Private Pension Plans In Latin America And Sustainable Finance

The private pension plan (PPP) market in Latin America is the region’s largest institutional client segment, with more than USD 900 billion in assets under management (AUM) at the end of 2020. And with projections forecasting AUM to reach USD 1.4 trillion by 2023, the PPPs are a reference point for smaller investors. Along with sovereign wealth funds (SWF), Latin America’s PPPs control a significant share of assets relative to GDP and thus can be very influential in the transition to sustainable investments, in turn helping meet the environmental urgencies and social demands confronting these societies.[1]

Q2 2021 hedge fund letters, conferences and more

Evidence supporting the business case of ESG strategies continues to grow. A recent study by the Inter-American Development Bank’s (IDB) clearly demonstrated that sustainable investing does not come at a discount and can outperform traditional investments.[2] Additionally, they further diversify existing asset allocations.

Given the initiatives led by the UN, NGOs, and regional development banks attempting to steer capital toward long-term sustainable outcomes, the time for asset managers’ participation is at hand, and as such they should continue working towards the harmonization of standards and further support these PPPs by tailoring strategies to create circular economies, providing value added services and developing strong knowledge transfer programs.[3]

The Private Pension Plan System In Latin America And Its Problems

There are considerable differences across Latin America’s pension systems. The regulatory environment varies from country to country, and in some cases different private and public schemes co-exist together. All systems within the region include a combination of investments in local and foreign securities, including alternative investments. For instance, government bonds make up 80 percent of El Salvador’s private pension assets, contrasting to only 17 percent of Peru’s. Foreign investment makes up half of Peru’s pension plans while it is less than ten percent of El Salvador’s portfolio.

While Chile, Peru and Colombia focus primarily on achieving their asset allocation through mutual funds, Mexico and Brazil, which possess the largest capital pools, have veered towards separately managed accounts, requiring a different set of resources and operational controls.[4]

Workers in the formal economy enrolled in these private schemes pay into a “contributory” pension system, while some countries have established a system financed by general tax revenues. As the primary pension scheme, contributory pensions are further divided between pay-as-you-go defined-benefit (PAYG-DB) and fully-funded defined contribution (FF-DC). Chile pioneered the private FF-DC system in 1981, and it remains the largest within the Andean region, which the Peruvians and Colombians have since mirrored. Mexico and Brazil, which follow a different model, have been slower to diversify internationally. The regulatory oversight of the Private Pension Plan system encourages a herd mentality in their investments and leaves little room for differentiation.[5]

| PAYG-DB | Competing Mix of PAYG-DB and FF-DC plans | Complementary Mix of PAYG-DB and FF-DC plans | FF-DC |

| Argentina | Mexico | Uruguay | Chile |

| Brazil | Colombia | Costa Rica | El Salvador |

| Venezuela | Peru | Panama | Bolivia |

| Dominican Republic |

Source: Adapted from de la Torre and Rudolph, 2018

The performance and perception of the private pensions have been mixed at best. These institutions face many challenges and social unrest in their respective countries due to the perception that the pensions’ asset managers’ interests are not aligned with those of the underlying pensioners.[6] This opinion has only hardened during the pandemic, which has led governments to allow significant withdrawals for pensioners to meet their current liquidity needs, adding further pressure to a fragile system.[7]

A Needed Mentality Shift - Embracing Sustainable Investing

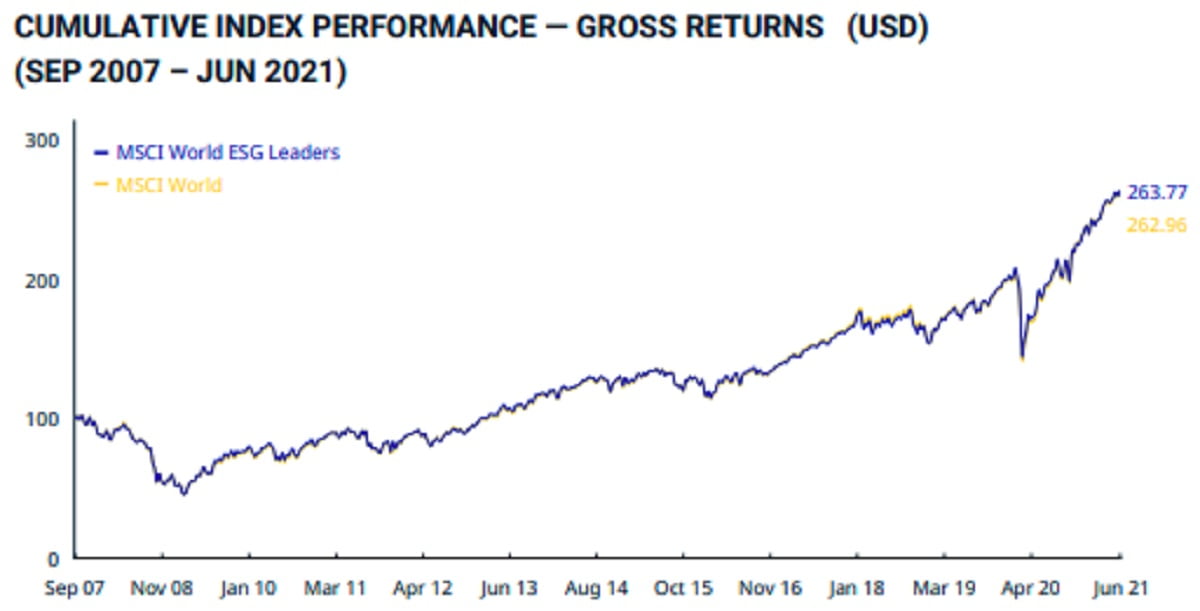

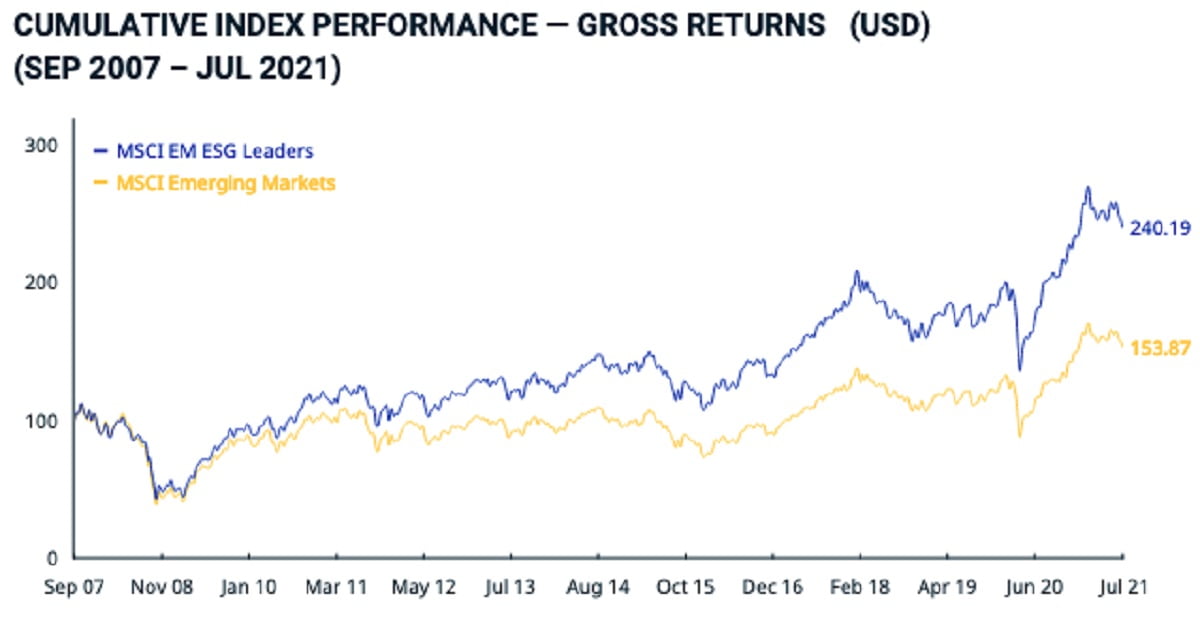

Sustainable investing requires new approaches and ways of thinking. Until recently there was a strong belief that ESG investing was a “do good/philanthropic investing” approach that compromised returns. Yet, the increasing evidence demonstrates ESG investing does not jeopardize returns. As the charts of the MSCI indexes illustrate, ESG performance in world equities and emerging equities either maps to their non-ESG counterparts or outperforms them, as detailed in the IDB’s recent paper “The Business Case for ESG Investing for Pension and Sovereign Wealth Funds.”[8]

ESG investing also contributes through indirect risk management and asset preservation. PPPs should look at it through the lenses of long term returns for the society they were created to serve. In addition, underlying pensioners / investors also need to make the mentality shift too and be more conscious of the non-pecuniary benefits that these investments bring, helping influence the PPPs’ investment decisions. This can be further eased through pension reforms that rewards sustainable investments as part of their required asset allocation to further incentivise such investments.[9]

Source: MSCI.com

Many countries in Latin America, in collaboration with IDB Invest, have been pioneers and quite active in the sustainability space, through issuance of green bonds, impact investing and other tailored investment deals.[10] This past May, rules came into force in Chile requiring AFPs (the private pension funds asset managers) to report how they assess climate and ESG criteria into their investment processes.[11]

It is now time for asset managers to join the movement. Some PPPs recently have become signatories of the UN’s Principles of Responsible Investing (UNPRI), and these pension plans are now participating in this transformation by incorporating sustainable investments into their asset allocation mix, primarily through thematic investments. Signatories work to implement the six aspirational goals related to ESG investing, measuring, and reporting.[12]

Work remains to be done as just 21 AFPs out of 51 (excluding Brazil) have signed the UNPRI through December 2020.

ESG screening leads to greater transparency and better risk management, better use of resources and cost savings, thereby managing volatility. ESG can avoid large financial and reputational costs which is critical for AFPs and SWFs. Yet the growth in ESG investing will depend on how transparency issues and standardization of ESG metrics are tackled. PPP will need to be a part of these discussions.

Asset Managers Can Help the PPPs, And Themselves

Latin America’s rich biodiversity distinguishes the region from others and within the region alone there are significant social differences and priorities[13]. Asset managers need to work with plan members to understand their needs, providing them optimal investment solutions that can contribute to their return targets and channelling significant capital to relevant sustainability issues thereby easing social unrest. This guidance would also incentivize compliance with the UNPRI principles for those AFPs which are signatories and encourage the others to join them.[14]

Source: MSCI.com

Asset managers must help in this transition through harmonization of metrics and continued evidence of outperformance. Working with regulators, knowledge transfer programs, and other value-added services will also play a strong role in empowering these institutions to further mobilize capital towards sustainable causes and by educating asset owners. Pension plans in Latin America have been facing significant social pressures, which coupled with the pandemic ramifications has only increased the stakes. Managers that have the ability to tailor and invest in local causes, thus having skin in the game, will be able to differentiate themselves and achieve greater market share.

Designing investment solutions to enhance and complement their existing portfolios, while addressing social issues that are currently affecting the pensioners that they were designed to serve, would result in a sustainable, circular economic model creating value and renewing trust from their pensioners. Sustainable investments that produce positive environmental and social outcomes should be the guiding strategy.

One thing is for certain, for this to succeed collaboration among regulators, financial institutions, asset managers, and the public and private sectors is needed. Finally, it is important to keep in mind that at the end of the day, we all need to do our part in channelling capital to such investments and understand that our savings and pensions will be worthless in a world that is no longer viable.

About the Authors

Fatima Meneses has worked in the asset management industry for 25+ years covering Institutional Clients, such as Private Pension Plans and Sovereign Institutions, across Latin America and the Caribbean for UBS Asset Management. Most recently, she covered Institutional Clients in Northern Europe and Switzerland for Santander Asset Management. Steven Hyland Jr., Ph.D. teaches in the Department of History and Political Science at Wingate University. Please connect with Fátima and Steven on LinkedIn.

Footnotes

[1] Rod James, “What Latin American pension funds are looking for,” Private Equity International, 11 December 2019. https://www.privateequityinternational.com/what-latin-american-pension-funds-are-looking-for/; “Estadísticas,” Federación Internacional de Adminstradoras de Fondos de Pensiones. https://www.fiapinternacional.org/estadisticas/ [Accessed 1 July 2020]; Gema Sacristán, “How the Way Was Paved for Sustainable Investment in Latin America and the Caribbean,” IBD Invest, 15 January 2021, https://idbinvest.org/en/blog/financial-institutions/how-way-was-paved-sustainable-investment-latin-america-and-caribbean

[2] Bridget Hoffman, Tristany Armangue I Jubert, and Eric Parrado, “The Business Case for ESG Investing for Pension and Sovereign Wealth Funds,” Policy Brief No. IDB-PB-338, Inter-American Development Bank, June 2020.

[3] Christine Idzelis, “Investors may be willing to sacrifice returns for ESG – but here’s where they haven’t had to, says Deutsche Bank,” Market Watch, 29 May 2021, https://www.marketwatch.com/story/investors-may-be-willing-to-sacrifice-returns-for-esg-but-heres-where-they-havent-had-to-says-deutsche-bank-11622150288; Will Feuer, “Here’s More Evidence That ESG Funds Outperformed During the Pandemic,” Institutional Investor, 7 April 2021, https://www.institutionalinvestor.com/article/b1r9gb5p9k10b4/Here-s-More-Evidence-That-ESG-Funds-Outperformed-During-the-Pandemic. For a counterargument, see Steve Johnson, “ESG outperformance narrative ‘is flawed’, new research shows,” Financial Times, 3 May 2021, https://www.ft.com/content/be140b1b-2249-4dd9-859c-3f8f12ce6036. For actions helping develop sustainable investment, see Gema Sacristán, “How the Way Was Paved for Sustainable Investment in Latin America and the Caribbean,” Financial Institutions, 15 January 2021, https://idbinvest.org/en/blog/financial-institutions/how-way-was-paved-sustainable-investment-latin-america-and-caribbean

[4] For a comprehensive breakdown of the systems, see Augusto de la Torre and Heinz P. Rudolph, “The troubled state of pension systems in Latin America,” Global Economy and Development Working Paper 112, March 2018. https://www.brookings.edu/research/the-problems-with-latin-americas-pension-systems/

[5] Ibid.

[6] Mac Margolis, “The Pensions That Ate Latin America,” Bloomberg, 10 January 2018. https://www.bloomberg.com/opinion/articles/2018-01-10/the-pensions-that-ate-latin-america; “Chile pensions protest draws tens of thousands,” BBC, 26 March 2017. https://www.bbc.com/news/world-latin-america-39401766.

[7] Oscar Medina, “Latin America Eyes Pension Billions as Welfare Alternative,” Bloomberg Quint, 30 June 2020, https://www.bloombergquint.com/onweb/latin-america-eyes-pension-billions-as-an-alternative-to-welfare; Emilie Sweigart, “How Latin Americans Are Using Pensions as a Covid-19 Lifeline,” Americas Quarterly, 29 July 2020, https://americasquarterly.org/article/how-latin-americans-are-using-pensions-as-a-covid-19-lifeline/

[8] Hoffman, et. al, “The Business Case for ESG Investing for Pension and Sovereign Wealth Funds,” p. 12.

[9] On the hesitancy of adopting ESG in Latin America, see Alexander Malaket, Michael Matera, and Silvina Vatnick, “Why ESG for Latin America?”, The Global Americans, 28 June 2021, https://theglobalamericans.org/2021/06/why-esg-for-latin-america/. See also Witold Henisz, Tim Koller, and Robin Nuttall, “Five ways ESG creates value,” McKinsey Quarterly, November 2019, https://www.mckinsey.com/~/media/McKinsey/Business%20Functions/Strategy%20and%20Corporate%20Finance/Our%20Insights/Five%20ways%20that%20ESG%20creates%20value/Five-ways-that-ESG-creates-value.ashx. See also de la Torre and Rudolph, “The troubled state of pension systems.”

[10] Sacristán, “How the Way Was Paved”; “ESG Investing in Latin America: The Story So Far,” Dechert, LLP. 24 June 2021, https://www.dechert.com/knowledge/onpoint/2021/6/esg-investing-in-latin-america--the-story-so-far.html.

[11] “Chile pensions watchdog unveils ESG, climate risk reporting rules,” BN Americas, 26 November 2020, https://www.bnamericas.com/en/news/chile-pensions-watchdog-unveils-esg-climate-risk-reporting-rules

[12] Philippa List and Mikhaelle Schiappacasse, “Overview of United Nations: Principles for responsible Investment,” Lexology, 6 April 2020, https://www.lexology.com/library/detail.aspx?g=6a05756a-1af6-4080-bca0-d1d6a433f288

[13] Carlos Alberto Vargas, Andrés Guerrero Alvarado, Angélica Rotondaro and Vicente José Servigón Caballero, “In Latin America, Impact Finance Demonstrates Remarkable Progress and Untapped Potential,” Stanford Social Innovation Review, 21 September 2020, https://ssir.org/articles/entry/in_latin_america_impact_finance_demonstrates_remarkable_progress_and_untapped_potential

[14] “Countries of Latin America and the Caribbean Commit to Implementing the 2030 Agenda for Sustainable Development and Building Forward Better,” Economic Commission for Latin America and the Caribbean, 18 March 2021. https://www.cepal.org/en/pressreleases/countries-latin-america-and-caribbean-commit-implementing-2030-agenda-sustainable; “La Superintendencia de Pensiones chilena publica una nueva norma que incorpora el riesgo climático y factores ESG,” Funds Society, 25 November 2020, https://www.fundssociety.com/es/noticias/normativa/la-superintendencia-de-pensiones-chilena-publica-una-nueva-norma-que-incorpora-el-riesgo-climatico-y-factores-esg; “Chile pensions watchdog unveils ESG, climate risk reporting rules,” BN Americas, 26 November 2020, https://www.bnamericas.com/en/news/chile-pensions-watchdog-unveils-esg-climate-risk-reporting-rules

Updated on

Source valuewalk