News

Temenos erreicht marktführenden Net Promoter Score, der den Vertrauensstatus und Kundenerfolg unterstreicht

Der NPS von +54 spiegelt den Vertrauensstatus von Temenos bei den Kunden und seine führende Rolle als bevorzugte Banking-Plattform wider

GENF, Feb. 09, 2024 (GLOBE NEWSWIRE) -- Temenos (SIX: TEMN)

Temenos erreicht marktführenden Net Promoter Score, der den Vertrauensstatus und Kundenerfolg unterstreicht

Der NPS von +54 spiegelt den Vertrauensstatus von Temenos bei den Kunden und seine führende Rolle als bevorzugte Banking-Plattform wider

GENF, Feb. 09, 2024 (GLOBE NEWSWIRE) -- Temenos (SIX: TEMN)

Die meistgehandelten Produkte: Anleger weiter optimistisch

Beflügelt von den Aussagen der FED vom Vorabend, springt der DAX® zum Handelsstart kurzfristig über die 17.000 Punkte Marke und erzielt ein neues Allzeithoch. Im Anschluss musste er wieder einen

Die meistgehandelten Produkte: Anleger weiter optimistisch

Beflügelt von den Aussagen der FED vom Vorabend, springt der DAX® zum Handelsstart kurzfristig über die 17.000 Punkte Marke und erzielt ein neues Allzeithoch. Im Anschluss musste er wieder einen

Die meistgehandelten Produkte: Anleger bei Silber und DAX® bullish

Der DAX® näherte sich heute morgen wieder seinem Allzeithoch an. Mit einem bisherigen Tageshoch von 16.836 Punkten hat der DAX® fast seine Bestmarke wieder geknackt. Im Verlauf des Abends wird

Die meistgehandelten Produkte: Anleger bei Silber und DAX® bullish

Der DAX® näherte sich heute morgen wieder seinem Allzeithoch an. Mit einem bisherigen Tageshoch von 16.836 Punkten hat der DAX® fast seine Bestmarke wieder geknackt. Im Verlauf des Abends wird

Die meistgehandelten Produkte: Deutsche Bank Calls gefragt

Zum heutigen Börsenstart haben die Bullen das Zepter am Aktienmakt wieder im Griff und schoben den DAX® im frühen Handel in den Bereich von 16.210 Punkte. Die Bundesagentur für Arbeit vermeldete

Die meistgehandelten Produkte: Deutsche Bank Calls gefragt

Zum heutigen Börsenstart haben die Bullen das Zepter am Aktienmakt wieder im Griff und schoben den DAX® im frühen Handel in den Bereich von 16.210 Punkte. Die Bundesagentur für Arbeit vermeldete

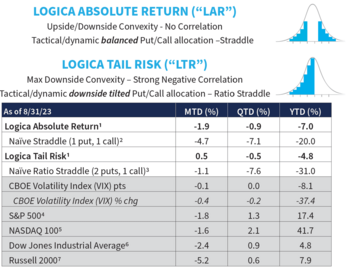

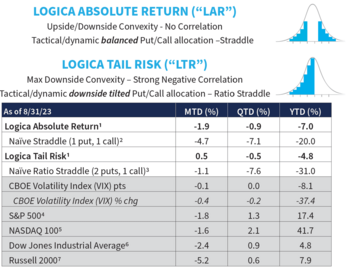

Logica Capital August 2023 Commentary

Logica Capital commentary for the month ended August 31, 2023.

Summary

Equity markets stumbled a tad in August, and VIX/Implied Volatility didn’t respond, as demonstrated by the concurrent negative

Logica Capital August 2023 Commentary

Logica Capital commentary for the month ended August 31, 2023.

Summary

Equity markets stumbled a tad in August, and VIX/Implied Volatility didn’t respond, as demonstrated by the concurrent negative

The Magnificent Seven Too React To Interest Rates

In his Daily Market Notes report to investors, Louis Navellier wrote:

Bonds Leading Stocks

Stocks are trying to eke out a gain to the end of the week. Bonds are cooperating, but it's no major

The Magnificent Seven Too React To Interest Rates

In his Daily Market Notes report to investors, Louis Navellier wrote:

Bonds Leading Stocks

Stocks are trying to eke out a gain to the end of the week. Bonds are cooperating, but it's no major

Poor Company Getting Better – Leidos Holdings Inc. (LDOS)

The Broad Market Index was down 0.31% last week and 46% of stocks out-performed the index.

Maintaining large cash balances to defend against a market decline is now easier than ever. With

Poor Company Getting Better – Leidos Holdings Inc. (LDOS)

The Broad Market Index was down 0.31% last week and 46% of stocks out-performed the index.

Maintaining large cash balances to defend against a market decline is now easier than ever. With

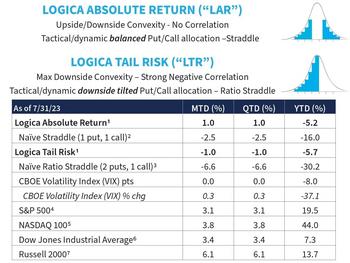

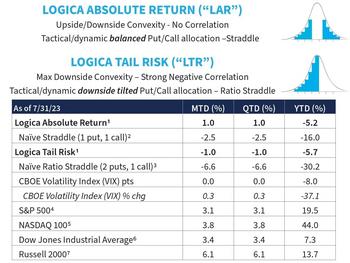

Logica Capital July 2023 Commentary

Logica Capital commentary for the month ended July 31, 2023.

Summary

Markets continued their broad rally in July, with all of the 4 major indices gaining more than +3.0%. In fact, all 11

Logica Capital July 2023 Commentary

Logica Capital commentary for the month ended July 31, 2023.

Summary

Markets continued their broad rally in July, with all of the 4 major indices gaining more than +3.0%. In fact, all 11

Investors Go into Risk-Off Mode for the Fund-Flows Week

Investors were net purchasers of fund assets (including those of conventional funds and ETFs) for the third week in four, injecting a net $10.8 billion for the LSEG Lipper fund-flows week ended

Investors Go into Risk-Off Mode for the Fund-Flows Week

Investors were net purchasers of fund assets (including those of conventional funds and ETFs) for the third week in four, injecting a net $10.8 billion for the LSEG Lipper fund-flows week ended

Soft Economic Data Falls Short of Threatening Soft Landing Expectations

In his Daily Market Notes report to investors, Louis Navellier wrote:

The 10-yr yield is back over 4%, and stock indexes are modestly lower early with the exception of the Dow.

Soft Landing

Soft Economic Data Falls Short of Threatening Soft Landing Expectations

In his Daily Market Notes report to investors, Louis Navellier wrote:

The 10-yr yield is back over 4%, and stock indexes are modestly lower early with the exception of the Dow.

Soft Landing

The Dow Has Been Playing A Rapid Game Of Catchup

In his Daily Market Notes report to investors, Louis Navellier wrote:

Stocks grind higher, interest rates softer, gold breaks above $2,000, crude higher.

Dow Catching Up

Another big week

The Dow Has Been Playing A Rapid Game Of Catchup

In his Daily Market Notes report to investors, Louis Navellier wrote:

Stocks grind higher, interest rates softer, gold breaks above $2,000, crude higher.

Dow Catching Up

Another big week

3 Ways Robo-Advisors Beat Investing On Your Own

It’s been nearly a decade and a half since the first robo-advisor, Betterment, emerged on the scene with its innovative automated portfolios of low-cost exchange-traded funds (ETFs), and the

3 Ways Robo-Advisors Beat Investing On Your Own

It’s been nearly a decade and a half since the first robo-advisor, Betterment, emerged on the scene with its innovative automated portfolios of low-cost exchange-traded funds (ETFs), and the

The Year The Index Achieved 13 Days of Positive Returns

All Right, Life Goal Nation! Investment markets have been thriving, showcasing an exceptional performance with the Dow Jones Index experiencing an impressive streak of consecutive positive returns.