Highwoods Provides Quarter-to-Date Second Generation Leasing Update

Highwoods Properties, Inc. HIW announced that it has signed more than 750,000 square feet of second-generation leases from the beginning of the second quarter through June 2, 2025. These includes more than 300,000 square feet of new leases.

Per Ted Klinck, president & CEO of HIW, “New users and existing customers continue to value our commute-worthy portfolio in BBD locations. The healthy volume of leases executed in the first five months of the year and pipeline of future prospects positions us to grow occupancy late in 2025 and thereafter.”

HIW: In a Nutshell

Highwoods is seeing a recovery in demand for its high-quality, well-placed office properties as highlighted by a rebound in new leasing volume. With an increasing number of organizations emphasizing return-to-office mandates, the demand for high-quality office spaces is picking up, propelling leasing activity.

During the first quarter of 2025, the company signed approximately 691,000 square feet of second-generation leases. This includes new leases spanning nearly 244,000 square feet.

Highwoods’ well-diversified tenant base, efforts to expand in the high-growth markets and balance sheet strength are its key growth drivers. However, competition from other players is likely to limit its pricing power and hurt profitability. High interest expenses add to its woes.

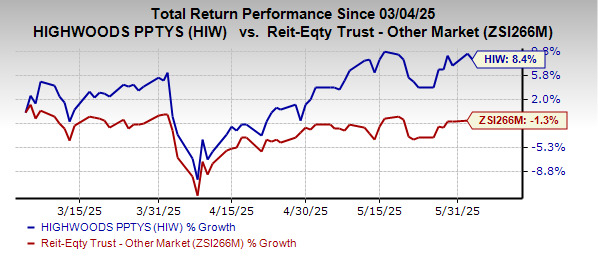

Over the past three months, shares of this Zacks Rank #3 (Hold) company have gained 8.4% against the industry's decline of 1.3%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader REIT sector are VICI Properties VICI and W.P. Carey WPC, each currently carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for VICI’s 2025 FFO per share has moved one cent northward to $2.34 over the past two months.

The consensus estimate for WPC’s 2025 FFO per share has been revised upward by 1% to $4.88 over the past month.

Note: Anything related to earnings presented in this write-up represents FFO, a widely used metric to gauge the performance of REITs.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Highwoods Properties, Inc. (HIW): Free Stock Analysis Report

W.P. Carey Inc. (WPC): Free Stock Analysis Report

VICI Properties Inc. (VICI): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com