News

Investment Headwinds And Tailwinds For The Second Half Of 2023: Navigating Uncertainty

Inflation, a slowing global economy, and high stock valuations present the three major challenges for investors in the second half of 2023. They must be prepared to navigate through ‘significant

Ready To Buy Property After Your Divorce: Here’s 7 Things You Should Know

Dissolution of marriage can be an unsettling experience for any partnership and family. With so much happening over the course of the divorce proceedings, which can take anything from 12 to 18

How Does Raising Interest Rates Lower Inflation?

Between March 2022 and March 2023, the Fed raised the federal funds target rate by 475 basis points or 4.75%. This news was widely covered in the media because it wasn’t immediately clear whether

Attention High Earners: You’re Not Taking Retirement Seriously Enough

Higher-income households are more likely to overestimate their retirement readiness, according to a new analysis from the Center for Retirement Research at Boston College. The findings underscore

How Inflation Affects Your Retirement Plan And Savings

Since the mid-1990s, inflation has stayed very close to the Federal Reserve’s benchmark of 2% per year, often dipping much lower than that. The upshot has been a long run in which prices have

Large Cap Tech And Mining Among The Top 10 Shorted Securities

Sourced from Hazeltree’s proprietary securities finance platform data, which tracks approximately 12,000 global equities, monthly snapshot examines shorting activity across the Americas, EMEA, and

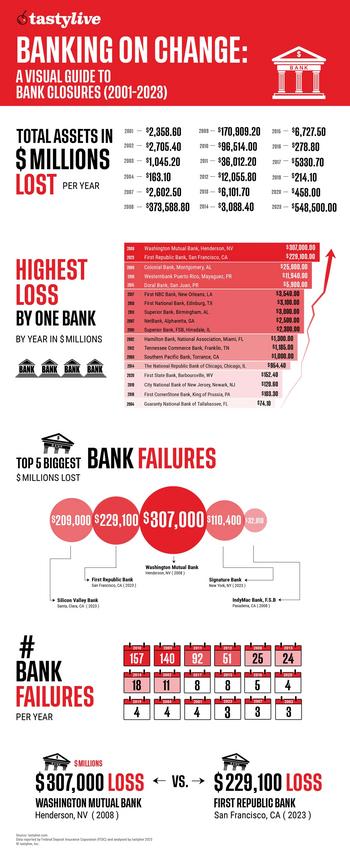

Banking On Change: A Visual Guide To Bank Closures (2001-2023)

Tastylive, one of the fastest growing online global financial networks, today unveils a comprehensive infographic charting Federal Deposit Insurance Corporation (FDIC) data on bank closures and

Is Inflation Slowing Down From Higher Interest Rates?

Many people are wondering if the higher interest rates set by the Federal Reserve are slowing inflation. For nine months straight, the annual inflation rate has been decreasing. However, the

Alarming Number of Working Americans Cash Out Retirement Accounts When Changing Jobs

The very essence of a retirement nest egg lies in the concept of patient growth and compounding of investments over time. Its purpose is to offer a bountiful reserve of funds when one bids farewell

Financial Advisors Reveal How Investors Should Prepare for Potential U.S. Debt Default – 2023 Survey

If Congress doesn’t opt to raise or extend the nation’s debt limit, the United States may run out of the money needed to pay its bills. With this deadline approaching as early as June 1, SmartAsset

Why Is Bitcoin Going Back Up?

Throughout 2022, the economy at large saw some turbulence. But the cryptocurrency market, in particular, experienced a downward slide from its epic heights in 2021. Even the oldest surviving

Are The Risks Facing U.S. Commercial Real Estate, And European And Japanese Banking Systems Contained?

Encouragingly, calm seems to have settled over financial markets after the recent banking woes. But attention has turned to other potential pressures. U.S. commercial real estate and banking