Nano Dimension Again Sweetens Offer for Stratasys But Prepares For Tender Process

SSYS stock is up in Tuesday’s premarket trading as investors react to boosted bid

3D printing company Stratasys (NASDAQ:SSYS) received a revised takeover proposal late Monday from Nano Dimension (NASDAQ:NNDM), at $20.05 per share. This is not the first offer that Nano Dimension has made for Stratasys, with the initial approach disclosed in early March 2023.

The new bid, called “our best and final all-cash offer” by Nano CEO Yoav Stern, represents a mere 2.55% increase in value compared to the previous offer made late last week that was at $19.55 per share.

Q1 2023 hedge fund letters, conferences and more

At last look, SSYS stock was up 2.81% to $16.84 per share, in pre-market trading early Tuesday.

Nano Dimension is a leading supplier of additively manufactured electronics and multi-dimensional polymer, metal & ceramic 3D printers. The latest offer represents a premium of 41% to the closing trading price as of March 3, and a 51% premium to the 90-day volume-weighted average price.

Poison Pill

The proposed combination of the two companies offers significant growth and value creation opportunities. However, Stratasys had previously taken a poison pill to protect itself from being acquired after Nano first disclosed its significant stake in the company in July 2022. A poison pill is a defensive strategy used by companies to prevent or discourage hostile takeovers.

In Monday's letter to Stratasys' board of directors, Nano Dimension said that the revised offer represents further value and the pursuer is willing to consider other options if rejected.

"We continue to believe in the quality of Stratasys management and we are prepared to move quickly to complete our due diligence so we can finalize a mutually agreeable transaction," Stern said in the company's press release. "However, in the absence of meaningful engagement from Stratasys' Board on this offer, we will consider a tender offer process to allow Stratasys shareholders to voice their opinion on the proposed transaction."

Other Targets

Nano Dimension also stated in its Monday evening announcement that it is currently engaged in dialogue with two other potential additive manufacturing acquisition targets, highlighting that it remains ideally positioned to act as a consolidator in the highly fragmented additive manufacturing landscape of small- and medium-sized businesses.

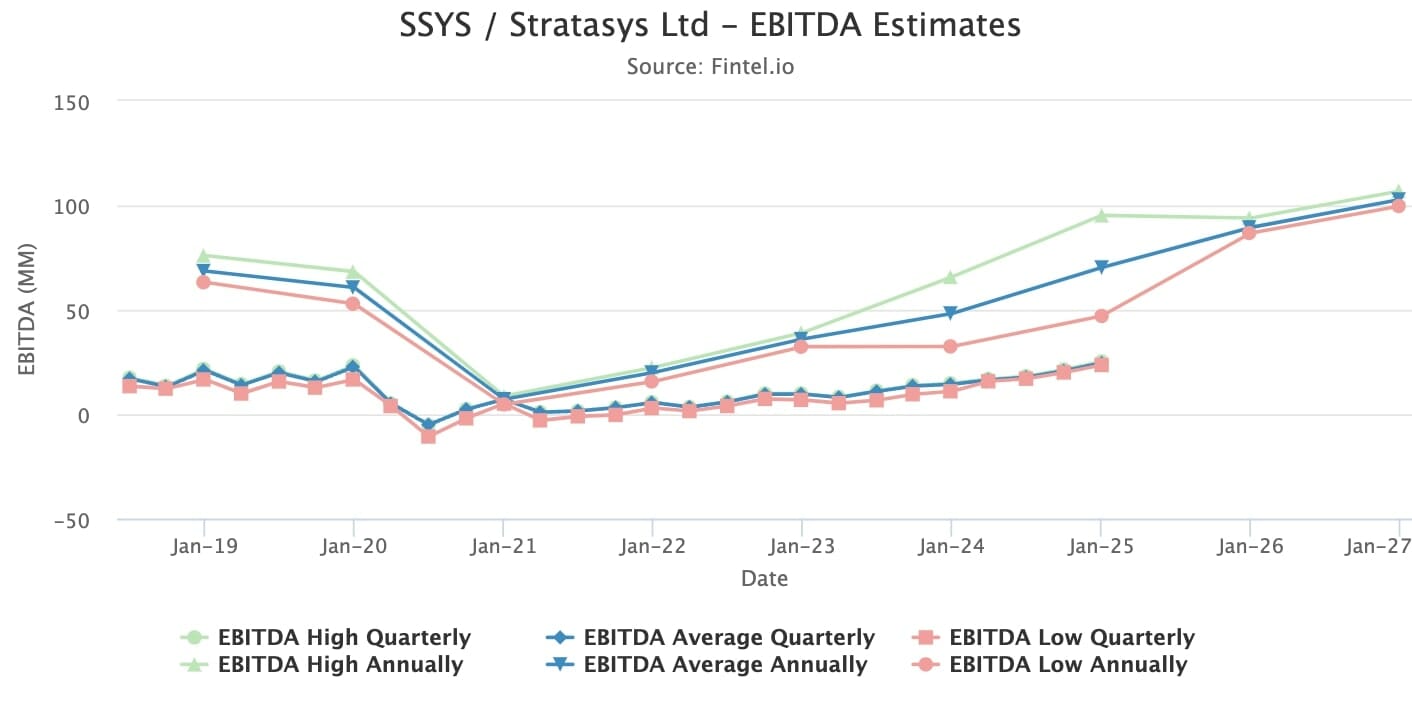

Stifel analyst Noelle Dilts agreed with Stratasys’ management that Nano’s prior offers were not compelling and believes the company should have solid growth and margins with a compressing multiple in the coming years. Stifel is of the view that the industry should perform well as the economy recovers and maintains a ‘buy’ call on the stock. The firm has a $18.50 price target for the stock.

Fintel’s consensus target price of $18.72 suggests analysts think the SSYS stock price could recover 14% over the next year.

Analysts are forecasting a continued rebound in underlying profitability by the group in the next five years surpassing pre-covid levels by 2025.

Although analysts seem generally bullish on the Stratasys medium-term story, institutions have been reducing exposure to the stock over the last few months.

Weak Sentiment

This is evident in a weak Fintel Fund Sentiment Score of 36.18 for SSYS which ranks the stock in the bottom 30% out of 37,625 globally screened securities for the greatest level of institutional buying activity.

There are 270 institutions on the SSYS register, however the average portfolio allocation to the stock has declined by -13% during the most recent quarter.

The post "Nano Dimension Again Sweetens Offer for Stratasys but Prepares for Tender Process" appeared first on Fintel.

Source valuewalk