Rowan Street 3Q21 Commentary: Sells Alibaba And Tencent

Rowan Street commentary for the third quarter ended September 2021.

Q3 2021 hedge fund letters, conferences and more

Dear Partners and Friends,

Rowan Street Performance Update

Rowan Street was down -13% in Q3, causing our fund to decline -9.2% (net) year-to-date as of September 30. This decline is normal and is to be expected, especially after a solid performance year we had in 2020, where our fund outperformed the market by 30% net of fees.

We would like to remind all our partners, especially the ones who have recently joined our partnership, that the sole focus of the fund is to compound our partners’ capital at double-digit rates of return over a long-term holding period. Since December 2017 (start of our fully invested period), the fund has delivered 68.8% return (net of fees) or 15% per annum. Although 3 ¾ years is still a relatively short period of time to judge whether we are successful in achieving our long-term double digit return goal (anything longer than 5 years would be a more desirable barometer), thus far we have been on target. Looking at a longer time period of 6 ½ years since we founded Rowan Street, which includes the initial period of 2 ¾ years when we held 75% of our portfolio in cash while we carefully developed and tested our investment strategy and internal processes and invested only our personal capital as well as friends and family, we have delivered 93.4% cumulative net return or 11% per annum. When we report our 7, 8, 9 & 10 year performance numbers, the benchmark of our success will always be — are we compounding our investors’ capital at double-digit returns over the long run? If the answer is yes, then we are doing our job and that is the only thing that truly matters.

In contrast to the majority of Wall Street funds out there, our focus will NEVER be on beating or keeping up with the market in any given quarter or a year, or on minimizing short-term volatility in the fund. We believe volatility is not the real risk. Volatility is part of the course of investing. In fact, there is NO wealth creation without volatility! It is simply the “price of admission” that the market demands us to pay, yet there is so much effort on Wall Street that is dedicated towards minimizing volatility.

These efforts are catered towards nurturing clients’ emotional well-being while creating an illusion of safety, but almost always come at a huge cost of reducing clients’ long-term returns.

We are very fortunate to have limited partners in the fund that allow us to focus on the long-term compounding of their family’s capital instead of being distracted from our main goal in order to nurture their emotional well-being. This is a huge advantage for us!

At Rowan Street, the #1 fundamental principle of everything we do is we have a mindset of a business owner — this is how we approach all our investments. When you start looking at the world through the lens of a business owner, you start paying less and less attention to the stock tickers that bounce up and down every day and realize that most of the time these daily stock price gyrations have very little to do with the long term intrinsic value of the business. Over the long run, however, stock prices accurately reflect the fundamentals of businesses. For example, when you purchase a house or a commercial property or buy into a small business, you do not get a quote on it every single moment or every single day. You are in it for the long run, and you make your investment decision based on the earnings that your property or business can generate over the next 5-10 years in relation to the capital that you have to put up up-front.

This is exactly how we structure the portfolio of our fund and how we judge the performance of our businesses, in which we are minority owners.

Spotify

Let’s look at one of our investments, Spotify Technology SA (NYSE:SPOT), as an example. We encourage you to review our investment thesis on Spotify that we published in our Q2 2020 Letter and in H1 2021 Letter. The company went public in April of 2018 and since the stock has delivered the following calendar year returns:

2018: -24% (since IPO date)

2019: +32%

2020: +110%

2021: -26% (as of this writing)

As you can see, performance of an individual stock can be very lumpy from year to year. Spotify was the biggest contributor to our funds’ performance in 2020 and it's the second biggest detractor thus far in 2021. Do these short-term stock price gyrations matter to us? Absolutely not! Focusing on this and judging our investment based on how it performs in any given year would be akin to attempting to win a football game while keeping our eyes on the scoreboard. This is why at Rowan Street, our eyes will always be focused on the “playing field”. If we continue to do that, the score will take care of itself over time!

What does it look like on the “playing field” for Spotify?

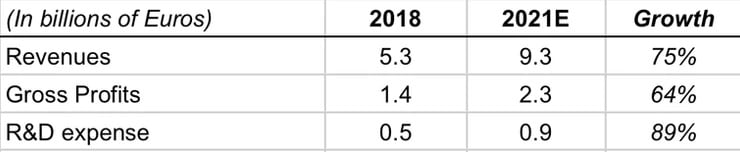

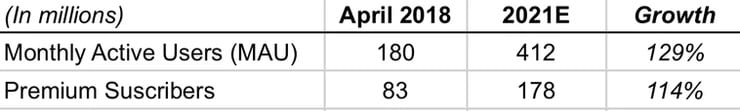

As you can see from the tables below, Spotify’s intrinsic value has increased quite a bit since its IPO date. Revenues have increased by 75% (or ~20% p.a.), gross profits have increased 64% (~18% p.a.). We believe that management has done a terrific job thus far in reinvesting these gross profits into building the world’s leading audio platform and constantly innovating ( and out-innovating its competitors) to deliver for both artists and fans. The result of their investments could be seen in the growth of Monthly Active Users (MAU) as well as their Premium Subscribers. The former has grown at 2.3x and the latter at 2.1x over the past 3 years, and we estimate that it’s feasible for Spotify to grow to ~1 billion users over the next 5 years. If the management continues executing the way they have been in the past, we have a pretty good chance of attaining our double-digit return from owning Spotify’s stock over the next 5 years.

Exit From Our Chinese Positions

As you know, we have owned stock in Alibaba Group Holding Ltd (NYSE:BABA) and Tencent Holdings ADR (OTCMKTS:TCEHY) since 2018. We know both companies very well and have spent countless hours studying their operations over the past 3 years. We have published our detailed write-up on Alibaba in our Q3 letter last year. At one point, in the first half of 2020, we were sitting on substantial gains in both positions (2x on Tencent), and our China exposure had grown to around 25% at the time. We started actively trimming these in Q1 and completely exited both positions in Q2 (please see our rationale below). All-in-all, we ended up netting a small gain in dollar terms. However, both Alibaba and Tencent detracted ~5% from our performance in 2021.

We believe the number one mistake that we as investors can make is to be unwilling to admit that we are wrong. Sometimes being willing to change our mind in the face of new evidence, selling when necessary, is one of the most important skills that we as investors can have.

So what new evidence changed our mind?

As you know, capital allocation and reinvestment of capital is one of the most important foundational pillars that we spend a lot of time on and watch very closely. Recent Chinese government crackdown and CCP’s ”common prosperity“ policies, which you are all well aware of as they have been widely covered this year, have a direct impact on the future capital allocation policies of both Alibaba and Tencent. When management of the companies that we are owners of do NOT have full control of the capital allocation, that goes against all our foundational principles as investors and stewards of your capital. At that point, we place a lot less importance on the size of revenues and cash flows that the company generates and how attractive their valuations may be (it's very apparent to just about everyone how statistically cheap the stock of Alibaba and Tencent currently are). The only logical decision here, once one of our foundational principles is violated, is to sell and to reinvest the proceeds into our high conviction ideas that fit our investment criteria and that have a high probability of compounding our fund’s capital at double-digits (p.a.) in the next 5-10 years, which is exactly what we have done over the past several months.

General Thoughts on China

Fred Liu, a fellow fund manager, recently gave a very good overview of China's latest crack-down and provided a basic framework through which to analyze the latest developments:

“The difference in Chinese policies vs. many western governments, is that China prioritizes the labor and tech components of the equation more so than capital… While labor is made up of the domestic population itself and technology is used to amplify this output, capital is face-less (or at least belonging most to those who have benefited from the country’s rise and accumulated the capital in the process, and thus have a “national duty” to help & repay their fellow citizens / country who helped them achieve success).”

“Capital is meant as a tool to enhance & accelerate society’s goals, not as an end-goal itself. Versus many Western markets, where it seems that the betterment of shareholders (and putting more money into their pockets) is often then the end goal itself. If the well-being of capital must be sacrificed to ensure a better long-term direction of society then in the Chinese government’s eyes, it's a worthy trade-off.”

“In this case, the Capital wasn’t being productive anyways, so there’s no loss if the government impairs it (and sends a message to discourage future investment in these fields). Capital (and investors) will be rewarded when capital is needed to fuel to achieve the broader goals of societal and economic advancement in a harmonious and equitable manner. But when capital investment in certain sectors is at odds with these goals, don’t be surprised when it's impaired.”

Fred makes some very good points and we would completely agree with this view. However, the entire ideology of a command economy with its 5-year plans is at odds with our own ideology in the Western world where free markets (or Adam Smith’s invisible hand) determines whether Capital is productive or not and how it should be allocated.

In his very famous book The Wealth of Nations, Adam Smith wrote:

“But the annual revenue of every society is always precisely equal to the exchangeable value of the whole annual produce of its industry, or rather is precisely the same thing with that exchangeable value. As every individual, therefore, endeavors as much as he can both to employ his capital in the support of domestic industry, and so to direct that industry that its produce may be of the greatest value, every individual necessarily labours to render the annual revenue of the society as great as he can. He generally, indeed, neither intends to promote the public interest, nor knows how much he is promoting it. By preferring the support of domestic to that of foreign industry, he intends only his own security; and by directing that industry in such a manner as its produce may be of the greatest value, he intends only his own gain, and he is in this, as in many other cases, led by an invisible hand to promote an end which was no part of his intention. Nor is it always the worse for the society that it was not part of it.

By pursuing his own interest he frequently promotes that of the society more effectively than when he really intends to promote it. I have never known much good done by those who were affected to trade for the public good. It is an affectation, indeed, not very common among merchants, and very few words need be employed in dissuading them from it.”

Using the invisible hand metaphor, Smith was trying to present how an individual exchanging money in his own self-interest unintentionally impacts the economy as a whole. In other words, there is something that binds self-interest, along with public interest, so that individuals who pursue their own interests will inevitably benefit society as a whole. This very ideology is the foundation of our capitalistic system that has worked so incredibly well for America over the past 245 years.

Fishing In Our Own Pond

The real question to ask ourselves as investors: Is this our game to play?

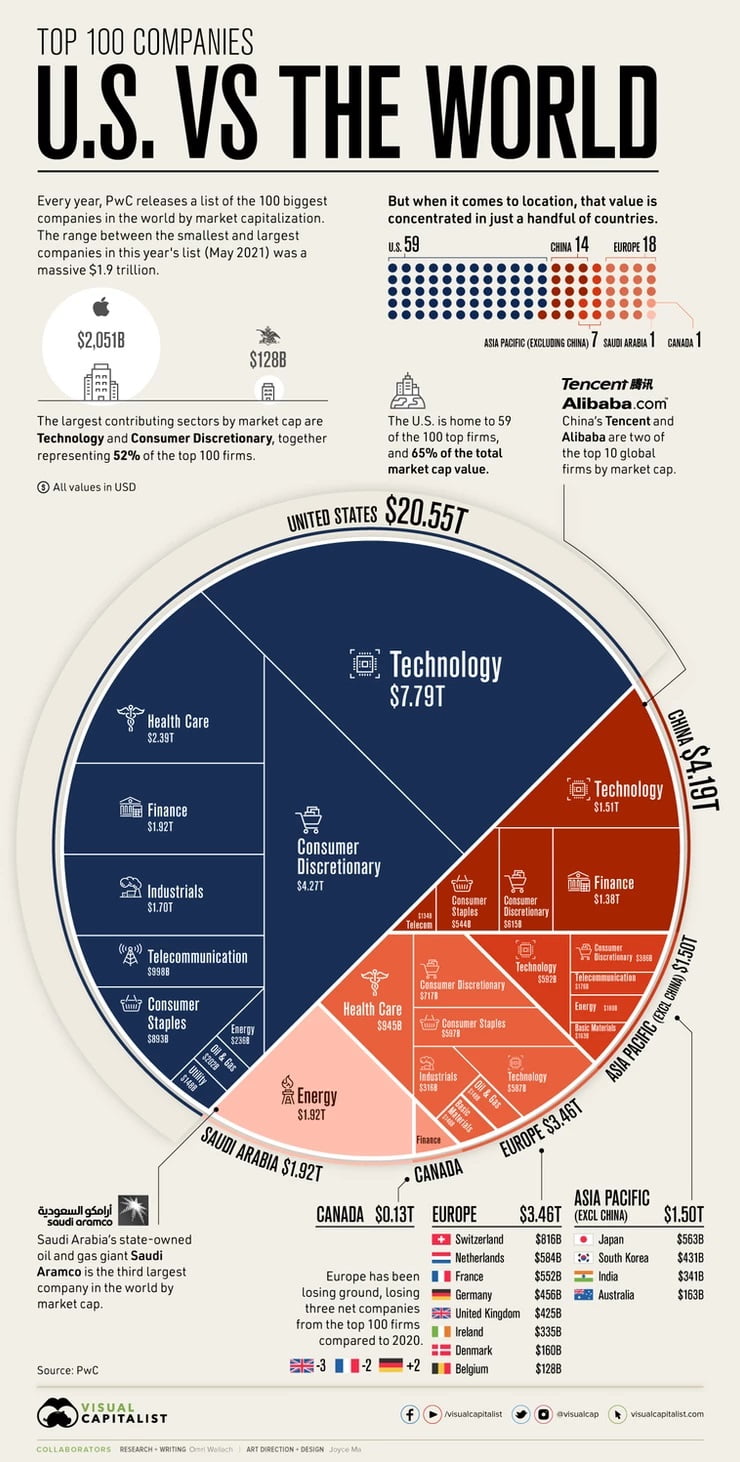

We would not invest in an individual company whose set of values, principles and ideologies is at odds with our own. The company‘s future prospects may prove to be very bright (as Alibaba’s and Tencent’s are very likely to be), but it would be extremely difficult-to-impossible for us to maintain a strong conviction in companies (and sleep well at night) that operate on a soil of a system, which at the very core, is contradictory to our own values. Simply put, we came to the conclusion that this is NOT our game to play! Continuing to invest in Chinese companies that are “outside of our circle of competence” makes little sense for Rowan Street considering we have an amazing “pond to fish” here in the United States. Some of the best innovators, entrepreneurs and some of the best companies in the world are still being founded and built here. When it comes to breaking down the top 100 companies of the world, according to this interesting chart below by Visual Capitalist, the United States still commands the largest slice of the pie.

And even though China has the second largest and rapidly growing slice of the pie, at the risk of sounding redundant, we have concluded that we have ZERO edge in that part of the world no matter how attractive their future may appear with their high GDP growth, huge size of the population, rise of the middle class and incredible pace of innovation (arguably even higher than in the USA). We believe that domestically we have much better odds of winning, and that’s where we will focus on from now on.

We want to thank you for your partnership. Joe and I have our entire net worths invested alongside you — we strongly believe in eating our own cooking. We look forward to reporting to you again at the end of 2021.

Best regards,

Alex and Joe

Updated on

Source valuewalk