Don’t Just Play the Market. Read it.

No one has access to the future. The ‘talking heads’ on business shows may try to make you believe they know the future; we know no one can know. Yet, as humans, we plan, make decisions, and take actions, the success of which will depend on the type of future that materializes. How do we do this if we have no clue of what is going to happen? How is it that we know to stay invested when so many are huddling in a defensive position?

The answer is, patterns.

When coaching basketball, we used to play a “freelance offense”. Many who have played the game would hear that term and think that it was a quick way out for the lazy coach. You just roll the ball out on the court and let the players go to it. But really there was a great deal of coaching involved in implementing the offense.

It was an offense that opposing teams had difficulty defending against. There didn’t seem to be a set pattern that the defense could breakdown and then counter. We had great success with the offense but to implement it, we had to break the offensive side of the game down into situations that occur all the time in a regular game of basketball. We had to teach the players to recognize certain situations that occur frequently in games. These patterns became cues for action on the part of our players.

Once our players, through repetition, became familiar with the patterns of the game, they then developed responses to those patterns. They began to read the game rather than just play it and as a result, we began to win more and more. More importantly, our players grew confident that they could adapt or react correctly to whatever a defense threw at them because they had seen the pattern before.

All market participants are playing the game, but few know how to read the game. The majority assume that it is news, both financial and Geo-political, which moves the market. On the face of it, the connection seems obvious; there is news every day, and the market moves every day. But if you make the effort to read the market, you find that there really is no consistent or repetitive correlation between news and market moves. In other words, there are no patterns in the relationship. The market reacts inconsistently to news, good or bad.

To win in the market, players must ‘recognize certain situations that occur frequently’. These recurring situations, these patterns, are the result of the only constant that exists in the market: human emotion. And specifically, the evolutionarily-adaptive emotion of fear. It, is what has consistently driven market moves throughout history. At ANG Traders, we seek out, read, and act on these patterns.

We’ve done the practice, let’s start reading a few of the patterns in the game.

Sentiment

The AAII weekly survey has produced a pattern where the SPX makes a top (either a minor of major top) when the bull-minus-bear sentiment differential is greater than +40%, about 60% of the time: between +15% and +40%, 25% of the time: and less than +15%, about 16% of the time. The differential is at +19% which implies only a 25% chance of a top forming (chart below).

The Rydex family of funds asset allocation data is, arguably, a more objective indicator of emotion than the AAII indicator because it is not based on a self-reporting survey. It is a direct accounting of where investors are putting their money.

The bear-to-bull asset allocation ratio of the Rydex family of funds, has a strong inverse correlation with the SPX; a declining 36-week MA in the Rydex ratio is bullish for the SPX. Down-spikes in the ratio, correspond with tops in the market. In the past, we have pointed out the similarity in trading patterns of the current bull market with those of the tech bull market of 2000. During the later-stages of the tech rally, the Rydex ratio (nominal) made a down-spike early in 2000, but the 36-week MA continued to move lower while the SPX moved higher for another six-months before hitting its high, and the Rydex ratio made its second (and final) down spike. It looks like this pattern is again forming.

The SPX continues to make new highs and the Rydex bear-to-bull ratio’s 36-month MA continues moving lower (chart below). This remains a bullish pattern.

The chart below consolidates several sentiment indicators; the Rydex bear:bull asset ratio, the Rydex bull assets (on its own), AAII bull sentiment , and AAII bear sentiment. All these indicators are displaying bullish patterns. The underlying emotional state of the market continues to exhibit a healthy level of fear.

Fundamental

Interest rates correlate strongly with bull markets. Contrary to popular belief, however, rising interest rates do not cause bear markets. Rates that have risen too high cause bear markets. And over the last 35-years, what the market considers as too high has been steadily decreasing (pink ovals below). If the rate increase continues to follow the current slope, then the maximum Fed funds rate is likely to max-out at the 2.5%-3.00% level.

The timing of this maxing-out, corresponds with 6–12-months after the inversion of the 10-year minus 2-year treasury yield differential (vertical red dashed-lines), which itself is expected in early 2019. This means that the bull market is unlikely to end until mid-2019 at the earliest.

The Generally Accepted Accounting Principles (GAAP) earnings, correlate very tightly with the S&P 500; bear markets don’t happen while earnings are rising. A bear market at this time is highly unlikely.

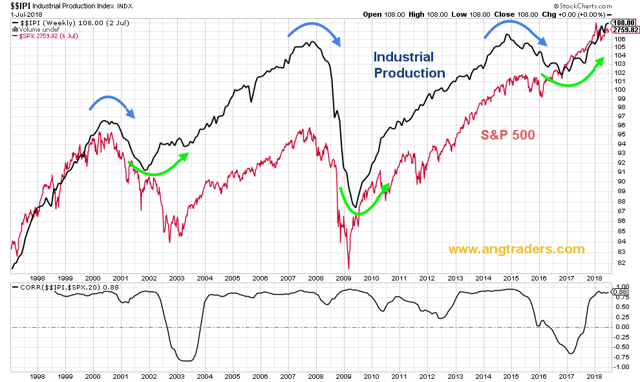

Industrial production correlates directly with the S&P 500. Industrial production continues to rise and the probability of a bear market starting, while it is rising, is vanishingly small.

In conclusion, we have presented just a few of the patterns that ‘occur frequently’ in the game and which call for offensive action to be taken for at least the next 6-months.

ANG Traders

Join us at www.angtraders.com and profit from our 40-years of experience.

Source: Nicholas Gomez