Summary

This prediction is currently active. The prediction currently has a performance of 17.92%. A total of €1.71 was paid as dividends for this prediction. This prediction currently runs until 08.09.26. The prediction end date can be changed by ValueFreak at any time. ValueFreak has 70% into this predictionPerformance without dividends (%)

| Name | 1w | 1m | 1y | 3y |

|---|---|---|---|---|

| Vale S.A. | -4.889% | -4.889% | 39.752% | -14.557% |

| iShares Core DAX® | 1.066% | -0.525% | 9.662% | 59.627% |

| iShares Nasdaq 100 | -0.493% | -4.055% | -0.132% | 84.636% |

| iShares Nikkei 225® | -2.028% | 6.911% | 26.863% | 64.579% |

| iShares S&P 500 | -0.103% | -2.366% | 0.508% | 58.341% |

According to ValueFreak what are the pros and cons of Vale S.A. for the foreseeable future?

Pros

Revenue growth >5% per year expected

EBIT growth >5% per year expected

Rising EBIT margin expected

Undervalued

Very high dividend yield expected

Very positive Cash Flow expected

Good rating

Standard Investments for future growth

Valuable balance sheet

ROE higher than 10% per year

Normal challenges to pay loans and raise capital

Good culture

Capable Management

Innovative

Strong uniques

Differentiated customer and product portfolio

Sustainability is important

Medium risks for its business

Market Leader or Top 3

Known brand

Future proof or reliable business model

Cons

Probably not worthwhile Investment

Significant cyclical dependencies

Comments by ValueFreak for this prediction

In the thread Vale S.A. diskutieren

Buy mit Kursziel 16,0

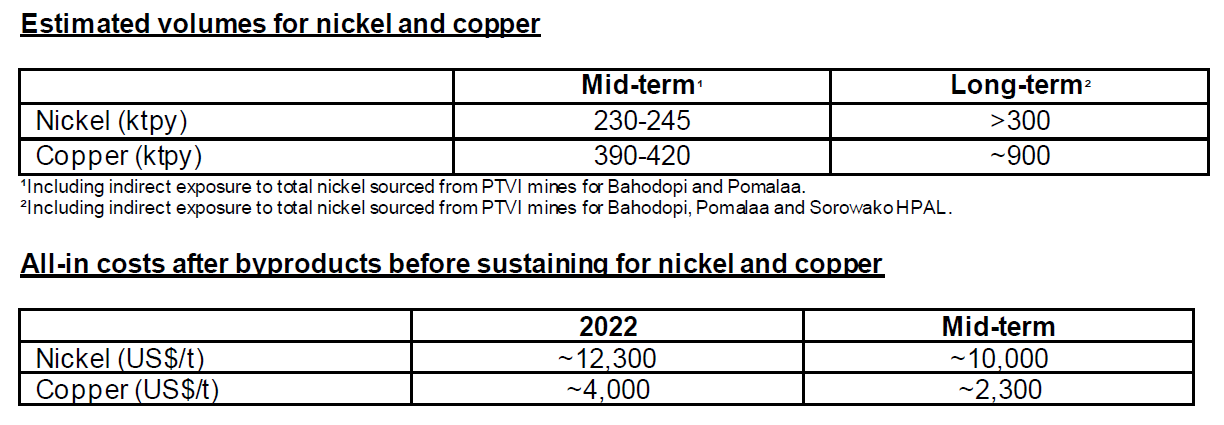

Vale's neue Präsentation zum Nickel- und Kupfergeschäft. Eine Projektion steigender Mengen und sinkender Gewinnungskosten

https://api.mziq.com/mzfilemanager/v2/d/53207d1c-63b4-48f1-96b7-19869fae19fe/c6c2d8f7-911a-53a7-04b9-651ca7e6f690?origin=1

https://api.mziq.com/mzfilemanager/v2/d/53207d1c-63b4-48f1-96b7-19869fae19fe/c6c2d8f7-911a-53a7-04b9-651ca7e6f690?origin=1

Vale mit Q3 Bericht und offenbar sehr positiv aufgenommenen Nachrichten zu Vorhaben in Nahost

http://www.vale.com/brasil/en/investors/information-market/press-releases/pages/default.aspx

http://www.vale.com/brasil/en/investors/information-market/press-releases/pages/default.aspx

Vale S.A. (“Vale”) announces that it has signed three agreements with local authorities and clients to jointly study the development of industrial complexes (“Mega Hubs”) in the Kingdom of Saudi Arabia, the United Arab Emirates, and the Sultanate of Oman to produce low-carbon products to the steelmaking industry.

The parties are seeking to cooperate in the development of these Mega Hubs to produce hot briquetted iron (“HBI”) and steel products to supply both the local and seaborne markets, with significant reduction of CO2 emissions.

The production of HBI using natural gas emits around 60%1 less CO2, when compared to pig iron production through the integrated BF-BOF route. In the future, the replacement of natural gas by hydrogen and the usage of renewable energy could eliminate CO2 emissions.

Vale reduziert den Anteil an PT Vale Indonesia

https://www.mining-technology.com/news/vale-sumitomo-sell-indonesia-stake/?cf-view

Die über Vale Canada gehaltenen Anteile am Indonesiengeschäft werden von 44,3% auf 33,9% reduziert. Die entsprechenden Anteile werden an die indonesische Gesellschaft PT Mineral Industri Indonesia (MIND ID) veräußert.

https://www.mining-technology.com/news/vale-sumitomo-sell-indonesia-stake/?cf-view

Die über Vale Canada gehaltenen Anteile am Indonesiengeschäft werden von 44,3% auf 33,9% reduziert. Die entsprechenden Anteile werden an die indonesische Gesellschaft PT Mineral Industri Indonesia (MIND ID) veräußert.

Vale CEO and Vale Base Metals board director Eduardo Bartolomeo said: “We are proud to continue supporting Indonesia’s ambitions in delivering low-carbon metals that are essential for the global energy transition. PTVI’s high-quality project portfolio, including Bahodopi, Sorowako and Pomalaa, will drive the next stage of growth in responsible nickel production, creating long-term value for all stakeholders.

The sale was announced by the Indonesian Minister for Energy and Mineral Resources, Arifin Tasrif, last week.

It complies with an Indonesian law that requires foreign companies to sell 51% of their stake in local businesses after operating for a certain period.

The divestment is a requirement for foreign businesses to extend their operating permit in Indonesia, and Vale’s current contract will end in 2025.

Vale in Q1 mit starken Volumen bei Eisenerz und Kupfer. Wegen niedrigerer Eisenerz Preise sinken Umsatz und Gewinn insbesondere gegenüber dem Vorquartal

https://vale.com/announcements-results-presentations-and-reports

https://vale.com/announcements-results-presentations-and-reports

- Proforma adjusted EBITDA (including associates and JVs proportionate EBITDA in the amount of US$ 203 million) of US$ 3.5 billion in Q1, 9% lower y/y and 49% lower q/q, mainly as a result of weaker iron ore fines realized prices. Q/q variation was also impacted by seasonally lower sales.

- Iron ore sales increased 8.2 Mt (+15%) and while copper sales increased 14.1 kt (+22%) y/y , both supported by continued operational improvements.

- Iron ore fines C1 cash cost ex-3rd party purchases was slightly lower y/y, reaching US$ 23.5/t in Q1, despite the negative effect of the BRL appreciation.

- Free Cash Flow generation totaled US$ 2.0 billion in Q1, representing an EBITDA to cash-conversion of 57%, positively impacted by strong collection from Q4 sales.

- Vale has achieved 100% renewable electricity consumption in Brazil two years ahead of schedule, which was 2025. With that, the company has zeroed its indirect CO2 emissions in the country. Also, it remains committed to achieving 100% renewable electricity consumption in its global operations by 2030, from the current 88.5%.

Im Anleihebereich realisiert Vale eine Umschuldung in langlaufende neue Anleihen mit Laufzeit bis 2054. Die Maßnahme verringert das Risiko, bei niedrigen Rohstoffpreisen Liquiditätsprobleme zu bekommen. Es geht hier nicht darum, überschüssige Liquidität für Schuldenabbau zu verwenden.

https://api.mziq.com/mzfilemanager/v2/d/53207d1c-63b4-48f1-96b7-19869fae19fe/d5c38eb7-1cd7-f182-4c68-4c65fd58a1d3?origin=1

https://api.mziq.com/mzfilemanager/v2/d/53207d1c-63b4-48f1-96b7-19869fae19fe/d5c38eb7-1cd7-f182-4c68-4c65fd58a1d3?origin=1

Rio de Janeiro, June 25th, 2024 - Vale S.A. ("Vale" or "Company") hereby announces that its wholly owned subsidiary Vale Overseas Limited (“Vale Overseas”) plans to offer notes due 2054 guaranteed by Vale (the “Notes”). Vale intends to use a portion of the net proceeds of the offering to (i) fund the purchase price of certain notes issued by Vale Overseas tendered and accepted for purchase pursuant to the tender offer announced on the date hereof; (ii) fund the redemption price of the 6.250% Guaranteed Notes due 2026 issued by Vale Overseas, and (iii) the remainder for general corporate purposes.

@stefan

Mein Eindruck von den KI Artikeln: die KI muss hier noch einiges dazulernen, dass für eine Einschätzung nicht ausschließlich die jüngsten Ankündigungen verwendet werden und dass vergangene und gegenwärtige Nachrichten im Zusammenhang zu lesen sind. Die Eisenerz Preise haben auch einen größeren Einfluss auf das Wohlergehen der Firma als Exane BNP Paribas.

Vale hat in 2025 ca. 10% mehr Kupfer produziert und dürfte vom Preisboom der Metalle profitieren. Aktuell notiert Kupfer zu Höchstkursen und auch die Nickelpreise haben sich aufgrund der indonesischen Politik erholt.

https://filemanager-cdn.mziq.com/published/53207d1c-63b4-48f1-96b7-19869fae19fe/c4dceca9-6ed8-408a-8065-b6f7e86810da_0127_relatorio_de_producao_i.pdf

.

.

Zusätzlich fielen größere Mengen bei den Begleitmetallen Kobalt, Gold und PGMs an

.

.

Für den 12.2. wird der Geschäftsbericht erwartet.

https://filemanager-cdn.mziq.com/published/53207d1c-63b4-48f1-96b7-19869fae19fe/c4dceca9-6ed8-408a-8065-b6f7e86810da_0127_relatorio_de_producao_i.pdf

.

.Zusätzlich fielen größere Mengen bei den Begleitmetallen Kobalt, Gold und PGMs an

.

.Für den 12.2. wird der Geschäftsbericht erwartet.

Vale mit Jahresbericht 2025 in der vergangenen Nacht

https://api.mziq.com/mzfilemanager/v2/d/53207d1c-63b4-48f1-96b7-19869fae19fe/0d85b370-58cc-698a-d7d8-a03173f32601?origin=2

Das vom expandierenden Kupferabbau und hohen Metallpreisen profitierende Ergebnis wird von einer hohen Abschreibung in Höhe von 3,5 Mrd. USD im Bereich des Nickel Abbaus getrübt (wegen der Preiserwartung für das Metall). Da diese sich nicht auf auf den Cashflow auswirkt, bleibt das ohne Auswirkung auf den aktuellen Aktienkurs und die Fähigkeit, weiterhin gute Dividenden auszuschütten

.

.

Die nächste großzügige Dividendenzahlung steht für März an. Das zugehörige Ex Datum liegt aber im vergangenen Dezember.

Hier ist noch der Link zur Investorenpräsentation von heute - die ist aber nur vom Sandmännchen

https://api.mziq.com/mzfilemanager/v2/d/53207d1c-63b4-48f1-96b7-19869fae19fe/39fbbebd-ef5e-bd72-826f-c3ee8a5b9d33?origin=2

https://api.mziq.com/mzfilemanager/v2/d/53207d1c-63b4-48f1-96b7-19869fae19fe/0d85b370-58cc-698a-d7d8-a03173f32601?origin=2

Das vom expandierenden Kupferabbau und hohen Metallpreisen profitierende Ergebnis wird von einer hohen Abschreibung in Höhe von 3,5 Mrd. USD im Bereich des Nickel Abbaus getrübt (wegen der Preiserwartung für das Metall). Da diese sich nicht auf auf den Cashflow auswirkt, bleibt das ohne Auswirkung auf den aktuellen Aktienkurs und die Fähigkeit, weiterhin gute Dividenden auszuschütten

.

.Die nächste großzügige Dividendenzahlung steht für März an. Das zugehörige Ex Datum liegt aber im vergangenen Dezember.

Hier ist noch der Link zur Investorenpräsentation von heute - die ist aber nur vom Sandmännchen

https://api.mziq.com/mzfilemanager/v2/d/53207d1c-63b4-48f1-96b7-19869fae19fe/39fbbebd-ef5e-bd72-826f-c3ee8a5b9d33?origin=2