The Business Affairs of Vertiv Holdings Co: Accounting Gymnastics; Inadequate Disclosures; Still No CFO

(See epitaph for a reference to Bertolt Brecht’s novel The Business Affairs of Mr. Julius Caesar)

Vertiv Holdings Co (NYSE:VRT) had a surprising change in business strategy in 1Q23. It involved obtaining $144M of customer financing in the form of a pre-payment and reclassifying current contract liabilities, which likely included short-term borrowings, as deferred revenue.

Neither the terms of the pre-payment nor an explanation for the reclassification were disclosed. However, the financial and accounting gymnastics allowed the company to exceed quarterly cash flow guidance when the odds-on bet was for another big miss.

We view the reclassification as a significant accounting irregularity where financing cashflows are possibly transformed into cashflows from operations given the company’s history of unaudited intra-year short-term borrowing in 2022. Absent the $144M deferred revenue transaction we question whether the company could have continued as a going concern.

A self-congratulatory call with a bonus stock rally followed the 1Q23 earnings release. The Executive Chairman opined that “cash flow was terrific!” in “a hell of a debut for our new CEO.” However, the cash flow problems are still significant and unresolved. As the table below illustrates, even with the massive boost to cash flow from operations in 1Q23 via the $144M add to working capital, it printed at -$86.9M.

The result needs to be put into the context of repeated management pledges of inventory reduction and focus on working capital efficiency. “As Dave and Gio both mentioned, optimizing working capital will be a significant focus for 2023 for Gio, for myself and quite frankly, the entire company” David Fallon CFO 4Q22 call February 22, 2023.

1Q22 Working Capital

Absent the $144M add, CFO would have swung from a reported + $42M to -$102M and FCF adjusted for asset dispositions prints at -$132M. VRT’s mid-point guidance issued on Feb 22, 2023, a little over a month before the end of 1Q23 was -$75M.

The late February guidance implies the company was not aware of the swiftly forthcoming deferred revenue payment in the month of March. Absent that fortuitous and strategic event, VRT would have missed its midpoint FCF guidance yet again by more than 75%.

As Mr. Fallon explained on the 1Q23 call “The advanced payments were (we’re) super focused on that but that’s a matter of timing.”

Large prepayments are not an industry practice for vendors in the data center space. VRT has historically received some deferred revenue payments in the first quarters of the year: $27M in ’20, $33M in ’21 and $55M in ’22 with minimal changes in other quarters. The last two quarters – 4Q22 and 1Q23 – the company has received a combined and unprecedented $175M.

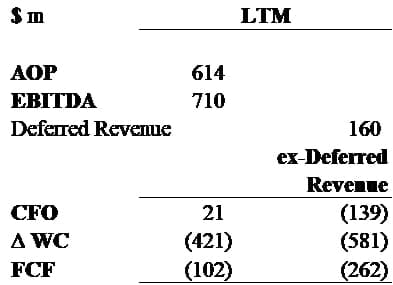

VRT’s Business Model Cannot Convert AOP/EBITDA into Cash

The surprise deferred revenue provided a stopgap solution to an ongoing cash generation problem. As the table below illustrates in the Last Twelve Months, VRT could not convert any of its margin EBITDA of $710M and AOP of $614 into free cashflow. We view this as a signal of two possible factors at play: the inflation of inventory to generate accounting margin while having to drive volume product business and receivables management issues likely linked to industry conditions and relative power positioning.

VRT’s Cash Burn: Worse Than it Looks

Source: Company filings and estimates

VRT’s DSO are pushing 120 days with industry standard 60 to 90 and keep increasing from below 100 days back in 2019. There is a bifurcation of cash collections with one branch of large prepayments and the second with general deterioration of payment terms.

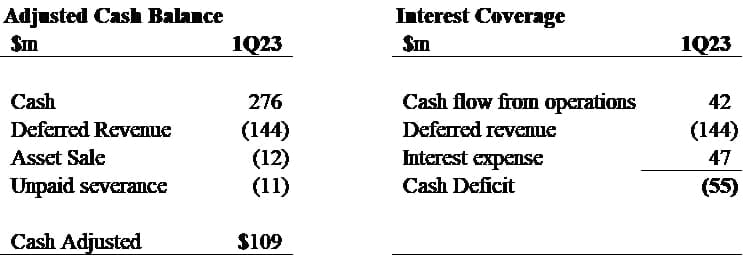

Absent Customer Funding, VRT Is in a Precarious Cash Position

Adjusting for the windfall deferred revenue in the quarter, some asset sales and unpaid severance as part of restructuring efforts, VRT would have had the lowest cash balance in its life as a public company. We question its ability to continue as a going concern absent a recapitalization.

VRT’s leverage is very high exceeding $3.2B. As shown above, the company did not generate enough cash flow to cover its $47M interest payment ex-deferred revenue in 1Q23. There is no space under the Term loan and the access to the ABL while technically available for another $325M with some geography limitations and subject to a 10% ceiling taking it closer to $270M (current rate 6.46%) could be non-existent if pledged inventory/AR need to be replaced with higher quality paper.

The practical lack of credit availability can explain the “short-term borrowings”, customer prepayments and accounting reclassifications but does not provide a sustainable solution absent large account receivable settlements and inventory reductions.

Despite raising its FY 23 AOP guidance by $25M in 1Q23, VRT left the free cashflow guidance unchanged. There is an implicit statement the improved profitability would again not be converted into free cashflow.

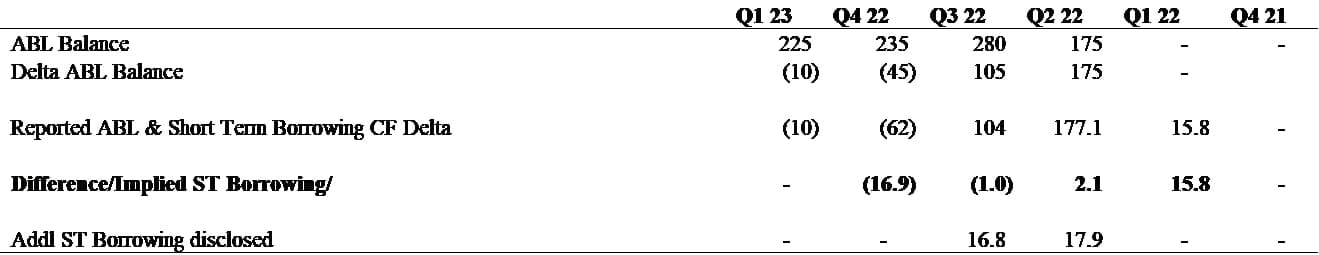

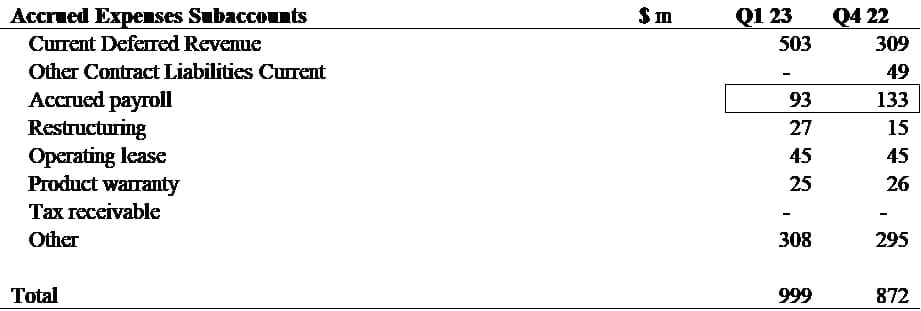

Obfuscated Intra-year Borrowing on Unaudited Statements Throughout 2022

As the table below illustrates, VRT has borrowed short term amounts in excess of the ABL loan. The loans started in 1Q22, were not disclosed till Q2 and Q3 2022 and were repaid before the accounts were settled for FY 2022. This results in all the information relative to the borrowings being unaudited, as is the current large deferred revenue payment.

VRT does not break its short-term borrowings from the ABL facility reporting. We backed-out the amounts based on the reported ABL balances and financing cashflows. The final balance indicates no short-term borrowings as of December 31, 2022 following the quarterly add-ons in Q1/Q2 and repayments in Q3/Q4.

Implied Short-Term Borrowing

Source: Company filings and estimates

The 1Q22 10-Q states that “at March 31, 2022 there was no borrowing balance on the ABL Revolving Credit Facility. Yet, the 1Q22 cash flow statement clearly indicates $15.8M of net new short-term borrowing.

Summary Cash from Financing 1Q22

Source: Company filings

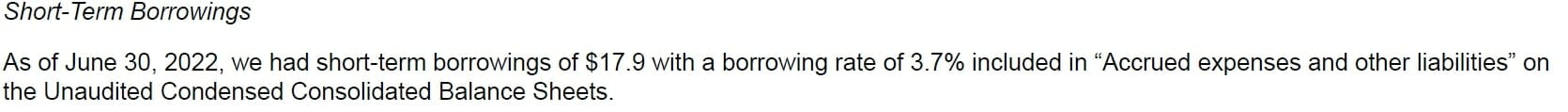

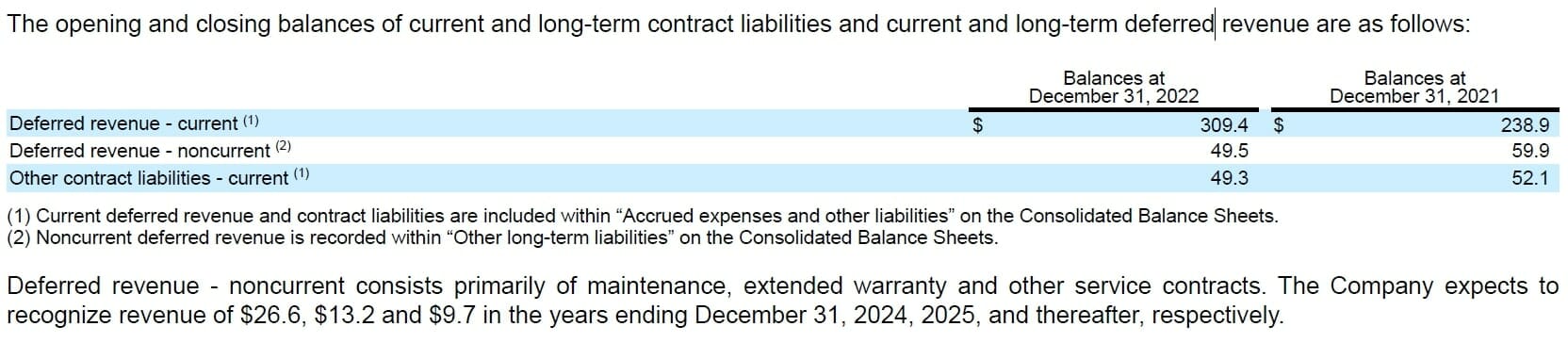

This $15.8M in non-ABL short-term borrowing was not disclosed until the 2Q22 single sentence disclosure in the 10-Q, shown below.

The cashflow statements indicate VRT borrowed $15.8M in 1Q22 and $2.1M in 2Q22 for the total amount of $17.9M, which was disclosed in the 2Q22 10-Q. The 3Q 10-Q disclosure is accurate. There is no non-ABL short-term borrowing mentioned in the 2022 10-K.

Intra-year Disclosure of Short-term Borrowings

The rate of 3.7% is very favorable when compared to that of the other VRT liabilities indicating a super senior position in the borrowing stack.

We view VRT short-term borrowing disclosures as deficient and misleading. They were never discussed by management; and we are interested to find out if they constituted additional senior secured borrowing under the company’s Term and ABL loan definition.

The Deficient Disclosure Regarding the Allocation of Short-term Borrowings to Accrued Expenses Subaccounts

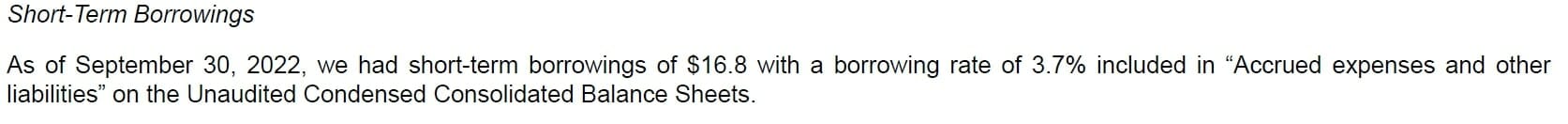

The additional borrowings were included in the all-encompassing Accrued Expenses and Other Liabilities account, which includes everything except payables, income taxes and current portion of long-term debt. The account’s astounding composition is presented below.

The account is a $1B amalgamation of unrelated categories like tax receivable, product warranties, restructuring costs and accrued payroll. The latter consuming $ -40M of cash in Q1 23 to add to the -62M of accounts payable and -$176M of receivable and inventories. We sympathize with VRT’s CFO as it was a very difficult quarter from a cash perspective. It might feel like Noble International déjà vu.

Despite clear cash headwinds, the company repaid $10M to its ABL facility.

We were unable to reconcile the short-term borrowing and deferred revenue changes between the balance sheet and the cashflow statement since there are no separate disclosures. Therefore, it is unclear whether the short-term borrowings have been included in the Other Contract Liabilities Current or Other subaccounts of the Accrued Expenses account.

It is likely that some of the borrowings were included in the Other Contract Liabilities Current subaccount given the directionality of the changes and/or Other, which we show below. It is impossible to know without the company improving its level of disclosure.

Changes in Accrued Expenses Subaccounts

Vertiv Merged the “Other Contract Liabilities” Subaccount with Deferred Revenue

In 1Q23, VRT has changed the way it reports two subcategories of the accrued expense account – deferred revenue and other current contract liabilities – without disclosing or discussing the change.

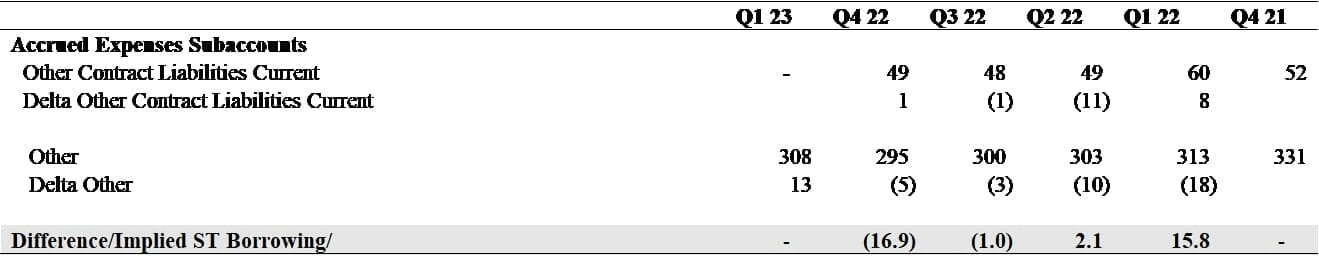

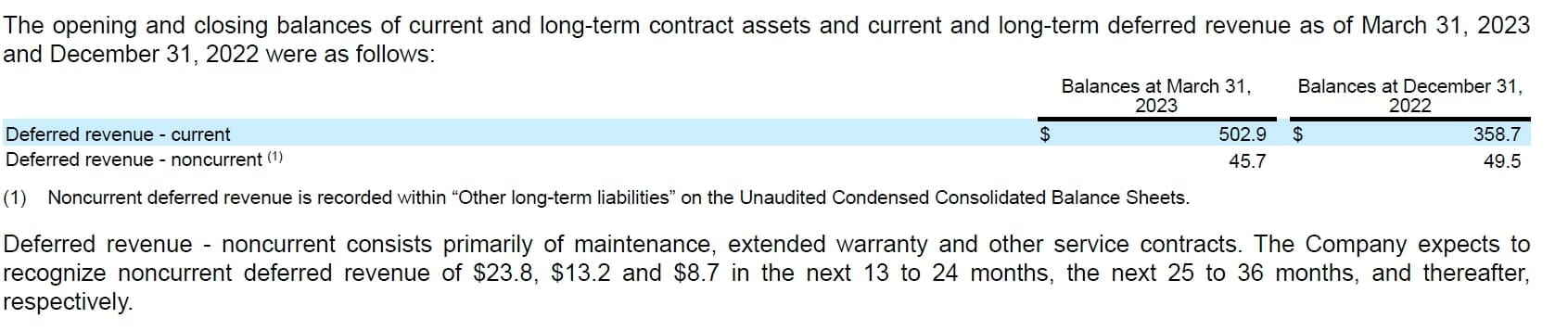

Below is VRT’s disclosure of current deferred revenue where customer prepayments are booked at December 31, 2022 from the company’s 10-K filed with the SEC. It lists current deferred revenue at $309.4M and other current contract liabilities at $49.3M.

The Old Deferred Revenue-Contract Liabilities Disclosure

The balances are reported differently (and applied retroactively) as of March 31, 2023. In the 10-Q, the company’s current deferred revenue was $358.7M at December 31, 2022, which is the result of combining the previously disclosed deferred revenue AND other current contract liabilities. We show it below.

The New Deferred Revenue Disclosure

Given previous disclosures and short-term borrowings, we believe it is likely that either the terms for the deferred revenue deal and/or part of the merged other contract liabilities current account constitute de-facto borrowing which might be properly classified as financing and not operational cashflow.

However, as a result of the reclassification and merging of current contract liabilities with current deferred revenue, short-term borrowings can be reported as deferred revenue operating cashflows on the financial statements.

VRT can set the record straight quite easily by providing the necessary disclosures to the financial community.

No Disclosure of Either Terms of a Significant Transaction or the Accounting Reclassification

There is no formal disclosure of the large prepayment other than amount. There is no disclosure of the merging of other current contract liabilities. Given the large amount, it is likely a hyperscale or another significant client. At what cost/terms did they agree to prepay? These are crucial questions especially given management’s touting it as a potential new “business model”.

In our view, the company’s disclosures are inadequate for such an important transaction and potentially impactful accounting change. We call on the SEC to examine them and take appropriate action.

The Business Affairs of Mr. Julius Caesar

In Bertolt Brecht’s novel an aspiring scholar attempts to write an idealized life of Julius Caesar twenty years after his death. But the historian abandons his planned biography, confronted by a baffling range of contradictory views.

Was Caesar an opportunist, a permanently bankrupt businessman who became too big for the banks to allow him to fail – as his former banker claims? Did he stumble into power while trying to make money, as suggested by the diary of his former slave?

Across the different versions of VRT’s story – spending $1.8B on a questionable acquisition with $1B cash paid to one man offshore Cyprus account right before the problems surface with the company, expanding margins, service focus, rep replacement model, channel focus, high volume hyperscale effort, cashflow management and ERP systems updates, SG control to leverage margins, paying the sponsor $100M of “tax receivable” in 2022 – all point to the wry truth of a company painfully struggling to stay afloat while being slowly mismanaged is an uncomfortable allegory that points perhaps to the overall reality of our own times.

Legal Disclaimer

In no way should this report be taken as investment advice or constitute responsibility for investment gains or losses. The information in this report should not be relied upon for investment decisions.

All investors must conduct their own due diligence and consult their own investment advisors in making trading decisions. This is not a solicitation to transact in any of the securities mentioned.

The data herein has been obtained from public sources we believe to be reliable. However, the information is presented on an ‘as is’ basis and we make no warranty of any kind as to the accuracy, timeliness and/or completeness of any material contained in this opinion piece.

Source valuewalk