The Energy Transition Basket: Are Cables The New “Shovels”? (Prysmian, Nexans, NKT)

Disclaimer: This is not investment advice. PLEASE DO YOUR OWN RESEARCH !!!

Q1 2021 hedge fund letters, conferences and more

Background:

I am currently trying to build up exposure to what I expect to be a long term trend towards electrification (see the first post). As I am still learning on the way, I decided to start with a “basket” approach where I try to build a basket of (lower weighted) potentially interesting stocks and then dive deeper during the following months/years So the initial analysis will be a little bit more shallow than usual.

This should be seen as a “scientific experiment”, so it could easily be that I find out that some (or all) of the positions don’t make any sense and I will sell them.

An alternative would be to read for months/years, write down a lot of stuff and then come out with a few “conviction investments” but that path is more difficult for me to implement. I prefer to get my toes into the water early in order to remain motivated.

As the whole effort in this sector/industry is about building up the infrastructure of the future, many of the companies will have a capital intensive business model. Of course I would prefer capital light business models at super low valuations but I haven’t been able to identify any yet.

Finally I am aware that I am maybe a little bit late to the party, but my expectation is that the party will last for a long time.

Are Cables the new shovels ?

During the Wild West Gold rush, there was the famous saying that the surest way to get rich in the gold rush was not to dig for gold but sell shovels to gold diggers. The deeper meaning of this saying is in my opinion, that in a situation similar to a gold rush you can make a lot of money by selling relatively ordinary things to people who desperately need them if there is a (local) shortage of these items.

Energy Transition / Electrification – implications

Introducing more Renewable energy into the grids has two main issues:

- The energy is more often than not generated far away from where it is actually used

- The supply of energy is more volatile

Much has been written about the need of storage, however much less is written about another interesting aspect:

In general, inter-connectedness of electricity grids is always beneficial for the stability of grids especially with fluctuating power sources.

When there is a grey windless February Day in Germany, there might be sun in Italy or Wind in Norway. So connecting national grids over longer distances will become more important the higher the share of renewable energy. The EU for instance has identified this relatively early and established a 15% electricity import/export requirement for each member state.

In technical terms, for long distance transport of Electricity, the “alternating current” electricity has to be transformed into “direct current” electricity. The efficiency losses are mostly in this conversion, distance as such is not a big issue especially at High Voltages.

It is also important to understand that the amount of electricity which can be transported through one cable is limited. The most recent opened inter connector between Germany and Norway for instance has a capacity of 1400 Megawatt/h or 1,4 Gigawatt. In comparison, Germany’s installed capacity is north of 200 Gigawatt and actual usage is up to 60 Gigawatts. So a lot more cables will be needed just for connecting grids.

On the other side of the world as an example, a Singaporean/Australian company is in the process of building a 4000km cable connecting Australia and Singapore.

In short, electricity will be transported over much larger distances in the future than it is now and this will result in a much higher demand for High Voltage electricity cables for a long period of time.

The cable industry:

Interestingly there are 3 different European listed companies that seem to dominate the market for cables:

Prysmian from Italy, Nexans from France and NKT from Denmark.

The percentage of the business that is directly related to Electricity varies between the 3 Players: For Prysmian it is ~47%. for Nexans 55% and NKT almost ~90%.

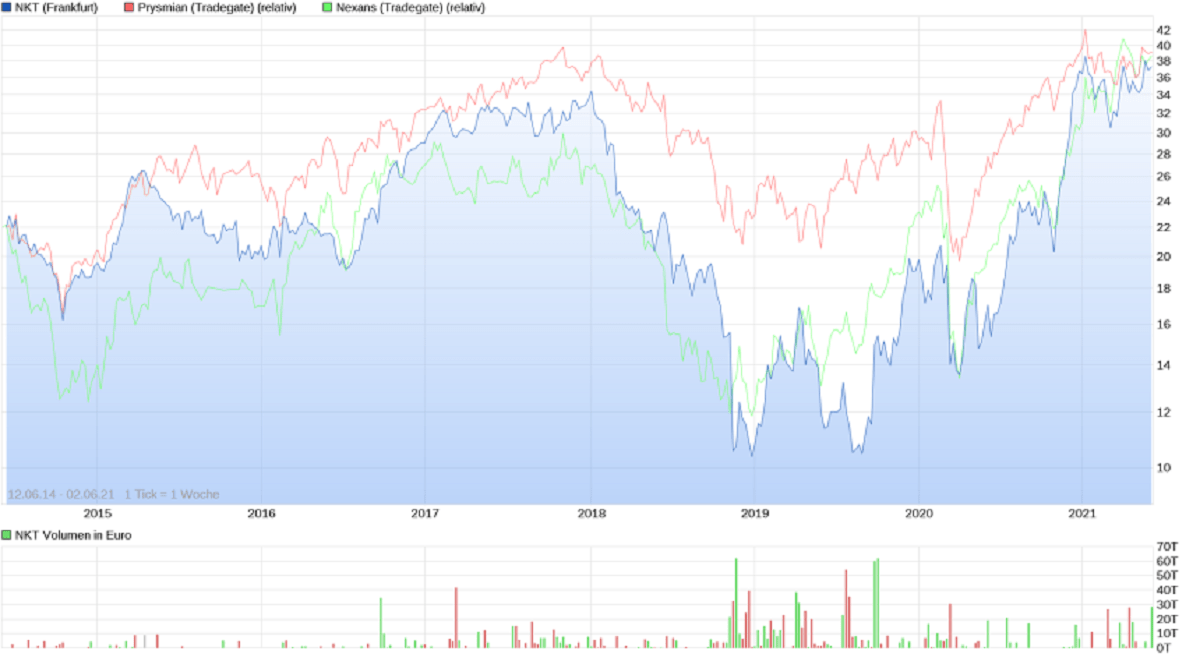

Chart comparison

Over the ~7 year period selected, all three stocks performed almost the same, however with a big difference in volatility. Prysmian, the largest company looks much more stable than Nexans and NKT.

In NKT’s case one has to consider that they spun off a division called Nifilsk in 2017.

Nexans has announced in February its intention to go full “electric”, i.e. to divest other activities.

The industry as such is capital intensive and to a certain level commoditized. Clients require a certain (high) level of quality plus the ability to lay the cables (Subsea) and offer maintenance.

This lead to a situation where returns on capital in general were not so great in the past. However, when looking at the company presentations one can see that order books are already pretty full and from what I have seen , so far no big additional capacity increases have been planned by these 3 players.

From what I have heard is that if one wants to get new cable in 2023, one must order right now and make a big down payment.

So overall I think there might be a good chance that we see a long upturn in the business and even some kind of “super cycle”, although some of that is clearly priced in already.

All 3 players have the ability (and own ships) to actually lay subsea cables which. As ships are always cool to look at, here are pictures of one ship per company:

Maybe these ships also represent some kind of “”barrier to entry”. On the other hand, there have been cartel fines for the major cable makers in 2014 which means that the barriers to enter don’t seem to be that high.

From a valuation perspective, all 3 companies are clearly not cheap. P&L statements are hard to read due to hedging, depreciation etc., but my estimate is that all three trade at a valuation of around 9-12x EV/EBITDA 2021

Starting position: NKT & Nexans

As starting position, I invested 1% of the portfolio into NKT (at 276 DKK) and Nexans (at 72 EUR). The reasons are as follows: I decided soleley based on the pictures of the ships.

- NKT is already an electrification pure play and is the most conservatively financed of the three. They also have a quite plausible mid term outlook of double digit revenue growth and margin expansion for the next 3-5 years

- Nexans has announced to concentrate on electrification. Here the outlook is less clear but the stock seems to be a little bit cheaper than the other two competitors at around 9x 2021 EV/EBITDA.

As mentioned above, both are not “sexy businesses” from the rear view mirror. However I do think with my current knowledge that all three companies might have some very good years in front of them with a decent chance of increasing profits and stock prices.

I have slightly reduced my Agfa and Euronext position to re-finance around 1,5% of the portfolio value. Some readers might consider this as the most relevant part of this write-up.

Article by memyselfandi007, Value And Opportunity

The post The Energy Transition Basket: Are Cables The New “Shovels”? (Prysmian, Nexans, NKT) appeared first on ValueWalk.

Source valuewalk