"Consistency and patience are crucial. Most investors are their own worst enemies. Endurance enables compounding." --Seth A. Klarman

Down, Up, DOWN, UP

Down, Up, DOWN, UP (July 16, 2023): It isn't widely appreciated that bear markets feature not only substantial percentage losses but dramatic rebounds which exceed the percentage gains achieved during bull markets and also happen more quickly. Therefore, it is necessary to keep switching from being net long, to net short, to net long, over and over again, gradually buying into the most extended pullbacks and progressively selling into the most extended uptrends.

Down, Up, DOWN, UP.

We are likely to experience all of the following events, in order: 1) the biggest percentage pullback of the 2021-2025 bear market to date over the next several months, roughly 50% from top to bottom for QQQ; 2) a strong rebound for several months as about half of this loss is regained; 3) a much more severe and sustained decline for about one year ending sometime in 2025 at the lowest absolute valuations since 2013 even without adjusting for inflation; 4) an impressive multi-year value bull market similar to 2002-2008 or 1975-1980 which will favor commodities, emerging markets, smaller companies, and definitely not megacap tech shares.

We have experienced several multi-decade and all-time record extremes of net exchange-traded inflows, call volume, new participation, and many other signals of a multi-decade U.S. stock-market peak.

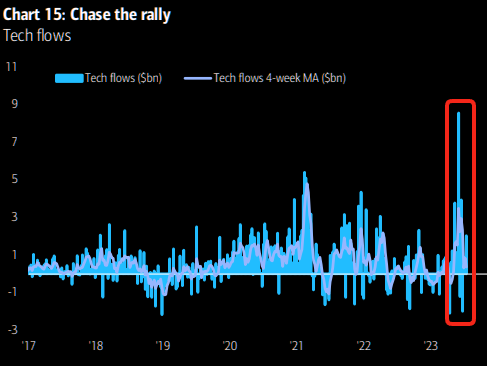

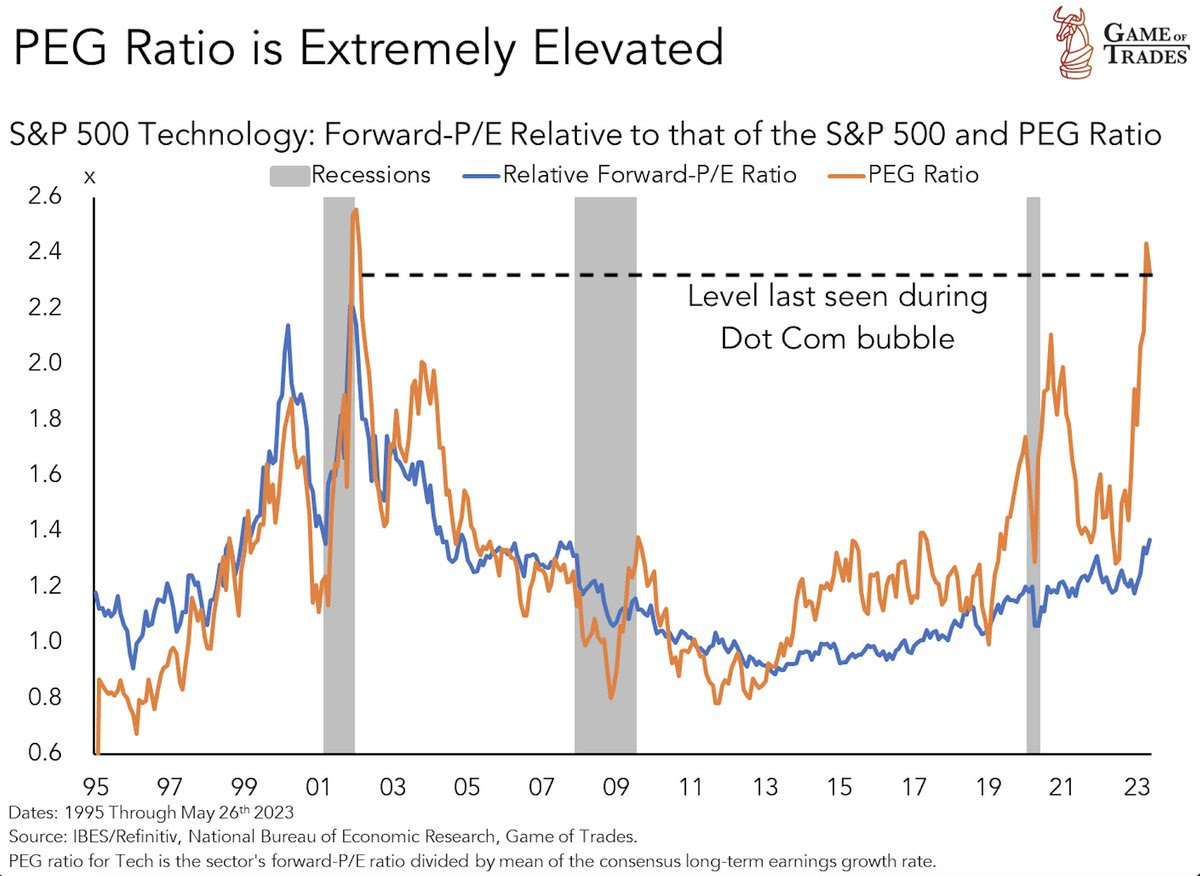

Recently we have achieved bubble extremes which have surpassed all previous records, including many which had been set less than two years ago in late 2021 and early 2022. While the S 500 Index, QQQ, the Russell 2000, and most other global equity indices haven't completely regained their all-time record overvaluations of November 2021 or January 2022, we have far exceeded the all-time record levels of net exchange-traded fund inflows, total call volume, number of first-time U.S. stock-market investors, and concentration into just seven shares (MSFT,AAPL,AMZN,NVDA,TSLA,GOOGL,META) which are responsible for the vast majority of the gains in market capitalization in 2023.

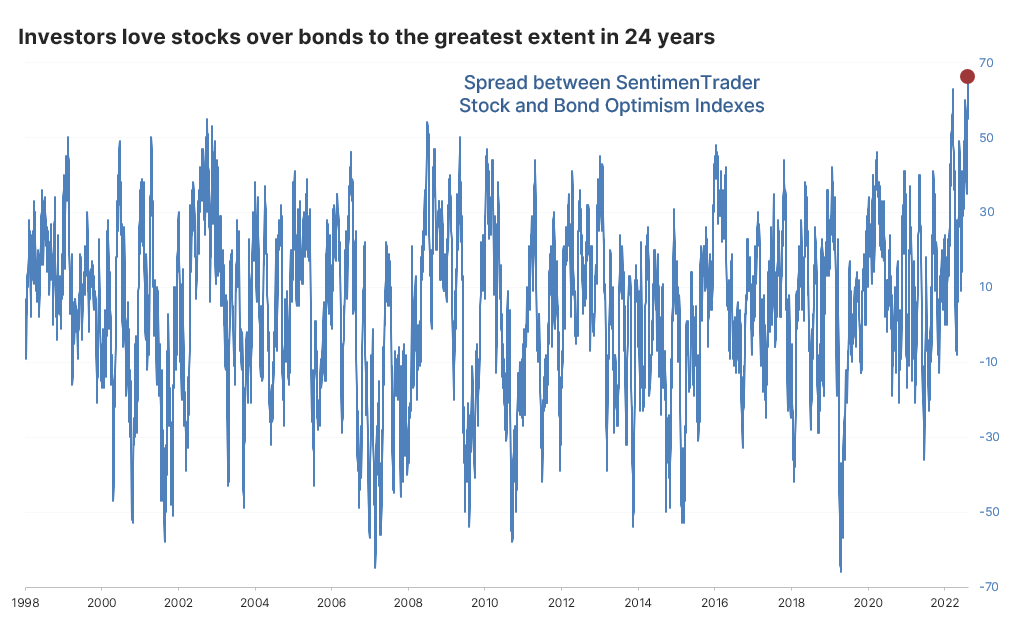

Investors had an excuse to make risky choices at the beginning of 2022 since safe U.S. Treasuries were yielding one quarter of one percent interest. 1-1/2 years later U.S. Treasury bills usually exceed 5.4% yields, so rationally risk should be less popular instead of at an all-time high of eagerness.

If the highest guaranteed return on your investment is 0.2% to 0.3%, as it had been at the start of 2022, then it is understandable why some investors would prefer to put their money into almost anything else. However, when you can get 5.4% or 5.5% with zero risk from U.S. Treasuries which mature in 8, 13, 17, 26, or 52 weeks, then why would anyone want to take a risk with other assets? You have to make 5.5% just to break even in relative terms, and that doesn't even count the fact that U.S. Treasury interest is free of state and local income taxes. Just as had been the case in 2000 and 2007, the last two times that U.S. Treasuries had sported similar yields, investors have become so eager to pile into stocks that they have stopped analyzing the fundamental trade-offs which are the core of how the financial markets work. The upcoming result will therefore be exactly the same as it had been after 2000 and 2007 with severe U.S. equity bear markets and dramatic declines for U.S. Treasury yields of all maturities.

Bear markets consistently experience the strongest rebounds.

At the beginning of 2022 I had recommended being heavily net short, but at the end of 2022 I had switched to being even more heavily net long. In 2023 I have progressively been closing out long positions, most recently selling gold mining and silver mining shares just in the past couple of days, while steadily adding to short positions in funds including QQQ and XLE whenever insiders were most aggressively selling and it was most timely to take action. I have therefore become heavily net short again, and will become even more net short if I continue to sell gold/silver mining shares in upcoming days as seems likely now that the U.S. dollar index has fallen below 100. Investors have recently become very bearish toward the U.S. dollar and also U.S. Treasuries just when they should be most aggressively accumulating them into weakness, thereby causing TLT to drop to 98.40 in the pre-market session on July 10, 2023 as well as the U.S. dollar index sliding below 100 in recent days.

It is useful to remind yourself about how much more strongly stocks will rebound during bear markets than they will during bull markets. In every bear markets, Bogleheads and others will tell you every time we have a sharp recovery that "the bear market is over" but then we have the next downward wave, at which point investors become too fearful and we get the next rebound, and so on. Here is a chart of how QQQ had behaved in 2000-2002, where you can see how many very strong percentage gains we had even as QQQ overall was busy dropping 83.6% from its March 10, 2000 peak to its October 10, 2002 bottom:

As a bear market matures, both the pullbacks and the recoveries become generally greater in percentage terms.

You probably heard a lot of people talk about the so-called Goldilocks economy in 2021. The problem with that analogy is that many people weren't paying attention in kindergarten when their teacher read the Goldilocks story: Goldilocks is always followed by three bears, known as Baby Bear, Mama Bear, and Papa Bear. We had Baby Bear in January-October 2022, where a modest pullback for the U.S. stock market had occurred, followed by a rebound. The recovery has been above average for a bear market in terms of duration and intensity, partly since we had a second bubble encouraged by AI hype.

We are about to experience Mama Bear. This will feature much greater percentage losses than we had experienced in 2022. Such a pullback will be followed by a strong bounce higher for several months, and then starting sometime in 2024 we will begin Papa Bear which will likely continue until some unknown point in 2025. Most investors aren't prepared for either of the bear parents to perform their inevitable starring roles, and have foolishly convinced themselves just as they had done in all previous bear markets that somehow we're in a "new bull market."

Pictures can be worth a thousand words or perhaps even ten thousand words. We have experienced numerous multi-decade extremes in recent weeks which are probably best shown through the actual data:

The bottom line: Look for down, up, DOWN, UP. Get ready for the following four major moves, in order: 1) the biggest percentage decline so far in the 2021-2025 bear market; 2) a strong multi-month rebound; 3) a much more intense collapse lasting roughly one year; and 4) a multi-year value bull market.

Disclosure of current holdings:

Below is my current asset allocation as of 4:00 p.m. on Friday, July 7, 2023. I have since added to my short position in QQQ while selling some GDX and GDXJ, which I will update soon.

I computed the exact totals for each position and grouped these according to sector.

The order is as follows: 1) U.S. government bonds; 2) shorts; 3) gold/silver mining; 4) coins; 5) individual securities.

TIAA(Traditional)/VMFXX/bank CDs/FZDXX/FZFXX/SPRXX/SPAXX/Savings/Checking long: 22.62%;

26-Week/17-Week/52-Week/13-Week/2-Year/8-Week/3-Year/5,10-Year TIPS/4-Week long: 13.86%;

I Bonds long: 9.48%;

TLT long: 9.43%;

XLK short (all shorts once again unhedged): 25.31%;

QQQ short: 12.17%;

XLE short: 4.58%;

XLI short: 2.60%;

XLV short: 1.62%;

SMH short: 0.89%;

AAPL short: 0.03%;

PSQ long: 0.01%;

GDXJ long: 10.75%;

ASA long: 6.79%;

GDX long: 2.98%;

BGEIX long: 1.44%;

Gold/silver/platinum coins: 5.88%;

HBI long: 0.29%;

PAK long: 0.03%.

The numbers add up to more than 100% because short positions only require 25% to 30% collateral in stocks/funds and only 4% to 6% in U.S. Treasuries (by SEC regulations; some brokers require more) to hold them with no margin required.

Steven Jon Kaplan runs True Contrarian where this article appeared first.

Source truecontrarian-sjk