Stanphyl Capital June 2022 Commentary

Stanphyl Capital commentary for the month ended June 30, 2022.

Friends and Fellow Investors:

For June 2022 the fund was down approximately 1.3% net of all fees and expenses. By way of comparison, the S&P 500 was down 8.3% and the Russell 2000 was down 8.2%. Year to date the fund is up approximately 36.8% net of all fees and expenses. By way of comparison, the S&P 500 is down 20.0% while the Russell 2000 is down 23.4%. Since inception on June 1, 2011 the fund is up approximately 134.3% net while the S&P 500 is up 250.6% and the Russell 2000 is up 133.9%. Since inception the fund has compounded at 8.0% net annually vs 12.0% for the S&P 500 and 8.0% for the Russell 2000. (The S&P and Russell performances are based on their “Total Returns” indices which include reinvested dividends. The fund’s performance results are approximate; investors will receive exact figures from the outside administrator within a week or two. Please note that individual partners’ returns will vary in accordance with their high-water marks.)

Q1 2022 hedge fund letters, conferences and more

Occasional rallies notwithstanding, I believe the S&P 500 is only around halfway through (“pricewise”—“timewise” could be a lot longer) a massive bear market in stocks, the inevitable hangover from the biggest asset bubble in U.S. history. For far too long, the Fed printed $120 billion a month and held short-term rates at zero while the government concurrently ran a record fiscal deficit. Now, thanks to the massive inflationary hangover from those idiotic policies, the Fed must reduce its balance sheet and raise interest rates substantially accompanied by no extra fiscal stimulus. Thus, the “everything bubble” is in the process of deflating, and we remain positioned for it—albeit, not as short this month as I wish we’d been!

The last time the 10-year Treasury yield was where it is now (approximately 3%) was December 2018 when the S&P 500 was around 2700 (almost 30% lower than it is today), yet inflation was vastly lower (allowing much higher PE multiples) and growth prospects were far better. And although corporate earnings are higher now than they were then, I believe that due to a looming slowdown in consumer spending and inflationary margin pressure those earnings expectations are too high while inflation will substantially lower the PE multiples placed on them, as happened in the inflationary era between 1973 and 1975 when the S&P 500’s PE rapidly dropped from 18x to 8x. (Perhaps a move from 30x to 14x might be in order this time around, although markets typically overshoot to the downside.) Thus, I think this stock market is going much lower, and although we covered our large SPY short position in May when I felt it was short-term oversold, I plan to reinstate it if there’s a large enough “bear market bounce.” Additionally, we continue to have a large short position in Tesla (NASDAQ:TSLA), the biggest bubble-stock in this entire bubble era, which will soon be to electric cars what Blackberry became to smartphones: the pioneer that wound up with arrows in its back.

Meanwhile, even last year when short-term rates were set at just 0.125% and average rates were around 1.5%, the gross interest on the $30 trillion of federal debt cost $573 billion, and that cost is now on a path to nearly double. Does anyone seriously think this Fed has the stomach to face the political firestorm of Congress having to slash Medicare, the defense budget, etc. in order to pay the even higher interest cost that would be created by upping those rates to a level commensurate with even 4% or 5% inflation (not to mention today’s over 8%)? Powell doesn’t have the guts for that, nor does anyone else in Washington; thus, this Fed will likely be behind the inflation curve for at least a decade. And that’s why we remain long gold (via the GLD ETF).

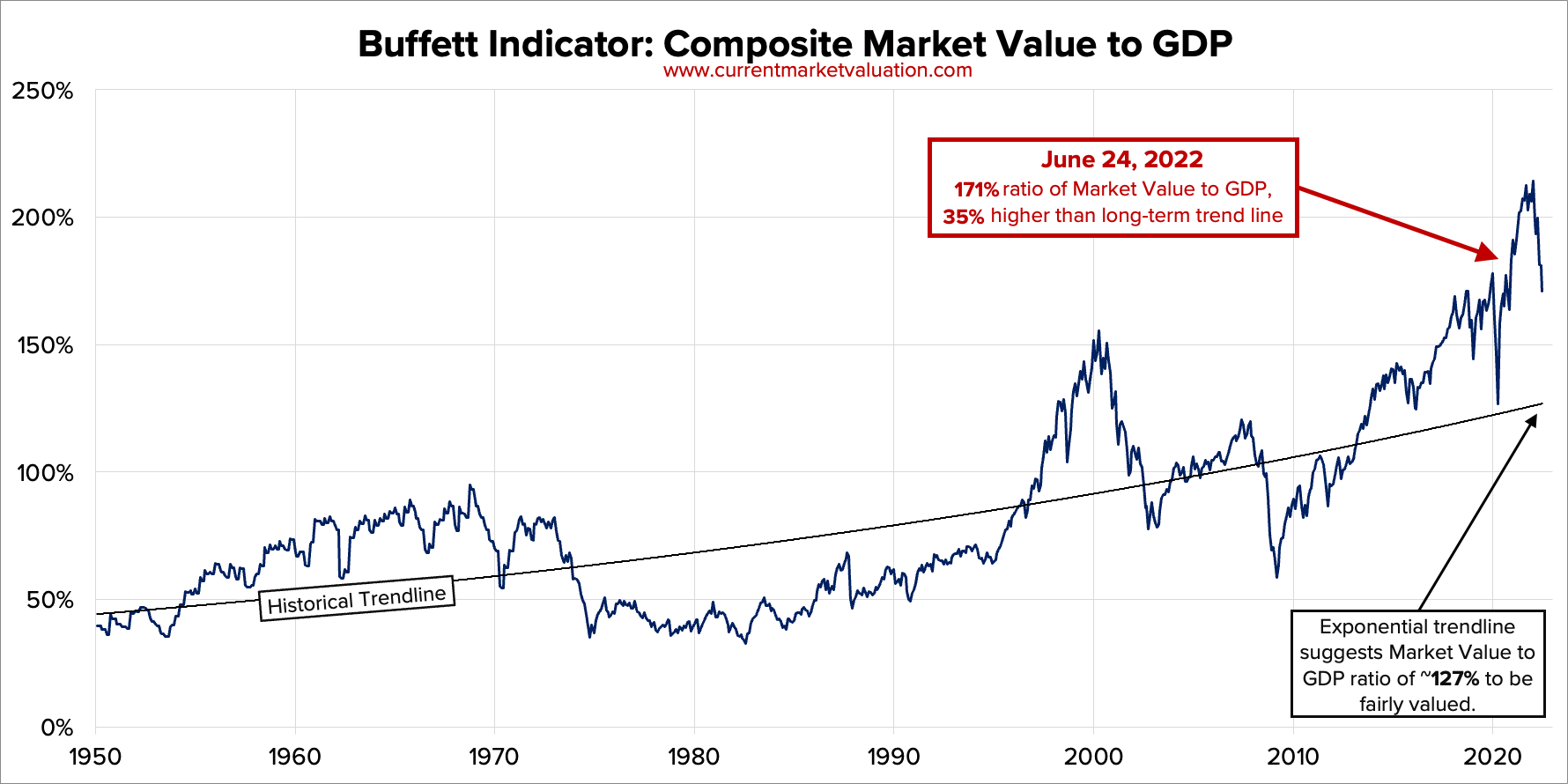

The Buffett Indicator

And finally, we can see from CurrentMarketValuation.com that (as of June 24th) the U.S. stock market’s valuation as a percentage of GDP (the so-called “Buffett Indicator”) is still astoundingly high, and thus valuations have a long way to go before reaching “normalcy” (which the market will almost certainly overshoot to the downside):

When stocks get meaningfully cheaper I’ll get longer, but until then the fund’s bias is towards caution!

Stanphyl Capital's Positions

Here then is some additional commentary on some of our positions; please note that we may add to or reduce these positions at any time…

We continue to own a long position in Volkswagen AG (via its OTCMKTS:VWAPY ADR, which represent “preference shares” that are identical to “ordinary” shares except they lack voting rights and thus sell at a discount). The stock has been pounded lately (down to less than 4x consensus 2022 earnings!) on a combination of “recession fears,” short-term issues obtaining energy (until alternative supplies are in place next year) and the euro’s slide against the dollar. But Volkswagen controls a massive number of terrific brands (including Porsche, which in February it announced it plans to spin off in a value unlocking transaction), and its EVs (several of which are more technologically advanced than any Tesla) combine to outsell Tesla in Europe and by 2025 should outsell Tesla worldwide. In March VW reported great 2021 financials and excellent guidance for 2022, although it did later warn that 2022 results will be adversely affected by parts shortages caused by the terrible situation in Ukraine. In total (without chip shortages) VW sells roughly 9 million vehicles a year vs. around 1.2 million a year for Tesla. Yet Tesla’s market cap is over 7x VW’s, meaning that an investor pays almost 60x as much for each Tesla sold as for each VW sold! And, as noted earlier, VW sells for less than 4x estimated 2022 earnings!

We continue to own a long position in General Motors (NYSE:GM), which currently sells for only around 4.5x the $7/share midpoint of 2022’s adjusted EPS guidance. GM is doing all the right things in electric cars, autonomous driving (via its Cruise ownership) and software, yet it’s extremely cheap because, as with other established automakers, investors have (for now) forsaken it in favor of “electric car pure-plays,” a sector which has thus become the largest valuation bubble in history. And regarding “autonomy,” keep in mind that unlike Tesla, which sells a LiDAR-less fraud to rubes, Cruise is already running a fleet of fully autonomous cars in San Francisco; you can see many videos of this on its YouTube channel.

I thus consider these positions (GM and VW) to be both “freestanding value stock buys” and “relative value paired trades” against our larger Tesla short.

We continue to own a small long position in Fuel Tech Inc. (NASDAQ:FTEK), a seller of air and water pollution control technologies. Although there’s no identifiable near-term catalyst for this stock, at our basis of $1.31/share we paid an enterprise value of only around 0.2x TTM revenue for this 47% gross margin company which has around $1.12/share in cash, no debt, and a TTM operating loss of only around $1.3 million vs. $34 million in cash. This is the kind of company that will either ignite growth and its stock will take off (its new “Dissolved Gas Infusion” water treatment technology is a potential medium-term catalyst for that), or it’s so cheap that it makes a good strategic acquisition target, as removing the costs of being an independent public company would make it instantly profitable while allowing the buyer to acquire a nice chunk of revenue very cheaply. In short, at its current price I think it’s a good “value stock” in which to park some money and see what happens; meanwhile in May the CEO stepped up and bought stock in the open market.

We continue to own a small, speculative long position in NuScale Power (NYSE:SMR), a developer of small modular nuclear reactors. I believe that the world will soon acknowledge that the only practical way to decarbonize is with more nuclear power (in February the EU even designated it as “green”), and NuScale’s passive-safety design is the only one (so far) approved by the Nuclear Regulatory Commission. This is a capex light company (it provides only engineering services), and although the first reactors in the pipeline won’t come online until the end of this decade, the cash flow begins much sooner as the company is paid as construction progresses. Also, NuScale has the U.S. government as a financial backer/supporter. At a pro-forma enterprise value of only around $2 billion with great strategic holders and (according to management) enough cash on hand to become cash flow positive, I believe this is an interesting speculation if sized accordingly. Here’s a link to the most recent company presentation.

Thanks,

Mark Spiegel

Updated on

Source valuewalk