Stocks Are Not Overvalued

Last week, we wrote:

Even if the Lira falling was, in fact, the reason why the market dropped on Friday Aug. 10/18 (which it’s not), what good would that do for us as investors? Up until Friday, the Lira had already fallen 25% since March of this year, yet the S&P 500 rose 7% during the same period. So, which is it; Lira weakness causes the market to go up, or Lira weakness causes the market to go down? The entire approach is ridiculous.

One week later, a test of support at 2800, and the S&P 500 is ten points higher than it was. After all the online fear-mongering that went on, the bull wasn’t slain by the Lira.

There is too much fear in the market and, as is typical for a bull market, the fear is not rational and much digital-ink is being spilled trying to rationalize it.

A few days ago, a successful (in terms of members and followers) investment advisor published a piece where he argued that stocks where over-valued based on the fact that, since April of this year, the forward earnings estimates made by analysts have dropped from a range of +30% to +40% increase, down to only +20% to +30% increase (with 90% of companies reporting, the earnings show an increase of +24% in the latest quarter). The logic being, that because earnings are only expected to grow by more than +20% (instead of more than +30%), stocks are over-valued and, therefore, owning stocks at this point is is risky. That, is a manifestation of baseless fear, and evidence that we are in a serious bull market.

Let’s look at more evidence, starting with the fundamentals.

Fundamentals

Corporate long-term debt, not due for more than one year (blue line), has been decreasing over the last 3-quarters, and debt that is due within one year (red line), has been holding steady for several years.

The chart below, shows how Real Personal Consumption Expenditures have dropped ahead of every recession since 1949, except for one (1961). PCE is rising which corresponds with economic expansion, not contraction.

The velocity of money (M2) has decreased during the first half, and increased during the second half of five of the last six expansions (red arrows). The velocity has just now started to rise (from historic lows), which implies we are only at the midpoint of the current expansion. While we have a hard time believing that there are another nine-more-years of expansion left, it does reassure us that we are not very close to the end of this bull market.

Rising interest rates do not kill bull markets. Too high interest rates kill the bull, and what the market considers too high has been decreasing over the last three decades. If we extrapolate the slope of the Fed rate (black dotted-line below), we get between 2.50% and 3.00% as “too high” of a rate being reached early in 2019. This produces the same timing as when we extrapolate the inversion of the 10-year minus 2-year Treasury rate differential. If the slope is maintained (red dotted-line below), the inversion should also happen early in 2019, but since contractions follow 6–12 months (or more) later, we do not see any reason to be fearful at this point.

Our preferred method of measuring stock market valuation is to compare the dividend rate of the S&P 500 with the risk-free 6-month Treasury rate. This differential went negative earlier this year and stands at -0.43. This is still a historically high yield and a decreasing net yield is a feature of late-stage bull markets (chart below). The chart below also shows how the net yield tends to flatten (stop decreasing) ahead of major market tops. Until the net yield starts flattening, we are not worried about a bear market.

Sentiment

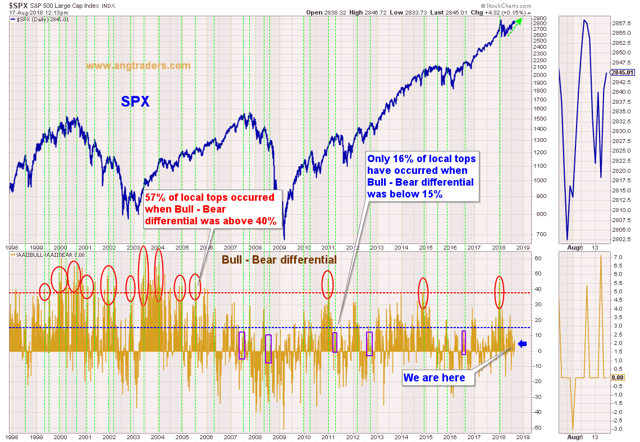

The AAII sentiment survey was essentially unchanged this week. The bull-minus-bear differential is at +7% which implies a healthy amount of fear. Most tops occur when the differential is above +40% bullish.

In conclusion, the stock market does not have the fundamental or psychological characteristics that would make it “over-valued”, at this time.

We have presented a small sample of the discussion which the members of our private service have received.

We provide our subscribers with a unique perspective, developed over the past 40-years, which helps to keep us on the ‘right-side’ of the market, and away from the herd.

SPECIAL NOTICE: As of September 1/18, our subscription rates (for new subscribers only) will be $50/month or $400/year.

We invite you to join us, before September 1/18, at the current rate of $30/month or $240/year, which will never increase as long as the membership is maintained.

ANG Traders

www.angtraders.com

Source: Nicholas Gomez