September Speculations in Railroads, Real Estate and Russian Rubles

For weekend reading, Gary Alexander, senior writer at Navellier Associates, offers the following commentary:

In the last 25 years, three events have haunted us, and they all share an anniversary this week, yet most of our attention this week may be focused on the 22nd anniversary of 9/11. That’s understandable from one perspective, but financial crises also carry their own long-term toll – plus some valuable lessons – and this month marks their 15th and 25th and 150th anniversaries, so let’s look at railroads, real estate and the ruble:

Crisis #1: September 20-29, 1998: The Russian Ruble Breaks the Bank

So many trading systems are based on “what works historically,” especially past trading ranges of historic tops and bottoms. A famous example of this folly is the case of Long-Term Capital Management (LTCM).

As often happens, the “best and the brightest” craft a foolproof system that ultimately fools themselves. The core system was devised by Nobel prize winners Myron Scholes and Robert C. Merton, using their eponymous Black-Scholes-Merton system for pricing options with no theoretical risk. Whenever spreads between a pair of sovereign bonds got too far out of alignment, they would sell the overpriced bond and buy the underpriced one, pocketing the difference as prices reverted to the mean, using high leverage to supercharge thin spreads. Trades were executed by another superstar, bond king John Merriwether.

For nearly half a decade (1994 to mid-1998) LTCM’s returns were so phenomenal (40% a year) that their assets under management (AUM) soared to nearly $100 billion, but in August 1998, Russia defaulted on its ruble debt and so LTCM’s narrow spreads – by then leveraged up to a stratospheric 50-to-1 – ballooned and exploded, resulting in a debt exposure over $1 trillion, so margin calls came streaming in.

According to later testimony by William J. McDonough, then-president of the New York Federal Reserve:

“A team from the New York Fed, led by Peter Fisher, head of our Markets Group, and joined by Treasury Assistant Secretary Gary Gensler, met with the Long-Term Capital partners at their offices, on Sunday, September 20. During this meeting, we learned the broad outlines of Long-Term Capital’s major positions in credit and equity markets, the difficulties they were having in trying to reduce these positions in thin market conditions, their deteriorating funding positions … The team also came to understand …that the size of these positions was much greater than market participants imagined.”

The rest of the world learned on Tuesday, September 22, that LTCM was bankrupt, and a government-led bail-out was to begin the next day. Essentially, the New York Federal Reserve organized a rescue plan – not for just this one hedge fund, but for global liquidity for all major currency exposures. What was not so clear at the time was that Warren Buffett offered to take over LTCM at about a dime on the dollar, but he was rejected because the firm rightly believed the Federal Reserve would bail them out more favorably.

The next week, on Monday, September 29, Federal Reserve Chairman Alan Greenspan cut short-term interest rates in response to rising global financial turmoil, but his work was not over. The Fed eventually reduced the Fed Funds rate three times throughout the fall of 1998 as liquidity fears spread globally.

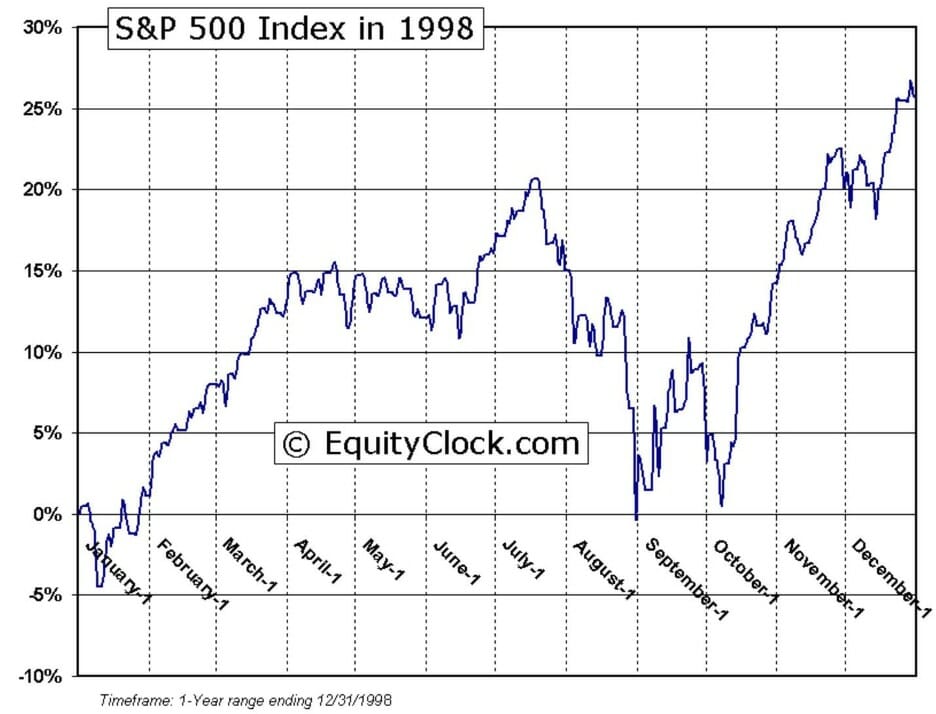

The Russian ruble and LTCM collapse caused a double bottom, but stocks then rallied 28% to new highs.

The bulk of the market decline that summer came during the ruble collapse from July 17 to August 31 (-19.3% in both the Dow and S 500). After an early September rally, the market set a double bottom on news of LTCM’s collapse. Thursday, October 8 was the “date of maximum pessimism.” That week, I was helping John Dessauer host his “Dream Swiss Seminar” in Grindelwald and we sensed major gloom among the 60+ investors assembled there, so Dessauer said he was buying stocks that day and encouraged others to do so. In short order, the S 500 rocketed back up 28% between October 8 and year-end 1998.

Crisis #2: September 15, 2008 – The Day Real Estate Debt Almost Destroyed Wall Street

It all started with a housing boom, as a series of politicians and realtors oversold the American Dream:

“In 2002, the George W. Bush administration urged Congress to pass the American Dream Down Payment Act, which subsidized the down payments of prospective home buyers whose incomes were below a certain level. After the passage of that Act, the president also urged Congress to pass legislation permitting the Federal Housing Administration to begin making zero-down-payment loans at low interest rates to low-income Americans” (Thomas Sowell, Housing Boom and Bust, p. 41-42).

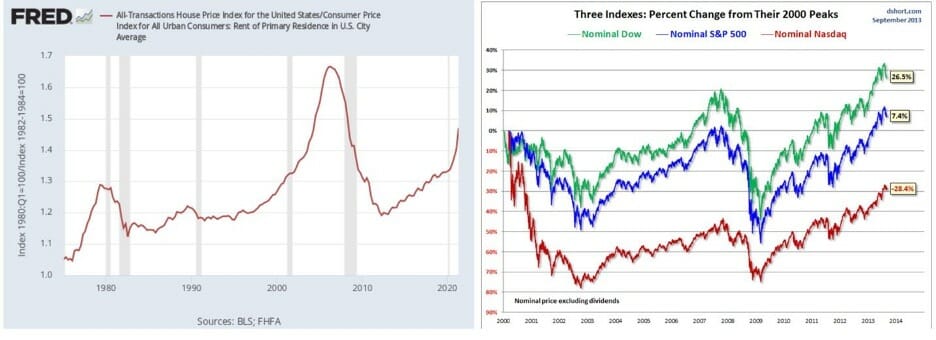

Home prices crashed in 2006-7 (St. Louis Fed chart), followed by a stock market crash in 2008-9 (Market Oracle)

Barney Frank, Chair of the House Committee on Financial Services, admitted that he “would like to get Fannie and Freddie more deeply into helping low-income housing and possibly moving into something that is more explicitly like a subsidy,” adding that, “I want to roll the dice a little bit more in this situation toward subsidized housing” (Sowell, page 49). As a result, home prices started escalating rapidly in 2002 to 2005, and homeowners often treated their homes like an ATM machine, refinancing to generate cash.

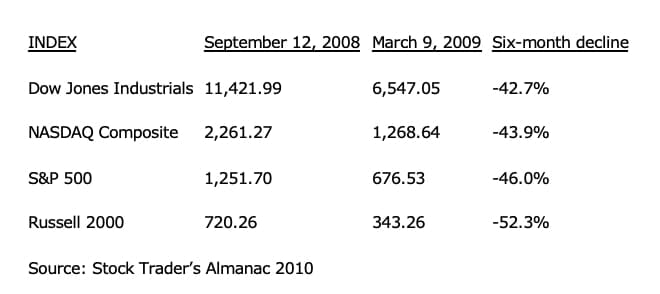

Bear Stearns was forced into a pennies-on-the dollar shotgun merger in March 2008, and other financial firms were next in line. After emergency measures failed to save Lehman Brothers on Sunday, September 14, the firm filed Chapter 11 bankruptcy papers on Monday, September 15, setting off a stock free-fall:

The Dow fell 4.5% on September 15, the worst one-day drop since the Attack on America on 9/11, but unlike 2001, these declines continued for the next six months. That first week of September 15-19, 2008, saw massive cash and money market withdrawals, threatening major banks with imminent failure.

It wasn’t just real estate, of course. Wall Street manufactured kinky derivatives out of risky “tranches” of real estate mortgage loans (many rated “AAA”), but bids disappeared on such junk in that fall of 2008.

Crisis #3: September 18-22, 1873: Bankrupt Railroads Unhorsed “Mad Traders” on Wall Street

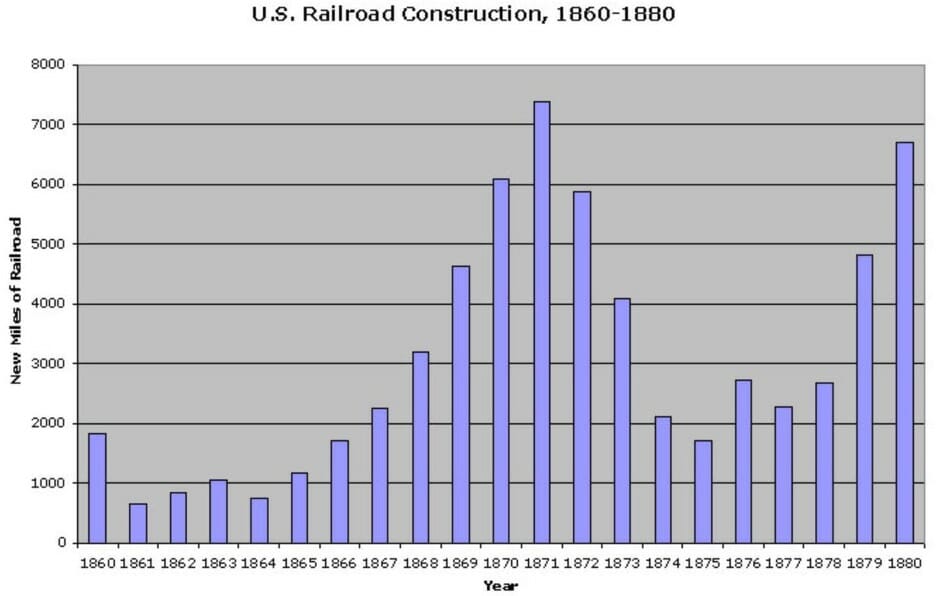

Going further back in our time machine, railroads were the hot tech stocks after the Civil War, especially after the first Transcontinental Railroad was completed in 1869, so banker Jay Cooke decided to build another transcontinental railroad! But on Thursday, September 18, 1873, at 11:00am on Wall Street, H.C. Fahnstock, Cooke’s New York partner, announced that Cooke’s office was closed. Cooke, in Philadelphia that day, admitted it was true, and so the most prominent banker in the country was suddenly bankrupt.

Despite Wall Street’s railroad mania, Cooke failed to construct a second transcontinental line. Apparently, demand could not support a second line. Cooke’s folly was mostly a symbol of gross over-speculation in land and securities. After this September opening shot, over 5000 businesses failed in the last quarter of 1873 and another 5,000 businesses failed over the next five years, as inflation gave way to deflation.

Robert Sobel, writing like Stephen King in Panic on Wall Street, said the “coal-black steed named Panic” quickly “thundered riderless down Wall Street,” where “a monstrous yell went up and seemed to literally shake the building in which all these mad brokers were for the moment confined.” Along with Jay Cooke, 37 other banks and two brokerage houses closed their doors on this date alone. In ensuing days, losses increased, and the NYSE was forced to close for over a week. Eventually, the Secretary of the Treasury decided to infuse the economy with $26 million in paper money and the market eventually re-opened.

There have been some superb books (and a movie or two) about these three September crashes:

America’s Panic soon spread to Europe, from whence much of the capital for these failed railroad bonds originated, causing the worst worldwide depression to that date, lasting for most of the rest of the 1870s.

Now you may understand why September has a worse historical record than even dreaded October! But the real lesson is not to get caught up in the reigning mania of the day, even if it seems like a sure thing.

Source valuewalk