Chevron: The Bottom-Line Decline Was Expected

Integrated energy giant (NYSE: CVX) announced that it earned $6 billion in the second quarter, or roughly $3.20 per share. Key bullet points from the earnings release called out record Permian production, record shareholder distributions, and an expected August closing date for a recent acquisition.

Management is clearly trying to accentuate the positives, which is fine. Only there was a negative here that shouldn't be ignored, even though it was entirely expected and predictable.

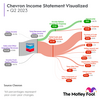

Before digging into the second quarter just a little, it is important to understand what Chevron does. As an integrated energy company, its operations span from the upstream (drilling) through the midstream (pipelines) into the downstream (chemical and refining). Each of these areas of the energy sector has different business dynamics. By grouping all three into one company, Chevron hopes to even out its financial performance over time.

Source Fool.com

Chevron Corp. Stock

The stock is an absolute favorite of our community with 26 Buy predictions and no Sell predictions.

As a result the target price of 179 € shows a positive potential of 22.89% compared to the current price of 145.66 € for Chevron Corp..