GAAP Earnings Technical Signal

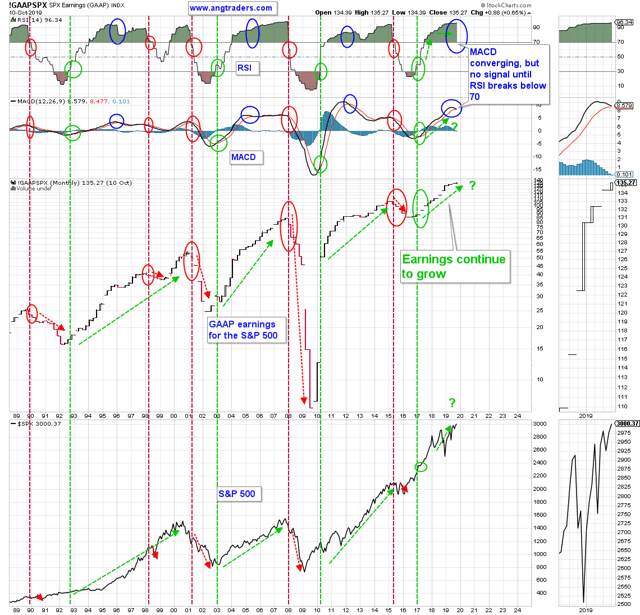

The technicals of the GAAP earnings numbers provide an early confirmation signal of major bear moves in the SPX.

Notice in the chart below, that the GAAP earnings MACD has recently been converging toward a bear cross-over, but by itself, that is not a sell-signal — in addition, the RSI has to drop below the 70 reading. The blue ovals on the chart below show other times in the past when the MACD crossed-over while the RSI remained above 70, and the SPX kept rallying. To get a macro-sell signal, we need to see both the MACD complete a cross-over, and the RSI drop below 70. Until then, we are in a bull market….and you shouldn’t sell the bull.

During the 2018 correction, our analysis showed that we were not at the start of a new bear market and that the bull market was not in the process of ending. As a result, our subscribers avoided the herd mentality of panicked-selling and the losses it created.

“ Happy ANG subscriber here. I believe them to be the best broad market analysts. “

“ … paid for the service on first trade.”

We continue to monitor the Treasury cash balance and investor sentiment as the key indicators of the future. Join us at www.angtraders.com and benefit from our 40-years of market experience.

Source Nicholas Gomez