Investor Confidence In The UK Takes A Knock

Investor confidence in the UK takes a knock despite ‘Freedom Day’ as infection rates soar.

[soros]

Q2 2021 hedge fund letters, conferences and more

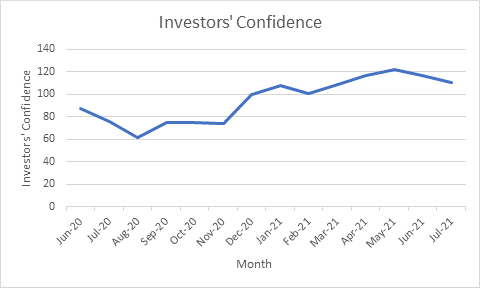

- Investor confidence in the UK falls by 5% in July.

- Investor confidence falls by 2% on average for global regions.

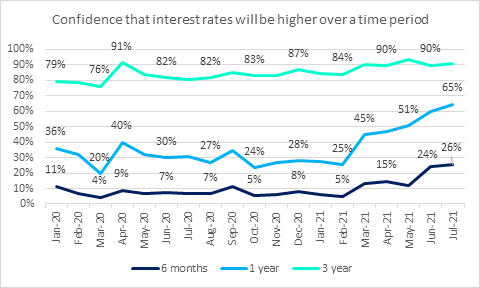

- 65% of investors believe interest rates will rise in a year’s time, compared to 60% in June.

- 26% of investors believe interest rates will rise in 6 months, compared to 24% in June.

Investor Confidence In The UK Falls Despite Freedom Day

“Far from bringing an added dose of confidence to investors, ‘Freedom Day’ appears to be a setback. Investors’ confidence in the UK has dropped by 5% in July, when compared to June, a steeper fall than the 2% registered on average for regions around the globe.

The sharply rising Covid infection rates across the UK, and concerns about fresh easing of restrictions, is likely to be behind the drop, which is identified in the HL monthly investor confidence survey*.

Worries are mounting about what the lifting of social distancing rules will mean for economic recovery, if the virus spreads more rapidly. Already many industries from hospitality to manufacturing are struggling to cope with high levels of absence as staff are pinged by the test and trace app, leading to the closure of some venues and a drop in output.

The confusion surrounding quarantine and testing rules for international travel is also leading to fresh uncertainty about the prospects for the aviation and tourism industries, which have been struggling through the worst crisis in their history. The lack of warning about the need for travellers from France to isolate for ten days from today, has thrown holiday plans into fresh mass chaos, with hopes of a boost to summer bookings evaporating.

Infection Rates Could Derail The Recovery

Amidst concerns that infection rates could derail the recovery are worries about inflation heating up and the knock on effect of rising interest rates. 65% of investors believe interest rates will be higher in a year’s time compared to 60% last month. That is the highest level since January 2019. More than a quarter (26%) now believe they could be higher in six months, compared to 24% in June 2021.

Economies have been re-opening with an energy that once seemed unlikely in the depths of the pandemic, which is pushing up inflation. In addition the recession left supply chains broken around the world, leading to some shortages. Companies have also slashed investment during the crisis, so the ability to increase production is limited, which has the effect of pushing up prices even further.

Central banks are largely still talking as a team, stressing that these effects are transitory, kicking the ball of monetary easing down the pitch. But it’s clear investors, watching from the side lines, are increasingly nervous that price rises are likely to linger for longer. More fear that a swifter rolling back of mass stimulus programmes and the spectre of rising interest rates could dampen economic growth and asset valuations.”

*The investor confidence index is compiled by surveying clients on a monthly basis. Each month we send the investors’ confidence survey to 6,000 random clients and there is a representative split of our clients by age. On average 10% of clients respond (around 600 clients).

Clients are asked to say how likely they are to invest in a certain sector over time frames of 6 months, 1 year and 3 years, by selecting Very Likely, Likely, Neither Nor, Unlikely or Very Unlikely.

HL Investor Confidence Survey

| Global Sectors | % Change July 2021 vs June 2021 |

| Asia Pacific | 2% |

| European | -1% |

| Global Emerging | -4% |

| Japanese | -1% |

| North American | -1% |

| UK | -5% |

| Average % Change | -2% |

Hl Investor Confidence Survey July 2021

HL Investor Confidence Survey July 2021

Do you think interest rates in the UK will be higher than they are today?

| 6 months | 1 year | 3 year | |

| Jan-19 | 25% | 66% | 92% |

| Feb-19 | 20% | 57% | 90% |

| Mar-19 | 18% | 48% | 88% |

| Apr-19 | 17% | 49% | 86% |

| May-19 | 21% | 59% | 92% |

| Jun-19 | 22% | 57% | 91% |

| Jul-19 | 16% | 46% | 85% |

| Aug-19 | 17% | 38% | 81% |

| Sep-19 | 15% | 40% | 81% |

| Oct-19 | 9% | 30% | 80% |

| Nov-19 | 10% | 35% | 78% |

| Dec-19 | 15% | 44% | 84% |

| Jan-20 | 11% | 36% | 79% |

| Feb-20 | 7% | 32% | 79% |

| Mar-20 | 4% | 20% | 76% |

| Apr-20 | 9% | 40% | 91% |

| May-20 | 7% | 32% | 84% |

| Jun-20 | 7% | 30% | 82% |

| Jul-20 | 7% | 31% | 81% |

| Aug-20 | 7% | 27% | 82% |

| Sep-20 | 11% | 35% | 85% |

| Oct-20 | 5% | 24% | 83% |

| Nov-20 | 6% | 27% | 83% |

| Dec-20 | 8% | 28% | 87% |

| Jan-21 | 6% | 27% | 84% |

| Feb-21 | 5% | 25% | 84% |

| Mar-21 | 13% | 45% | 90% |

| Apr-21 | 15% | 47% | 90% |

| May-21 | 12% | 51% | 94% |

| Jun-21 | 24% | 60% | 90% |

| Jul-21 | 26% | 65% | 91% |

Data from the HL Investor Confidence Survey

Article by Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown

About Hargreaves Lansdown

Over 1.6 million clients trust us with £132.9 billion (as at 30 April 2021), making us the UK’s largest digital wealth management service. More than 98% of client activity is done through our digital channels and over 600,000 access our mobile app each month.

The post Investor Confidence In The UK Takes A Knock appeared first on ValueWalk.

Source valuewalk