Markets Play A Cat And Mouse Game

S&P 500 dicey premarket upswing fizzled out right after the open, volume picked up, and market breadth correspondigly deteriorated. Bonds confirmed, and the higher yields didn‘t even send the dollar much upwards.

Together with the sea of red in commodities and precious metals, this smacks of deleveraging, still of the relatively orderly flavor if you look at the well behaved VIX at 26 only. The steep post Jackson Hole downswing will pause, but there isn‘t a sign that would happen precisely today yet.

Q2 2022 hedge fund letters, conferences and more

Looking at the daily chart of CRB Index, crude oil, gold and silver with the miners, odds are that we would see a repeat of yesterday‘s action today as well – to a good degree.

Not much has really change since my yesterday‘s review of real assets and cryptos, and especially the crude oil setback (reinforced by the Iran deal speculation Europe is pinning its eyes on) is generally worrying.

The Fed keeps hammering the same message, and short end of the curve keeps duly rising. Tombstone reminder for those overstaying in the S&P 500 rally to the 200-day moving average, would be „don‘t fight the Fed – the central bank doesn‘t have your bank now, and would act on the out of control inflation“.

I hope you‘re enjoying the very lively Twitter feed, which comes on top of getting the key analytics right into your mailbox. Plenty gets addressed there, but the analyses over email are the bedrock. Still, the next days would feature generally shorter analyses per the legal update on my homepage.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

S&P 500 bears still have the undeniable strategic initiative, and the pace of the downswing is really all that‘s being questioned. Earnings are still to deteriorate, and P/E to go down – inflation isn‘t declining fast enough, so equities react appropriately. CFA material 101.

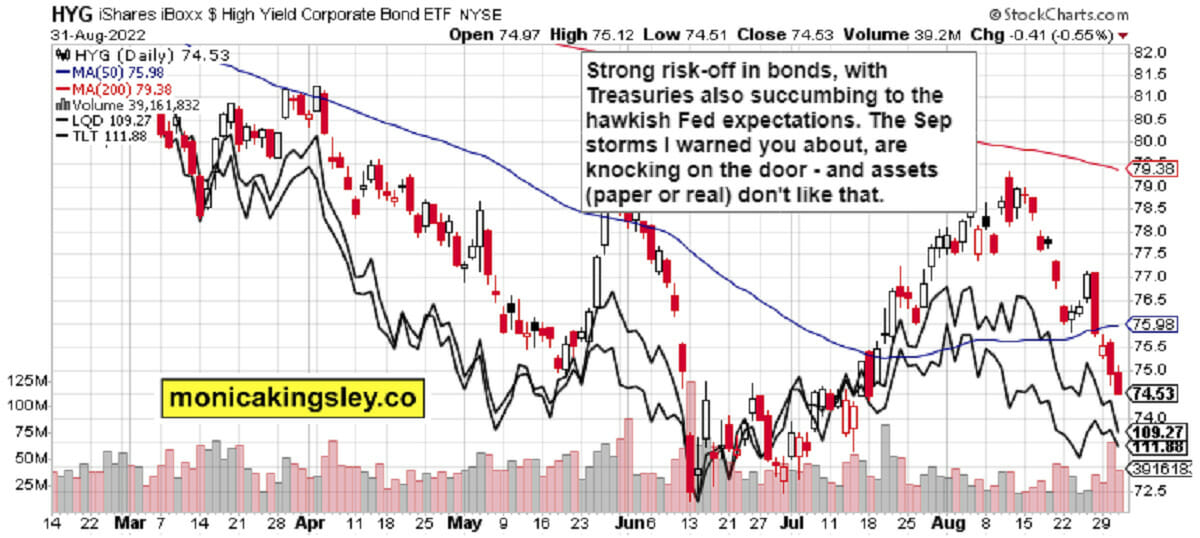

Credit Markets

HYG rested a little only on intraday basis, and objectively speaking it‘s downswing didn‘t trigger a genuine bloodbath in stocks. This can change but the steady dollar kind of doesn‘t hint at that right next.

The S&P 500 bears should take it easy, because the coming days would be and feel like a consolidation compared to what we have been just through.

Thank you for having read today‘s free analysis, which is a small part of the premium Monica's Trading Signals covering all the markets you're used to (stocks, bonds, gold, silver, oil, copper, cryptos), and of the premium Monica's Stock Signals presenting stocks and bonds only.

Both publications feature real-time trade calls and intraday updates. While at my homesite, you can subscribe to the free Monica‘s Insider Club for instant publishing notifications and other content useful for making your own trade moves on top of my extra Twitter feed tips.

Thanks for subscribing & all your support that makes this great ride possible!

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice.

Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind.

Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor.

By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss.

Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

Source valuewalk