The Rising Inflation And Falling Credit Card Debt

Whitney Tilson’s email to investors discussing his thoughts on the rising inflation; the fed is playing with fire; inflation is coming, here’s what to do about it; a shift in market leadership; credit-card debt keeps falling.

Q1 2021 hedge fund letters, conferences and more

Thoughts On The Rising Inflation

1) To achieve sustained investment success, I generally advise spending the great majority of your time on bottoms-up stock picking – focusing on developing in-depth (and ideally, differentiated) insights about a handful of companies and industries.

That said, it pays to at least keep an eye on big macro factors like economic growth, unemployment, inflation, interest rates, valuation levels across the entire market, fiscal and monetary stimulus, budget deficits, and so forth. If one or more of these things really gets out of whack, the effect on stocks can be substantial.

The macro factor I'm watching most closely these days is inflation. The sharp economic rebound (what I call "the mother of all economic booms"), unprecedented fiscal and monetary stimulus, and supply chain disruptions around the world are causing prices to soar in many sectors.

Here's a good overview from blogger Eric Rosen's recent missive:

Inflation Discussion

For the past couple months, I have been writing about my concerns about inflation and rising prices virtually everywhere. The markets have not seemed to mind too much and the all-knowing "experts," have not been concerned despite unprecedented stimulus and printing (1mm new $1,400 stimulus checks have been sent).

Well, Yellen came out Monday and suggested rates may have to rise to keep a lid on burgeoning economic growth brought on in part by trillions of stimulus spending. Markets sold off on the news. I would have thought they would have been harder hit. However, she is the Treasury Secretary, not the Fed Chair. Treasury Secretary Janet Yellen later said Tuesday afternoon she wasn't forecasting interest-rate increases to rein in any inflation spurred by President Joe Biden's proposed spending, clarifying comments that ruffled financial markets a few hours earlier.

Wow, that is not too confusing. Amateur hour. From my perspective, she 100% believes we need rate hikes.

Here are various other articles about rising inflation:

- The Price of the Stuff That Makes Everything Is Surging (Bloomberg)

- U.S. Home Prices Surge, Scaring Off Some Potential Buyers (WSJ)

- Looking to Buy a Used Car? Expect High Prices, Few Options (WSJ)

- Global Scramble for Commodities Sends Shipping Prices Soaring (Bloomberg)

- Lumber Prices Break New Records, Adding Heat to Home Prices (WSJ)

- Americans Expect Record Jump in House Prices, Rent in Fed Survey (Bloomberg)

- Bets on Economic Rebound Push Copper Prices to Record High (WSJ)

And here's a chart from the Financial Times:

The Fed Is Playing With Fire

2) So what should be done? Legendary investor Stanley Druckenmiller and his colleague Christian Broda, in this op-ed in yesterday's WSJ, The Fed Is Playing With Fire, called on the Federal Reserve to tighten monetary policy and raise interest rates. Excerpt:

With Covid uncertainty receding fast, and several quarters deep into the strongest recovery from any postwar recession, the Federal Reserve's guidance continues to be the most accommodative on record, by a mile. Keeping emergency settings after the emergency has passed carries bigger risks for the Fed than missing its inflation target by a few decimal points. It's time for a change.

The American economy is back to prerecession levels of gross domestic product and the unemployment rate has recovered 70% of the initial pandemic hit in only six months, four times as fast as in a typical recession.

Normally at this stage of a recovery, the Fed would be planning its first rate hike. This time the Fed is telling markets that the first hike will happen in 32 months, two and a half years later than normal. In addition, the Fed continues to buy $40 billion a month in mortgages even as housing is clearly running out of supply. And the central bank still isn't even thinking about ending $120 billion a month of bond purchases.

Inflation Is Coming

3) As for what you should do to protect your portfolio, this WSJ article outlines some options: Inflation Is Coming. Here's What To Do About It. Excerpt:

Here are five approaches, along with their biggest risks:

- Gold

- Commodities

- Stocks With Low Pricing Power

- Treasury Inflation Protected Securities

- Assets With Short Duration

Frankly, I don't like any of these options... So I'm playing a bit of defense by sitting on 22% cash and taking some profits among my biggest winners.

A Shift In Market Leadership

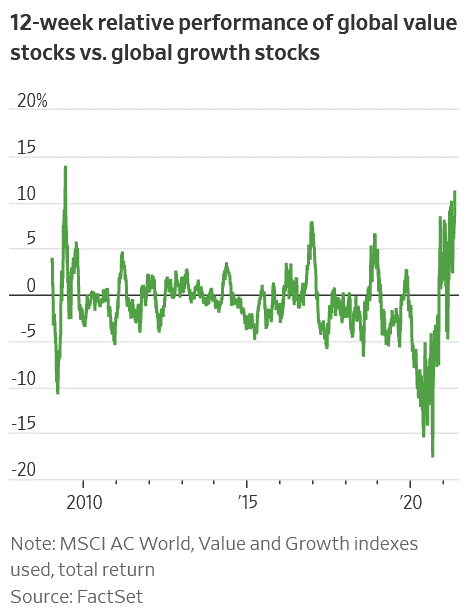

4) Investors are also rotating from growth into value, as this WSJ article notes: A Shift in Market Leadership Is Reassuring When Stocks Get Frothy. Excerpt:

Value stocks globally have just recorded their strongest short-term performance against growth stocks in over a decade. In a market riddled with signs of froth and euphoria, that's a healthy development.

The MSCI All Country World Value Index – heavy on less-expensive financial, healthcare and industrial stocks – is beating its growth-stocks equivalent by 11.3 percentage points over the past 12 weeks. That's its biggest advantage since mid-2009, when the equity market was climbing off the floor following the global financial crisis.

Of course, that follows last year's even-larger outperformance by richly valued growth stocks, the greatest since the heat of the dot-com bubble. In general, growth stocks – led not just by the U.S. FAANG set but also the emerging Chinese tech sector – have trounced their more staid peers globally over the last decade.

Credit-Card Debt Keeps Falling

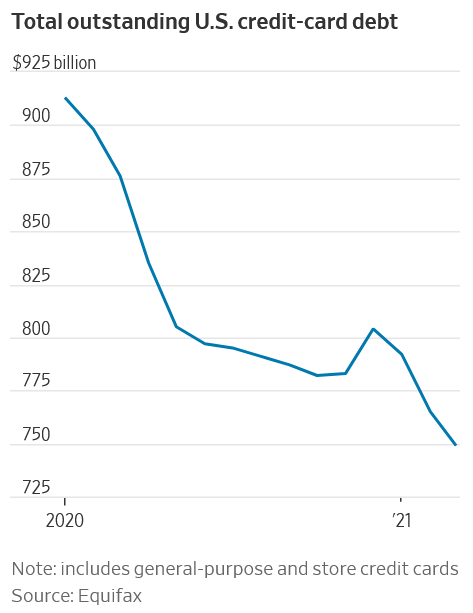

5) Another smart thing to do, especially if you're worried about a market pullback, is pay off high-cost debt – so it's good to see Americans doing exactly this: Credit-Card Debt Keeps Falling. Excerpt:

Americans are paying down their credit-card debt at levels not seen in years. That is good news for everyone but credit-card issuers.

Large card issuers that cater to borrowers ranging from the affluent to the subprime say that overall card balances – and thus the firms' interest income – are falling. To make up for it, issuers are spending more on marketing and loosening their underwriting standards.

Best regards,

Whitney

The post The Rising Inflation And Falling Credit Card Debt appeared first on ValueWalk.

Source valuewalk