Updated on November 9th, 2020 by Aristofanis Papadatos

Uber Technologies (UBER) had its widely-anticipated IPO in May-2019 at a price of $45 per share. Since then, the stock has been on a roller-coaster. It slumped shortly after its IPO due to concerns over rich valuation, it then retrieved its losses thanks to strong business performance but the stock plunged once again this year due to the pandemic.

However, Uber has been on a recovery path since the unprecedented lockdowns in March and thus it is now trading near its IPO price.

Uber has a market capitalization of $79 billion. Still, many large-cap tech stocks like Uber do not pay dividends to shareholders. While Uber has never paid a dividend, many other stocks have maintained long histories of dividend growth, such as the Dividend Aristocrats.

The Dividend Aristocrats are a group of 65 stocks in the S&P 500 Index, with 25+ consecutive years of dividend growth. You can see all 65 Dividend Aristocrats here.

Additionally, you can download a full list of all 65 Dividend Aristocrats, along with important metrics that matter (such as dividend yields and price-to-earnings ratios) by clicking on the link below:

As the company is in the early phases of a multi-year growth trajectory, it would be a myopic approach to focus on the short-term gyrations of the stock price. Instead, investors should try to evaluate the long-term prospects of this innovative company.

Nevertheless, the big question for income investors is whether Uber will ever pay a dividend.

Business Overview

Uber develops and supports technology applications that enable independent providers of ridesharing, meal preparation, and delivery services to transact with riders and eaters worldwide. Its driver partners provide ridesharing through a wide range of vehicles while its restaurant and delivery partners provide meal preparation and delivery services under the Uber Eats brand.

Uber has spent an entire decade in order to build its extensive network and improve its applications. It is currently present in more than 900 cities in 69 countries and aims to offer exceptional returns to its shareholders thanks to a new secular trend, namely the shift of consumers away from car ownership, towards transportation-as-a-service. According to its major competitor Lyft (LYFT), approximately 300,000 people have sold their cars in order to switch to transportation-as-a-service.

Related: Will Lyft Ever Pay A Dividend?

Uber has grown its revenues at a breathtaking rate in the last four years. However, it is facing an unprecedented downturn this year due to the coronavirus crisis, which has caused a severe global recession and has forced people to stay at home more than ever.

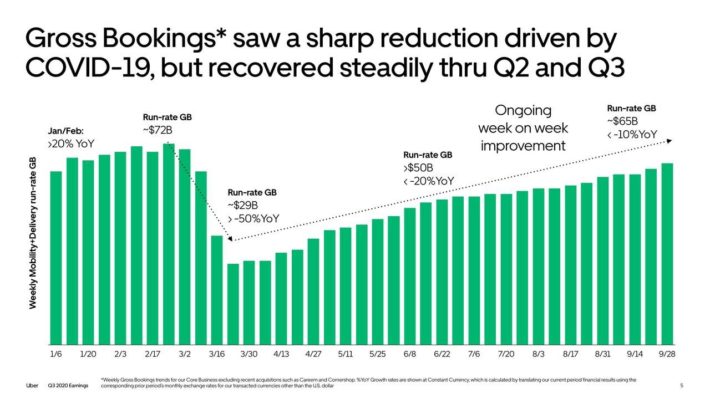

In March, which was characterized by unprecedented lockdowns, Uber saw its gross bookings plunge 50% Y/Y. However, gross bookings bottomed in March and they have been in a steady recovery since then thanks to the reopening of the economies worldwide.

In early November, Uber reported its financial results for the third quarter of 2020. The gross bookings of the company continued to recover and thus they improved from $10.2 billion in the second quarter to $14.7 billion. This level is just 10% lower than last year’s level.

Source: Investor Presentation

As shown in the chart above, Uber has been in strong recovery mode since the initial shock from the pandemic.

The steep recovery has been driven primarily by immense growth in the delivery business. In the third quarter, gross mobility bookings plunged 50% over the prior year’s quarter but gross delivery bookings jumped 135%, thus offsetting most of the effect of the pandemic and resulting in a modest 10% decrease in the total bookings.

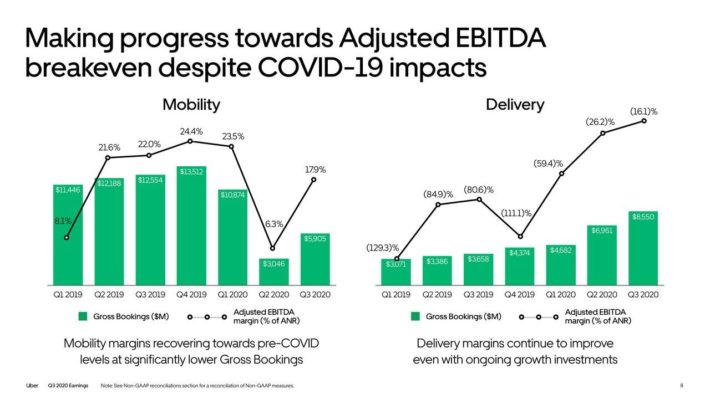

Source: Investor Presentation

This is very important, as the delivery business is essentially immune to the pandemic and actually benefits from the pandemic, given that people order food at home much more often than they visit a restaurant. In other words, Uber has now adopted a growth strategy that is much more resilient to the pandemic than it was until this year.

On the one hand, the ongoing second wave of the pandemic, which has caused many new lockdowns worldwide, is likely to weigh on the results of Uber in the short term. On the other hand, Uber has become more resilient to the pandemic thanks to its focus on the delivery business.

Moreover, management believes that there is tremendous growth potential ahead, as the current active-platform consumers represent only 2% of the population in the 69 countries in which Uber is present while the total addressable market is estimated to be a $12 trillion business on an annual basis. It is also worth noting that Uber accounts for less than 1% of all the miles driven globally.

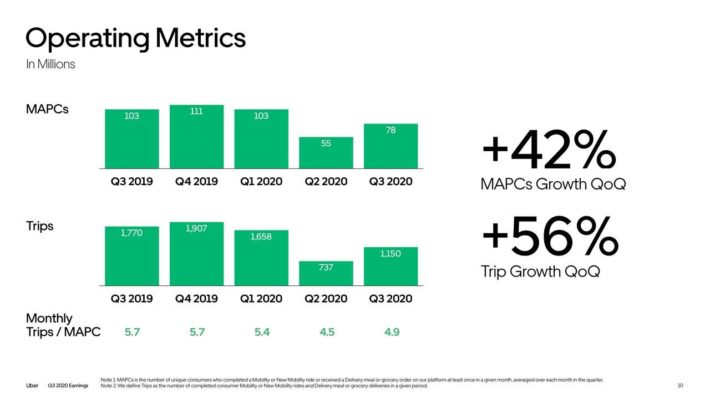

While these facts and figures are certainly promising, there are some points of concern. For instance, the monthly trips per active consumer have stalled around 5.0 for ten consecutive quarters.

Source: Investor Presentation

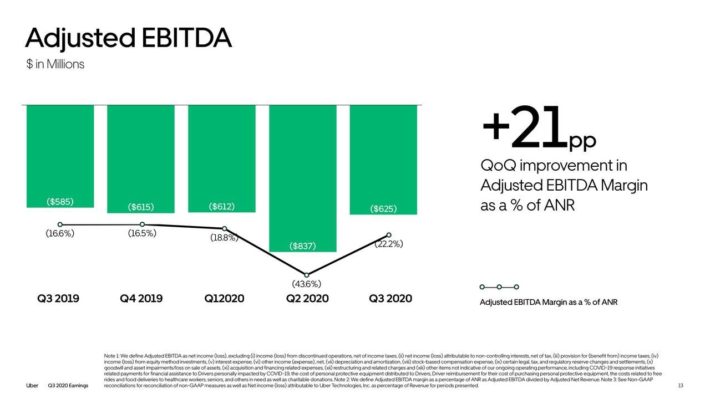

Moreover, the business is still far from becoming profitable. Uber has posted a loss in every single quarter, excluding special factors.

In addition, while its losses narrowed temporarily in early 2018, they widened shortly after and have remained elevated in the last two years.

Source: Investor Presentation

There are two majors reasons behind the recurring losses. First of all, Uber needs to invest heavily in its business in order to convince consumers to change their driving habits. For instance, Uber has a rewards program across the U.S. in order to recognize and reward its most loyal consumers.

The other reason behind the recurring losses is the competition in this market, as Uber is competing against Lyft, with both companies posting losses quarter after quarter.

Uber’s management has not provided any guidance regarding when the company will eventually become profitable. Given the absence of any guidance in this respect, it is safe to conclude that the company will not become profitable in the next few years.

Free Cash Flow Analysis

As dividends are funded directly from free cash flows, income-oriented investors should always check the free cash flow of their stocks. Uber has been posting negative free cash flows for an extended period, as it has been investing heavily in its business.

In the third quarter of this year, its cost of revenues consumed 45% of revenues. Moreover, its marketing expenses increased from 30% of net revenues in last year’s quarter to 32%. Furthermore, R&D expenses grew from 13% of net revenues in last year’s quarter to 14%. While management does its best to limit all the types of costs amid the pandemic, it will certainly need to maintain high marketing and R&D expenses in order to maintain strong revenue growth.

All these expenses are necessary for Uber to remain in its growth trajectory but they result in negative free cash flows. As these costs will remain elevated for the foreseeable future, investors should not expect meaningful free cash flows for the foreseeable future.

Will Uber Ever Pay A Dividend?

As long as Uber keeps posting losses, investors should not expect a dividend from the company. Even when the company becomes profitable, it will not distribute a dividend right away. As Uber is a high-growth company, its stock will be trading at excessive price-to-earnings ratios when it becomes profitable. Consequently, even if the company considers distributing a portion of its earnings in dividends, those dividends will be negligible for the shareholders.

For instance, if Uber trades at a price-to-earnings ratio of 40 and decides to distribute 20% of its earnings in dividends, it will offer a 0.5% dividend yield to its shareholders. Such a low yield will be negligible for the shareholders of a high-growth stock.

Moreover, a dividend is a long-term commitment. Once a company initiates a dividend, its shareholders expect to receive a regular dividend quarter after quarter. In fact, they often expect to receive a growing dividend year after year. Therefore, a company needs to achieve consistent and reliable earnings for many years before it initiates a dividend. As Uber is very far from posting consistent profits for years, it is safe to assume that the company is very far from initiating a dividend.

As dividends are paramount for income-oriented investors, most investors in this category will reject the stock. However, the rest of investors should not dismiss the stock solely for the absence of a dividend. When a business has tremendous growth potential, management should focus exclusively on investing in the business in the best possible way and not be distracted with a meaningless dividend.

Final Thoughts

The pandemic has temporarily disrupted the multi-year growth trajectory of Uber this year but the company is recovering at a fast clip, after the initial shock in its business. As its monthly active consumers comprise only 2% of the population in the countries where Uber is present, the company has immense growth potential ahead.

On the other hand, Uber is still very far from becoming profitable. Even if it becomes profitable after many years, it will still need to invest heavily in its business, given the competition in its markets and the early stage of the secular trend of consumers shifting away from car ownership. As a result, investors should not expect a dividend from Uber for several more years.