Apple & Google: A New AI Superteam?

If there’s one thing that remains certain for 2026, it’s that the AI frenzy will continue to dominate market headlines and overall commentary. It’s not unsurprising, given some of the lofty forecasts we’ve received, though the fresh year will likely weed out a few of the ‘pretenders’ from the real winners.

And the headlines just keep flowing in, with Alphabet GOOGL announcing a multi-year collaboration with fellow technology titan Apple AAPL. More specifically, Apple and Google have entered into a multi-year collaboration under which the next generation of Apple Foundation Models will be based on Google's Gemini models and cloud technology.

Apple & Gemini

In a joint statement, the companies said, ‘After careful evaluation, Apple determined that Google's Al technology provides the most capable foundation for Apple Foundation Models and is excited about the innovative new experiences it will unlock for Apple users. Apple Intelligence will continue to run on Apple devices and Private Cloud Compute, while maintaining Apple's industry-leading privacy standards.’

It's an exciting development in the ever-expanding AI space, particularly following growing sentiment that Apple is being ‘left behind’ in the race. Notably, AAPL has not had its big AI moment, but today’s announcement helps alleviate some of the concerns.

Keep in mind that the reaction to Apple Intelligence so far has been mixed, with several highly anticipated features, like an improved Siri, delayed during the initial rollout. After a few years of remaining quiet about AI in general, the less-than-ideal rollout of the announced features really amplified the concerns.

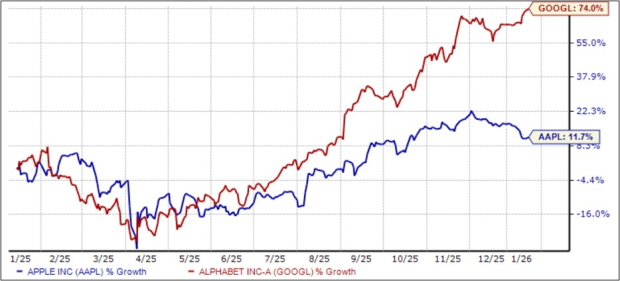

There’s been a massive performance disparity between the two over the past year, as shown below. The weaker gains in AAPL could partly reflect less excitement about its AI trajectory relative to GOOGL, though the recently announced deal should help turn sentiment.

Image Source: Zacks Investment Research

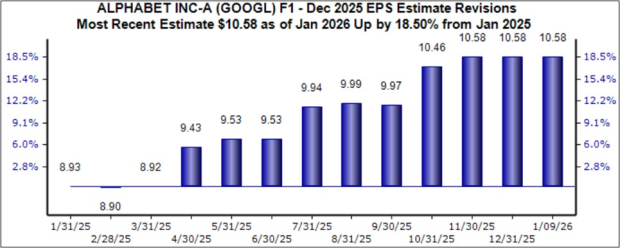

Both stocks continue to sport rosy outlooks concerning their current fiscal years, with analysts bullishly revising their expectations higher. GOOGL’s $10.58 Zacks Consensus EPS estimate is up 18% over the last year, as shown below.

Image Source: Zacks Investment Research

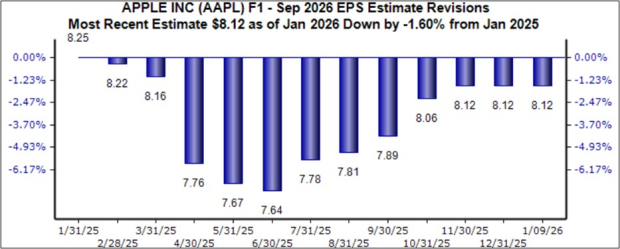

EPS expectations for Apple bottomed out in July of last year, on a notably bullish trajectory since.

Image Source: Zacks Investment Research

Putting Everything Together

Overall, it’s a clear win-win situation for both Apple AAPL and Alphabet GOOGL, with Apple securing its AI backbone and Google further cementing Gemini as a core component of AI infrastructure for the world's largest consumer ecosystem.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com