Crescat Capital April 2021 Letter: Miner Setback

Crescat Capital‘s letter to investors for the month ended April 2021,titled, “Miner Setback.”

Q1 2021 hedge fund letters, conferences and more

Dear Investors:

"Miner" Setback

It is time to evaluate your level of exposure to precious metals. We believe the macro cycle for gold and silver has turned. This could be the last chance to build a position at depressed prices. The economy is likely headed into an inflationary period and it is time to act.

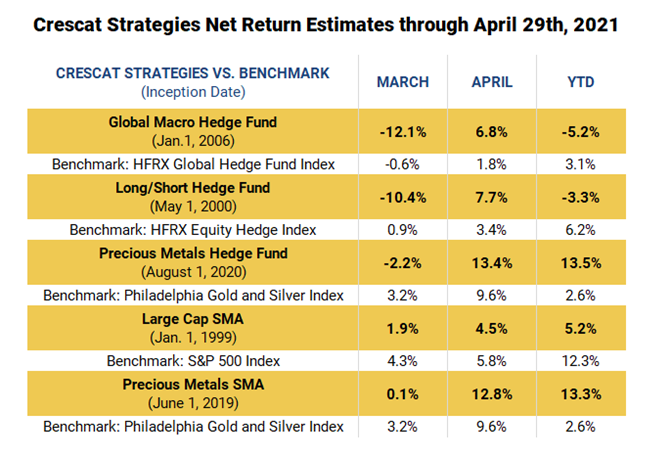

Crescat’s performance estimates for March, April month-to-date and year-to-date are as follows:

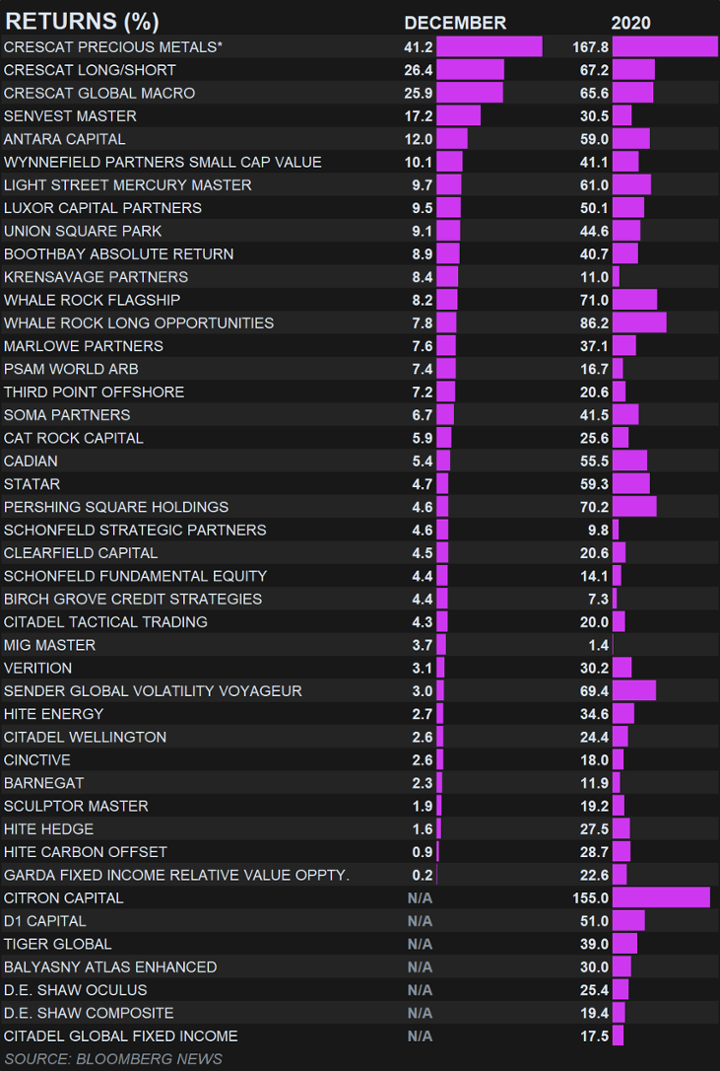

In other good news, Deloitte has completed our 2020 audit. Investor statements, the audit report, and K-1s will be available via the Alps investor services portal shortly. You will have access to these reports next week. Crescat had an outstanding year in 2020 across all funds.

April has been a strong month for Crescat, with MTD performance up across all five of our strategies. In March, the short positions worked against us in both Crescat’s global macro and long short funds. We strongly believe there is significant downside risk to equity markets as we further explain below. Hedge funds are being stopped out creating an uncrowded trade. The timing for adding short exposure now is probably as good as it has ever been.

The Valuation Of The S&P 500

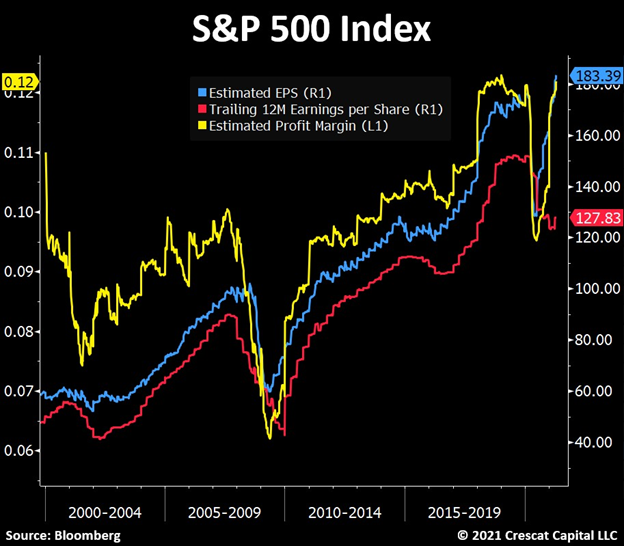

S&P 500 valuations are higher today than the peak of the tech bubble in 2000. Speculation is raging and risks are high due to ultra-easy financial conditions and record leverage. The stock market is priced for a future that is impossible to live up to.

Wall Street analysts predict profit margins will return to all-time pre-Covid highs but ignore rising inflation due to structural shortages and de-globalization across the entire supply chain. They also underestimate risks of ultimately rising labor costs and corporate taxes.

The stock market is still near record highs, but internals are deteriorating. The breadth of the NASDAQ Composite has diverged to the downside since February. The faltering leadership of the widely owned tech sector presents contagion risks.

The Dawn Of The Great Rotation

We believe it is the dawn of the Great Rotation where investors will be selling overvalued, long duration financial assets and buying undervalued hard assets, including scarce resource stocks with high near-term growth fundamentals. Rising inflation is the self-reinforcing catalyst.

With precious metals’ prices at their current levels, mining companies continue to improve their margins, tighten up their cost structure, and generate more money than any other time in history. The aggregate free-cash-flow for the top 50 gold and silver miners is now growing exponentially. The fundamental improvement in the overall industry is a central part of our thesis and the reason why each of our hedge funds have significant exposure in early-stage exploration companies. As the larger, and more established, companies deplete their reserves and continue to build a strong cash balance foundation, we think they will be compelled to acquire high-quality projects to replenish their production pipelines. This is especially the case today due to an overly conservative management that is unwilling to spend on exploration. In our view, it is a matter of time until major producers begin to look for highly economic deposits as an alternative to their supply cliff problem, setting off a unique opportunity for us.

At Crescat, our activist goal is six-fold:

- Identify potential large-scale gold and silver deposits.

- Acquire meaningful stake.

- Infuse capital.

- Bring in experts through our strategic relationship with Quinton Hennigh, PhD.

- Collaborate with existing management and board.

- Unlock value by sharing the story.

Our recently launched activist strategy had enormous success last year, but we remain focused on the prize. In our view, the real upward move in gold and silver prices is yet ahead of us. Given the current macro set up, we think precious metals are in the early innings of a secular bull market. Central Banks are trapped and have no choice but to continue to suppress interest rates to allow historically indebted governments to run massive fiscal deficits. More importantly, late-cycle investors also need subdued nominal rates to justify their holdings in risky assets at record fundamental multiples. The problem is these valuations also require low inflation to be sustained. This environment supercharges the case for tangible assets, particularly monetary metals. We believe the recent pull back in gold, silver, and miners since August just gave us the perfect opportunity and timing to continue to raise capital and build a portfolio of companies with exceptional properties in strategic geologic locations worldwide.

We believe the timing is setting up well for all Crescat’s strategies and that the pullback in precious metals since August is over as our April MTD indicates. Meanwhile, the set up for shorts in overvalued long duration equity shorts as part of the Great Rotation could hardly be better. If you are interested in adding money for a May 1st effective date, today is the last day to initiate your request. Please reach out to Marek Iwahashi at [email protected] or Cassie Fischer at [email protected].

For more specific ideas and opportunities, we encourage you to watch Crescat’s latest YouTube presentation. Therein, we provide a macro update and comprehensive overview of our activist precious metals’ strategy.

The interview below, with Tavi Costa and Palisades Gold Radio, provides Crescat’s more in-depth views about the current macro environment.

We will have a more comprehensive research letter coming out soon.

Sincerely,

Kevin C. Smith, CFA

Member & CIO

Tavi Costa

Partner & Portfolio Manager

For more information including how to invest, please contact:

Marek Iwahashi

Client Service Associate

Cassie Fischer

Client Service Associate

Linda Carleu Smith, CPA

Partner & COO

© 2021 Crescat Capital LLC

The post Crescat Capital April 2021 Letter: Miner Setback appeared first on ValueWalk.

Source valuewalk