News

Logica Capital July 2023 Commentary

Logica Capital commentary for the month ended July 31, 2023.

Summary

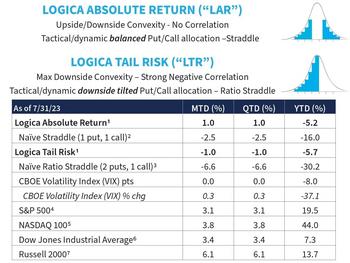

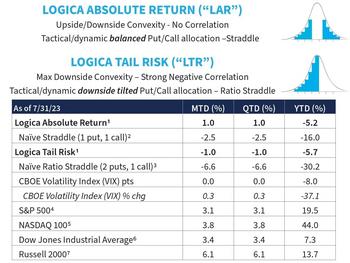

Markets continued their broad rally in July, with all of the 4 major indices gaining more than +3.0%. In fact, all 11

Logica Capital July 2023 Commentary

Logica Capital commentary for the month ended July 31, 2023.

Summary

Markets continued their broad rally in July, with all of the 4 major indices gaining more than +3.0%. In fact, all 11

Investors Go into Risk-Off Mode for the Fund-Flows Week

Investors were net purchasers of fund assets (including those of conventional funds and ETFs) for the third week in four, injecting a net $10.8 billion for the LSEG Lipper fund-flows week ended

Investors Go into Risk-Off Mode for the Fund-Flows Week

Investors were net purchasers of fund assets (including those of conventional funds and ETFs) for the third week in four, injecting a net $10.8 billion for the LSEG Lipper fund-flows week ended

Soft Economic Data Falls Short of Threatening Soft Landing Expectations

In his Daily Market Notes report to investors, Louis Navellier wrote:

The 10-yr yield is back over 4%, and stock indexes are modestly lower early with the exception of the Dow.

Soft Landing

Soft Economic Data Falls Short of Threatening Soft Landing Expectations

In his Daily Market Notes report to investors, Louis Navellier wrote:

The 10-yr yield is back over 4%, and stock indexes are modestly lower early with the exception of the Dow.

Soft Landing

The Dow Has Been Playing A Rapid Game Of Catchup

In his Daily Market Notes report to investors, Louis Navellier wrote:

Stocks grind higher, interest rates softer, gold breaks above $2,000, crude higher.

Dow Catching Up

Another big week

The Dow Has Been Playing A Rapid Game Of Catchup

In his Daily Market Notes report to investors, Louis Navellier wrote:

Stocks grind higher, interest rates softer, gold breaks above $2,000, crude higher.

Dow Catching Up

Another big week

3 Ways Robo-Advisors Beat Investing On Your Own

It’s been nearly a decade and a half since the first robo-advisor, Betterment, emerged on the scene with its innovative automated portfolios of low-cost exchange-traded funds (ETFs), and the

3 Ways Robo-Advisors Beat Investing On Your Own

It’s been nearly a decade and a half since the first robo-advisor, Betterment, emerged on the scene with its innovative automated portfolios of low-cost exchange-traded funds (ETFs), and the

The Year The Index Achieved 13 Days of Positive Returns

All Right, Life Goal Nation! Investment markets have been thriving, showcasing an exceptional performance with the Dow Jones Index experiencing an impressive streak of consecutive positive returns.

The Year The Index Achieved 13 Days of Positive Returns

All Right, Life Goal Nation! Investment markets have been thriving, showcasing an exceptional performance with the Dow Jones Index experiencing an impressive streak of consecutive positive returns.

The Fed’s Focus On Real Rates

In his Daily Market Notes report to investors, Louis Navellier wrote:

Biggest Earnings Week

The biggest week of the earnings season is upon us. Plus the Fed’s next increase.

This week

The Fed’s Focus On Real Rates

In his Daily Market Notes report to investors, Louis Navellier wrote:

Biggest Earnings Week

The biggest week of the earnings season is upon us. Plus the Fed’s next increase.

This week

Pessimism Is Popular, But Optimism Is More Profitable

For weekend reading, Gary Alexander, senior writer at Navellier & Associates, offers the following commentary:

The Conference Board – those folks that said a recession was “99% certain” this

Pessimism Is Popular, But Optimism Is More Profitable

For weekend reading, Gary Alexander, senior writer at Navellier & Associates, offers the following commentary:

The Conference Board – those folks that said a recession was “99% certain” this

The Market Is Broadening The Rally

In his Daily Market Notes report to investors, Louis Navellier wrote:

Positive Trends

Stocks continue to rise, interest rates are lower, gold and crude higher, as earnings season heats up.

The Market Is Broadening The Rally

In his Daily Market Notes report to investors, Louis Navellier wrote:

Positive Trends

Stocks continue to rise, interest rates are lower, gold and crude higher, as earnings season heats up.

Taxable Bond ETFs and Conventional Funds Attract Net Inflows for the Fund-Flows Week

Investors were net sellers of fund assets (including those of conventional funds and ETFs) for the third week in four, withdrawing a net $18.0 billion for the LSEG Lipper fund-flows week ended

Taxable Bond ETFs and Conventional Funds Attract Net Inflows for the Fund-Flows Week

Investors were net sellers of fund assets (including those of conventional funds and ETFs) for the third week in four, withdrawing a net $18.0 billion for the LSEG Lipper fund-flows week ended

Die meistgehandelten Produkte: Tesla, Netflix und JP Morgan Chase gefragt

Der Dax® ist nach Verlusten letzter Woche leicht positiv in den Handel gestartet. Die kommende Berichtssaison wird für die nächsten Wochen im Fokus der Anleger sein. Im Moment setzt der Großteil der

Die meistgehandelten Produkte: Tesla, Netflix und JP Morgan Chase gefragt

Der Dax® ist nach Verlusten letzter Woche leicht positiv in den Handel gestartet. Die kommende Berichtssaison wird für die nächsten Wochen im Fokus der Anleger sein. Im Moment setzt der Großteil der

Market Turmoil: Act Before The Federal Reserve Does

Now is the time for investors to prepare for the Federal Reserve to resume interest rate hikes, which will impact global stock markets, warns the CEO and founder of one of the world’s largest

Market Turmoil: Act Before The Federal Reserve Does

Now is the time for investors to prepare for the Federal Reserve to resume interest rate hikes, which will impact global stock markets, warns the CEO and founder of one of the world’s largest

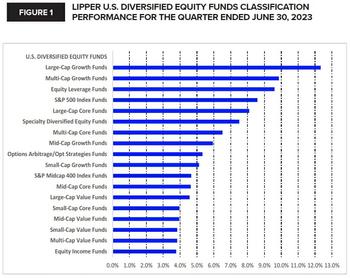

Equity Funds Post Their Third Straight Quarter Of Plus-Side Returns For Q2 2023

Summary:

- For Q2 2023, equity funds (+4.36% on average) posted their third quarterly gain in a row.

- Lipper’s U.S. Diversified Equity Funds macro-classification (+6.25%) outpaced the other six