The Investing “Truth” No One Wants To Hear

Today, I’m uncovering a “truth” about investing almost nobody understands.

This truth explains why most investors struggle to make any real money in the stock market… while a few achieve life-changing gains.

The truth is… most stocks suck.

Forgive me for the crude language.

There’s simply no other word that so accurately sums up my thoughts on the vast majority of stocks:

They suck.

Let me show you what I mean… and how you can turn this truth into an edge that’ll let you beat 99% of investors.

Most Stocks Suck

- In 2021, JP Morgan Asset Management published a great paper called The Agony The Ecstasy.

It’s a deep dive into the performance of the US stock market over the past 40 years.

JPMorgan found almost half of stocks suffered a “catastrophic loss” from 1980 to 2020. Meaning they plunged 70%+ and never recovered.

Another 26% of stocks handed out returns lower than the overall market.

In other words, roughly eight in 10 stocks were total duds that cost investors money.

But you surely know the US stock market is a lot higher than it was 40 years ago.

How is that possible when eight in 10 stocks are losers?

Turns out, all of the market’s returns came from just 10% of stocks, which JPMorgan called “megawinners.” In short, this elite group of stocks performed so well, they pulled the entire market up with them.

Whether you’re measuring early stage start-ups or large stocks, you can’t escape this investing truth.

Lots of losers… a few big winners.

In short, the odds are stacked against investors from the start. It’s no wonder most stock market investors struggle to even keep up with inflation.

This is why picking individual stocks isn’t for everyone. In fact, many folks are better off owning a broad basket of US stocks or buying indexes.

By simply owning the S&P 500 ETF (NYMARKET:SPY), you would have earned more than 59% over the past five years. That’s a good, stress-free option.

But investors who really want to get rich have to hunt for “megawinners.”

Finding Disruptors

- “Stephen… how do I find these elite stocks?”

It’s a lot easier once you know what to look for.

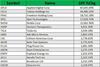

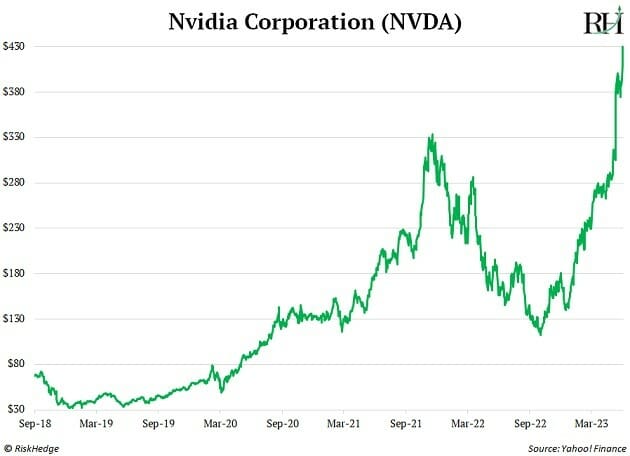

Here are the top-performing large US stocks over the past 10 years:

These megawinners aren’t all household names. But most of them share one key trait: They’re disruptors.

Disruptors are companies that change the world and invent the future. Take a quick look at the names on the list above…

Applied Digital Corp (NASDAQ:APLD) rocketed to the top of the list by designing and operating next-generating data centers.

Tesla Inc (NASDAQ:TSLA) climbed the ladder by pioneering affordable electric cars.

And America’s largest chipmaker, Nvidia, is the “brains” behind the most important artificial intelligence (AI) projects in the world today.

Investing In Nvidia

- My job is to get you into these disruptive megawinners.

We want to invest in companies pioneering whole new industries and transforming old ones.

The above list shows businesses that achieve these feats routinely turn out to be megawinners… and can hand you 1,000%+ gains—or sometimes a lot more—over the course of a decade.

For example, I made a big call back in 2018.

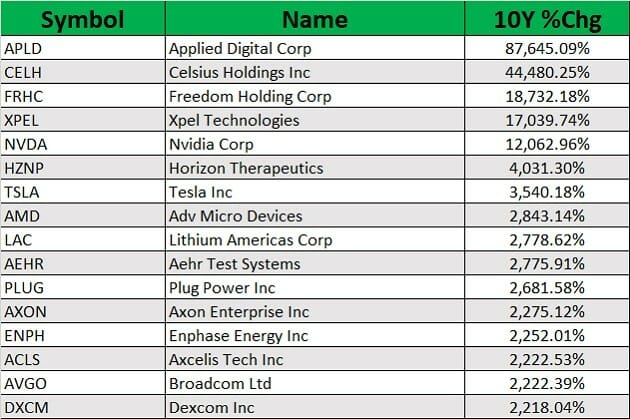

I said if I could only buy one stock for the next five years… it would be Nvidia (NASDAQ:NVDA). The stock is up 6.5X since September 2018:

Why did I choose Nvidia?

It ticked all the boxes to become a megawinner. The disruptive chipmaker almost single-handedly revived the dream of creating artificial intelligence (AI) with its revolutionary chip called the GPU.

Not only are these chips responsible for the lifelike video game graphics we have today…

These gaming chips are perfect for training machines to “think” like humans.

This breakthrough has helped Nvidia grow its AI-related data center sales 1,356% over the past five years.

Remember, disruptive megawinners routinely pioneer whole new industries. This allows them to grow uninterrupted year after year.

Nvidia’s stock has handed out 14X gains over the past five years.

So, next time you think about buying a stock, remember the truth:

Most stocks suck.

If you want to get rich investing, you must own the “megawinners.”

Article by Stephen McBride – Chief Analyst, RiskHedge

To get more ideas like this sent straight to your inbox every Wednesday and Saturday, make sure to sign up for The RiskHedge Report, a free investment letter focused on profiting from disruption.

Expect smart insights and analysis on the latest breakthrough technologies, the big stories the mainstream media isn’t reporting on, and much more… including actionable recommendations.

Source valuewalk

JPMorgan Chase & Co. Stock

The stock is an absolute favorite of our community with 29 Buy predictions and no Sell predictions.

With a target price of 202 € there is a slightly positive potential of 12.17% for JPMorgan Chase & Co. compared to the current price of 180.08 €.