Bull of the Day: Photronics (PLAB)

Photronics PLAB, a current Zacks Rank #1 (Strong Buy), is a global market leader in photomasks (stencils used to print tiny circuits onto semiconductor wafers) for lithographic imaging in semiconductor and flat panel display production.

Analysts have taken a bullish stance on the company’s EPS outlook, with the trend notably strong for its Q1 period. The company reports on February 25th before the open.

Image Source: Zacks Investment Research

Photronics Plays a Critical Role

PLAB shares have been red-hot over the last three months on the back of a strong quarterly print, gaining 50% compared to the S&P 500’s roughly 3% gain. The company plays a critical role in the AI frenzy, particularly in the chip-making supply chain.

Image Source: Zacks Investment Research

PLAB’s latest release showed record-high-end (advanced chips) revenue, with noted strength in the United States. Importantly, as AI chips become more complex, PLAB’s top line is poised to benefit significantly given its critical role in the broader industry.

The company’s CapEx has also grown significantly as it looks to expand its operations in the United States and South Korea, which will provide a solid growth runway as we wade deeper into the booming chip industry, fueled by the AI era.

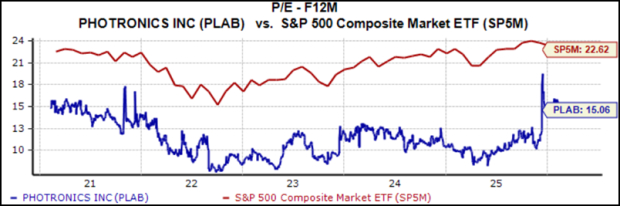

Valuation multiples have expanded over recent months, with the current 15.1X forward 12-month earnings multiple well above the 11.1X five-year median. Though above historical values, it still reflects a solid 33% discount relative to the S&P 500’s current 22.6X multiple.

Image Source: Zacks Investment Research

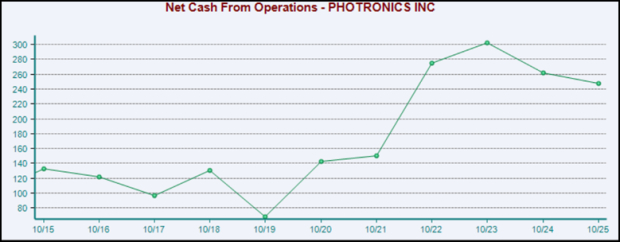

Operating cash flow has also expanded nicely over recent years, helping to fund the above-mentioned CapEx plans geared toward its future growth. CapEx during its latest fiscal year totaled $188.1 million, compared with $131 million in FY24.

Please note that the chart below is on an annual basis, not quarterly.

Image Source: Zacks Investment Research

Bottom Line

Investors can implement a stellar strategy to find expected winners by taking advantage of the Zacks Rank – one of the most powerful market tools that provides a massive edge.

The top 5% of all stocks receive the highly coveted Zacks Rank #1 (Strong Buy). These stocks should outperform the market more than any other rank.

Photronics PLAB would be an excellent stock for investors to consider, as displayed by its Zack Rank #1 (Strong Buy).

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in the coming year. While not all picks can be winners, previous recommendations have soared +112%, +171%, +209% and +232%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Photronics, Inc. (PLAB): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com