Dice Therapeutics Experiences Stellar 62% Gain On Phase 1 Trial Data And Launches $250 Million Offering

Discusses the Phase 1 result release, stock offering that was announced and some market commentary

Biopharma company Dice Therapeutics (NASDAQ:DICE) was once of the markets top gainers on Tuesday as the stock opened and jumped more than 86% higher to $45.99 after the company released initial Phase 1 trial results for its DC-806 lead oral IL-17 Antagonist for skin disease, Psoriasis.

Q3 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

The company is focused on treating chronic diseases in immunology and other therapeutic areas.

Dice Therapeutics Stock Jumps

After an initial jump, the stock pulled back a little over 10% and traded relatively flat, ending the day with a healthy 62% gain at a $40 closing price.

Psoriasis is considered to be a skin disease that causes a rash with itchy, scaly patches, most commonly on the knees, elbows, trunk and scalp and currently has no cure.

The top line results showed that the proof-of-concept in psoriasis achieved a mean percentage reduction of 43.7% from a baseline at four weeks. This compares to a 13.3% reduction in the placebo group for comparison.

Management noted that the DC-806 candidate was tolerated well with an ‘excellent’ safety profile across all of the dose groups (three cohorts).

The data will now support the further development of the candidate as the potential best-in-class oral agent for the disease.

Dice now expects to advance into a Phase 2b clinical trial in the first half of 2023.

After market close management seized the opportunity to capture the inflated share price with a proposed $250 million stock offering to increase the firm's cash reserves.

Institutions BofA, SVB Securities, Evercore ISI and Guggenheim will be leading the offering as joint book-runners.

It is a rarity that we see recent IPOs that occurred during the pandemic with positive gains for investors. DICE remains a key gainer from its original IPO price that was set at $17 per share back in September 2021.

The stock has been a strong performer against a backdrop of small-mid cap biotech companies that are trading at significant discounts to their 2021 share prices.

Analyst Thomas Smith from SVB Securities discussed that the results cleared the bar for ~40% PASI reduction with a competitive efficacy with a better safety profile. Smith believes the results as clinically de-risking with the potential for a best-in-class oral profile and hence increased his target price from $46 to $77. The firm remains ‘outperform’ rated on DICE.

DICE has a consensus ‘buy’ recommendation with an average target of $67. Price targets across the street have significantly risen on the back of the top line data.

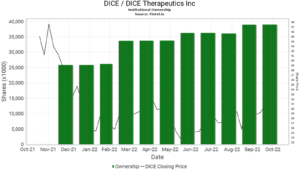

Fintel’s platform analysis of institutional interest in the stock is bullish with an ownership accumulation score of 82.60. The score places DICE in the top 5% of 31,298 companies screened across global markets.

DICE currently has 216 institutions on the register that own approximately 39 million shares. Some of these institutions include: Ra Capital Management, Northpond Ventures, Sands Capital Ventures, T Rowe Price, Driehaus Capital Management, and Eventide Asset Management.

The chart provided shows the growing level of institutional interest on the register over time against the share price.

Article by Ben Ward, Fintel

Source valuewalk