Competitors Will Potentially Threaten Tesla’s Profitability

In his Daily Market Notes report to investors, while commenting on Tesla’s profitability, Louis Navellier wrote:

Q1 2021 hedge fund letters, conferences and more

Change In Tax Policies

Tax chatter has increased because of Biden’s $2.25 trillion infrastructure plan. If the money doesn’t come from corporations, then it will come from other sources in the form of higher individual income taxes, eliminating qualified dividends, eliminating step-up basis for estates, taxing unrealized capital gains, new gas/carbon taxes, and possibly a national Value-Added Tax (VAT) at some point.

Whatever the end game is for policymakers, taxes for corporations and for individuals are about to increase by varying degrees. To date, the stock market has paid little attention to this soon-to-be reality, instead opting to focus on Fed QE policies and Congressional stimulus. At some point, it would seem that this transformational change in tax policies will matter to the stock market.

Last Sunday, April 4, we lost a great champion of economic sanity, Robert A. Mundell, the 1999 Nobel Prize winner in economics, the inventor of the Euro currency and, most importantly, a long-time champion of honest money. He died on the cusp of the passage of the second $2-trillion package of fiat money programs in three months under the Biden administration.

Strong Dollar

He lived through the great “stagflation” of the 1970s which were the fruits of going off the gold standard and setting the dollar afloat, only to capsize in a value-focused world.

Those lessons now apparently must be learned all over again by a generation which never felt the pain of the 1970s. A new mystical theology called Modern Monetary Theory (MMT) promises a free lunch of prosperity for all by printing unlimited funds for all with no significant “morning after,” either through inflation or debt hangover. We are now in that magic period between the dream state and waking up.

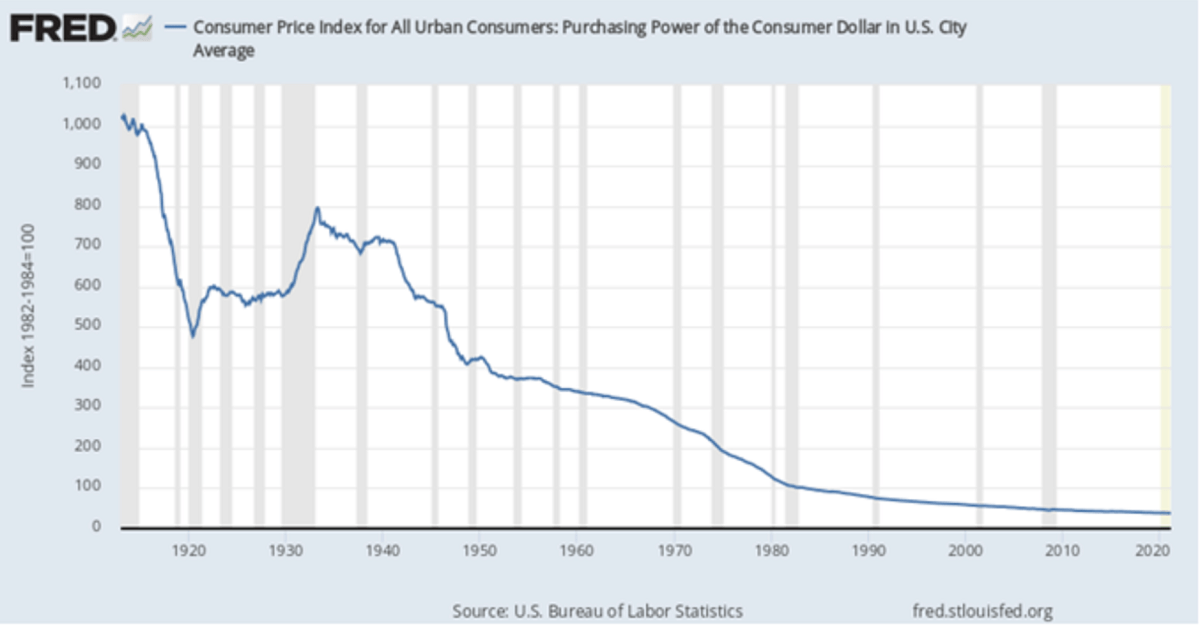

The dollar is strong, but compared to what and when? From March 15, 2020 to year end, the U.S. Dollar Index was down over 12%. It rose in the first quarter of 2021, but the Dollar Index is down 1.2% so far in April after the Fed reiterated that it won’t raise rates despite forecasts that the U.S. economy will likely recover faster than its peers. Longer term, the dollar is down 99% to gold since the Federal Reserve was created in 1913, and the dollar is down 98% to gold since it was set afloat in 1971.

In a surreal fashion, gold bullion traded under $1700/oz. in March due to rising U.S. long-term interest rates that are pushing the U.S. dollar higher. I think interest rates may rise more from here, but gold bullion won’t fall further since, in real terms, rates are likely to make new lows. If the 10-year Treasury surges above 2% and inflation goes to 4%-5%, the real interest rates will make new lows for this cycle. This negative real-interest rate environment is perfect for gold bullion.

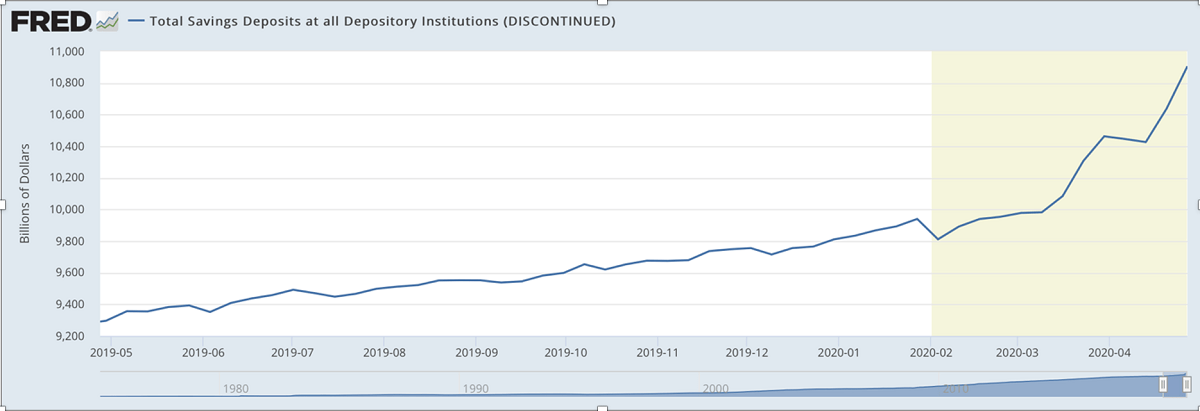

Since we haven’t been able to spend on restaurants, entertainment, travel or cruises, we’ve saved up a lot of money. Note the spike in 2020 on the chart below. Not only do we have lots of cash, but we’re itching to spend it – a classic formula for inflation.

Tesla's Profitability

The wild card associated with EV profitability remains the $1.58 billion tax/carbon credits that Tesla received from other auto manufacturers in 2020, which accounted for virtually all of its $721 million in 2020 earnings. As VW Group, Ford, GM, Renault, NIO and Xpeng and other auto manufacturers continue to ramp their EV production, it will be interesting if this impacts Tesla’s tax/carbon credits that it receives from other auto manufacturers.

Stellantis NV (formally Fiat Chrysler) has been the biggest buyer of Tesla’s tax/carbon credits, but is now throttling up is own EV production. If Tesla’s EV competitors can eventually sell enough EVs that they do not have to buy Tesla’s tax/carbon credits, they will potentially threaten Tesla's profitability. Several years from now, Tesla’s new manufacturing plants should be more efficient and will hold the key to its long-term profitability.

The post Competitors Will Potentially Threaten Tesla’s Profitability appeared first on ValueWalk.

Source valuewalk