Die heutigen Sitzungen an den Börsen waren von großer Nervosität geprägt und sorgten bei DAX®, CAC®40 und EuroSTOXX®50 für Abschläge. Zentrales Thema ist der heute Abend anstehende Zinsentscheidung

News und Analysen

Productivity Surges 3.7% In The Second Quarter

In his podcast addressing the markets today, Louis Navellier offered the following commentary.

Energy Bet Paying Off

My big energy bet is paying off now that we are in the midst of peak

Productivity Surges 3.7% In The Second Quarter

In his podcast addressing the markets today, Louis Navellier offered the following commentary.

Energy Bet Paying Off

My big energy bet is paying off now that we are in the midst of peak

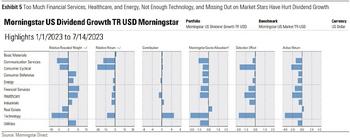

Bots, Barrels, Banks, And Biopharma: Inside 2023’s Dividend Doldrums

The latest report from Dan Lefkovitz, strategist at Morningstar Indexes, examines dividend-stock underperformance in 2023.

Recent weakness among Morningstar dividend indexes is less about

Buy British: Bargain UK Funds Left Behind The Rally

- After a stellar 2022, the UK market has been left for dust in 2023 amid a growth resurgence

- Upside inflation surprises have cranked up the pressure on the Bank of England

- The UK market

CPI Deceleration May Convince The Fed To Pause Again

In his podcast addressing the markets today, Louis Navellier offered the following commentary.

If you wish to listen to this commentary, please click here.

Labor Department Figures Are More

CPI Deceleration May Convince The Fed To Pause Again

In his podcast addressing the markets today, Louis Navellier offered the following commentary.

If you wish to listen to this commentary, please click here.

Labor Department Figures Are More

CPI Deceleration May Convince The Fed To Pause Again

In his podcast addressing the markets today, Louis Navellier offered the following commentary.

If you wish to listen to this commentary, please click here.

Labor Department Figures Are More

The Changing Face Of Emerging Markets – Part II, Addressing Your Feedback

Rob Brewis published a piece a couple of weeks ago on the evolution of Emerging Markets (“EM”). Although EM indices play no part in our process, their changing constituents do reflect the

June Inflation Will Drive Pace of Rate Hikes

In his podcast addressing the markets today, Louis Navellier offered the following commentary.

If you wish to listen to this commentary, please click here.

In the wake of the disappointing

June Inflation Will Drive Pace of Rate Hikes

In his podcast addressing the markets today, Louis Navellier offered the following commentary.

If you wish to listen to this commentary, please click here.

In the wake of the disappointing

June Inflation Will Drive Pace of Rate Hikes

In his podcast addressing the markets today, Louis Navellier offered the following commentary.

If you wish to listen to this commentary, please click here.

In the wake of the disappointing

Customers And Creators: The Focus Of Every Business

Reducing consumer friction may be an obvious trend. But it ranges from the quite literal elimination of steps taken on a website to making a variety of everyday tasks easier for the consumer.

Potential Violation Of Civil Rights And Debanking Of Conservatives By Mastercard

Washington, D.C. – Shareholder activists with the National Center for Public Policy Research’s Free Enterprise Project (FEP) will close out their most active shareholder season to date by

Even With High Interest Rates, Should You Hold Cash In Your Portfolio?

With some bank CDs paying more than a 5% APY and some savings and money market accounts yielding around that figure too (as of June 2023), no one can blame investors if they’ve become tempted to

Timber Investments: Real Asset Investment Guide

Investing in forest land suitable for producing lumber can provide you income, diversification, inflation protection and more. Timber investing requires careful study of the industry, market and

These Five Defensive Stocks Can Be Resilient As Investors Flock To Safety

Investors continue to park their cash in ultra-safe investment vehicles amid the current economic climate, with many hoping to cushion their portfolios against sudden market meltdown, seasoned

These Five Defensive Stocks Can Be Resilient As Investors Flock To Safety

Investors continue to park their cash in ultra-safe investment vehicles amid the current economic climate, with many hoping to cushion their portfolios against sudden market meltdown, seasoned

Looking for Bargain Stocks? Morningstar Says These Are Cheap

Now might be a good time to buy.

That’s the takeaway from a recent Morningstar analysis, which reported in on a seeming contradiction in stock prices. The market as a whole, Morningstar writes

Why ‘Sell In May And Go Away’ Is A Myth

- There is an adage that you should sell your shares in May and leave them in cash until November

- Winter months do tend to be the better performers

- But by cashing in you miss out on summer

Stock Buyback Clash: Biden’s Plan Faces Resistance From Critics And Investors

President Joe Biden has championed a substantial financial proposal in the latter half of his term: increasing taxes on businesses engaging in stock buybacks. This initiative aims to redirect

HOCHTIEF AG mit Fehlausbruch – ist das eine Short-Chance?

Die Bauindustrie boomt nicht mehr, seitdem sich die Zinsen für Kredite mehr als verdreifacht haben. Dennoch ist die Aktie der HOCHTIEF AG auf ein neues Zwei-Jahreshoch gestiegen, bevor kleinere

Ecolab: Slow And Steady Wins The Race

Key Points

- Ecolab produced a better-than-expected quarter and reaffirmed its long-term targets.

- The yield isn’t high, but it’s reliable and compounded by share repurchases.

- Analysts are

As Economic Rumblings Materialize, Investors Should Keep Kforce On Their Watchlists

A rarely covered enterprise, Kforce (NASDAQ:KFRC) – which provides professional staffing services and solutions for the U.S. workforce – typically operates in the shadows of its larger rivals, such

Impact Scores von Twelve Capital: Die Bedeutung der Finanzindustrie für Netto-Null

ZÜRICH, Switzerland, May 03, 2023 (GLOBE NEWSWIRE) -- Die Hauptprämisse der Climate Transition Strategie von Twelve Capital ist, dass die aktuell vorherrschende Finanzierungslücke geschlossen