Will Vehicle Electronics Evolution Fuel ADI's Automotive Growth?

Analog Devices ADI has become a crucial player supporting the shift of the automotive industry toward software-defined vehicles, driver assistance technology, electrification and infotainment integration. ADI will also gain traction in Battery Management Systems, Powertrain, Power ICs & Modules, MCUs & Processors, Sensors, which is expected to witness a CAGR 9.1% from 2025 to 2032 to become a $57.5 billion market in 2032, per the report by MarketsAndMarkets.

The automotive segment has contributed 29.7% of fiscal 2025 revenues from 20% in fiscal 2022. The company highlighted in its fourth-quarter fiscal 2025 earnings that its growth is being driven by higher content and share gains in Level 2+ ADAS systems globally, which include sensing, signal processing, connectivity, and functional safety power solutions. These systems require far more analog and mixed-signal complexity than traditional vehicles, where ADI stands out.

ADI has partnered with global manufacturers, and now its portfolio covers products for enriching the in-cabin experience, low emission, navigation, car audio, voice processing and connectivity, battery monitoring and management systems and video processing and connectivity. Analog Devices has cited that traction in Gigabit Multimedia Serial Link, Automotive Audio Bus and Ethernet to the Edge Bus as its major growth engines.

Although the company was facing temporary challenges from tariffs and policy-related decisions of the U.S. government, ADI has been able to gain share in the Chinese vehicle market. Looking ahead, the Zacks Consensus Estimate for the automotive segment’s revenues is pegged at $802.36 for the first quarter of fiscal 2026, indicating year-over-year growth of 9.9%.

How Competitors Fare Against Analog Devices

Analog Devices competes with Texas Instruments TXN and STMicroelectronics STM in the Automotive segment. Texas Instruments competes with ADI in Analog sensors, power ICs, in-vehicle networking/signal chain, and driver assistance electronics.

STMicroelectronics competes in sensors like MEMS and inertial, analog front ends, interface ICs, and microcontrollers. Both Texas Instruments and STMicroelectronics compete with ADI in the broader scope of the Industrial and communication segment.

ADI’s Price Performance, Valuation and Estimates

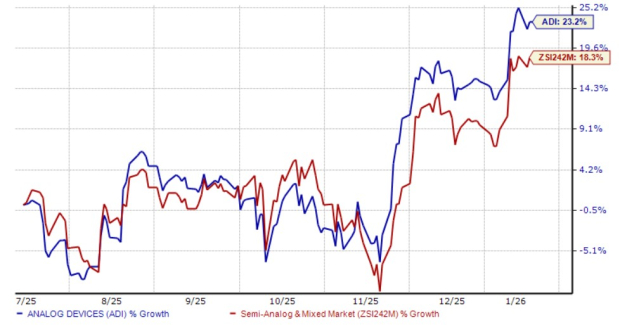

Shares of ADI have gained 23.2% in the past six months compared with the Semiconductor - Analog and Mixed industry’s growth of 18.3%.

ADI 6-Month Performance Chart

Image Source: Zacks Investment Research

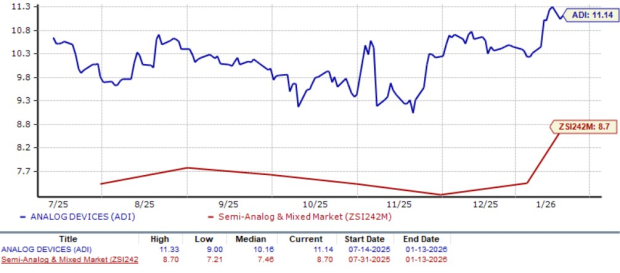

From a valuation standpoint, ADI trades at a forward price-to-sales ratio of 11.14X, higher than the industry’s average of 8.7X.

ADI Forward 12-Month (P/S) Valuation Chart

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for ADI’s fiscal 2026 and 2027 earnings implies year-over-year growth of 25.67% and 12.56%, respectively. The consensus estimate for fiscal 2026 and 2027 has been revised upward in the past 30 days.

Image Source: Zacks Investment Research

ADI currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Just Released: Zacks Top 10 Stocks for 2026

Hurry – you can still get in early on our 10 top tickers for 2026. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful.

From inception in 2012 through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2026. You can still be among the first to see these just-released stocks with enormous potential.

See New Top 10 Stocks >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Analog Devices, Inc. (ADI): Free Stock Analysis Report

Texas Instruments Incorporated (TXN): Free Stock Analysis Report

STMicroelectronics N.V. (STM): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com