News

Die meistgehandelten Produkte: Deutsche Bank Calls gefragt

Zum heutigen Börsenstart haben die Bullen das Zepter am Aktienmakt wieder im Griff und schoben den DAX® im frühen Handel in den Bereich von 16.210 Punkte. Die Bundesagentur für Arbeit vermeldete

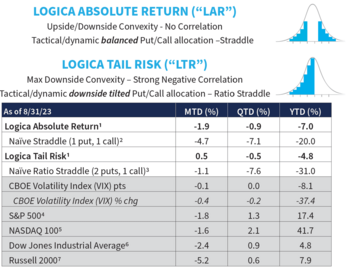

Logica Capital August 2023 Commentary

Logica Capital commentary for the month ended August 31, 2023.

Summary

Equity markets stumbled a tad in August, and VIX/Implied Volatility didn’t respond, as demonstrated by the concurrent negative

The Magnificent Seven Too React To Interest Rates

In his Daily Market Notes report to investors, Louis Navellier wrote:

Bonds Leading Stocks

Stocks are trying to eke out a gain to the end of the week. Bonds are cooperating, but it's no major

Poor Company Getting Better – Leidos Holdings Inc. (LDOS)

The Broad Market Index was down 0.31% last week and 46% of stocks out-performed the index.

Maintaining large cash balances to defend against a market decline is now easier than ever. With

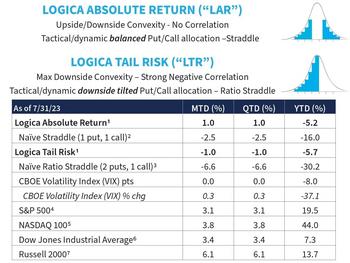

Logica Capital July 2023 Commentary

Logica Capital commentary for the month ended July 31, 2023.

Summary

Markets continued their broad rally in July, with all of the 4 major indices gaining more than +3.0%. In fact, all 11

Investors Go into Risk-Off Mode for the Fund-Flows Week

Investors were net purchasers of fund assets (including those of conventional funds and ETFs) for the third week in four, injecting a net $10.8 billion for the LSEG Lipper fund-flows week ended

Soft Economic Data Falls Short of Threatening Soft Landing Expectations

In his Daily Market Notes report to investors, Louis Navellier wrote:

The 10-yr yield is back over 4%, and stock indexes are modestly lower early with the exception of the Dow.

Soft Landing

The Dow Has Been Playing A Rapid Game Of Catchup

In his Daily Market Notes report to investors, Louis Navellier wrote:

Stocks grind higher, interest rates softer, gold breaks above $2,000, crude higher.

Dow Catching Up

Another big week

3 Ways Robo-Advisors Beat Investing On Your Own

It’s been nearly a decade and a half since the first robo-advisor, Betterment, emerged on the scene with its innovative automated portfolios of low-cost exchange-traded funds (ETFs), and the

The Year The Index Achieved 13 Days of Positive Returns

All Right, Life Goal Nation! Investment markets have been thriving, showcasing an exceptional performance with the Dow Jones Index experiencing an impressive streak of consecutive positive returns.

The Fed’s Focus On Real Rates

In his Daily Market Notes report to investors, Louis Navellier wrote:

Biggest Earnings Week

The biggest week of the earnings season is upon us. Plus the Fed’s next increase.

This week

Pessimism Is Popular, But Optimism Is More Profitable

For weekend reading, Gary Alexander, senior writer at Navellier & Associates, offers the following commentary:

The Conference Board – those folks that said a recession was “99% certain” this

The Market Is Broadening The Rally

In his Daily Market Notes report to investors, Louis Navellier wrote:

Positive Trends

Stocks continue to rise, interest rates are lower, gold and crude higher, as earnings season heats up.

Taxable Bond ETFs and Conventional Funds Attract Net Inflows for the Fund-Flows Week

Investors were net sellers of fund assets (including those of conventional funds and ETFs) for the third week in four, withdrawing a net $18.0 billion for the LSEG Lipper fund-flows week ended

Die meistgehandelten Produkte: Tesla, Netflix und JP Morgan Chase gefragt

Der Dax® ist nach Verlusten letzter Woche leicht positiv in den Handel gestartet. Die kommende Berichtssaison wird für die nächsten Wochen im Fokus der Anleger sein. Im Moment setzt der Großteil der

Market Turmoil: Act Before The Federal Reserve Does

Now is the time for investors to prepare for the Federal Reserve to resume interest rate hikes, which will impact global stock markets, warns the CEO and founder of one of the world’s largest

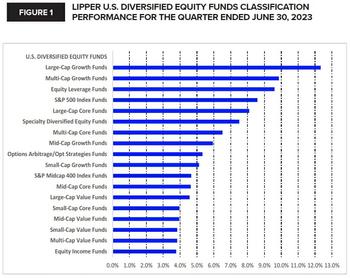

Equity Funds Post Their Third Straight Quarter Of Plus-Side Returns For Q2 2023

Summary:

- For Q2 2023, equity funds (+4.36% on average) posted their third quarterly gain in a row.

- Lipper’s U.S. Diversified Equity Funds macro-classification (+6.25%) outpaced the other six

Die meistgehandelten Produkte: Trader setzen auf eine Korrektur

Das Sentiment der Anleger Dax® ist trotz des starken Schlusses letzter Woche negativ. Sie setzen mit teils hohen Hebel auf eine Kursumkehr. Die amerikanischen Leitindizes S&P500® und DowJones® sind

It’s Hard Not To Call This A New Bull Market

In his Daily Market Notes report to investors, Louis Navellier wrote:

A New Bull Market

The market ends the first half on a high. All signals are green.

The Bears are in retreat. All the

Caution: Likely Market Correction, Opportunity To Invest In Quality Companies

Stock markets are likely to fall this summer, which will provide investors a key buying opportunity to enhance their portfolios, says the CEO and founder of one of the world’s largest independent

Stock Markets Likely To Get ‘Wide Boost’ This Week

Global stock markets are likely to experience a wide boost this week – not just the mega cap tech stocks – as the US Federal Reserve is expected to pause interest rate hikes, says the CEO and

Top-Performing REITs To Watch As U.S. Commercial Real Estate Prices Fall

For the first time in more than a decade, U.S. commercial real estate (CRE) prices have fallen according to data by Moody’s Analytics. The release has now left investors puzzled over the

How Much Did the Fed Raise Interest Rates in 2022?

Last month, the Federal Reserve increased interest rates again, the ninth consecutive increase since the Fed began raising rates in March 2022. While the full effects of the latest rate hike remain

A Shift Back To Retail Earnings

In his Daily Market Notes report to investors, Louis Navellier wrote:

Debt Ceiling Discussions Planned

Lots of Fed-speak, and debt ceiling discussions this morning.

Stocks were higher

Regional Banks Feel The Pressure Of Heightened FDIC Scrutiny

In his Daily Market Notes report to investors, Louis Navellier wrote:

Fed Doublespeak

The Fed doesn’t blink; an increase with no official pause.

The Fed is sticking to their guns and still