on the operating table.” – Warren Buffett

Fortunately for Buffett, Berkshire, and Berkshire’s investors, the Oracle of Omaha recognized that American Express was far from being ‘on the operating table’. Today, Buffett’s American Express investment is worth significantly more than its carrying value on Berkshire’s books.

The current American Express is a far different enterprise than the one that Buffett invested in all those years ago.

With a market capitalization of $78 billion, American Express is a diversified financial services company that is best known for its name-brand credit cards. It operates the following business units: US Card Services, International Consumer and Network Services, Global Commercial Services, and Global Merchant Services.

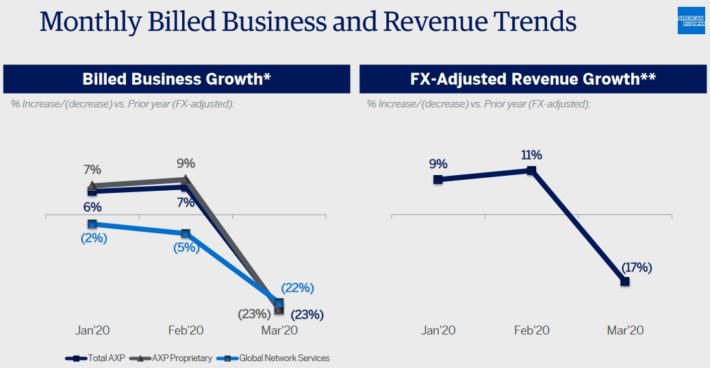

American Express reported its first-quarter earnings results on Aprilm24. The company generated revenues of $10.3 billion during the quarter, which was 0.5% less than during the previous year’s quarter. Not surprisingly, the coronavirus wreaked havoc on business trends over the past few months:

Source: Investor Presentation

The revenue decline was based on lower transaction volumes, caused by the drop in consumer and business spending that was the result of the ongoing coronavirus crisis. At constant currency rates, American Express would still have managed to grow its revenues by 1%.

The company is preparing for the impact of the crisis through cost-cutting. It also increased its provisions for loan losses from $810 million to $2.6 billion. While company profits will decline substantially in 2020 due to the coronavirus, although the company should remain profitable in 2020. We are expecting growth to resume in 2021 and beyond, once the coronavirus crisis ends.

The stock has a current yield of 1.8%, which is below the ~2% average yield of the S&P 500 Index. While American Express’ yield does not immediately appeal to dividend investors, its long-term dividend growth helps make up for a below-average yield.

#3 – The Coca-Cola Company (KO)

Dividend Yield: 3.5%

Percent of Warren Buffett’s Portfolio: 10.4%

10 Year Total Return CAGR: 9.5%

The Coca-Cola Company is one of Warren Buffett’s most iconic investments. Buffett’s portfolio holds 400,000,000 shares of Coca-Cola with a market value of $17.7 billion, comprising just over 10% of the investor’s portfolio.

Coca-Cola has been a profitable operation for decades and enjoys a high level of brand recognition and geographic diversity. However, many investors believe that Coca-Cola’s best days are behind it.

This is not the case.

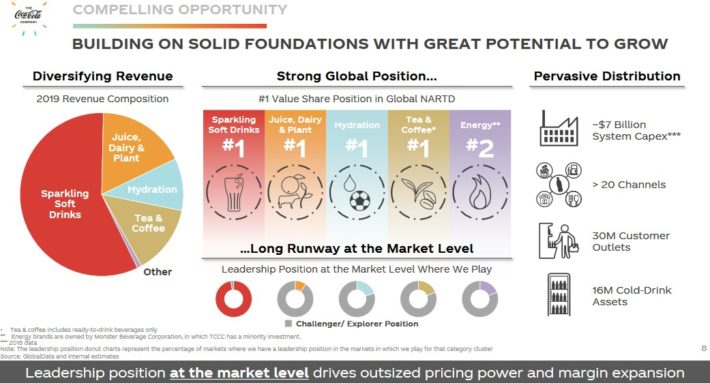

First of all, consider the sheer size of Coca-Cola’s business. The Coca-Cola Company is the undisputed leader in the global beverage industry. It is the world’s largest beverage company, as it owns or licenses more than 500 unique non-alcoholic brands. Since the company’s founding in 1886, it has spread to more than 200 countries worldwide.

It currently has a market capitalization of $202 billion and its brands account for about 2 billion servings of beverages worldwide every day, producing roughly $39 billion in annual revenue. Coca-Cola is one of the world’s most widely recognized and valuable brands.

According to Fortune, Coca-Cola is the world’s #6 most valuable brand, with an estimated brand value of $59.2 billion. This means consumers naturally gravitate to Coca-Cola’s products, giving Coca-Cola significant brand loyalty and also the ability to raise prices over time.

Additionally, and perhaps most importantly, the global beverage industry is expected to actually grow over the next several years, although not much of this growth will come from Coca-Cola’s traditional sugary soft drinks.

Soda consumption has been on the decline in the U.S. for over a decade. Instead, the industry’s growth is expected to be generated by alternative beverages like juice, tea, and coffee. Coca-Cola has invested heavily in recent years to broaden its product portfolio.

Source: Investor Presentation

Coca-Cola still has multiple long-term growth catalysts, particularly in still beverages, coffee, and also growth in new geographic markets. For example, Coca-Cola acquired Costa in a ~$5 billion acquisition, which gave it instant exposure to coffee, a growth market. Coca-Cola stated at the time of the acquisition that the global coffee market was growing at 6% per year, and Costa has operations in more than 30 countries.

The emerging markets continue to be a long-term growth driver for Coca-Cola, even as the coronavirus poses a significant challenge in the near-term. Emerging markets such as India and China remain highly attractive markets for U.S. consumer brands such as Coca-Cola, due to the large populations of these countries and high potential for long-term economic growth. In the meanwhile, Coca-Cola is repositioning its business to ensure its long-term growth prospects remain robust.

In the meantime, Coca-Cola is an attractive stock for income investors. The stock has a current yield of 3.5%, and the company is on the list of Dividend Aristocrats and Dividend Kings, having raised its dividend each year for over 50 consecutive years.

You can read more Sure Dividend analysis on Coca-Cola at the following link:

#2 – Bank of America (BAC)

Dividend Yield: 2.9%

Percent of Warren Buffett’s Portfolio: 11.5%

10 Year Total Return CAGR: 6.0%

Bank of America was founded back in 1904 and since then, has grown into a global banking juggernaut. It has built a strong presence in credit cards, consumer and commercial lending, wealth management, and other financial services. The market capitalization of $225 billion makes Bank of America one of the largest U.S. banks.

Bank of America’s rising loans have been a major driver of the company’s growth in recent years.

Source: Investor Presentation

Bank of America reported Q1 earnings on April 15th, and results were better than expectations on the top line but missed on profits. Net income fell from $7.3 billion in the year-ago quarter to just $4 billion in this year’s Q1, thanks to a $3.8 billion loan loss reserve build as the bank tries to estimate the impact of COVID-19 on its results.

Net interest income was down only slightly against the year-ago period, coming in at $12.1 billion, down from $12.4 billion. Net charge-offs came to 0.46% of loans, up from 0.39% in Q4 of 2019. Average deposits continued their years-long streak of gains, this time adding 6% year-over-year to $1.4 trillion. Average loan and lease balances also gained 6% to $954 billion, putting Bank of America’s loan-to-deposit ratio at 68%, which is still quite low, as it has been for years.

The bank’s loan portfolio keeps growing, consistent with Q1 results. Bank of America is also focused on minimizing expenses, as evidenced by its low efficiency ratio.If this trend continues, Bank of America’s earnings growth will remain higher than the company’s revenue growth rate. Bank of America also buys back shares, although they have temporarily been suspended which is another tailwind for earnings-per-share growth.

Bank of America is also an appealing stock for income investors, as it offers a 2.8% dividend yield.

#1 – Apple Inc. (AAPL)

Dividend Yield: 1.0%

Percent of Warren Buffett’s Portfolio: 36.5%

10 Year Total Return CAGR: 26.1%

Apple is the largest company in the world based on its massive market capitalization of $1.4 trillion. After years and years of purposefully avoiding technology companies because he found them difficult to understand, Buffett’s Apple position marks his biggest foray into the technology sector.

After an initial $1 billion investment, Buffett’s Apple stake quickly grew over the years, and is now his largest individual position representing over 36% of the total portfolio. Buffett’s position is worth over $62 billion, his largest investment by far.

As a business, Apple needs no introduction. The company has one of the world’s most iconic brands, thanks to its popular iPhone, Mac, iPad and Apple Watch products.

Apple is a technology company that designs, manufactures and sells products such as smartphones, personal computers and portable digital music players. Apple also has a thriving services business that sells music, apps, and subscriptions. The stock has a market capitalization of $1.2 trillion.

On April 30th, 2020 Apple reported Q2 fiscal year 2020 results for the period ending March 28th, 2020. (Apple’s fiscal year ends the last Saturday in September.) For the quarter Apple generated revenue of $58.3 billion (below previous guidance of $63 billion to $67 billion), representing 0.5% growth compared to Q2 2019.

Product sales were down -3.4%, with iPhones down -6.7%. However, a 16.6% improvement in Services, a much smaller portion of the business, and an increase in Wearables helped offset this.

Net income equaled $11.25 billion, a -2.7% decrease, while earnings-per-share totaled $2.55 compared to $2.46 previously, a 3.7% gain due to a substantially lower share count. Apple also declared an $0.82 quarterly dividend, payable May 14th, representing a 6.5% year-over-year increase, to go along with a $50 billion increase to the company’s share repurchase program.

Going forward Apple’s earnings growth will be driven by several factors. One of these is the ongoing cycle of iPhone releases, despite the significant decline in 2019. In the long run Apple should be able to grow its iPhone sales, albeit in an irregular fashion. Moreover, in emerging countries where consumers have rising disposable incomes, Apple should be able to increase the number of smartphones it is selling over the coming years. Increasing the selling prices of its phones could be a tailwind for revenue as well.

Another avenue for growth is Apple’s Services segment. This business unit, which consists of iTunes, Apple Music, the App Store, iCloud, Apple Pay, etc., has recorded a significant revenue growth rate during the last couple of quarters. Services revenues grow substantially faster than other segments and produce high-margin recurring revenues.

Final Thoughts

Warren Buffett’s investment portfolio contains many of the strongest, most long-lived businesses around. You can see more high-quality dividend stocks in the following Sure Dividend databases:

- The 2020 Dividend Kings List: Dividend Stocks With 50+ Years of Rising Dividends

- The 2020 Dividend Aristocrats List: 25+ Years of Rising Dividends

- 2020 Blue Chips List: Stocks With 10+ Years of Rising Dividends

Alternatively, another great place to look for high-quality business is inside the portfolios of other highly successful investors.

To that end, Sure Dividend has created the following stock databases:

- Seth Klarman’s Top 5 High Dividend Stocks

- Joel Greenblatt’s Top 20 High Dividend Stocks

- Bill Gates’ Stock Portfolio: Every Holding Analyzed

- Prem Watsa’s Dividend Stock Portfolio: Every Holding Analyzed

You might also be looking to create a highly customized dividend income stream to pay for life’s expenses.

The following two lists provide useful information on high dividend stocks and stocks that pay monthly dividends: