SPOT vs. PATH: Which Tech Stock Possess Stronger Growth Potential?

Both Spotify Technology S.A. SPOT and UiPath PATH are prominent software-driven tech stocks. SPOT is a leading personalized audio streaming and content platform, while PATH focuses on robotic process automation (RPA). Despite operating in different niches, both companies are linked by AI-backed growth narratives.

Our comparative analysis will help investors figure out the tech stock that offers a more optimistic growth prospect.

The Case for Spotify Technology

Spotify Technology’s AI integration has aided its growth trajectory, evidenced by its improving key performance indicators. By the end of March 2025, the company added 3 million monthly active users (MAUs) and the count increased 10% year over year. Similarly, premium subscriber count increased by 5 million by the end of March and grew 12% year over year. This performance shines a light on AI’s ability to create bespoke and engaging user experiences, elevating its business performance.

SPOT has tactfully incorporated AI into its recommendation engines. The algorithms are subjected to analyze consumer habits, allowing the company to generate hyper-personalized features such as Discover Weekly, Release Radar and Daily Mixes. These playlists are driving user engagement by increasing time spent on the platform, leading to higher retention and a greater probability of a free user converting into a premium subscriber.

Apart from recommendations, AI facilitates an annual marketing campaign — Spotify Wrapped — a user recap feature that provides an individualized summary of user’s listening habits from the past year. This feature acts as an organic marketing tool and contributes significantly toward user acquisition and brand visibility due to its virality.

Moving on, ad-supported MAUs increased 9% year over year in the first quarter of 2025. AI is a significant driver behind this growth, helping the company optimize target advertising and enhancing ad revenues. Finally, AI DJ and AI Playlist are a few of the company’s AI-led innovations that demonstrate commitment to strengthening user interaction. This ultimately improves user retention and paves the path for prolonged growth in the competitive market.

The Case for UiPath

PATH, a global player in the RPA domain, leverages AI to fuel its growth, transforming traditional automation into an intelligent one. The strategic collaboration of AI has expanded the scope of processes that can be automated, supporting its growth trajectory positively. In fiscal 2025, the company registered annual recurring revenues (ARR) of $1.7 billion, increasing 14% year over year. Also, $424 in revenues was recorded in the fourth quarter of fiscal 2025, rising 5% from the year-ago quarter.

Banking on sophisticated AI-powered solutions, the company has been able to generate strong ARR, indicating a healthy recurring stream of revenues and customer retention. Furthermore, the dollar-based net retention rate hovered at 110%, further bolstering PATH’s success in broadening its customer base, which is a direct benefit of its AI-backed offerings.

The company has introduced intelligent document processing, communications mining and computer vision to automate unstructured and complex tasks that RPA cannot handle by itself. This agentic automation, which allows AI agents to work alongside robots, generates a higher return on investment for clients by enabling businesses to tackle complicated workflows.

For instance, the recent acquisition of Peak aims to strengthen PATH’s vertical AI solutions strategy by accelerating AI adoption in retail and manufacturing sectors. Acquisitions as such and AI-led innovations backed by substantial R&D investment are instrumental in retaining market leadership and capitalizing on the rising demand for enterprise-wide AI transformation.

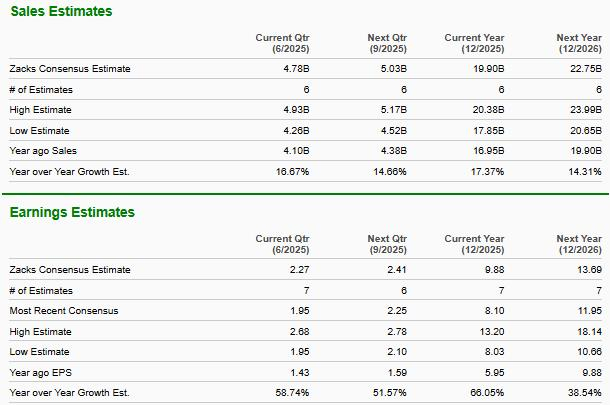

How Do Estimates Compare for SPOT & PATH?

The Zacks Consensus Estimate for Spotify Technology’s 2025 sales is pegged at $19.9 billion, suggesting 17.4% year-over-year growth. The consensus estimate for earnings is pegged at $9.88, indicating a 66.1% rise from the preceding year’s actual. Three estimates for 2025 have moved north in the past 60 days versus four southward revisions.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

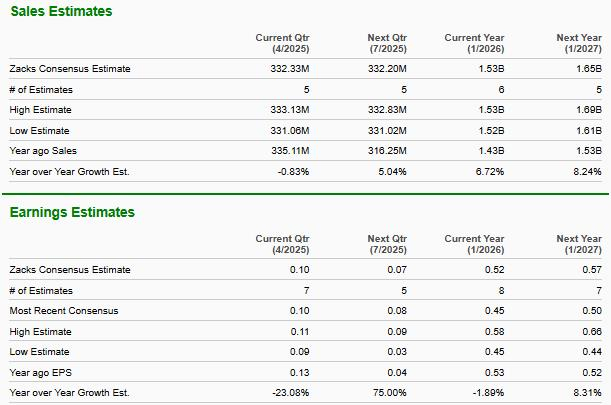

The Zacks Consensus Estimate for UiPath’s 2025 sales is pegged at $1.5 billion, implying 6.7% year-over-year growth. The consensus estimate for earnings is pegged at 52 cents per share, indicating a 1.9% year-over-year decline. No estimate for 2025 has moved north in the past 60 days versus two southward revisions.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

PATH Looks Cheaper Than SPOT

Spotify Technology is currently trading at a forward 12-month Price/Sales ratio of 6.45X, which is higher than the 12-month median of 4.83X, indicating an overvaluation. UiPath appears slightly overvalued with its 12-month Price/Sales ratio of 4.56X, which is marginally above the 12-month median of 4.53X. While both stocks are trading at a premium compared with their historical valuations, PATH is priced attractively from a valuation standpoint, suggesting greater breadth for expansion.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Verdict

While both SPOT and PATH rely heavily on AI to gain a competitive advantage, Spotify Technologies’ near-term prospects appear brighter. SPOT’s excellent user growth and impressive financial performance paint a detailed picture of a better near-term potential. That being said, we do acknowledge PATH’s strength in enterprise automation and its lower valuation compared with Spotify Technology.

However, SPOT is a fundamentally stronger stock than UiPath, with a remarkably higher earnings growth outlook, giving investors greater confidence to bet on its growth.

SPOT and PATH have a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UiPath, Inc. (PATH): Free Stock Analysis Report

Spotify Technology (SPOT): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com