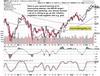

S&P 500’s Rebound – Reasonably Dovish FOMC

S 500 did slide all the way till 4,465, and it was the hesitation in the 4,470s that made me recognize an intraday rebound was getting underday – still good enough Intraday Signals daily total result. When that reversal proved a bit more staying power, it was time to terminate the profitable swing short as both SPY daily volume and sectoral composition progress hinted at rather dovish FOMC positioning getting underway.

Pay no attention to the conflicting inflation data out of UK and Canada – the Fed has been quite clear about no Sep hike (and I expect no hawkish setback) if you read between the lines. The same conclusion I support with charts in the stock market analytical section below.

I‘ll be covering the price moves well before FOMC on Twitter and chiefly on the two premium Telegram channels (one for stocks, the other for gold, silver and oil). I‘m looking for a pretty interesting move in and beyond preciuous metals!

Keep enjoying the lively Twitter feed via keeping my tab open at all times (notifications on aren't enough) – combine with subscribing to my Youtube channel, and of course Telegram that always delivers my extra intraday calls (head off to Twitter to talk to me there), but getting the key daily analytics right into your mailbox is the bedrock.

So, make sure you‘re signed up for the free newsletter and make use of both Twitter and Telegram - benefit and find out why I'm the most blocked market analyst and trader on Twitter.

Let‘s move right into the charts (all courtesy of www.stockcharts.com) – today‘s full scale article contains 4 of them.

Gold, Silver and Miners

I don‘t think gold has topped, and it‘s reasonable to expect $1,960 and $23.90 to be broken to the upside later today. Copper bouncing off its $3.75 magnet isn‘t a surprise really – these real assets would benefit once the FOMC dust settles.

Crude Oil

Crude oil remains one of the bullish picks, and the more patient you are, the greater reward here in Q3 and Q4 2023 (nearest only). Monday and Tuesday‘s candlesticks provide a clear warning, which I had foreseen yesterday with the $88.50 at worst target, and commented on already in the newer Telegram channel.

Thank you for having read today‘s free analysis, which is a small part of my site‘s daily premium Monica's Trading Signals covering all the markets you're used to (stocks, bonds, gold, silver, miners, oil, copper, cryptos), and of the daily premium Monica's Stock Signals presenting stocks and bonds only. Both publications feature real-time trade calls and intraday updates.

While at my site, you can subscribe to the free Monica‘s Insider Club for instant publishing notifications and other content useful for making your own trade moves.

Turn notifications on, and have my Twitter profile (tweets only) opened in a fresh tab so as not to miss a thing – such as extra intraday opportunities. Thanks for all your support that makes this great ride possible!

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice.

Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind.

Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make.

Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

Source valuewalk