Top-Down Convertible Funds Are Timely

In his Weekend Reading Notes to investors, while commenting on convertible bond funds, Louis Navellier wrote:

Q2 2021 hedge fund letters, conferences and more

A Situation For The Monetary History Books

I’m not sure when the last time such a divide over the direction of interest rates and bond yields existed, but the present situation is one for the monetary history books. When it looked like lower commodity prices were taking hold, about the only commodity that really retreated heavily from its recent high was lumber.

Energy and food are trading higher following a broad pullback earlier this month. However, as we approach August, the price of corn, soybeans, wheat, cattle, lean hogs, coffee, sugar, and orange juice are trending back up near 2021 highs. Light sweet crude turned higher this past week following a minor correction and natural gas is trading at a new yearly high.

I think it drives us all a little crazy when the government reports core inflation, ex-food and energy, because of the volatile nature of the two. But for a family of four where both parents are working and commuting by car to put food on the table, pay the rent/mortgage, healthcare, and all the services to function week after week, there would be little argument that inflation is having a deep impact on their way of life.

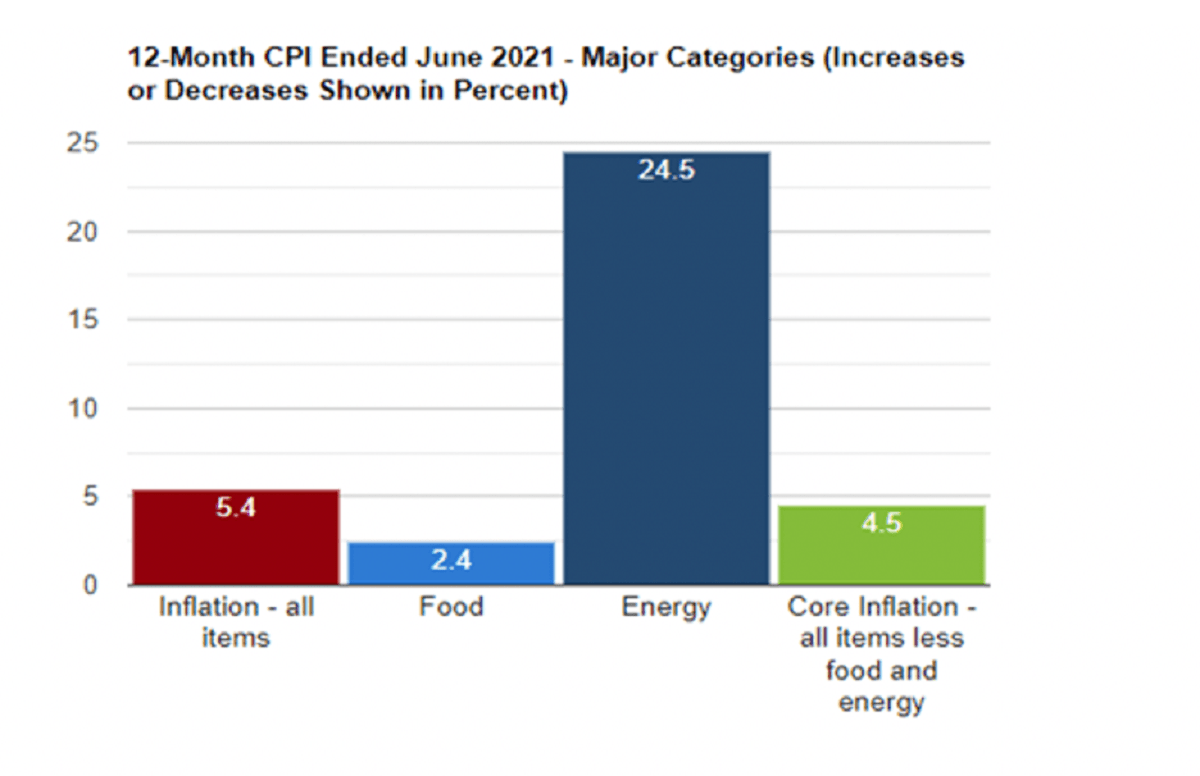

The Consumer Price Index, which is run by the Bureau of Labor Statistics, measures more than 200 categories of items arranged into eight major groups, including: food and beverages, housing, apparel, transportation, medical care, recreation, education and communication, and other goods and services.

Most recently, the BLS reported that “The CPI for June rose by 0.9%, after rising 0.6 percent in May, and was the largest 1-month change since June 2008 when the index rose 1.0 percent. Over the last 12 months, the all-items index increased 5.4 percent before seasonal adjustment; this was the largest 12-month increase since a 5.4-percent increase for the period ending August 2008.”

July 2021 CPI data are scheduled to be released on August 11 and will provide some key insight as to whether the Fed’s transitory stance will be further tested. At present, both the stock and bond markets have voted with the Fed, and as long as U.S. Treasury yields are higher than yields from other AAA-rated sovereign bonds from around the globe, the massive liquidity created seems to be a force that will keep soaking up whatever amount of QE hits the market via auctions.

This, along with the ongoing threat of the spread of new Covid-19 variants that have yet to rattle the stock market save for one nasty July 19 Monday, is also providing a strong bid under U.S. Treasuries. It’s a real tale of two trajectories at work, higher inflation and higher bond prices, that defy historical patterns. And for some very savvy inflation pundits like Wharton Finance professor Jeremy Seigel and DoubleLine’s Jeffrey Gundlach, that believe the Fed is behind the curve, it presents a quandary for investors seeking bond-related income.

Convertible Bond Funds Present A Smart Alternative

Convertible bonds can present a smart alternative as the market is affected by the forces of Fed policy, inflation, and rising GDP rates. It just makes sense to be flexible and willing to move into the right asset classes as the investing landscape characteristics change when coming out of a pandemic in such an uneven manner.

For the uninitiated, convertible debt is either a convertible bond or a convertible preferred stock. On their own, pure convertibles serve as a low paying class of income security that would normally not satisfy the yield-hungry income investor. The way in which we can exploit this sector and still maintain a high yield is to invest in closed-end funds that combine convertible securities with high-yield bonds and some leverage, thereby capturing some juicy yields and taking full advantage of the stock market’s upside.

Very simply, a convertible bond can be converted into the company’s common stock at a given strike price. That means you can exchange the bond for a predetermined number of shares. The conversion ratio will vary from bond to bond, but you’ll find the terms of the convertible (such as the exact number of shares or the method of determining how many shares the bond is converted into) in the bond’s indenture.

For example, a conversion ratio of 50-to-1 means that every bond (with a $1,000 par value) you hold can be exchanged for 50 shares of stock. If a $1,000 convertible bond is convertible into 50 shares of stock, the parity price of the stock is $20. If the stock moves up to $25, then for the stock and bonds to remain at parity, the bonds would have to be trading at $1,250. A convertible bond provides the performance attributes of common stock and the long-term safety of a bond with a fixed maturity.

The Risk Associated With Convertibles

One risk associated with convertibles is that most are “callable” at the company’s discretion, which can limit upside opportunity. When a bond is converted to common stock, the corporate debt is reduced. What was formerly debt is now converted to equity. Of course, converting debt into stock has the effect of diluting the equity.

The upside of the convertible bond comes from its common stock component, while the downside protection comes from the cash coupon, fixed maturity, and status in the capital structure. I like the convertible securities market because it addresses the desires of both bond and equity investors. For equity-oriented investors, convertibles can be viewed as a stock with a put option. The downside protection of the convertible comes from its higher-yield, fixed-maturity value, and status in the capital structure, all of which combine to give the security some real advantages.

Investors may want to consider looking into closed-end convertible funds with monthly payouts at www.cefconnect.com for more information. A few sample funds include:

- Calamos Dynamic Convertible & Income Fund (CCD), current yield 7.75%

- Gabelli Convertible & Income Securities Fund (GCV), current yield 7.51%

- Advent Convertible & Income Fund (AVK), current yield 7.47%

- AllianceGl Diversified Income & Convertible Fund (ACV), current yield 5.89%

- Ellsworth Growth & Income Fund (ECF), current 3.49%

The post Top-Down Convertible Funds Are Timely appeared first on ValueWalk.

Source valuewalk