Here's the Best Industrial Stock to Buy for Passive Income

If you want a combination of a good dividend yield (in this case, 3.9%) from a leading industry player with great long-term growth prospects, look no further than (NYSE: UPS). Yes, the company faces near-term headwinds, but the market has arguably factored the slowing economy into the stock price. Meanwhile, management's restructuring of the business for growth continues apace, and UPS is highly likely to emerge as a much stronger company coming out of a trough year in 2023. Here's why UPS is an excellent stock for income-seeking investors.

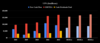

The following chart helps to explain the key points quantitatively, and then we'll dig into how UPS is improving its underlying growth prospects.

The chart below shows how well UPS's cash dividends have been covered by earnings before interest, taxes, depreciation, and amortization (EBITDA), and free cash flow (FCF). In addition, included are Wall Street analyst consensus estimates for 2023-2025 to indicate a couple of critical points.

Source Fool.com

United Parcel Service Inc. Stock

With 13 Buy predictions and only 1 Sell predictions the community sentiment for the stock is positive.

As a result the target price of 162 € shows a slightly positive potential of 17.49% compared to the current price of 137.88 € for United Parcel Service Inc..