AstraZeneca plc buy ValueFreak

Start price

11.11.22

/

50%

€124.30

Target price

08.09.26

€165.00

Performance (%)

46.05%

Price

13:40

€174.85

Summary

This prediction is currently active. With a performance of 46.05% the BUY prediction by ValueFreak is a big success. A total of €6.69 was paid as dividends for this prediction. This prediction currently runs until 08.09.26. The prediction end date can be changed by ValueFreak at any time. ValueFreak has 50% into this predictionPerformance without dividends (%)

| Name | 1w | 1m | 1y | 3y |

|---|---|---|---|---|

| AstraZeneca plc | -0.680% | -0.680% | 22.494% | 38.946% |

| iShares Core DAX® | 0,02 % | 0,58 % | 11,67 % | 61,62 % |

| iShares Nasdaq 100 | 1,74 % | -2,06 % | 4,18 % | 88,71 % |

| iShares Nikkei 225® | 0,43 % | 10,49 % | 29,99 % | 67,05 % |

| iShares S&P 500 | 1,33 % | 0,14 % | 3,33 % | 60,86 % |

According to ValueFreak what are the pros and cons of AstraZeneca plc for the foreseeable future?

Pros

Could be worthwhile Investment >10% per year

Revenue growth >5% per year expected

EBIT growth >5% per year expected

positive Cash Flow expected

Higher EBIT margin than peer group

Fair valuation

Top Rating

Strong uniques

High Investments for future growth

Valuable balance sheet

ROE higher than 10% per year

Normal challenges to pay loans and raise capital

Very capable Management

Very good company culture

Leading role in innovation

Very differentiated customer and product portfolio

Growths much faster than the competition

Sustainability is important

Management is a major shareholder

Small Risks for its business

Very small cyclical dependencies

Well known brand

Very Future proof/growth oriented business model

Market Leader or Top 3

Cons

Low dividend yield expected

Comments by ValueFreak for this prediction

In the thread AstraZeneca plc diskutieren

Meine Buy Einschätzung war hier verloren gegangen.

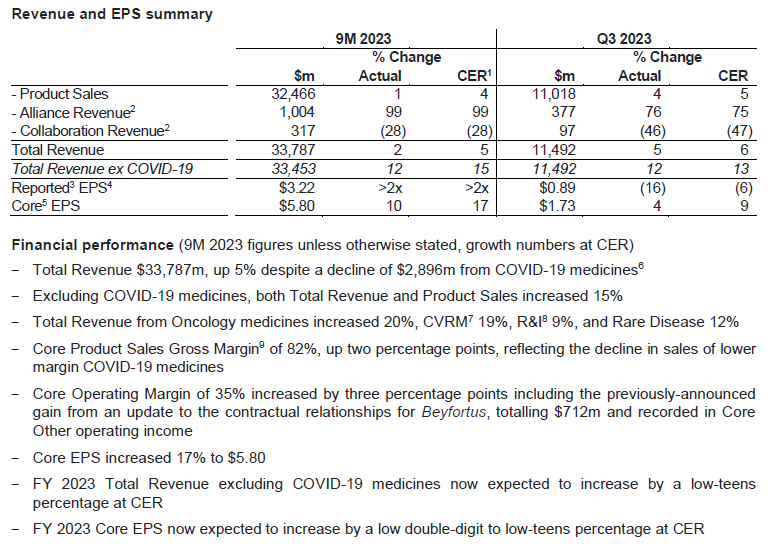

Heute Q3 Bericht - höhere Umsätze trotz drastischem Rückgang des COVID-19 Geschäftes

https://www.astrazeneca.com/investor-relations/9m-and-q3-2023-results.html

https://www.astrazeneca.com/investor-relations/9m-and-q3-2023-results.html

The Company updates its Total Revenue and Core EPS guidance for FY 2023 at CER, based on the average

foreign exchange rates through 2022.Total Revenue is expected to increase by a mid single-digit percentage (previously low-to-mid single-digit).(previously low double-digit).

- Excluding COVID-19 medicines, Total Revenue is expected to increase by a low-teens percentage

(previously high single-digit to low double-digit).

- Core EPS is expected to increase by a low double-digit to low-teens percentage

An der Börse scheint der Bericht positiv anzukommen.

.

.

Astra Zeneca mit gutem Start in das neue Jahr

https://www.astrazeneca.com/media-centre/press-releases/2024/q1-2024-results.html

https://www.astrazeneca.com/media-centre/press-releases/2024/q1-2024-results.html

Financial performance for Q1 2024 (Growth numbers at CER):

- Total Revenue up 19% to $12,679m, driven by an 18% increase in Product Sales and continued growth in Alliance Revenue from partnered medicines

- Double-digit growth in Total Revenue from Oncology at 26%, CVRM at 23%, R&I at 17%, and Rare Disease at 16%.

- Core Product Sales Gross Margin3 of 82%

- Core Operating Margin of 34%

- Core Tax Rate of 21%

- Core EPS increased 13% to $2.06. The increase in Core EPS was lower than Total Revenue growth principally due to a $241m gain in the prior year period on the disposal of Pulmicort Flexhaler US rights

- Total Revenue and Core EPS guidance at CER for FY 2024 reiterated

Die Börse honoriert heute die guten Geschäftszahlen und setzt den Anstieg der Aktie der letzten Tage fort.

Heute ist Investorentag bei Astra Zeneca - Material findet ihr hier

https://www.astrazeneca.com/investor-relations/astrazeneca-investor-day.html

Bis 2030 wird die Verdopplung des Umsatzes angestrebt - die Firma ist was für konservative Anleger, die auch Freude am Wachstum haben.

.

.

https://www.astrazeneca.com/investor-relations/astrazeneca-investor-day.html

Bis 2030 wird die Verdopplung des Umsatzes angestrebt - die Firma ist was für konservative Anleger, die auch Freude am Wachstum haben.

AstraZeneca berichtet zweistelliges Wachstum und erhöht die Jahresprognose

https://www.astrazeneca.com/content/dam/az/PDF/2024/9mq3/9M-and-Q3-2024-results-announcement.pdf

Nach den jüngsten Nachrichten über Untersuchungen der chinesischen Strafverfolgungsbehörden gegen Mitarbeiter des Unternehmens werden die Aktien mit deutlichem Abschlag gehandelt.

https://www.astrazeneca.com/content/dam/az/PDF/2024/9mq3/9M-and-Q3-2024-results-announcement.pdf

Nach den jüngsten Nachrichten über Untersuchungen der chinesischen Strafverfolgungsbehörden gegen Mitarbeiter des Unternehmens werden die Aktien mit deutlichem Abschlag gehandelt.

As previously disclosed, the Company is aware of a number of individual investigations by the Chinese authorities into current and former AstraZeneca employees. To the best of the Company’s knowledge, the investigations include allegations of medical insurance fraud, illegal drug mportation and personal information breaches.

Recently Leon Wang, EVP International and AstraZeneca China President was detained. The Company has not received any notification that it is itself under investigation. If requested, AstraZeneca will fully cooperate with the Chinese authorities.

Total Revenue is expected to increase by a high teens percentage (previously a mid teens percentage)

Core EPS is expected to increase by a high teens percentage (previously a mid teens percentage)

AstraZeneca hat einen neuen China Chef

https://edition.cnn.com/2024/12/05/business/china-astrazeneca-detained-hnk-intl/index.html

Leon Wang scheint in den Justizmühlen erst mal verschwunden zu sein und es gibt nur Vermutungen zu den Ursachen seiner Verhaftung.

https://edition.cnn.com/2024/12/05/business/china-astrazeneca-detained-hnk-intl/index.html

Leon Wang scheint in den Justizmühlen erst mal verschwunden zu sein und es gibt nur Vermutungen zu den Ursachen seiner Verhaftung.

AstraZeneca mit US Deal - die Direktvermarktung von Medikamenten soll deutliche Preisnachlässe für Medikamente in den USA ermöglichen

https://www.zeit.de/politik/ausland/2025-10/usa-medikamentenpreise-astrazeneca-donald-trump

https://www.zeit.de/politik/ausland/2025-10/usa-medikamentenpreise-astrazeneca-donald-trump

Das Abkommen mit AstraZeneca gilt als Vorlage für weitere Vereinbarungen, mit denen die US-Regierung die Preise für verschreibungspflichtige Medikamente in den USA senken will. AstraZeneca hatte bereits im Juli angekündigt, bis 2030 rund 50 Milliarden Dollar in die Produktion sowie Forschung und Entwicklung in den USA investieren zu wollen. Soriot bezeichnete den Konzern zuletzt als "sehr amerikanisches Unternehmen" und kündigte eine Börsennotierung in den USA an.

Pfizer hat ein ähnliches Abkommen mit der Trump Administration abgeschlossen.

Stopped prediction by ValueFreak for AstraZeneca plc

AstraZeneca plc

Start price

Target price

Perf. (%)

€91.61

03.06.21

03.06.21

€115.00

03.06.22

03.06.22

34.21%

04.06.22

04.06.22

Could be worthwhile Investment >10% per year

Revenue growth >5% per year expected

EBIT growth >5% per year expected

positive Cash Flow expected

AstraZeneca plc

Start price

Target price

Perf. (%)

€82.10

28.12.20

28.12.20

€95.00

1.94%

11.01.21

11.01.21

Could be worthwhile Investment >10% per year

Revenue growth >5% per year expected

EBIT growth >5% per year expected

positive Cash Flow expected