News

3 Oil & Gas Gear Makers With Triple-Digit EPS Growth Forecasts

The energy sector was leading the market on August 17, while eight of the 12 S&P sectors traded lower.

Among the gainers were oilfield services providers Schlumberger Ltd. (NYSE: SLB) and

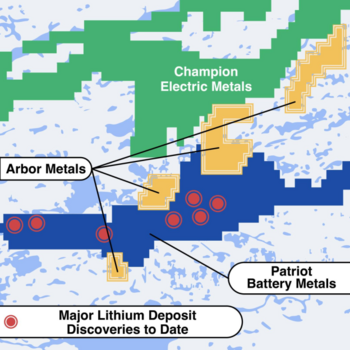

Arbor Metals Encouraged by Albemarle’s Investment in St. James Lithium Camp

Vancouver, Canada – August 9, 2023 - Arbor Metals Corp. (“Arbor” or the “Company”) (TSXV: ABR, FWB: 432) is encouraged by Albemarle Corp.'s (NYSE: ALB) recent investment of $109 million in

‘Dogs of the Dow’ Decade Edition...More Pains or Gains Ahead?

The ‘Dogs of the Dow’ investment strategy became popular in the early 1990’s when author Michael O’Higgins wrote a book titled “Beating the Dow - A High Return, Low-Risk Method for Investing in

Why Investors Should Be Loving C.F. Industries This Summer

As the United States economy continues to show signs of a potential contraction, especially after following the nine-month consecutive contracting readings in the ISM manufacturing PMI index, some

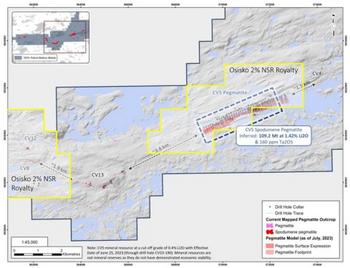

Osisko Congratulates Patriot Battery Metals on its Maiden Mineral Resource Estimate at Corvette & Subsequent Strategic Investment by Albemarle Corporation

MONTREAL, August 01, 2023 — Osisko Gold Royalties Ltd (“Osisko”) (OR: TSX & NYSE - https://www.commodity-tv.com/ondemand/companies/profil/osisko-gold-royalties-ltd/) is pleased to

FMC Drops Below $100, Investors Cultivate Positions

Agricultural sciences leader FMC Corporation (NYSE: FMC) slashed its second quarter and full-year outlook last week, sparking a high-volume selloff. The market’s response since suggests a plowed

Why Mosaic's Price Targets May Be Understated

Shares of Mosaic (NYSE: MOS) have been on a steady downtrend since their peak price of $79.28 per share in April 2022. The decline had only accelerated with a more substantial fall lasting for the

Rebound Rallies? The Dow's 2 Most Oversold Stocks Are Stabilizing

The U.S. stock market is in a bull market!

Last week’s big headline is undoubtedly good news but should’ve come with an asterisk. More specifically, the S&P 500 index closed up more than 20% from

The ‘Other’ Coke Stock Quietly Hits a Record High

Coca-Cola Europacific Partners plc (NYSE: CCEP) is one of a six-pack of ways to invest in classic beverage maker Coke — and a darn good one at that.

Over the last 12 months, the world’s largest

Analyst Flags Concerns About P&G Growth Despite Earnings Beat

If you look around your house you’re almost certain to find Procter & Gamble Co. (NYSE: PG) brands somewhere in the kitchen or bathroom.

While the company’s products are well-known and

American Water Works Doesn’t Come Cheap, but it May be Worth It

Normally you don’t hear premium valuation and utility stock mentioned in the same context. But that’s what investors need to consider with American Water Works Co. (NYSE: AWK). The venerable water

Buying the Dip On Albemarle, Fundamentals Still Sound

Certain mining stocks are falling after the Chilean government announced its plan to change the nation's stance toward the mining industry, rightfully worrying most investors. Chile has delivered

Temenos erreicht marktführenden Net Promoter Score, der den Vertrauensstatus und Kundenerfolg unterstreicht

Der NPS von +54 spiegelt den Vertrauensstatus von Temenos bei den Kunden und seine führende Rolle als bevorzugte Banking-Plattform wider

GENF, Feb. 09, 2024 (GLOBE NEWSWIRE) -- Temenos (SIX: TEMN)

Die meistgehandelten Produkte: Anleger weiter optimistisch

Beflügelt von den Aussagen der FED vom Vorabend, springt der DAX® zum Handelsstart kurzfristig über die 17.000 Punkte Marke und erzielt ein neues Allzeithoch. Im Anschluss musste er wieder einen

Die meistgehandelten Produkte: Anleger bei Silber und DAX® bullish

Der DAX® näherte sich heute morgen wieder seinem Allzeithoch an. Mit einem bisherigen Tageshoch von 16.836 Punkten hat der DAX® fast seine Bestmarke wieder geknackt. Im Verlauf des Abends wird

Die meistgehandelten Produkte: Deutsche Bank Calls gefragt

Zum heutigen Börsenstart haben die Bullen das Zepter am Aktienmakt wieder im Griff und schoben den DAX® im frühen Handel in den Bereich von 16.210 Punkte. Die Bundesagentur für Arbeit vermeldete

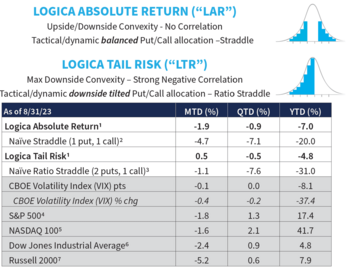

Logica Capital August 2023 Commentary

Logica Capital commentary for the month ended August 31, 2023.

Summary

Equity markets stumbled a tad in August, and VIX/Implied Volatility didn’t respond, as demonstrated by the concurrent negative

Stock Prices Are Schizophrenic And It’s About To Get Rocky…

I woke up a very proud dad.

It was my daughter’s first day of kindergarten yesterday. And I’m not afraid to admit I had tears walking her to school in her little green uniform.

The parents

The Magnificent Seven Too React To Interest Rates

In his Daily Market Notes report to investors, Louis Navellier wrote:

Bonds Leading Stocks

Stocks are trying to eke out a gain to the end of the week. Bonds are cooperating, but it's no major

Poor Company Getting Better – Leidos Holdings Inc. (LDOS)

The Broad Market Index was down 0.31% last week and 46% of stocks out-performed the index.

Maintaining large cash balances to defend against a market decline is now easier than ever. With

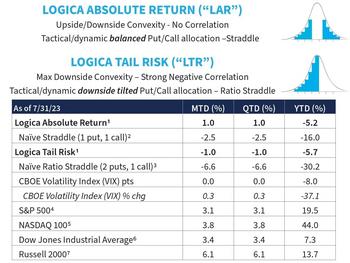

Logica Capital July 2023 Commentary

Logica Capital commentary for the month ended July 31, 2023.

Summary

Markets continued their broad rally in July, with all of the 4 major indices gaining more than +3.0%. In fact, all 11

Investors Go into Risk-Off Mode for the Fund-Flows Week

Investors were net purchasers of fund assets (including those of conventional funds and ETFs) for the third week in four, injecting a net $10.8 billion for the LSEG Lipper fund-flows week ended

Soft Economic Data Falls Short of Threatening Soft Landing Expectations

In his Daily Market Notes report to investors, Louis Navellier wrote:

The 10-yr yield is back over 4%, and stock indexes are modestly lower early with the exception of the Dow.

Soft Landing

The Dow Has Been Playing A Rapid Game Of Catchup

In his Daily Market Notes report to investors, Louis Navellier wrote:

Stocks grind higher, interest rates softer, gold breaks above $2,000, crude higher.

Dow Catching Up

Another big week

3 Ways Robo-Advisors Beat Investing On Your Own

It’s been nearly a decade and a half since the first robo-advisor, Betterment, emerged on the scene with its innovative automated portfolios of low-cost exchange-traded funds (ETFs), and the