Lowes Companies Inc. buy marge

Summary

This prediction ended on 05.11.21 with a price of €206.50. The BUY prediction by marge for Lowes Companies Inc. saw massive gains of 137.02%. Dividends of €6.35 are taken into consideration when calculating the performance. marge has 50% into this predictionPerformance without dividends (%)

| Name | 1w | 1m | 1y | 3y |

|---|---|---|---|---|

| Lowes Companies Inc. | -5.844% | -5.844% | -5.106% | 16.313% |

| iShares Core DAX® | -0,38 % | 1,09 % | 11,64 % | 60,42 % |

| iShares Nasdaq 100 | -0,41 % | -1,97 % | 7,27 % | 87,82 % |

| iShares Nikkei 225® | 1,84 % | 10,26 % | 31,38 % | 66,93 % |

| iShares S&P 500 | -0,71 % | 0,44 % | 4,30 % | 60,46 % |

Comments by marge for this prediction

In the thread Lowes Companies Inc. diskutieren

Lowe's: The Best Low-Risk Turnaround Story On Wall Street

marge stimmt am 13.01.2019 der Outperform-Einschätzung der institutionellen Analysten mit dem Kursziel 111.23$ zu.

Founded in 1946, Lowe's is the world's second largest home improvement retailer. Lowe's and Home Depot dominate the large but highly fragmented home improvement market. In fact, while Lowe's over 2,000 stores make it the second biggest player in its industry, it still has just 8% market share.

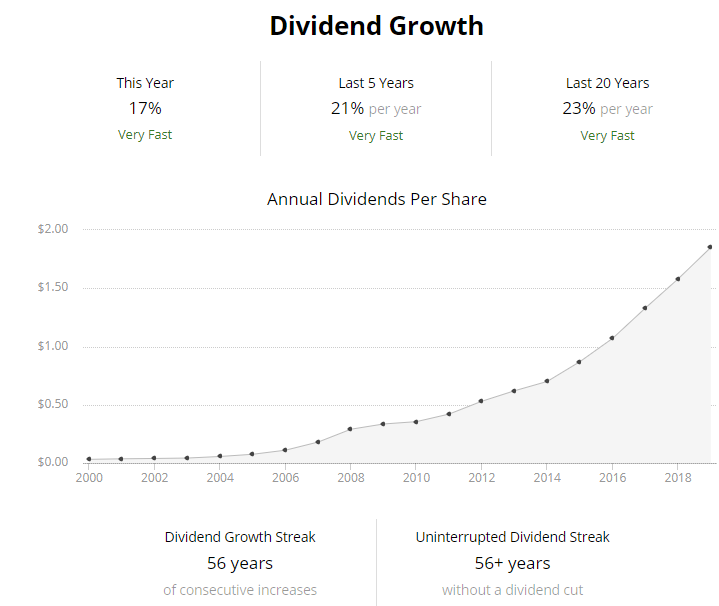

Lowe's dominance in home improvement retail, surpassed only by Home Depot's, has served investors well, including 56 consecutive years of dividend growth. More impressive is that the dividend has grown at 23% over the past 20 years.

In 2019, Lowe's expects greater capex spending to cause free cash flow to come in at $4.9 billion, down 8% compared to the trailing 12 months. However, using the last year's worth of dividends, that amounts to a 29% FCF payout ratio. In other words, Lowe's will be investing heavily into improving and ultimately growing its business while still having plenty of free cash flow left over for buybacks of its undervalued shares.

In the thread Trading Lowes Companies Inc.